Global Flow Cytometry Market Size, Share, and COVID-19 Impact Analysis, By Technology (Cell-Based and Bead-Based), By Product (Instruments and Software), By Application (Industrial and Clinical), By End User (Commercial Organizations, Hospitals, Academic Institutes, & Clinical Testing Labs), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Flow Cytometry Market Insights Forecasts to 2032

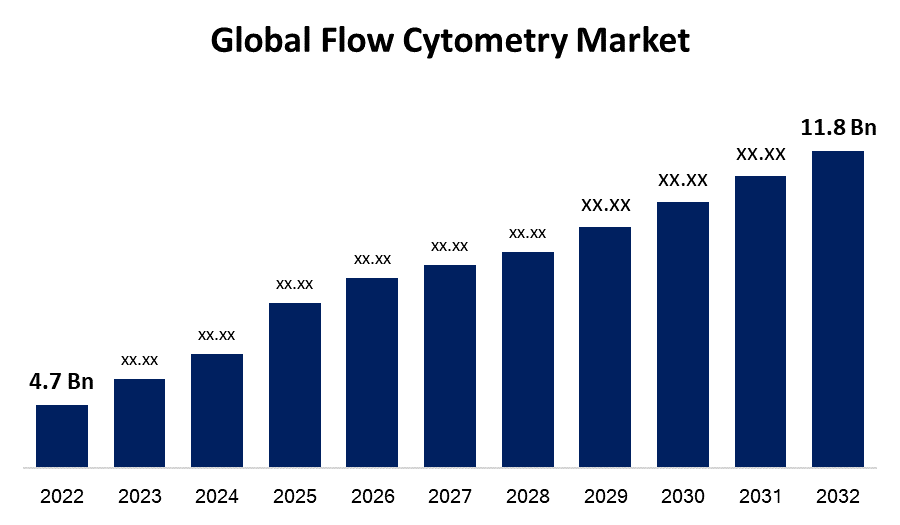

- The Global Flow Cytometry Market Size was valued at USD 4.7 Billion in 2022.

- The Market Size is Growing at a CAGR of 9.6% from 2022 to 2032.

- The Worldwide Flow Cytometry Market size is expected to reach USD 11.8 Billion by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Flow Cytometry Market Size is expected to reach USD 11.8 Billion by 2032, at a CAGR of 9.6% during the forecast period 2022 to 2032.

Market Overview

Flow cytometry technology is utilized in both academic and clinical research and diagnostics to evaluate and measure distinct cell properties. It is utilized in the clinical diagnosis of cancer, blood disorders (leukemia and lymphoma), and HIV illnesses, as well as the evaluation of organ transplants. Sample collection is a huge issue for proper analysis, but it is now achievable thanks to the advancement of robotics in flow cytometry. The technique of flow cytometry is widely employed in clinical and healthcare applications, genomics, proteomics, marine biology, microbiology and environmental sciences, and molecular cytogenetics. It is utilized in multiplex arrays in genomics to identify genetic abnormalities and genotyping. Other genomics uses include mRNA typing, microorganism identification, and subtyping.

Report Coverage

This research report categorizes the global flow cytometry market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global flow cytometry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global flow cytometry market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Flow Cytometry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.6% |

| 2032 Value Projection: | USD 11.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Product, By Application, By End User, By Region. |

| Companies covered:: | Danaher Corp., Becton, Dickinson, and Company (BD), Sysmex Corp., Agilent Technologies, Inc., Apogee Flow Systems Ltd., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Stratedigm, Inc., DiaSorin SpA, Miltenyi Biotec, Sony Biotechnology, Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key companies in the worldwide market are increasingly focusing on creating and commercializing technologically sophisticated flow cytometry solutions that provide simplified workflows, simplicity of operation, and faster turnaround times. Such novel items are likely to have a considerable demand increase throughout the projection period, particularly in mature economies with a high adoption rate of technologically sophisticated products. For example, in March 2022, Beckman Coulter (a Danaher Corporation firm) (US) introduced CellMek SPS, a completely automated sample preparation system for clinical flow cytometry. Also, because the infectious illness burden in low- and lower-middle-income countries is large, a consistent rise in mortality owing to new and re-emerging infectious diseases is expected to boost demand for highly efficient testing methods such as flow cytometry. Furthermore, increased investments in large biotechnology and biopharmaceutical businesses are supporting sector growth substantially.

Restraining Factors

The majority of end users, such as clinical laboratories, large research institutes, and pharmaceutical businesses, require a large number of flow cytometry instruments to perform many research projects at the same time. This results in a large rise in the capital cost of purchasing and maintaining these devices. Furthermore, maintenance charges and other indirect expenses raise the total cost of ownership of these devices. As a result, high product installation costs and related expenses restrict the optimal adoption of flow cytometry instruments in clinical and research settings, particularly in poor nations.

Market Segmentation

- In 2022, the bead-based segment is dominating the market with the largest market share during the forecast period.

Based on technology, the global flow cytometry market is segmented into different segments such as cell-based and bead-based. Among these segments, the bead-based segment has the biggest revenue share over the predicted period due to its widespread usage in research applications, reduced time consumption, and simultaneous analysis of several samples. However, the cell-based flow cytometry sector generates the most revenue due to its widespread usage in the detection of illnesses such as cancer and HIV, biomedical research, and rising use in monitoring medication treatment progress.

