Global Food Encapsulation Market Size, Share, and COVID-19 Impact Analysis, By Shell Material (Emulsifiers, Lipids, Polysaccharides, and Proteins), By Technology (Hybrid Encapsulation, Microencapsulation, and Nanoencapsulation), By Core Phase (Enzymes, Minerals, Prebiotics, Organic Acids, Additives, Vitamins, Probiotics, Essential Oils, and Other Substances), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Food & BeveragesGlobal Food Encapsulation Market Insights Forecasts to 2032

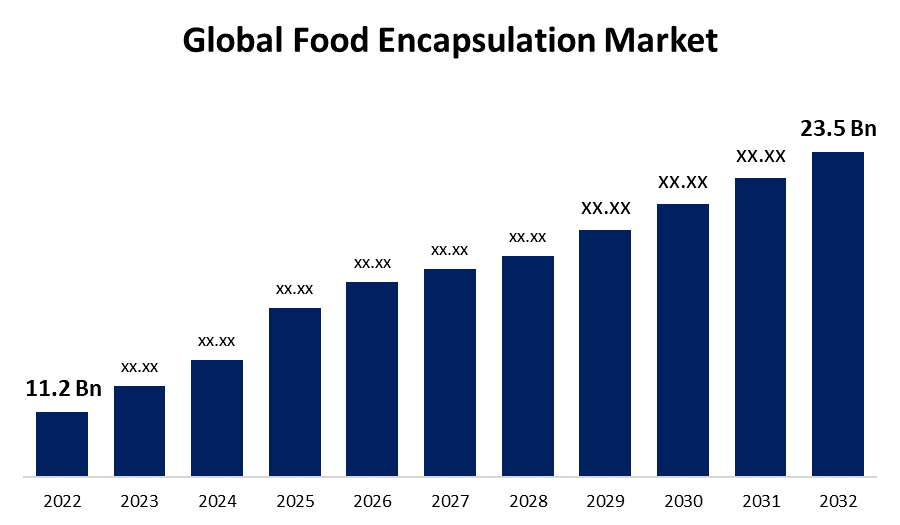

- The Global Food Encapsulation Market Size was valued at USD 11.2 Billion in 2022.

- The Market is Growing at a CAGR of 7.6% from 2022 to 2032

- The Worldwide Food Encapsulation Market Size is expected to reach USD 23.5 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Food Encapsulation Market is projected to exceed USD 23.5 Billion by 2032, growing at a CAGR of 7.6% from 2022 to 2032. Due to its many applications and numerous advantages over competing technologies, the encapsulation market is expanding significantly on a global scale. Some of the major benefits of encapsulation include improved stability and bioavailability of bioactive ingredients, the increased shelf life of food products, and the preservation of taste and flavor for a longer period of time. Encapsulation is becoming more popular in a variety of industries, including nutraceuticals and food and beverages.

Market Overview

The global food encapsulation market refers to the market for technologies and processes that are used to encapsulate food ingredients or additives such as vitamins, flavors, colors, enzymes, and other functional ingredients. Encapsulation is the process of enclosing a substance within a coating, often to protect it from the environment or to control its release. The market for food encapsulation is driven by the increasing demand for convenience foods, functional foods, and nutraceuticals, as well as the need to preserve and protect the nutritional value of food ingredients. Encapsulation helps to extend the shelf life of food products, enhance their flavor, and improve their texture. Encapsulants act as a shielding material, shielding the core, which contains a sensitive bioactive agent, from light, oxygen, and water in order to prevent any reaction in the core phase. Food-grade, biodegradable substances are strictly utilized in the design of encapsulated protective shells because they must be effective in creating a barrier between the internal phase and its surroundings.

North America is expected to dominate the global food encapsulation market due to the presence of a large number of food and beverage companies and the growing demand for functional foods and nutraceuticals. However, the Asia Pacific region is expected to grow at a faster rate due to the increasing population, rising disposable incomes, and growing health awareness.

Report Coverage

This research report categorizes the market for the global food encapsulation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the food encapsulation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the food encapsulation market.

Global Food Encapsulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.6% |

| 2032 Value Projection: | USD 23.5 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Shell Material, By Technology, By Core Phase, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Balchem, Cargill, Incorporated, International Flavors & Fragrances Inc, Aveka Group, ABCO Laboratories Inc., Advanced Bionutrition Corp, Sphera Encapsulation, National Enzyme Company, Encapsys LLC, DuPont, Lycored Ltd., Sensient Technologies Corporation, DSM, BASF SE, Ingredion Incorporated, Others |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The busy lifestyles of consumers have led to a rise in demand for ready-to-eat and easy-to-prepare foods. Encapsulation helps to enhance the shelf life of these products, making them more convenient and appealing to consumers. Encapsulation helps to protect sensitive vitamins, minerals, and other nutrients from degradation due to environmental factors such as oxygen, light, and heat. This helps to ensure that the nutritional value of food products is preserved, even during storage and transportation.

Advances in encapsulation technologies have led to the development of more effective and efficient encapsulation methods. This has increased the availability of encapsulated food ingredients and additives in the market, as the result driving demand for market. The development of novel encapsulation innovations, such as nanoencapsulation as well as bio-encapsulation, propels encapsulation demand in a variety of food applications. Encapsulation improves the taste of many food products. Initially, omega-3 fatty acid-containing products had a foul odour. Encapsulation technology has improved the fragrance and taste of omega-3 fatty acids. Recent advances in liposome technology are used in the production of a variety of products, including probiotics, nutraceuticals, and nutrigenomics, which provide numerous health benefits. Encapsulation has become more popular in niche applications such as gourmet and infant food due to technological advancements.

