Global Floating Wind Turbine Market Size, Share, and COVID-19 Impact Analysis, By Foundation Type (Spar-Buoy, Semi-Submersible, Tension Leg Platform, and Others), By Capacity (Up to 3 MW, 3 MW to 5 MW, Above 5 MW), By Application (Commercial, Industrial, and Others), By Component (Turbine, Floating Structure, Anchor System, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Floating Wind Turbine Market Insights Forecasts to 2033

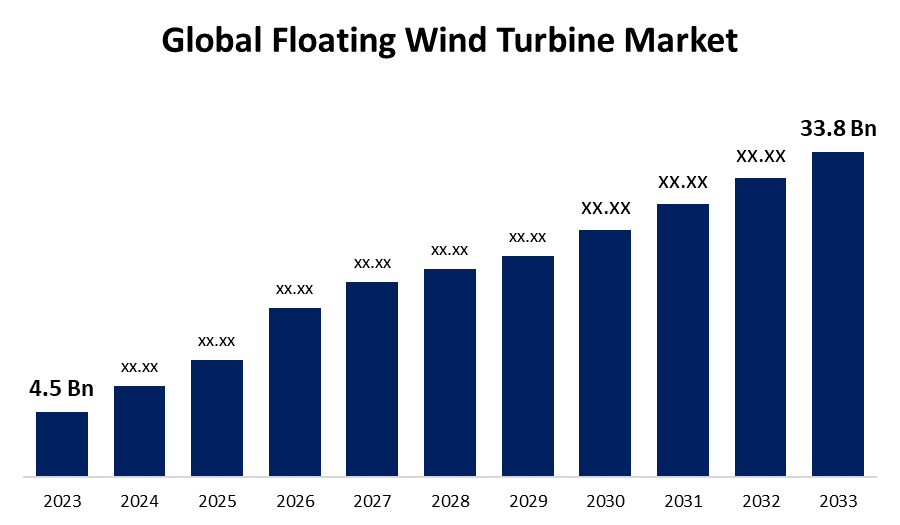

- The Global Floating Wind Turbine Market Size Was Estimated at USD 4.5 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 22.34% from 2023 to 2033

- The Worldwide Floating Wind Turbine Market Size is Expected to Reach USD 33.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Floating Wind Turbine Market Size is anticipated to exceed USD 33.8 Billion by 2033, growing at a CAGR of 22.34% from 2023 to 2033. The global market of floating wind turbines is expanding due to the growing demand for renewable and clean energy sources and heightened environmental consciousness regarding the reduction of carbon footprint or carbon emissions. The contribution of renewable energy sources to power generation has grown globally, prompting many countries to aim for a higher share of renewables in their energy mix, with wind energy playing a significant role.

Market Overview

The floating wind turbine industry involves the development and use of floating wind turbines to generate renewable energy. A floating wind turbine, which is a part of the offshore wind turbine, is supported by a floating base that has the majority of its weight water-logged. The elevated framework enables the wind turbine to produce electricity in water depths unsuitable for a fixed foundation. Also, floating wind technology enables countries to increase their renewable energy resources significantly, floating wind technology can harness stronger and more consistent winds that are found farther offshore.

Increasing demand for renewable and clean energy sources and rise in environmental awareness for reducing carbon footprint or carbon emission. Renewable energy sources' contribution to power generation has increased worldwide, it is a target for many nations to raise their renewable energy share in power generation, among this wind energy plays a major role. Floating wind turbines enable access to wind resources in deeper waters, where wind speeds are generally higher and more stable, thereby optimizing energy production. This capability meets rising energy demands sustainably as well as supports the global transition toward a low-carbon energy power system.

Report Coverage

This research report categorizes the global floating wind turbine market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global floating wind turbine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global floating wind turbine market.

Global Floating Wind Turbine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 22.34% |

| 023 – 2033 Value Projection: | USD 33.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Foundation Type, By Capacity, By Capacity, By Application, By Component and By Region |

| Companies covered:: | Doosan Heavy Industries & Construction Co., Ltd. Suzlon Energy Limited ABB Ltd. Nordex SE Envision Energy Goldwind Science & Technology Co., Ltd. Enercon GmbH MingYang Smart Energy Group Co., Ltd. Hitachi Ltd. Vestas Wind Systems A/S Shanghai Electric Wind Power Equipment Co., Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Significant growth in the need for renewable energy sources is expected to boost the growth of the floating wind turbine industry. Moreover, floating wind turbines are economical and lower carbon emissions compared to traditional energy sources. Also, the floating wind turbine technology eliminates the limitation of water depth, facilitating the selection of the most ideal site for energy production. For instance, in December 2023, Vestas, a manufacturer of wind turbines, collaborated with Pattern Energy to obtain an order for the delivery of 242 V163-4.5 MW turbines for the SunZia Wind project located in New Mexico. This 1.1 GW initiative represents Vestas' biggest order so far in the U.S. market and is the largest single onshore project worldwide. This kind of initiative by operating companies in the industry helps to empower the floating wind turbine market.

