Global Food Safety Testing Equipment and Consumables Market Size, Share, and COVID-19 Impact Analysis, By Type (Chromatography Systems, Mass Spectrometry Systems, PCR Equipment, Immunoassay Systems, Hybrid Systems, NMR Systems, and Flow Cytometry Systems), By Contaminant Type (Microbiological Analysis, Allergens Analysis, Pesticides & Fertilizers, Drugs And Antibiotics, Natural Toxins Analysis, and GMO Testing), By Food Type (Milk & Dairy Products, Grains, Fruits & Vegetables, Processed Food, Meat & Poultry, Sea Food, Cereals & Nuts, Beverages) and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2022 - 2030

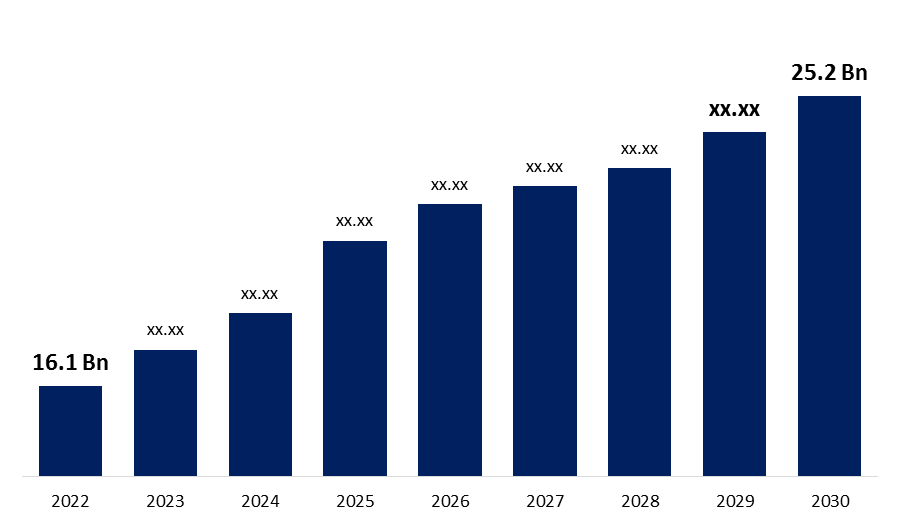

Industry: Food & BeveragesThe Global Food Safety Testing Equipment and Consumables Market Size is projected to grow from USD 16.1 billion in 2022 to USD 25.2 billion by 2030 at a CAGR of 7.6% during the forecast period. Food safety, a well-balanced diet, and food security are all linked. Unsafe food contributes to a vicious circle of infections and malnutrition, which disproportionately affects newborns, children, the elderly, and the sick. A healthy food supply not only helps to maintain food and nutrition security, but it also helps to boost national economies, trade, and tourism, all of which contribute to long-term development. Food safety is impacted by the world's rising population, climate change, and a fast-changing food system. The rising number of infectious diseases caused by food contamination, combined with increased awareness about food safety testing, has become the primary factor driving the market for food safety testing equipment and consumables. In the near future, the rapid growth of the food and beverage industry to meet customer expectations is expected to increase demand for food safety testing equipment. In addition, the expansion of the dairy industry has contributed to a rise in the demand for food pathogen testing. Strict government regulations, as well as a rapidly expanding food and beverage industry, are expected to propel market growth.

Get more details on this report -

REPORT COVERAGE

This research report categorizes the market for food safety testing equipment and consumables based on various segments and regions and forecasts revenue growth and analysis of trends in each of the submarkets. The report analyses the key growth drivers, opportunities, and challenges that influence the Food Safety Testing Equipment and Consumables Market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included in order to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Food Safety Testing Equipment and Consumables Market.

Food Safety Testing Equipment and Consumables Market Sedimentation

Based on the Type, the Food Safety Testing Equipment and Consumables Market is categorized into Chromatography Systems, Mass Spectrometry Systems, PCR Equipment, Immunoassay Systems, Hybrid Systems, NMR Systems, and Flow Cytometry Systems. The Polymerase Chain Reaction (PCR) Equipment segment will account for the greatest revenue in the market due to the advantages of using PCR technology to test a wide range of pathogens such as Listeria spp., Salmonella spp., and others that are analyzed using quick PCR systems, depending on the system. When it comes to GMOs, the PCR technique gives flexibility in terms of detecting several pathogens within a run, as well as detecting multiple species within a single test (depending on Test).

Based on Contamination Type, the Food Safety Testing Equipment and Consumables Market is categorized into Microbiological Analysis, Allergens Analysis, Pesticides & Fertilizers, Drugs and Antibiotics, Natural Toxins Analysis, and GMO Testing. The Microbiology analysis has accounted for the largest revenue in the market due to an increase in the number of microbial attacks and microbial food contamination instances that result in foodborne illness for food safety and consumer protection, rapid detection of spoilage microorganisms, foodborne pathogens, and other biological contaminants in complex food matrices is critical. Time-to-detection is a key barrier when testing food, particularly those with a limited shelf life such as meat, fish, dairy products, and vegetables. Microbial growth is the most common cause of spoiling, and it can manifest itself in the form of visible growth (slime and colonies), texture alterations (polymer breakdown), or the development of off-odors and flavors. Food deterioration caused by microbes is the leading cause of economic failure and waste, accounting for over a third of the world's total food supply.