- In 2022, the instruments segment is influencing the largest market share over the forecast period.

Based on product, the global flow cytometry market is classified into instruments and software. Throughout these segments, the instruments segment is leading the market due to higher penetration coupled with technical developments. In January 2022, Sony Biotechnology, Inc. presented the CGX10, a revolutionary closed-cell separation device for use in GMP-compliant cell sorting applications. The program was supposed to provide the organization with fresh growth prospects. Such technological developments result in cost-effectiveness, increased precision, and mobility, as well as the potential for future expansion.

- In 2022, the clinical segment is dominating the market with the largest market share of 45.44% during the forecast period.

Based on application, the global flow cytometry market is bifurcated into different segments such as industrial and clinical. Among these segments, the clinical segment has the biggest revenue share of 45.44% over the predicted period. This significant percentage can be attributed to increased cancer and infectious disease research and development, especially COVID-19. Additionally, increased R&D investments in the biotechnology and pharmaceutical industries are projected to foster market expansion. Furthermore, ongoing expansion efforts by industry-leading players, as well as the introduction of innovative flow cytometry technologies for clinical applications, are expected to considerably assist segment growth.

- In 2022, the academic institutes segment is influencing the largest market share over the forecast period.

Based on end users, the global flow cytometry market is bifurcated into different segments such as commercial organizations, hospitals, academic institutes, & clinical testing labs. Among these segments, the academic institutes segment has the biggest revenue share during the forecast period due to the rising emphasis of academic institutions on creating assays for novel applications promoting demand for flow cytometry products in this end-user category. Additionally, increasing pharmaceutical company investments in university research boosts market expansion.

Regional Segment Analysis of the global flow cytometry market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

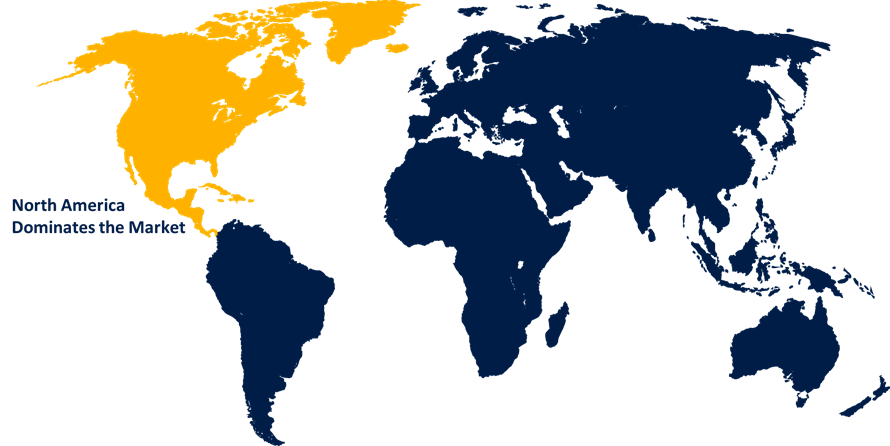

- North America is dominating the market with the largest market revenue share during the forecast period

Get more details on this report -

North America is leading the significant market growth during the forecast period. The market in North America is mature, with significant penetration of flow cytometry technology among major end users. However, due to the growing application areas of flow cytometry in clinical settings, this market is likely to provide significant growth prospects. Also, a favorable business environment, growing government support through funds and grants, the high prevalence of HIV/AIDS and cancer, a growing focus on the development of treatment options for target diseases (such as cancer and immunological disorders), and the strong presence of key players are driving the region's market growth.

In Asia Pacific, the market for flow cytometry market is predicted to develop rapidly over the forecast period owing to the expanding pharmaceutical and biotechnology sectors in rising nations such as China and India. The growing prevalence of chronic illnesses and the increasing usage of cytometry devices in various applications in the area are driving the industry. Furthermore, current advancements in the domains of cancer and infectious diseases, such as COVID-19, are projected to fuel the regional market.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global flow cytometry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danaher Corp.

- Becton, Dickinson, and Company (BD)

- Sysmex Corp.

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Stratedigm, Inc.

- DiaSorin SpA

- Miltenyi Biotec

- Sony Biotechnology, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, BD (US) introduced the BD FACSDiscover S8 Cell Sorter, which uses high-speed imaging technology to sort cells based on visual criteria.

- In March 2022, Beckman Coulter, Inc. (US) has announced the CellMek SPS, a fully automated sample preparation system (SPS) that offers on-demand processing for a wide range of sample types to help laboratories increase their capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Flow Cytometry Market based on the below-mentioned segments:

Global Flow Cytometry Market, By Technology

- Cell-based

- Bead-based

Global Flow Cytometry Market, By Product

- Instruments

- Software

Global Flow Cytometry Market, By Application

- Transnasal

- Intraventricular

- Transcranial

Global Flow Cytometry Market, By End User

- Commercial Organizations

- Hospitals

- Academic Institutes

- Clinical Testing Labs

Flow Cytometry Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?