Global Food Thickeners Market Size, Share, and COVID-19 Impact Analysis, By Type (Protein, Starch, Hydrocolloids & Others), By Source (Animal, Plant & Others), By Application (Bakery, Confectionery & Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Food Thickeners Market Insights Forecasts to 2033.

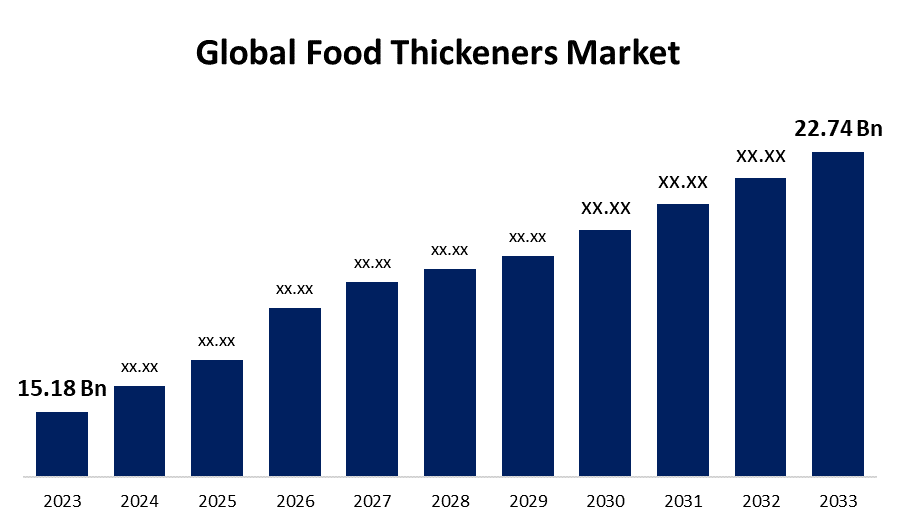

- The Global Food Thickeners Market Size was Valued at USD 15.18 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.12% from 2023 to 2033.

- The Worldwide Food Thickeners Market Size is Expected to Reach USD 22.74 Billion by 2033.

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Food Thickeners Market Size is Anticipated to Exceed USD 22.74 Billion by 2033, Growing at a CAGR of 4.12% from 2023 to 2033.

Market Overview

Food thickeners are substances that make a liquid thicker without significantly altering its other characteristics, such as flavor. Food thickeners are derived from a variety of sources, including plants, animals, and microorganisms. Starch is a naturally occurring energy source found in plants that gets collected and utilized in cooking. Starchy plants, including corn, rice, wheat, barley, spelt, oats, beans, peas, potatoes, tapioca, arrowroot, green bananas, plantains, gums, and pectin, are used in cooking. In the food and beverage sector, food thickeners are frequently used to thicken sauces, soups, and puddings without affecting their flavor. Food thickeners thicken food by absorbing its liquids and changing its texture. In addition, liquid food thickeners are used in dysphagia management to help reduce aspiration and enhance bolus control. Animal-based food thickeners include gelatin, collagen, blood albumin, and eggs. Eggs are frequently employed as coagulants in cakes, pastries, and sweets.

Report Coverage

This research report categorizes the market for the global food thickeners market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global food thickeners market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global food thickeners market.

Global Food Thickeners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.18 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.12% |

| 2033 Value Projection: | USD 22.74 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Source, By Application, By Region. |

| Companies covered:: | Cargill, Inc., Archer Daniels Midland Company, DuPont De Nemours, Inc., Tate & Lyle PLC, CP Kelco, Kerry Inc., Ingredion Incorporated, Ashland, TIC Gums, Inc., FDL Limited, Naturex S.A., Medline Industries, Inc., Darling Ingredients Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factor

The global food thickeners market is driven by various factors, including the growing concern about healthy lifestyles, which is boosting the market. There is an increase in demand in the global market due to factors such as the growing need for convenience meals, people choosing better lives, rising awareness of healthy eating, and the numerous features and advantages they provide. Food thickener producers work hard to develop new products every day, so they are increasing their revenue and diversifying their offerings. The need for food thickeners is being driven by all of these problems. Additional elements driving the expansion of the industry include enhancements to the functional and organoleptic characteristics of products. In addition, rising prepared food demand, rising disposable income, and the advantages and range of uses of food thickeners. Global firms in the area should have significant development potential as a result of growing consumer awareness of health. Moreover, the market expansion is being propelled by the growing consumer demand for convenience and ready-to-eat food items. RTE dairy and frozen desserts, bakery goods, sauces, and dressings are frequently made using food thickeners like proteins, hydrocolloids, and starch. Accordingly, the growing market expansion is also being facilitated by the rising desire for natural, healthy snacks.

