Global Food Sweetener Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Sucrose, Starch Sweeteners, and Sugar Alcohols, High-Intensity Sweeteners (HIS)), By Application (Bakery and Confectionery, Dairy and Desserts, Beverages, Meat, and Meat Products, Soups, Sauces and Dressings, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Departmental Stores, Convenience Stores, Online Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Food Sweetener Market Insights Forecasts to 2033

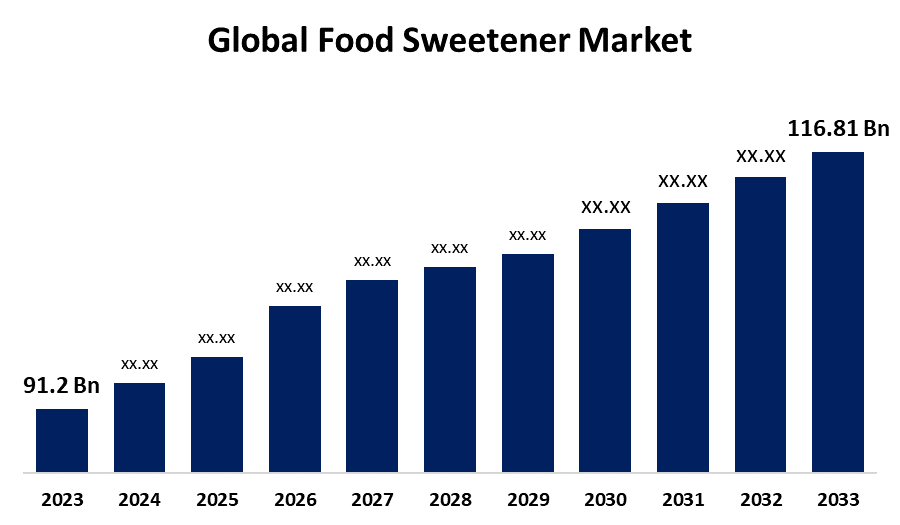

- The Global Food Sweetener Market Size was Valued at USD 91.2 Billion in 2023

- The Market Size is Growing at a CAGR of 2.51% from 2023 to 2033

- The Worldwide Food Sweetener Market Size is Expected to Reach USD 116.81 Billion by 2033

- South America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Food Sweetener Market Size is anticipated to exceed USD 116.81 billion by 2033, growing at a CAGR 2.51% from 2023 to 2033.

Market Overview

Food sweetener serves as a sugar substitute, offering the same sweetening properties as sugar but with a lower energy content and fewer calories. The increase in food sweetener consumption is primarily due to government regulations that significantly cut the sugar intake and also consumer consciousness and application in a variety of healthy food products available in the market. Food sweeteners importance is that they improve taste, preserve food, and give choices for sugars for consumers who cannot have them, particularly those who have diabetes. Sweeteners can be classified into two major categories: the first being artificial sweeteners and the second comprising natural sweeteners. Stevia and monk fruit are considered natural sweeteners, and their consumption is skyrocketing owing to the increasing consumer tendency towards organic foods. Innovation in food processing and ingredient formulation has helped propel the industry, enabling manufacturers to come up with several sweetening solutions. Versatile sweeteners are used in numerous types of products such as dairy, bakery items, confectionery, and beverages, thereby enhancing market reach.

Report Coverage

This research report categorizes the market for the food sweetener market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the food sweetener market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the food sweetener market.

Global Food Sweetener Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 91.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.51% |

| 2033 Value Projection: | USD 116.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product Type, By Application, By Distribution Channel, By Regional Analysis |

| Companies covered:: | Cargill Incorporated, Archer Daniels Midland Company, DuPont de Nemours. Inc., Ingredion Incorporated, Ajinomoto Co. Inc., S&W Seed Company, Manus Bio Inc. (NutraSweet), GLG Life Tech Corporation, Tereos SA, Celanese Corporation, Foodchem International Corporation. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors propelling the food sweetener market expansion is the convenience of processed goods that require sweet/sugar-based ready-to-eat foods, ready-to-drink beverages, snacks, and frozen dinners. Growing awareness about health, along with changing lifestyles, has created demand for sugar-free and low-calorie products, where sweeteners such as mannitol, stevia, and isomalt are increasingly gaining momentum among consumers. Hence, manufacturers have been continuously investing in this growing segment of the sweeteners market to meet the demand for low-calorie substitution.

Restraining Factors

The main restriction for the market is the very costly price of natural sweeteners in comparison with other traditional sugars. Additionally, side effects and health disorders that might arise from the overconsumption of food sweeteners works as main obstacles to the market development.

