Global Float Glass Market Size, Share, Growth, and Industry Analysis, By Product Type (Clear, Tinted, Patterned, and Wired), By Raw Materials (Sand, Limestone, Soda Ash, Dolomite, and Others) By Application (Building and Construction, Automotive, Solar Glass, and Others) and Regional Insights and Forecast to 2033.

Industry: Chemicals & MaterialsGlobal Float Glass Market Insights Forecasts to 2033

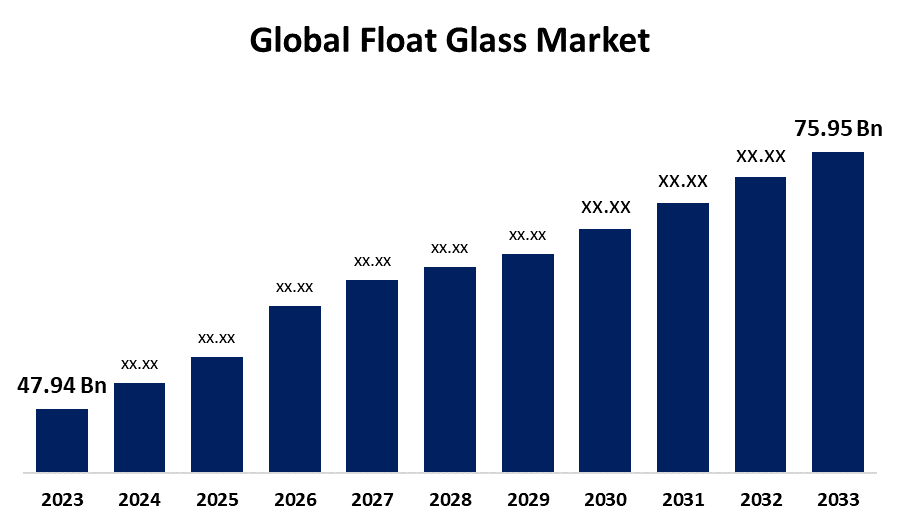

- The Global Float Glass Market Size was Valued at USD 47.94 Billion in 2023

- The Market Size is Growing at a CAGR of 4.71% from 2023 to 2033

- The Worldwide Float Glass Market Size is Expected to Reach USD 75.95 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Float Glass Market Size is Anticipated to Exceed USD 75.95 Billion by 2033, Growing at a CAGR of 4.71% from 2023 to 2033. High-performance glass variations are now produced as a result of technological developments in glass manufacturing processes, satisfying end users' changing needs for resilience, safety, and visual appeal.

FLOAT GLASS MARKET REPORT OVERVIEW

Float glass is essentially an extremely smooth, free-of-distortion glass that is used to create a variety of glass products, including laminated and heat-toughened glass. Float glass is transparent and can transmit up to 87% of the light it receives. It also gives consumers an exceptionally clear perspective. The procedure of making float glass, which involves submerging molten glass into a tin bath to let it float freely, is responsible for the glass's unusual nomenclature.

Float glass is becoming more and more popular in the residential, commercial, and industrial sectors of the building and construction business. The building industry has increased its need for float glass due to its high degree of light transmission, and versatility in producing different hues and opacities. In the residential sector, float glass is used for doors and windows, providing both practical and decorative purposes. It's also being used more and more in contemporary interior and architectural design. The market for float glass is expanding due to urbanization and the expanding industrial sector. Over the medium term, increased usage in the construction and automotive industries is another development driver.

Float glass has established a strong reputation in the automotive industry, where it is frequently used in side and rear windows due to its wide range of thickness options. In addition to windows and doors, furniture shelves also use this glass. Because this application improves the appearance of furniture, more people want to have this type of glass installed. Because it works so well to stop heat loss via glass doors and windows, float glass is utilized as insulated glass.

The rise in solar power is encouraging market expansion. An important application area for manufacturers is solar panels, which are growing in popularity. Innovation in terms of functionality and technology is a major market trend. Novel types with attributes such as self-cleaning or energy-saving capabilities are in development.

Report Coverage

This research report categorizes the market for the float glass market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the float glass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the float glass market.

Global Float Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 47.94 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.71% |

| 2033 Value Projection: | USD 75.95 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Raw Materials, By Application |

| Companies covered:: | PT Mulia Industrindo Tbk, Saint-Gobain, SCHOTT AG, Taiwan Glass Ind Corp., Xinyi Glass Holdings Limited, AGC Inc., BG, Cardinal Glass Industries Inc., China Glass Holdings Limited, China Luoyang Float Glass Group Co. Ltd, Etex Group, Guardian Glass LLC, Kibing Group, Nippon Sheet Glass Co. Ltd, Press Glass Holding SA, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

DRIVING FACTORS:

“The building and construction industry's growing demand could boost market expansion”

In order to make float glass, recycled glass, lime, silica sand, potash, and soda are heated in a furnace and then float on top of a bed of molten tin. In the residential sector, float glass is used for windows and doors, providing both an aesthetically pleasing and practical usage. Float glass is popular in the business sector because it offers a visually appealing and low-maintenance external surface. Because of its transparency, durability, and ease of cleaning, float glass is also utilized as display windows in retail establishments. The market for float glass is anticipated to rise due to growing consumer awareness of building safety and a greater emphasis on adhering to government building rules. Therefore, over the projected period, the growing demand for float glass from the building and construction industry could fuel the market's expansion.

RESTRAINING FACTORS

“The environmental concerns and sustainability can impede the growth of the float glass market over the forecast period”

The production process can consume a lot of energy and pollute the air and water. Growing environmental concerns could hinder the float glass market's growth.