The rapid urbanization and increasing recognition of the advantages of wind energy are propelling industry expansion. The use of renewable energy bolsters the groundwork for commercial and industrial sectors. Wind energy generates a variety of jobs, employing more than 1.46 million individuals in 2023, with wind turbine technicians ranking as one of the rapidly expanding careers. These factors boost the need for floating wind turbines, thus speeding up the overall growth rate of the market. The combined benefits of wind energy and employment growth support the industry's growth and aid in sustainable progress.

Restraints & Challenges

The high cost of installation, operation, and maintenance of wind energy units is a major hindrance to the expansion floating wind turbine industry. The acceptance of this technology may be reduced by these costs, which may discourage investment. These exorbitant expenses are a result of the intricate engineering and specialized equipment needed for offshore installations. Market expansion is impacted as a result of the industry's struggles to achieve broad deployment and lower overall costs.

Market Segmentation

The global floating wind turbine market share is classified into foundation type, capacity, application, and component.

- The spar-buoy segment held a dominant share in 2023 and is expected to grow at a notable CAGR during the forecast period.

Based on the foundation type, the global floating wind turbine market is classified into spar-buoy, semi-submersible, tension leg platform, and others. Among these, the spar-buoy segment held a dominant share in 2023 and is expected to grow at a notable CAGR during the forecast period. The segmental dominance is attributed to its stabilization and simplicity, as well as its ability to naturally install in deep waters. Also, this is cost-effective for small and medium-sized rigs. Compared to TLPs and semi-submersible foundations, it offers greater stability and a less complex design. The expenses for the spar-buoy anchoring system are lower than those of TLPs. Its substantial balance at the base provides stability independent of mooring while reducing environmental impact.

- The above 5 MW segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the capacity, the global floating wind turbine market is categorized into up to 3 MW, 3 MW to 5 MW, and above 5 MW. Among these, the above 5 MW segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth, which can be attributed to its superior capacity relative to other turbines, could be advantageous in large-scale facilities aiming to boost energy production and achieve their primary revenue targets. Furthermore, it is beneficial because of the simple installation and functioning of smaller turbines with greater output, leading to lower total project expenses. Moreover, larger turbines are more efficient at capturing energy from strong winds located offshore, which makes them essential for the financial success of floating wind farms implemented in deep-water areas. Furthermore, the growing capacity of floating wind turbines corresponds with worldwide energy objectives, enabling larger input from renewable sources to national grids.

- The commercial segment accounted for the highest share in 2023 and is projected to grow at a notable CAGR during the forecast period.

Based on the application, the global floating wind turbine market is divided into commercial, industrial, and others. Among these, the commercial segment accounted for the highest share in 2023 and is projected to grow at a notable CAGR during the forecast period. Increase in awareness about renewable energy and the growing trend towards the adoption of renewable energy for commercial purposes. This needs to transition to clean, sustainable energy sources to combat climate change, and increasingly incorporated with government energy schemes and goals. These strategies and goals are fuelled by operational systems or government initiatives that aim to enhance renewable energy adoption. In particular, the commercial sector benefits from the ability to deploy large-scale wind farms in offshore locations with high wind potential, providing a substantial and reliable source of clean energy. This helps to meet energy consumption demands from urban areas and major cities by reducing the dependence on thermal energy and fossil fuels across the regions.

- The turbine segment held a dominant share in 2023 and is expected to grow at a notable CAGR during the forecast period.

Based on the components, the global floating wind turbine market is categorized into turbines, floating structures, anchor systems, and others. Among these, the turbine segment held a dominant share in 2023 and is expected to grow at a notable CAGR during the forecast period. The segmental dominance is attributed to its ability to serve as a crucial element in wind energy by transforming kinetic wind energy into electrical energy. Additionally, substantial production goals were affected to address the growing demands for electricity usage. The increased demand for new technology-driven turbine designs, featuring larger diameter rotors and larger plants, is boosting energy capture and efficiency, leading to lower costs and better performance in floating wind projects.

