Global Food Blenders and Mixers Market Size, Share, and COVID-19 Impact Analysis, By Type (Shaft, High Shear, Ribbon Mixer, Planetary Mixer, Double Cone, Screw Mixers & Blenders), By Application (Bakery, Dairy, Beverages, Confectionery), By Technology (Batch mixing, Continuous mixing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Consumer GoodsGlobal Food Blenders and Mixers Market Insights Forecasts to 2032

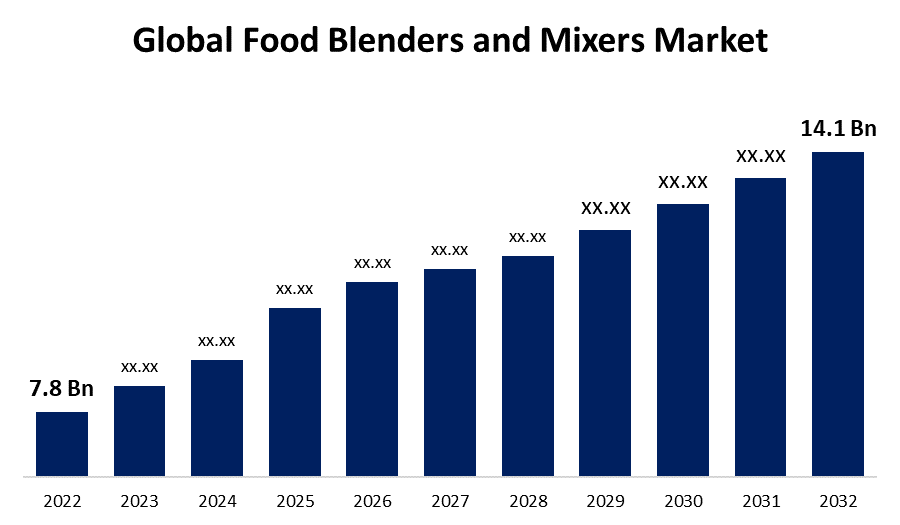

- The Global Food Blenders and Mixers Market Size was valued at USD 7.8 Billion in 2022.

- The Market is growing at a CAGR of 6.1% from 2022 to 2032

- The Worldwide Food Blenders and Mixers Market Size is expected to reach USD 14.1 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Food Blenders and Mixers Market is anticipated to exceed USD 14.1 Billion by 2032, growing at a CAGR of 6.1% from 2022 to 2032. The Global Food Blenders and Mixers Market is witnessing steady growth driven by the increasing demand for processed and convenience foods, product innovation, and the focus on food safety and hygiene. The market offers a wide range of equipment options to cater to different food processing requirements. As the food industry continues to evolve and consumer preferences change, the demand for food blenders and mixers are expected to grow, presenting opportunities for manufacturers to innovate and expand their product offerings.

Market Overview

The Global Food Blenders and Mixers Market refer to the market for equipment used in the food industry to blend, mix, and homogenize various ingredients in the production of food products. Food blenders and mixers are widely utilized in food processing units, bakeries, confectioneries, and other food manufacturing facilities. These machines play a crucial role in ensuring consistency, improving product quality, and increasing production efficiency in the food processing industry.

The global food blenders and mixers market offer a wide range of equipment options, including high-shear mixers, ribbon blenders, planetary mixers, screw mixers, and static mixers, among others. Each type of blender or mixer caters to specific food processing requirements, such as blending, mixing, emulsifying, or kneading, and manufacturers offer customized solutions to meet individual customer needs.

The market for food blenders and mixers has witnessed significant growth in recent years due to several factors. One of the primary drivers is the increasing demand for processed and convenience foods across the globe. Additionally, the growing focus on product innovation and customization in the food industry has also fueled the demand for food blenders and mixers.

Report Coverage

This research report categorizes the market for the global food blenders and mixers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the food blenders and mixers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the food blenders and mixers market.