Market Segmentation

The global float glass market share is classified into product type, raw materials, and application.

Which segment is expected to hold the largest share of the global float glass market during the forecast period?

“The clear segment is the biggest supplier to the market and is expected to boost the market growth during the forecast period”

Based on product type, the global float glass market is classified into clear, tinted, patterned, and wired. Among these, the clear segment is the biggest supplier to the market and is expected to boost the market growth during the forecast period. In contrast to other float glasses, clear float glass offers better optical quality, flatness, consistent thickness, excellent surface finishing, and a dazzling look. Clear float glass can also be tempered using heat processing without losing any of its characteristics. To make transparent float glass, glass is heated to a molten condition and then passed through a tweel, a tin bath, and a lehr. As the object floats through the molten tin, surface tension and gravity combine to create smooth, flat surfaces on all sides. Many objects, such as furniture, doors, mirrors, windows, and car windshields, utilize a lot of clear float glass.

Why limestone is the most preferred raw material?

“Limestone's primary purpose is to add calcium oxide, which is necessary to increase glass's resilience against chemicals and deterioration”

Based on raw materials, the global float glass market is classified into sand, limestone, soda ash, dolomite, and others. Among these, the limestone segment is projected to hold the largest share of the market over the forecast period. The main function of limestone is to add calcium oxide, which is essential for enhancing the durability and chemical resistance of glass. It also acts as a stabilizing agent during the manufacturing of float glass. To make glass, limestone is needed twice: once for the production of sodium carbonate and again as a part of the batch that will be melted. Limestone material has low iron and moisture concentrations. Because of this, a growing number of float glass manufacturers select limestone as one of the essential components, which tends to increase the quantity of limestone used in float glass manufacturing globally.

Which segment of application dominates the global float glass market?

“The building & construction segment is expected to dominate the market throughout the forecast period”

Based on the application, the global float glass market is classified into building and construction, automotive, solar glass, and others. Among these, the building & construction segment is expected to dominate the market throughout the forecast period. Because it offers consumers a clear view out of the window and protects them from the elements, such as UV radiation, float glass is widely utilized in windows in building and construction applications. The increasing number of people living in cities and the rise in disposable money around the world are two other important variables that have greatly accelerated the growth of infrastructure and construction operations globally. The requirement for float glass, which typically drives market growth, is intimately linked to the expansion of building and infrastructure development.

Regional Segment Analysis of the Global Float Glass Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Which region is expected to hold the largest share of the float glass market over the forecast period?

“Asia-Pacific region is holding the highest share of the global float glass market during the forecast period”

Get more details on this report -

China holds a market share of over fifty percent, making it the world's largest producer of float glass. Producing products that comply with Western industrial and environmental standards is the goal of many Chinese firms. The nation's need for float glass is growing rapidly, mostly because of its use in construction and building. The country's demand for float glass is mostly met by the building sector. Over the course of the projection period, there will likely be an increase in the demand for float glass in the country as a result of this anticipated to be a sizable window of opportunity for the solar panel industry.

Why Europe is growing at the fastest CAGR in the global float glass market?

The country's demand for float glass is mostly met by the building sector. The growth in new residential construction activities has led to a sluggish expansion of the nation's construction industry. The need for new home building has increased as a result of the nation's growing immigration rate. Producers are concentrating on creating float glass in thin sheets for usage in a variety of electronic equipment. Vendors can reach a wider audience and increase their market share in emerging markets by utilizing the new features and technology. This element is probably going to propel the float glass business in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global float glass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PT Mulia Industrindo Tbk

- Saint-Gobain

- SCHOTT AG

- Taiwan Glass Ind Corp.

- Xinyi Glass Holdings Limited

- AGC Inc.

- BG

- Cardinal Glass Industries Inc.

- China Glass Holdings Limited

- China Luoyang Float Glass Group Co. Ltd

- Etex Group

- Guardian Glass LLC

- Kibing Group

- Nippon Sheet Glass Co. Ltd

- Press Glass Holding SA

- Others

Key Market Developments

- In September 2022, AGC, a major global manufacturer of glass, chemicals, and high-tech materials, released the "AGC Sustainability Data Book 2022".

- In January 2022, China Glass Holding Limited acquired the Orda float glass production facility located in Kazakhstan. By leveraging the latest technology developed and supplied by Stewart, it aims to be the most sophisticated industrial float glass facility in the world.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global float glass market based on the below-mentioned segments:

Global Float Glass Market, By Product Type

- Clear

- Tinted

- Patterned

- Wired

Global Float Glass Market, By Raw Materials

- Sand

- Limestone

- Soda Ash

- Dolomite

- Others

Global Float Glass Market, By Application

- Building and Construction

- Automotive

- Solar Glass

- Others

Global Float Glass Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global float glass market over the forecast period?The Global float glass market size is expected to grow from USD 47.94 billion in 2023 to USD 75.95 billion by 2033, at a CAGR of 4.71% during the forecast period 2023-2033.

-

2. Which region is Expected to hold the highest share in the global float glass market?Asisa-Pacific is projected to hold the largest share of the global float glass market over the forecast period.

-

3. Who are the top key players in the float glass market?PT Mulia Industrindo Tbk, Saint-Gobain, SCHOTT AG, Taiwan Glass Ind Corp., Xinyi Glass Holdings Limited, AGC Inc, BG, Cardinal Glass Industries Inc., China Glass Holdings Limited, China Luoyang Float Glass Group Co. Ltd, Etex Group, Guardian Glass LLC, Kibing Group, Nippon Sheet Glass Co. Ltd, Press Glass Holding SA, and Others.

Need help to buy this report?