Based on Food Type, the Food Safety Testing Equipment and Consumables Market is categorized into Milk & Dairy Products, Grains, Fruits & Vegetables, Processed Food, Meat & Poultry, Sea Food, Cereals & Nuts, Beverages. Due to an increase in global consumption of meat and meat products, the Meat & Poultry category held the biggest market share over the projection period.

Global Food Safety Testing Equipment and Consumables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 16.1 billion |

| Forecast Period: | 2022 to 2030 |

| Forecast Period CAGR 2022 to 2030 : | 7.6% |

| 2030 Value Projection: | USD 25.2 billion |

| Historical Data for: | 2017 to 2020 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Type, Contaminant Type, Food Type, and Region |

| Companies covered:: | Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Shimadzu Corporation, PerkinElmer Inc., Bruker, QIAGEN, ROKA BIO SCIENCE, DuPont., 3M |

| Growth Drivers: | Opportunities and Challenges that influence the Market. |

| Pitfalls & Challenges: | Expansion, Product Launch and Development, Partnership, Merger, and Acquisition |

Get more details on this report -

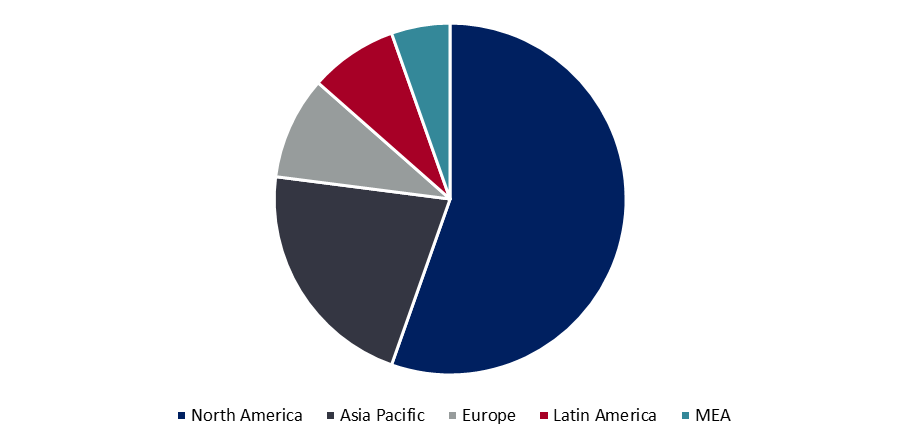

Food Safety Testing Equipment and Consumables Market Region Coverage

Based on region, the Food Safety Testing Equipment and Consumables Market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa. North America is expected to be the largest market. This is mostly due to the region's significant penetration of processed foods and strict food laws. Food safety funding from the government should be increased, as should the implementation of strict food safety legislation in this region. Furthermore, the United States' Food Safety and Modernization Act has enhanced the acceptance of food testing solutions in the region's food business. The primary purpose of food safety standards and organizations such as the Canadian Food Inspection Agency is to eliminate foodborne pathogens by preventing contamination. According to the Centers for Disease Control and Prevention, foodborne illness affects 48 million individuals in the United States each year, resulting in 128,000 hospitalizations and 3000 deaths.

Get more details on this report -

The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2028, owing to the rising processed food sector and increased focus on food safety, particularly in emerging economies such as China and India. Food is a large industry in the Asia-Pacific, and it is an important part of the region's economic growth potential. With ever-increasing degrees of national and international expertise, the food trading industry is booming. These changes have increased the demand for quality standards at all levels, with a greater emphasis on food safety, transparency, quality, and nutritional and health implications.

COMPETITIVE LANDSCAPE

Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Shimadzu Corporation, PerkinElmer Inc., Bruker, QIAGEN, ROKA BIO SCIENCE, DuPont., 3M. are some of the most well-known players in the global Food Safety Testing Equipment and Consumables Market. These firms have used various growth strategies such as new product launches, expansion, agreements, mergers, and acquisitions to maintain a competitive market position in the globe. New product introduction is the most popular growth strategy, accounting for more than half of all growth strategies, followed by expansion.

Some of the Key Developments:

In August 2019, Agilent Technologies, Inc. announced the completion of its acquisition of Bio Tek Instruments, a global leader in the design, manufacture, and distribution of novel life science instrumentation.

In February 2019, Invisible Sentinel, a US-based company that specializes in food and beverage molecular testing, was acquired by Biomatrix.

MARKET SEGMENTS

Food Safety Testing Equipment and Consumables Market, By Type

- Chromatography Systems

- Mass Spectrometry Systems

- PCR Equipment

- Immunoassay Systems

- Hybrid Systems

- NMR Systems

- Flow Cytometry Systems

Food Safety Testing Equipment and Consumables Market, By Contaminant Type

- Microbiological Analysis

- Allergens Analysis

- Pesticides & Fertilizers

- Drugs and Antibiotics

- Natural Toxins Analysis

- GMO Testing

Food Safety Testing Equipment and Consumables Market, By Food Type

- Milk & Dairy Products

- Grains

- Fruits & Vegetables

- Processed Food

- Meat & Poultry

- Sea Food

- Cereals & Nuts

- Beverages

Powered Lower Limb Orthosis Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?