Global Floating Production Storage & Offloading Market Size, Share, and COVID-19 Impact Analysis, By Type (Converted and New Build), By Hull Type (Single Hull and Double Hull), By Propulsion (Self-propelled and Towed), By Usage (Shallow Water, Deep Water, and Ultra-deep Water), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Energy & PowerGlobal Floating Production Storage & Offloading Market Insights Forecasts to 2032

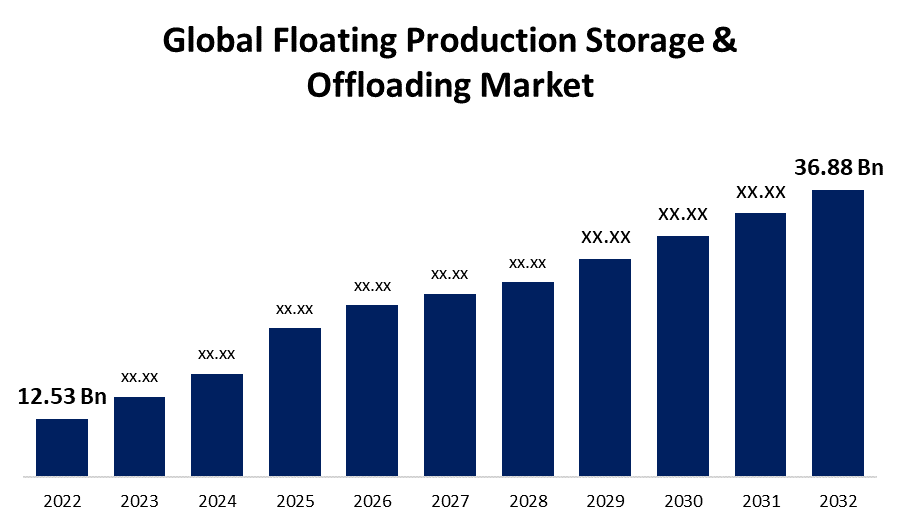

- The Floating Production Storage & Offloading Market Size was valued at USD 12.53 Billion in 2022.

- The Market is growing at a CAGR of 11.4% from 2023 to 2032

- The Worldwide floating production storage & offloading market is expected to reach USD 36.88 Billion by 2032

- Latin America is expected to grow the fastest during the forecast period

Get more details on this report -

The global floating production storage & offloading market is expected to reach USD 36.88 Billion by 2032, at a CAGR of 11.4% during the forecast period 2023 to 2032.

Market Overview

A Floating Production Storage and Offloading (FPSO) vessel is a versatile floating facility used in the offshore oil and gas industry. It combines production, storage, and offloading capabilities, enabling the extraction of hydrocarbons from offshore fields. The FPSO receives raw oil and gas from subsea wells, processes it onboard, and stores it in large tanks before offloading it to tankers for transportation to refineries. It eliminates the need for fixed offshore platforms, making it suitable for remote or deep-water locations. FPSOs are designed to withstand harsh environmental conditions and can be leased and deployed on a project-specific basis, offering flexibility and cost-effectiveness. Their adaptability and ability to handle both oil and gas production make them a popular choice in the industry.

Report Coverage

This research report categorizes the market for floating production storage & offloading market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the floating production storage & offloading market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the floating production storage & offloading market.

Global Floating Production Storage & Offloading Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.53 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.4% |

| 2032 Value Projection: | USD 36.88 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Hull Type, By Propulsion, By Usage, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Chevron, Exxon Mobil, BP PLC, Equinor, Woodside Energy, Aker Solutions, Eni S.P.A., Dommo Energia, BW Offshore, Teekay, and others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The floating production storage and offloading (FPSO) market is driven by several factors. The increasing exploration and production activities in offshore fields, particularly in deep-water and remote locations, are boosting the demand for FPSOs. These vessels offer a flexible and cost-effective solution for oil and gas extraction in such challenging environments. The FPSOs provide a quick time-to-market advantage compared to fixed offshore platforms, allowing for rapid deployment and production commencement. Additionally, FPSOs offer operational and logistical benefits, as they can be easily moved between different fields, reducing capital costs. Furthermore, technological advancements in FPSO design, such as improved mooring systems and processing capabilities, are attracting investments in the market. Overall, the growing demand for offshore hydrocarbon reserves, coupled with the advantages offered by FPSOs, is propelling the market's growth.