Restraining Factors

The high cost of encapsulation technology is a major restraint on the growth of the global food encapsulation market. Encapsulation technology can be relatively expensive, particularly for small and medium-sized food companies that may not have the financial resources to invest in this technology. This could limit the adoption of encapsulation technology and restrict the growth of the market, particularly in developing countries where cost is a major concern. The high cost of encapsulation technology may also result in higher prices for encapsulated food products, which could limit their appeal to price-sensitive consumers. This could limit the demand for encapsulated food products and restrict the growth of the market.

Market Segmentation

The Global Food Encapsulation Market share is classified into shell material, technology, and core phase.

- The polysaccharides segment is expected to hold the largest share of the global food encapsulation market during the forecast period.

Based on the shell material, the global food encapsulation market is segmented into emulsifiers, lipids, polysaccharides, and proteins. Among these, the polysaccharides segment is expected to hold the largest share of the global food encapsulation market during the forecast period. The growth can be attributed due to the wide range of polysaccharides available, their low cost, and their versatility in encapsulation applications. Polysaccharides such as alginate, pectin, and chitosan are commonly used in encapsulation due to their ability to form gels and provide improved stability to active ingredients. Polysaccharides, such as starches and gums, are used in encapsulation to form a protective coating around the active ingredients and provide improved functionality.

- The microencapsulation segment is estimated to hold the largest share of the global food encapsulation market over the study period.

Based on the technology, the global food encapsulation market is segmented into hybrid encapsulation, microencapsulation, and nanoencapsulation. Among these, the microencapsulation segment is estimated to hold the largest share of the global food encapsulation market over the study period. The primary factor attributed to the segment's large share is the growing demand and preference for microencapsulation due to its ease of manufacturing and superior functional advantages. The growth can be attributed due to its versatility in encapsulating a wide range of active ingredients, its ability to improve the stability and functionality of these ingredients, and its relatively low cost compared to other encapsulation technologies. Microencapsulation technology involves the use of different techniques such as spray-drying, coacervation, and extrusion to encapsulate active ingredients in particles ranging in size from 1 to 1000 micrometers. This technique is commonly used to improve the stability, bioavailability, and controlled release of active ingredients. It is an innovative technique that has been used in the personal care products, pharmaceuticals, agrochemical, and food sectors and is used in flavours, acids, oils, vitamins, and microorganisms, among other things.

- The probiotics segment is anticipated to hold the largest share of the global food encapsulation market over the projected timeframe.

Based on the core phase, the global food encapsulation market is segmented into enzymes, minerals, prebiotics, organic acids, additives, vitamins, probiotics, essential oils, and other Substances. Among these, the probiotics segment is anticipated to hold the largest share of the global food encapsulation market over the projected timeframe. The reason for the increase is, the increasing demand for functional foods that promote digestive health. Probiotics are live microorganisms that provide health benefits when consumed in adequate amounts. Encapsulation of probiotics can improve their survival during food processing, storage, and digestion.

Regional Segment Analysis of the Food Encapsulation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is estimated to hold the largest share of the global food encapsulation market during the predicted timeframe.

Get more details on this report -

In 2021, the North American region dominated the global food encapsulation market. This pattern of growth is projected to continue throughout the 2022-2032 period of forecasting. Factors include the increasing demand for encapsulation due to its use in the development of multiple food products; the broad availability of shell supplies such as hydrocolloid, and emulsions; a number of well-established competitors in the region; the growing customer demand and awareness for functional food products in the region; and the region's increasing product development and innovation are among the major factors contributing to the large market.

The Asia-Pacific region is expected to witness the highest growth rate in the global food encapsulation market during the forecast period. The growth can be attributed to the increasing demand for processed foods and beverages in countries such as China, India, and Japan. In addition, the growing awareness about health and wellness and the increasing demand for functional foods and dietary supplements are expected to drive the growth of the food encapsulation market in the region. China is the largest market for food encapsulation in the Asia-Pacific region, driven by the increasing demand for processed food products in the country. The growing urbanization and changing lifestyles of consumers in China have led to increasing demand for convenience foods, which in turn is driving the growth of the food encapsulation market in the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global food encapsulation along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Balchem

- Cargill, Incorporated

- International Flavors & Fragrances Inc

- Aveka Group

- ABCO Laboratories Inc.

- Advanced Bionutrition Corp

- Sphera Encapsulation

- National Enzyme Company

- Encapsys LLC

- DuPont

- Lycored Ltd.

- Sensient Technologies Corporation

- DSM

- BASF SE

- Ingredion Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2021, Ingredion and Verdient Foods have expanded their collaboration to produce a variety of protein concentrates flour from lentils, fava beans, and peas. This would allow the company to increase its protein production capacity and experiment with newer technologies.

- In March 2022, Kerry established a USD 137 million food technology and innovation excellence centre in Rome, Georgia. This would assist the company in innovating and entering new markets using food technologies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Food Encapsulation Market based on the below-mentioned segments:

Global Food Encapsulation Market, By Shell Material

- Emulsifiers

- Lipids

- Polysaccharides

- Proteins

Global Food Encapsulation Market, By Technology

- Hybrid Encapsulation

- Microencapsulation

- Nanoencapsulation

Global Food Encapsulation Market, By Core Phase

- Enzymes

- Minerals

- Prebiotics

- Organic Acids

- Additives

- Vitamins

- Probiotics

- Essential Oils

- Other Substances

Global Food Encapsulation Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?