Regional Segment Analysis of the Global Floating Wind Turbine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

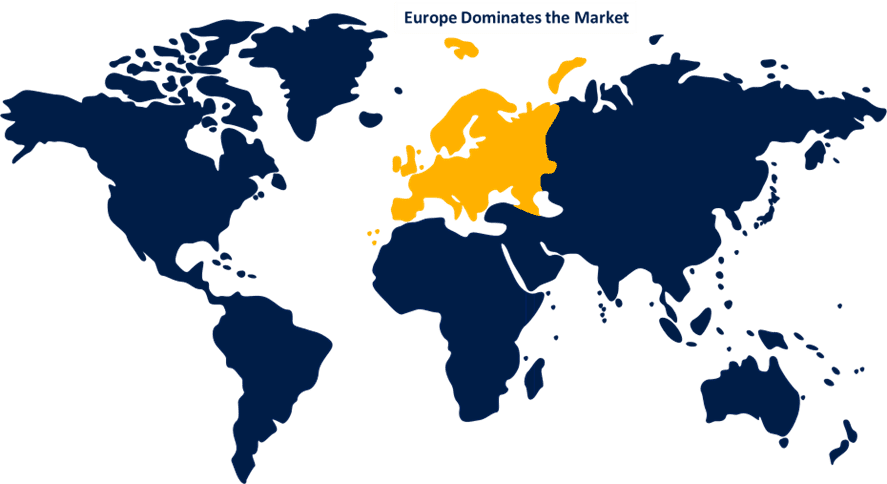

Europe is anticipated to hold the largest share of the global floating wind turbine market over the projected timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global floating wind turbine market over the predicted timeframe. This regional dominance is attributed to several factors such as the early embrace of offshore wind technology, robust governmental backing, substantial funding for research and development, existing manufacturing hubs for wind turbines in the area, and an emphasis on deep-water locations ideal for floating turbine setups, especially in nations like Denmark, Norway, and the UK. These government strategies fuelling the increasing share of renewable energy in electricity generation.

Asia Pacific region is expected to grow the fastest during the forecast period, which is attributed to the increasing demand by developing economies and people's diversion towards renewable energy dependence. Additionally, major economies in regions India, China, Japan, and South Korea are deploying floating wind technology in the nations. Also, these countries are investing heavily in offshore wind projects to enhance energy security and reduce reliance on fossil fuels, to increase their dependence on renewable energy while reducing environmental impact.

North America is expected to grow at a significant CAGR in the floating wind turbine market over the forecast period. This region is experiencing growing interest in floating wind technology, with the United States at the forefront of project development and investment. The East and West coasts of the country present significant wind resources ideal for floating wind projects, and favorable policies are promoting investments from the private sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global floating wind turbine market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Doosan Heavy Industries & Construction Co., Ltd.

- Suzlon Energy Limited

- ABB Ltd.

- Nordex SE

- Envision Energy

- Goldwind Science & Technology Co., Ltd.

- Enercon GmbH

- MingYang Smart Energy Group Co., Ltd.

- Hitachi Ltd.

- Vestas Wind Systems A/S

- Shanghai Electric Wind Power Equipment Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Vattenfall and BASF SE signed a supply and service agreement with Vestas for their Nordlicht offshore wind projects in the German North Sea. The agreement involves the supply of 112 V236-15.0 MW wind turbines, which are currently the most powerful offshore wind turbines available in the domestic market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global floating wind turbine market based on the below-mentioned segments:

Global Floating Wind Turbine Market, By Foundation Type

- Spar-Buoy

- Semi-Submersible

- Tension Leg Platform

- Others

Global Floating Wind Turbine Market, By Capacity

- Up to 3 MW

- 3 MW to 5 MW

- Above 5 MW

Global Floating Wind Turbine Market, By Application

- Commercial

- Industrial

- Others

Global Floating Wind Turbine Market, By Component

- Turbine

- Floating Structure

- Anchor System

- Others

Global Floating Wind Turbine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global floating wind turbine market over the forecast period?The global floating wind turbine market size was valued at USD 4.5 Billion in 2023 and is expected to reach USD 33.8 Billion by 2033, growing at a CAGR of 22.34% from 2023 to 2033

-

2. Which region holds the largest share of the global floating wind turbine market?Europe is estimated to hold the largest share of the global alkaline battery market over the projected timeframe.

-

3. Who are the top key players in the global floating wind turbine market?Doosan Heavy Industries & Construction Co., Ltd., Suzlon Energy Limited, ABB Ltd., Nordex SE, Envision Energy, Goldwind Science & Technology Co., Ltd., Enercon GmbH, MingYang Smart, Energy Group Co., Ltd., Hitachi Ltd., Vestas Wind Systems A/S, Shanghai Electric Wind Power Equipment Co., Ltd., and Others.

Need help to buy this report?