Global Food Blenders and Mixers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.8 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 6.1% |

| 022 – 2032 Value Projection: | USD 14.1 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application, By Technology and By Region. |

| Companies covered:: | GEA Group, Tetra Laval, SPX Flow, Alfa Laval, Marel, Krones AG, Sulzer Ltd, Buhler, JBT, KHS Group, Hosokawa Micron Group, Amixon GmbH, Technosilos AP, Admix Inc., Nano Pharm Technology Machinery Equipment Co. Ltd., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The food industry is characterized by continuous product innovation and customization. Manufacturers strive to meet evolving consumer preferences by introducing new food products with unique flavors, textures, and nutritional profiles. Blenders and mixers are essential tools for achieving precise ingredient combinations, uniform distribution, and optimal blending, thereby facilitating product innovation and customization. Food blenders and mixers contribute to improved efficiency and productivity in food processing operations. These machines automate the blending and mixing processes, reducing manual labor and human errors.

Advancements in technology have greatly influenced the food blenders and mixers market. Manufacturers are continually developing new and advanced equipment with enhanced functionalities and features. For example, the integration of automation, IoT (Internet of Things), and data analytics capabilities in blenders and mixers allows for real-time monitoring, remote control, and predictive maintenance, improving operational efficiency and minimizing downtime.

Restraining Factors

Acquiring food blenders and mixers involves significant upfront costs for food manufacturers, especially for technologically advanced and high-capacity equipment. The initial investment required to purchase, install, and maintain these machines can be a restraint for small and medium-sized enterprises (SMEs) with limited financial resources. High capital expenditure can discourage some businesses from adopting or upgrading their blending and mixing equipment, thereby impeding market growth.

Food blenders and mixers are energy-intensive machines that consume significant amounts of electricity. The increasing emphasis on sustainable practices and environmental concerns has led to a growing focus on energy efficiency in the food industry. The high energy consumption of blenders and mixers can be seen as a restraint, as manufacturers face pressure to reduce their carbon footprint and minimize energy costs. This has prompted the development of more energy-efficient equipment, but cost considerations may hinder adoption.

Market Segmentation

The Global Food Blenders and Mixers Market share is classified into type, application, and technology.

- The high shear segment is expected to grow at the fastest pace in the global food blenders and mixers market during the forecast period.

The global food blenders and mixers market is segmented by type into shaft, high shear, ribbon mixer, planetary mixer, double cone, screw mixers & blenders. Among these, the high shear segment is expected to grow at the fastest pace in the global food blenders and mixers market during the forecast period. High shear mixers and blenders are designed to produce intense mixing and blending action by utilizing high rotational speeds and specialized mixing tools, such as high-speed impellers or rotor-stators. These machines are used for emulsifying, dispersing, and homogenizing ingredients to create smooth textures, stable emulsions, and uniform particle size distribution. High shear mixers find applications in industries such as sauces, dressings, dairy products, and pharmaceuticals.

- The beverages segment is expected to grow at the highest pace in the global food blenders and mixers market during the forecast period.

Based on the application, the global food blenders and mixers market is divided into bakery, dairy, beverages, and confectionery. Among these, the beverages segment is expected to grow at the highest pace in the global food blenders and mixers market during the forecast period. The reason behind the growth is, blenders and mixers are used in the production of beverages for mixing ingredients, dissolving powders, emulsifying flavors, and ensuring consistent product quality. The beverages segment covers a wide range of products, including soft drinks, juices, energy drinks, and alcoholic beverages. High shear mixers, static mixers, and blending systems are commonly employed in the beverage industry to achieve proper mixing and blending of ingredients.

- The batch mixing segment is expected to hold the largest share of the global food blenders and mixers market over the forecast period.

Based on the technology, the global food blenders and mixers market is divided into batch mixing and continuous mixing. Among these, the batch mixing segment is expected to hold the largest share of the global food blenders and mixers market over the forecast period. The reason behind the growth is, the batch mixing segment is typically more prevalent among small-scale and artisanal food producers, while continuous mixing is commonly adopted by large-scale food manufacturers due to its efficiency and productivity benefits. In this method, a specific quantity of ingredients is loaded into the mixer, and the mixing process occurs for a set duration until the desired blending is achieved. Batch mixers are suitable for applications such as bakery products, sauces, marinades, and small-scale food production.