Restraining Factors

The majority of food thickeners are made from natural materials, including starches and gums, and the availability of these materials is impacted by things like crop yields and weather. Problems with supply chains and price changes are possible because of this. Moreover, a few food-thickening ingredients, such as carrageenan, have been linked to health problems like inflammation and digestive problems. Consequently, there has been a shift in customer preferences and a movement toward alternative parts.

Market Segmentation

The Global Food Thickeners Market share is classified into and type, source, and application.

- The hydrocolloid segment is expected to hold the largest share of the global food thickeners market during the forecast period.

Based on the type, the global food thickeners market is divided into protein, starch, hydrocolloids, and others. Among these, the hydrocolloid segment is expected to hold the largest share of the global food thickeners market during the forecast period. Hydrocolloids are extensively utilized as thickeners and food additives. They are used, for example, as a starch dispersion agent in rice, a food stabilizer in whipped cream, a coating material for nuts and dried fish, a substitute for wheat flour in cookies, and a food substitute for sugar in steamed bread and whipped cream.

- The plant segment is expected to hold the largest share of the global food thickeners market during the forecast period.

Based on the source, the global food thickeners market is divided into animal, plant, and others. Among these, the plant segment is expected to hold the largest share of the global food thickeners market during the forecast period. The explanation for the widespread usage of plant-based products in various fields, including bakeries, confectioneries, and ready-to-eat meals, is their cost-effectiveness and high effectiveness. Plant-based food thickeners such as cornstarch, tapioca, agar, xanthan gum, rice flour, and pectin frequently used.

- The bakery segment is expected to hold the largest share of the global food thickeners market during the forecast period.

Based on the application, the global food thickeners market is divided into bakery, confectionery and others. Among these, the bakery segment is expected to hold the largest share of the global food thickeners market during the forecast period. Over the course of the forecast period, the market for food thickeners is anticipated to rise as a result of increased consumer awareness of items with traditional and exotic tastes and the resulting increase in demand for convenience meals. Food consumption habits have changed as a result of rising disposable incomes and rapidly urbanizing lifestyles, which help to boost demand throughout the forecast period.

Regional Segment Analysis of the Global Food Thickeners Market.

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global food thickeners market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global food thickener market over the predicted timeframe. The highly developed food and beverage sectors in the United States and Canada are the main drivers of the market in North America. The existence of several international food processing and manufacturing enterprises benefits the industry as well, increasing demand for the product. In recent years, there has been an increase in demand in North America for products including croissants, muffins, and cupcakes. Through the use of various thickeners, players in the baking and confectionery business are bringing innovation into their goods. Additionally, the region's need for bread and confectionery goods is growing.

Europe is expected to grow the fastest during the forecast period. The existence of a healthy confectionary and bakery sector, in addition to rising consumer demand, Over the duration of the forecast period, the market is also anticipated to rise at a faster rate due to the growing demand for packaged juices and energy drinks. European food thickener producers export value-added goods, such as combinations of flavoring ingredients and thickeners. The producers are steadily growing their operations in Eastern Europe, whereas the exporters are mostly based in Western Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global food thickeners along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Inc.

- Archer Daniels Midland Company

- DuPont De Nemours, Inc.

- Tate & Lyle PLC

- CP Kelco

- Kerry Inc.

- Ingredion Incorporated

- Ashland

- TIC Gums, Inc.

- FDL Limited

- Naturex S.A.

- Medline Industries, Inc.

- Darling Ingredients Inc.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, for patients with dysphagia, Nestlé introduced food and beverage thickeners in India.

- In January 2021, Tate & Lyle has launched new thickening starches, REZISTA® max, and gelling starches, BRIOGEL®, are being introduced as part of the expansion.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Food Thickeners Market based on the below-mentioned segments:

Global Food Thickeners Market, By Type

- Protein

- Starch

- Hydrocolloids

- Others

Global Food Thickeners Market, By Source

- Animal

- Plant

- Others

Global Food Thickeners Market, By Application

- Bakery

- Confectionery

- Others

Global Food Thickeners Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What are the food thinkers?A thickening substance that improves a liquid mix's viscosity without affecting its other characteristics is called a food thickener.

-

2. Which region has the largest share in the global food thickeners market?North America has the largest share in the global food thickeners market.

-

3. What is the value of the global food thickeners market in 2023?In 2023, the size of the global food thickeners market was estimated to be USD 15.18 billion.

Need help to buy this report?