Market Segmentation

The food sweetener market share is classified into product type, application, and distribution channel.

- The sucrose segment is anticipated to hold the largest share of the market through the forecast period.

Based on the product type, the food sweetener market is categorized into sucrose, starch sweeteners, sugar alcohols, and high-intensity sweeteners (HIS). Among these, the sucrose segment is anticipated to hold the largest share of the market through the forecast period. The growth is attributed to consumer propensity to use natural sweeteners rather than artificial sweeteners, particularly in foods and beverages (F&B). Increased health consciousness is causing consumers to shift towards products that they perceive as healthier, or healthier alternatives for sweetening, thus creating more demand for naturally available sugar, especially sucrose.

- The beverages segment is projected to hold the majority market share through the forecast period.

Based on the application, the food sweetener market is categorized into bakery and confectionery, dairy and desserts, beverages, meat and meat products, soups, sauces, and dressings, and others. Among these, the beverages segment is projected to hold the majority market share through the forecast period. The growth is propelled by the demand for healthier options, as consumers become increasingly concerned and aware of clear all-natural sweeteners, low-calorie sweetening substitutes, or none at all in beverages. Growing understanding of health risks brought about by sugary drinks, for example, the obesity and diabetes epidemic, is quickly replacing the traditional sugar sweeteners. The functional drink category that comprises sports drinks, energy drinks, and fortified waters, most of which keep sweeteners to enhance taste with no compromise on the healthy profile, further fuels this segment.

- The supermarket & hypermarket segment is expected to hold the highest market share through the forecast period.

Based on the distribution channel, the food sweetener market is categorized into supermarkets and hypermarkets, department stores, convenience stores, online stores, and others. Among these, the supermarket & hypermarket segment is expected to hold the highest market share through the forecast period. The segmental growth is due to the massive availability of various food sweeteners, which in turn have attracted artificial to natural consumers to these outlets. These retail outlets are all suitable carriers under one roof, as they carry both sweeteners for diet and regular sweetening purposes: Consumers are given even more convenience as the trend for health-conscious shopping continues to surge, as the demand for shelf space for low-calorie natural sweeteners increases, along with the need for other sweeteners.

Regional Segment Analysis of the Food Sweetener Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the food sweetener market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the food sweetener market over the forecast period. People are inclined more towards having healthier and natural food products, particularly in rapidly developed nations such as China and India. It is mostly because of growing awareness regarding health hazards that high sugar consumption can bring to a person's body, and thus, the demand for low-calorie, as well as natural sweeteners, is increasing quite fast. Further, the urban as well as the rising disposable income among the consumers in this region is also contributing quite a lot to this development in the industry of food and beverage.

South America is expected to grow at the rapid CAGR in the food sweetener market during the forecast period. Brazil is the greatest sugar producer and exporter in the world. Such sweetness consumption levels, along with the country's emerging status, make it lucrative for destination markets. Further, demand for artificial sweeteners in Brazil will continue to grow in the years ahead because of the consumer demand for low-calorie products and the high-growth potential of Brazil's beverage market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the food sweetener market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Incorporated

- Archer Daniels Midland Company

- DuPont de Nemours. Inc.

- Ingredion Incorporated

- Ajinomoto Co. Inc.

- S&W Seed Company

- Manus Bio Inc. (NutraSweet)

- GLG Life Tech Corporation

- Tereos SA

- Celanese Corporation

- Foodchem International Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Tate & Lyle declared a grand collaboration with CryptoBiotix for a fresh ex-vivo study, which looked at the impacts of low- and no-calorie sweeteners on human gut microbiota. The study showed that these sweeteners either had a positive influence on gut health or neither negatively nor positively impacted it, thus proving to be potential beneficial alternatives to sugar.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the food sweetener market based on the below-mentioned segments:

Global Food Sweetener Market, By Product Type

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- High-Intensity Sweeteners (HIS)

Global Food Sweetener Market, By Application

- Bakery and Confectionery

- Dairy and Desserts

- Beverages

- Meat and Meat Products

- Soups, Sauces and Dressings

- Others

Global Food Sweetener Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

- Others

Global Food Sweetener Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global food sweetener market?The global food sweetener market is projected to expand at 2.51% during the forecast period.

-

2. Who are the top key players in the global food sweetener market?The key players in the global food sweetener market are Cargill Incorporated, Archer Daniels Midland Company, DuPont de Nemours. Inc., Ingredion Incorporated, Ajinomoto Co. Inc., S&W Seed Company, Manus Bio Inc. (NutraSweet), GLG Life Tech Corporation, Tereos SA, Celanese Corporation, Foodchem International Corporation.

Need help to buy this report?