Restraining Factors

The floating production storage and offloading (FPSO) market also faces certain restraints. The high initial capital investment required for the construction and deployment of FPSOs can be a deterrent for smaller operators or companies with limited financial resources. The complex regulatory and environmental requirements associated with offshore operations pose challenges and increase compliance costs. The volatility of oil prices and fluctuations in global energy demand can impact the profitability of FPSO projects. Additionally, the limited availability of skilled personnel and the potential risks associated with offshore operations, such as adverse weather conditions and technical failures, can act as deterrents for market growth.

Market Segmentation

- In 2022, the self-propelled segment accounted for around 61.8% market share

On the basis of propulsion, the global floating production storage & offloading market is segmented into self-propelled and towed. The self-propelled segment has emerged as the frontrunner, holding the largest market share in various industries. This dominance can be attributed to several factors. The self-propelled products and solutions offer enhanced mobility and flexibility compared to their non-self-propelled counterparts. They are equipped with their own propulsion systems, allowing them to operate independently without the need for external power sources or towing. This autonomy enables efficient operations, reduced dependency on external resources, and improved maneuverability, making self-propelled solutions highly sought after. Additionally, self-propelled equipment offers versatility and adaptability across different terrains and environments, making them suitable for a wide range of applications. Their capability to navigate challenging or remote locations further enhances their market appeal. Moreover, advancements in technology and engineering have resulted in the development of highly efficient and reliable self-propelled solutions, further strengthening their market position. Collectively, these factors have propelled the self-propelled segment to hold the largest market share in various industries.

- In 2022, the converted segment dominated with more than 44.7% market share

Based on the type, the global floating production storage & offloading market is segmented into converted and new build. The converted segment has emerged as the market leader, holding the largest market share in various industries. This dominance can be attributed to several factors. The conversion of existing assets, such as ships or vessels, into new applications provides a cost-effective and time-efficient solution. Converting existing structures allows for the repurposing of resources, reducing the need for extensive construction from scratch. This factor contributes to the significant market share of the converted segment. Additionally, the conversion process enables the customization of assets to specific requirements, accommodating diverse applications and operational needs. This flexibility and adaptability make the converted segment highly attractive to industries seeking tailored solutions. Moreover, the converted segment benefits from the utilization of existing infrastructure and resources, resulting in reduced capital investments and accelerated project timelines. Collectively, these advantages have propelled the converted segment to hold the largest market share in various industries.

Regional Segment Analysis of the Floating Production Storage & Offloading Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