Regional Segment Analysis of the Global Food Blenders and Mixers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

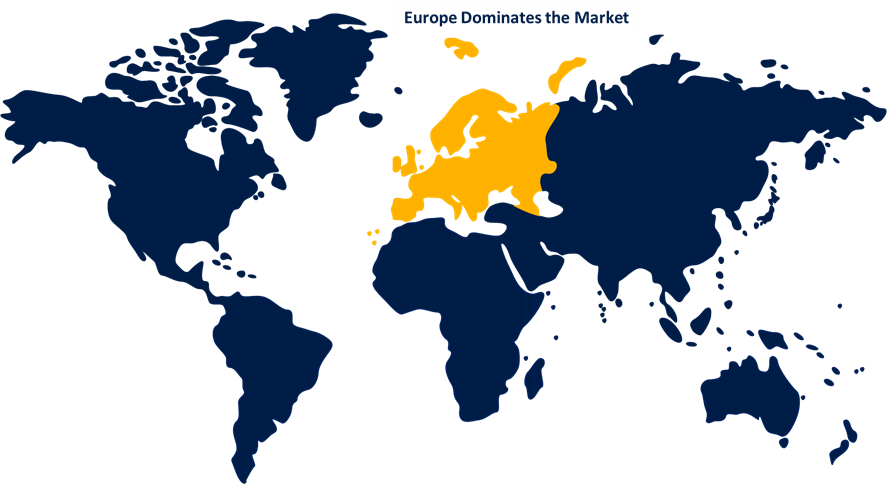

Europe is estimated to hold the largest share of the global food blenders and mixers market over the predicted timeframe.

Get more details on this report -

Europe is expected to hold the largest share of the global food blenders and mixers market during the forecast period. Countries such as Germany, France, the United Kingdom, and Italy have a strong presence in the food processing industry and are major consumers of blending and mixing equipment. The demand is driven by the diverse range of food products produced in the region, including bakery products, dairy products, beverages, and confectionery. Stringent food safety regulations and a focus on product innovation contribute to the growth of the market in Europe.

Asia Pacific is expected to grow at the fastest pace in the global food blenders and mixers market during the forecast period. The Asia Pacific region, including countries like China, Japan, India, and Australia, is witnessing rapid growth in the food blenders and mixers market. The increasing population, urbanization, and changing consumer preferences for processed and convenience foods are key drivers of market growth in this region. The rise of the bakery, dairy, and beverage industries, along with increasing investments in food processing infrastructure, further propel the demand for blending and mixing equipment.

South America is emerging as a significant market for food blenders and mixers. Countries like Brazil, Mexico, and Argentina have a growing food processing sector, leading to increased demand for blending and mixing equipment. The region's rich agricultural resources and the production of commodities such as cocoa, coffee, and fruits contribute to the demand for food processing equipment. Rapid urbanization, a rising middle class, and changing lifestyles also drive market growth in Latin America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global food blenders and mixers along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GEA Group

- Tetra Laval

- SPX Flow

- Alfa Laval

- Marel

- Krones AG

- Sulzer Ltd

- Buhler

- JBT

- KHS Group

- Hosokawa Micron Group

- Amixon GmbH

- Technosilos AP

- Admix Inc.

- Nano Pharm Technology Machinery Equipment Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2021, SPX FLOW, Inc. (NYSE: FLOW), a major supplier of process solutions for the food, beverage, and industrial sectors, announced the completion of its acquisition of UTG Mixing Group, the manufacturer of Stelzer, Uutechnic, and Jamix mixing solutions for the chemical, food, metallurgical and fertilizer, environmental technology, water treatment, and pharmaceuticals markets.

- In April 2021, Marel has established a new office and demonstration centre in Brazil. The company relocated its corporate office from Piracicaba to Campinas as part of the expansion and upgrade decision. At the same location, the company will also open a new Progress Point demonstration and training centre, which will help the company connect with its clients and strengthen its ability to support Latin American food processors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Food Blenders and Mixers Market based on the below-mentioned segments:

Global Food Blenders and Mixers Market, By Type

- Shaft

- High Shear

- Ribbon Mixer

- Planetary Mixer

- Double Cone

- Screw Mixers & Blenders

Global Food Blenders and Mixers Market, By Application

- Bakery

- Dairy

- Beverages

- Confectionery

Global Food Blenders and Mixers Market, By Technology

- Batch mixing

- Continuous mixing

Global Food Blenders and Mixers Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?