Global Footwear Market Size, Share, and COVID-19 Impact Analysis, By Type (Athletic and Non-Athletic), By Material (Leather and Non-Leather), By Distribution Channel (E-Commerce and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Footwear Market Insights Forecasts to 2033

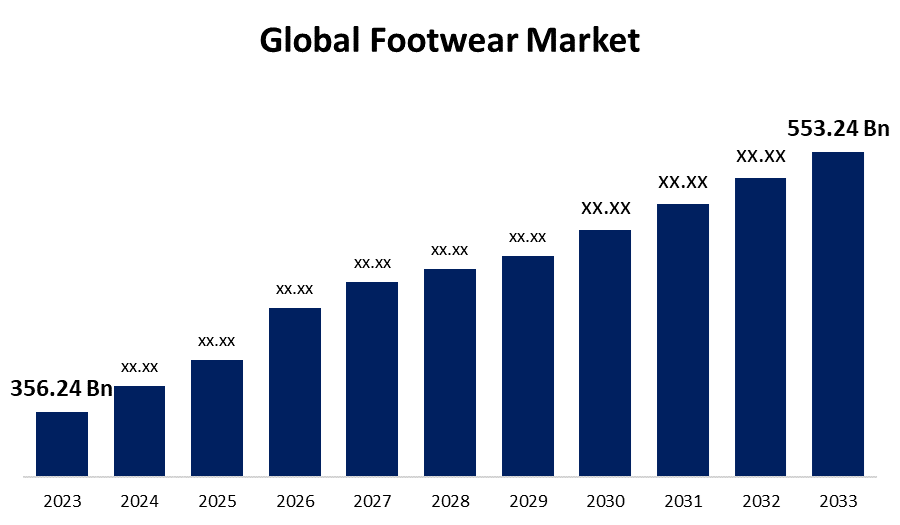

- The Global Footwear Market Size was Valued at USD 356.24 Billion in 2023

- The Market Size is Growing at a CAGR of 4.50% from 2023 to 2033

- The Worldwide Footwear Market Size is Expected to Reach USD 553.24 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Footwear Market Size is Anticipated to Exceed USD 553.24 Billion by 2033, Growing at a CAGR of 4.50% from 2023 to 2033.

Market Overview

Footwear helps to shield the foot from uneven surfaces, extremes in temperature, and gravel roads. Rubber, cloth, leather, and plastic are some of the materials used to make footwear. When the first footwear was made, leather was one of the main materials used. In present times eco-friendly raw materials are being used by companies to make footwear items. Safety shoes and other industrial protective footwear are used in a variety of industries, including food and beverage, mining, oil and gas, construction, and mining. The primary drivers of the market's expansion are the rising need for athletic footwear, the growing demand made possible by e-commerce, and the significant advertising expenditures made by footwear firms. In addition, a growing number of people are being motivated to participate in sports and fitness activities due to the increased prevalence of lifestyle-related health problems including stress and obesity. This is driving up demand for fashionable, comfortable footwear. The footwear market has been significantly influenced by the increasing number of working professionals, which increases demand for a variety of shoe styles catered to different lifestyle and professional requirements

Report Coverage

This research report categorizes the market for the global footwear market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global footwear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global footwear market.

Global Footwear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 356.24 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.50% |

| 2033 Value Projection: | USD 553.24 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material, By Distribution Channel, By Region |

| Companies covered:: | Nike, Adidas, Puma, Reebok, New Balance, Skechers, Under Armour, Converse, Vans, Timberland, Clarks, Crocs, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide footwear market is being driven by an increase in demand for fashionable, comfortable footwear. The growing consumer demand for environmentally friendly products is pushing shoemakers to replace traditional leather with recyclable and natural raw materials. Through a variety of measures, emerging economies are concentrating on increasing the market share of regional firms. To help with these activities, they are also exporting more items. The population's increased interest in sports and increased health consciousness are driving up demand for both athletic and non-athletic footwear. To improve their revenue streams, major players in the global market are concentrating on product performance and technological developments. Furthermore, there has been a rise in government support for international competitions such as the Olympics, Formula 1, Cricket World Cups, and FIFA. There are now more athletes competing in the domestic sporting events that are being planned owing to government authorities' encouragement to sign up. There is an increasing need for sports accessories such as apparel, footwear, and sunglasses due to the increase in participants.

