Global Floating Foam Fenders Market Size, Share, and COVID-19 Impact Analysis, By Type (Closed-Cell Foam Fenders, Open-Cell Foam Fenders), By Application (Ship-to-Ship (STS) Transfer, Ship-to-Shore (STS) Berthing, Offshore Platforms), By End-User (Ports, Shipyards, Oil & Gas Industry, Marine Terminals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Floating Foam Fenders Market Insights Forecasts to 2033

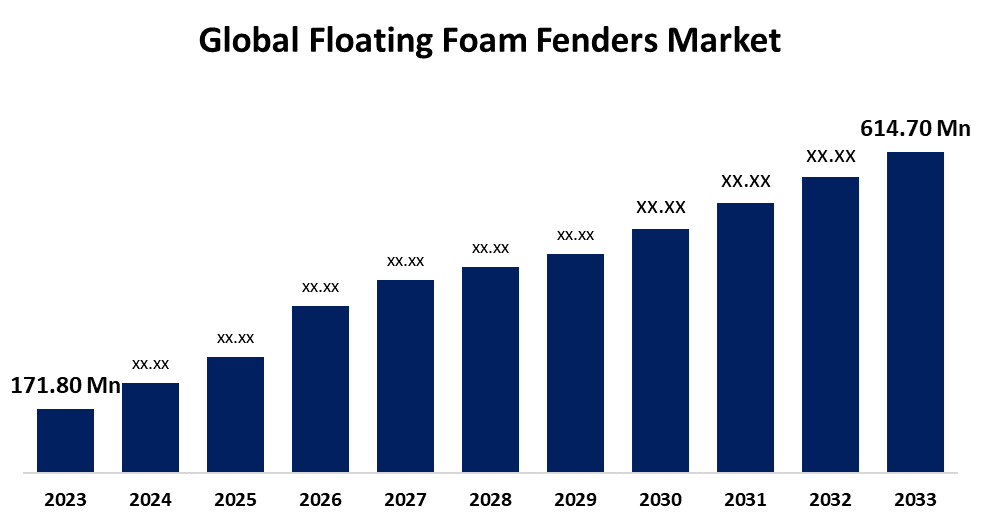

- The Global Floating Foam Fenders Market Size was Valued at USD 171.80 Million in 2023

- The Market Size is Growing at a CAGR of 13.60% from 2023 to 2033

- The Worldwide Floating Foam Fenders Market Size is Expected to Reach USD 614.70 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Floating Foam Fenders Market Size is Anticipated to Exceed USD 614.70 Million by 2033, Growing at a CAGR of 13.60% from 2023 to 2033.

Market Overview

Floating foam fenders are specialized marine fenders designed to protect boats, ships, and docks from damage during docking or mooring operations. They are typically constructed from durable materials including rubber or foam, allowing them to absorb impact effectively. Floating foam fenders are essential in marine operations for protecting vessels and docks from damage during mooring or berthing. They are shock-absorbing, cost-effective, lightweight, durable, and meet safety and environmental regulations, making them a popular choice.

Floating foam fenders are crucial in marine applications for their protective capabilities, including port operations, shipyards, offshore environments, marinas, tugboat and barge operations, and heavy cargo handling. Their versatility ensures safety and efficiency in marine settings.

Report Coverage

This research report categorizes the market for floating foam fenders based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the floating foam fenders market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the floating foam fenders market.

Global Floating Foam Fenders Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 171.80 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 13.60% |

| 2033 Value Projection: | USD 614.70 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Fendercare Marine, Irmome, Trelleborg, Bencros, RG Seasight Fenders, Yokohama, Urethane Products Corporation (UPC), ISCA, Pacific Marine Industrial, Eurotech Benelux, OCEAN 3, Resinex, Floating Fender Company, OU TAI Sponge Enterprise, Evergreen Maritime, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The floating foam fenders market is propelled by several factors including the growth of maritime activities and the expansion of ports, which raise the demand for effective protective fendering systems. The increasing demand for offshore oil and gas operations also plays a significant role and advancements in materials that improve the performance and durability of fenders. Stricter safety and environmental regulations further encourage the adoption of high-quality fender solutions. Furthermore, rising awareness of marine safety and emerging markets due to rapid industrialization provide new growth opportunities. The customization and versatility of floating foam fenders enhance their attractiveness across various maritime sectors further contributing to market growth worldwide.

