Global Food Safety Testing Market Size, Share, and COVID-19 Impact Analysis, By Test (Allergen Testing, Chemical & Nutritional Testing, pathogen testing), By Food Tested (Meat, Poultry & Seafood, Dairy Products, Processed Foods, Fruits & Vegetables, and Others), By Technology (Rapid and Conventional), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Food Safety Testing Market Insights Forecasts to 2033

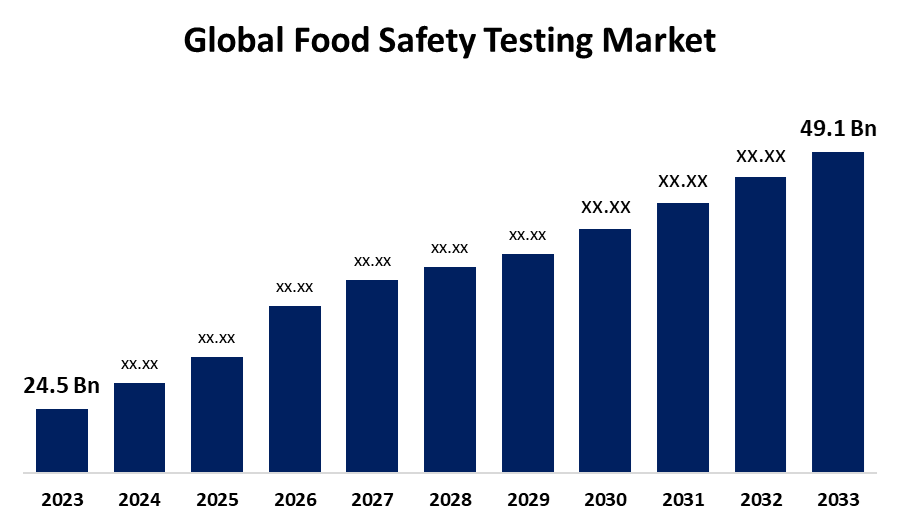

- The Global Food Safety Testing Market Size was Valued at USD 24.5 Billion in 2023

- The Market Size is Growing at a CAGR of 7.20% from 2023 to 2033

- The Worldwide Food Safety Testing Market Size is Expected to Reach USD 49.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Food Safety Testing Market Size is anticipated to exceed USD 49.1 billion by 2033, growing at a CAGR of 7.20% from 2023 to 2033.

Market Overview

Food safety testing is an evaluation of food products to determine their edibility or otherwise to find and isolate contaminants, pathogens, and other kinds of dangerous microorganisms. Testing is the most ensuring activity for eliminating the possibilities of food-borne illnesses and ensuring compliance with legislation and quality requirements of food products. Part of food safety testing involves following different methods: microbiological tests, chemical analyses, and physical tests that find bacteria, viruses, toxins, pesticides, and heavy metals that may contaminate food samples. The main drivers of demand for food safety testing are stringent new regulations from the government, increasing consumer awareness in terms of food quality and safety, and globalization of food supply chains. One such example involves advanced techniques such as PCR (polymerase chain reaction), immunoassays, and high-performance liquid chromatography, which have got widely used in fast and accurate detection of contaminants. There is a very dynamic and plethoric factors which create and shape the food testing safety market, for example the regulatory environment, technological application and market demands. It spurred growth in the global market due to high demand for natural and nutritious food additives, increased consumer awareness regarding their health benefits, food safety issues, growing elderly population, increased healthcare costs, lifestyle changes, and various food safety testing options available.

Report Coverage

This research report categorizes the market for the food safety testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Food Safety Testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the food safety testing market.

Global Food Safety Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 24.5 billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.20% |

| 023 – 2033 Value Projection: | USD 49.1 billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Test, By Food Tested and COVID-19 Impact Analysis |

| Companies covered:: | Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, and other key players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis, |

Get more details on this report -

Driving Factors

Increasingly changing climate patterns, acquiring greater food supply chaining globalization in the world, and shifting food patterns and preferences have also aggravated the risk of contamination and spreading foodborne pathogens. Heightened consumer awareness and the ever-increasing demand for the availability of safe food products bring about increasing pressure for investment in advanced testing technologies, leading to a growth trajectory in the market.

Restraining Factors

Market growth is repressed by such a high cost of sophisticated food safety testing equipment. These highly advanced testing instruments including mass spectrometers, chromatographs, and molecular analyzers are the most important equipment for a precision-intensive, thorough analysis of food hazards. Nevertheless, entry costs to use such equipment, in addition to ongoing maintenance costs, are very high, making them unaffordable costs, particularly for small and medium-sized enterprises (SMEs).

Market Segmentation

The Food Safety Testing market share is classified into Test, Food Tested, and Technology.