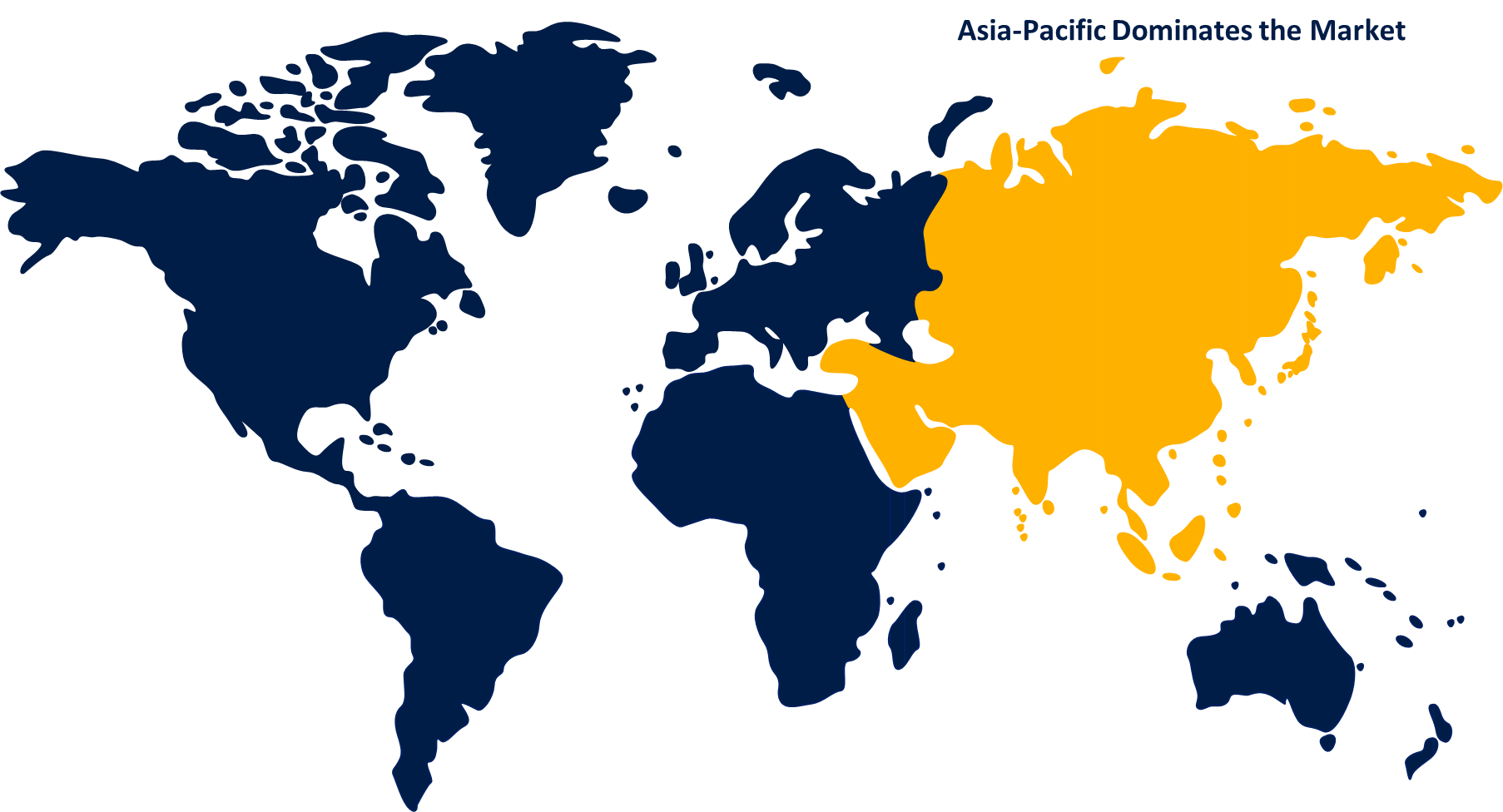

North America dominated the market with more than 34.6% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player with the largest market share in various industries. Several factors contribute to this significant market presence. The region is home to advanced economies, including the United States and Canada, which possess robust industrial sectors and technological advancements. These countries have a strong focus on research and development, innovation, and entrepreneurship, leading to the creation of cutting-edge products and services. North America has abundant natural resources, including oil, gas, and minerals, which drive the energy and mining sectors. Additionally, the region has a well-developed infrastructure, efficient logistics networks, and a stable regulatory environment that promotes business growth. Furthermore, a large consumer base, high disposable income, and a culture of consumerism contribute to the strong market demand for a wide range of products and services. Collectively, these factors have propelled North America to hold a significant and largest market share across various industries.

Recent Developments

In November 2022, SBM Offshore has recently disclosed a collaboration with China Merchants Financial Leasing (Hong Kong) Holding Company (CMFL), a financial institution based in China. The aim of this partnership is to jointly engage in the ownership and operation of FPSO projects. By combining the respective strengths of both companies, they will be able to provide top-notch FPSO solutions to clients globally. SBM Offshore's expertise in the design, construction, and operation of FPSOs will be complemented by CMFL's robust financial capabilities and leasing and financing experience. This partnership seeks to leverage the synergy between the two entities to deliver high-quality FPSO services to customers in the industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global floating production storage & offloading market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Chevron

- Exxon Mobil

- BP PLC

- Equinor

- Woodside Energy

- Aker Solutions

- Eni S.P.A.

- Dommo Energia

- BW Offshore

- Teekay

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global floating production storage & offloading market based on the below-mentioned segments:

Floating Production Storage & Offloading Market, By Type

- Converted

- New Build

Floating Production Storage & Offloading Market, By Hull Type

- Single Hull

- Double Hull

Floating Production Storage & Offloading Market, By Propulsion

- Self-propelled

- Towed

Floating Production Storage & Offloading Market, By Usage

- Shallow Water

- Deep Water

- Ultra-deep Water

Floating Production Storage & Offloading Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?