Restraining Factors

The floating foam fenders market is hindered by several restraining factors including high initial costs that might deter smaller operations from investing. Limited awareness about the benefits and applications of these fenders can also slow adoption, particularly in certain regions. Competition from alternative fendering solutions, like rubber fenders, presents another challenge. Furthermore, economic downturns can lead to reduced spending on maritime infrastructure, further impacting market growth.

Market Segmentation

The floating foam fenders market share is classified into type, application, and end-user.

- The closed-cell foam fenders segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the floating foam fenders market is classified into closed-cell foam fenders and open-cell foam fenders. Among these, the closed-cell foam fenders segment is estimated to hold the highest market revenue share through the projected period. Closed-cell foam fenders are typically preferred due to their durability, low water absorption, and resistance to wear and tear, making them suitable for various marine applications. Their ability to provide better protection for vessels in rough conditions contributes to their higher market revenue share.

- The ship-to-ship (STS) transfer segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the floating foam fenders market is divided into ship-to-ship (STS) transfer, ship-to-shore (STS) berthing, and offshore platforms. Among these, the ship-to-ship (STS) transfer segment is anticipated to hold the largest market share through the forecast period. The ship-to-ship (STS) transfer segment dominance is primarily due to the increasing volume of maritime trade and the rising need for safe and efficient transfer operations. STS operations require robust fender systems to protect vessels during transfers, especially in congested or challenging environments. The growing adoption of STS transfers in oil and gas logistics, as well as in bulk cargo handling, further supports the demand for high-quality foam fenders.

- The oil & gas industry segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end-user, the floating foam fenders market is categorized into ports, shipyards, oil & gas industry, and marine terminals. Among these, the oil & gas industry segment is anticipated to grow at the fastest CAGR growth through the forecast period. The rapid expansion is attributed to increasing offshore exploration and production activities, which necessitate reliable fender systems for safe vessel operations. The focus on safety and operational efficiency in transporting energy resources further fuels demand in the oil & gas sector.

Regional Segment Analysis of the Floating Foam Fenders Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the floating foam fenders market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the floating foam fenders market over the predicted timeframe. The region's dominance can be attributed to a robust maritime industry, significant offshore oil and gas activities, and well-established shipping routes. The region's focus on safety regulations and advanced marine technologies also drives demand for high-quality fender systems. Furthermore, the presence of major ports and shipyards further contributes to the market's growth in North America.

Asia Pacific is expected to grow at the fastest CAGR growth of the floating foam fenders market during the forecast period. The rapid expansion is propelled due to rapid industrialization, increasing maritime trade, and the expansion of shipping and logistics infrastructure in countries like China and India. The region's rising investments in offshore oil and gas exploration further enhance demand for effective floating foam fenders.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the floating foam fenders market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fendercare Marine

- Irmome

- Trelleborg

- Bencros

- RG Seasight Fenders

- Yokohama

- Urethane Products Corporation (UPC)

- ISCA

- Pacific Marine Industrial

- Eurotech Benelux

- OCEAN 3

- Resinex

- Floating Fender Company

- OU TAI Sponge Enterprise

- Evergreen Maritime

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, YOKOHAMA announced the addition of two strong fenders to its line-up for harbor moorings. The new additions include cell-type and cone-type solid fenders. These new high-performance solid fenders complement YOKOHAMA's basic model V-type fender.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the floating foam fenders market based on the below-mentioned segments:

Global Floating Foam Fenders Market, By Type

- Closed-Cell Foam Fenders

- Open-Cell Foam Fenders

Global Floating Foam Fenders Market, By Application

- Ship-to-Ship (STS) Transfer

- Ship-to-Shore (STS) Berthing

- Offshore Platforms

Global Floating Foam Fenders Market, By End-User

- Ports

- Shipyards

- Oil & Gas Industry

- Marine Terminals

Global Floating Foam Fenders Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the floating foam fenders market over the forecast period?The floating foam fenders market is projected to expand at a CAGR of 13.60% during the forecast period.

-

2. What is the market size of the floating foam fenders market?The Global Floating Foam Fenders Market Size is Expected to Grow from USD 171.80 Million in 2023 to USD 614.70 Million by 2033, Growing at a CAGR of 13.60% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the floating foam fenders market?North America is anticipated to hold the largest share of the floating foam fenders market over the predicted timeframe.

Need help to buy this report?