- The allergen testing segment is expected to hold the largest share through the forecast period.

Based on the test, the food safety testing market is categorized into allergen testing, chemical & nutritional testing, and pathogen testing. Among these, the allergen testing segment is expected to hold the largest share through the forecast period. The growth is attributed to food allergen testing methods that are now growing in the segment due to increasing food allergies among consumers. This has also given rise to health consciousness amongst people. Nearly 6 % of both children and adults in the USA have some sort of food allergy, increasing the segment during the forecast period.

- The meat, poultry & seafood segment holds the highest market share through the forecast period.

Based on the food tested, the food safety testing market is categorized into meat, poultry & seafood, dairy products, processed foods, fruits & vegetables, and others. Among these, the meat, poultry & seafood segment holds the highest market share through the forecast period. The growth is driven due to the meat chicken and fish such as ones that for the most basic food products check for any pathogens or chemicals or allergens to ensure the food is fit for human consumption. This has been increasing demand for the food that had all types of protein, and especially meat products. Meat, poultry, and seafood consumption levels are increasing the rest of the world. There's increasing need for protein-rich foods: meat products, in particular. Increasing consumption levels of meat, poultry, and seafood are perceivable continuously around the world.

- Conventional segment holds the biggest market share of the food safety testing market through the forecast period.

Based on the technology, the food safety testing market is categorized into rapid and conventional. Among these, the conventional segment holds the highest market share of the food safety testing market through the forecast period. The segmental growth is due to these tests, which would consume valuable time and cost a lot of money in equipment to get accurate results with them. They isolate the bacteria from the sample and grow them on culture media for identification. Although they are time-consuming, conventional tests provide more accurate results than rapid tests.

Regional Segment Analysis of the Food Safety Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

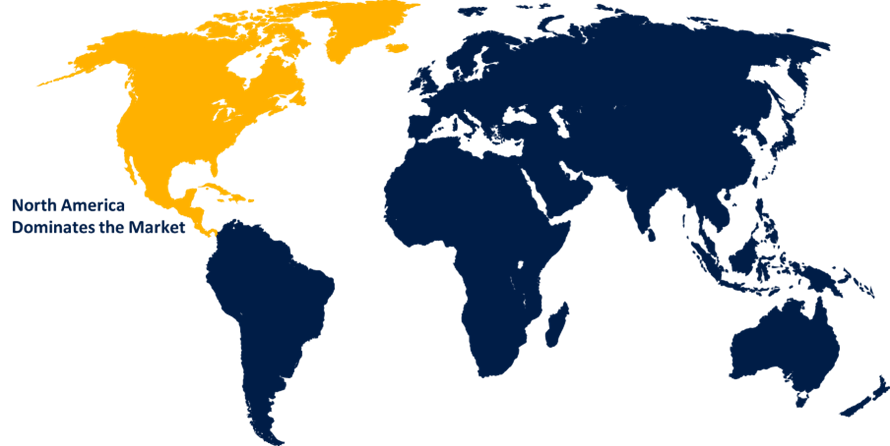

North America dominates the food safety testing market over the predicted timeframe.

Get more details on this report -

North America dominates the food safety testing market over the forecast period. Offering specific product lines and food safety testing services of a higher standard, deploying cutting-edge manufacturing and marketing techniques. High disposable income in Canada is also expected to contribute to the further growth of regional markets.

Asia Pacific is expected to grow the fastest during the forecast period. The growth is being seen due to stringent rules and regulations that are entirely focused on foods. Regional development is supported by rising needs for processed foods in fast-developing countries like China, Indonesia, India, and Thailand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the food safety testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eurofins Scientific

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- FOSS

- ALS

- LexaGene

- ROKA BIO SCIENCE

- Biorex Food Diagnostics (BFD)

- Randox Food Diagnostics

- Omega Diagnostics Group PLC

- Romer Labs Division Holding GmbH

- SGS Société Générale de Surveillance SA

- 3M

- Clear Labs, Inc.

- Invisible Sentinel

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, A quantitative Elisa assay for the detection of walnut allergens was launched by Neogen Corporation, the leading international food safety company.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the food safety testing market based on the below-mentioned segments:

Global Food Safety Testing Market, By Test

- Allergen Testing

- Chemical & Nutritional Testing

- pathogen Testing

Global Food Safety Testing Market, By Food Tested

- Meat, Poultry & Seafood

- Dairy Products

- Processed Foods

- Fruits & Vegetables

- Others

Global Food Safety Testing Market, By Technology

- Rapid

- Conventional

Global Food Safety Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global Food Safety Testing market?The global Food Safety Testing market is projected to expand at 7.20% during the forecast period.

-

2. Who are the top key players in the global Food Safety Testing market?The key players in the global Food Safety Testing market Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel.

Need help to buy this report?