Restraining Factors

The rise in popularity of counterfeit names can be attributed to the expensive prices of footwear brands such as Puma, Adidas, and Nike, as well as their increased demand. Counterfeit items are often sold to consumers in developing countries who are budget-sensitive. This issue makes it more difficult for the current original footwear brands to sell in these markets. Consumer perceptions of counterfeit items are generally negative due to their poor quality, frequent inconveniences, and safety concerns. The internet distribution channel is one of the primary venues where the sale of counterfeit brands can be concealed with ease. Therefore, it is anticipated that the growth of the counterfeit industry will hinder the growth of the footwear market.

Market Segmentation

The global footwear market share is segmented into type, material, and distribution channels.

- The non-athletic segment dominates the market with the largest market share through the forecast period.

Based on the type, the global footwear market is categorized into athletic and non-athletic. Among these, the non-athletic segment dominates the market with the largest market share through the forecast period. The growth in working professionals has led to a rise in the total demand for both formal and casual shoes. A rise in fashion consciousness and women's shifting preferences have also contributed to an increase in the market for non-athletic footwear. The market for non-athletic footwear is dominated by the wide variety of footwear options available, such as heels, wedges, and sandals. Children's growing preference for flip-flops, sandals, and boots is fueling the worldwide footwear market's demand. These shoes are a staple in most people's wardrobes due to they are appropriate for a variety of situations and are worn every day. The general market sales of non-athletic shoes are significantly influenced by the constant need for these shoes, which is driven by social functions, painting requirements, and style changes.

- The non-leather segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the material, the global footwear market is segmented into leather and non-leather. Among these, the non-leather segment is anticipated to grow at the fastest CAGR growth through the forecast period. This segment comprises shoes made of rubber, fabrics, synthetic materials, and various environmentally friendly substitutes. Non-leather shoes are becoming more popular due to their affordability, cruelty-free products, and increased consumer awareness of environmental issues. In this category, brands are also emphasizing innovation by introducing eco-friendly materials and captivating designs that appeal to a wider range of consumers.

- The offline stores segment accounted for the largest revenue share through the forecast period.

Based on the distribution channel, the global footwear market is segmented into e-commerce and offline stores. Among these, the offline stores segment accounted for the largest revenue share through the forecast period. The offline channel makes it easy for customers to access a wide variety of product portfolios from multiple market areas. With a presence both domestically and internationally, it is an effective store with a wide range of winter footwear. These stores give clients access to specialty products that are sold in the marketplace. Consequently, profitable possibilities for the footwear market's growth are created by the establishment of offline channels in multiple locations. Special discounts provided by the manufacturers through these channels significantly increase footwear sales. These discounts also encourage hypermarkets and supermarket chains to sell their products, thereby generating a variety of opportunities in the global footwear market.

Regional Segment Analysis of the Global Footwear Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global footwear market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global footwear market over the predicted timeframe. The market demand is expected to be driven by the expanding middle class, developing economies, and rapid urbanization. This is due to the rise in health consciousness, shifting lifestyle preferences, and the introduction of novel footwear products by different firms. It is home to China, India, and Vietnam, three of the world's leading shoe manufacturing nations. These nations are significant providers of footwear to international markets due to their reputation for powerful and economical manufacturing capabilities. The demand for luxury and branded shoes has increased due to rising disposable income and urbanization in nations like China and India.

North America is expected to grow at the fastest CAGR growth of the global footwear market during the forecast period. Shoes continue to be one of the most popular products bought by Americans. One of the world's most robust supply chains is found in the footwear sector. The market is being driven by consumers' growing desire for fashionable but comfortable footwear. Strong prospects for market expansion are seen in the North American region due to the rising popularity of sports like basketball, football, and other wintertime sports.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global footwear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nike

- Adidas

- Puma

- Reebok

- New Balance

- Skechers

- Under Armour

- Converse

- Vans

- Timberland

- Clarks

- Crocs

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Nike launched a brand-new line of footwear crafted from recycled materials.

- In May 2023, Skechers launched a brand-new line of shoes that use artificial intelligence to regulate the man or woman wearer's gait.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global footwear market based on the below-mentioned segments:

Global Footwear Market, By Type

- Athletic

- Non-Athletic

Global Footwear Market, By Material

- Leather

- Non-Leather

Global Footwear Market, By Distribution Channel

- E-Commerce

- Offline

Global Footwear Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Nike, Adidas, Puma, Reebok, New Balance, Skechers, Under Armour, Converse, Vans, Timberland, Clarks, Crocs, and Others

-

2.What is the size of the Global Footwear Market?Nike, Adidas, Puma, Reebok, New Balance, Skechers, Under Armour, Converse, Vans, Timberland, Clarks, Crocs, and Others The Global Footwear Market Size is Expected to Grow from USD 356.24 Billion in 2023 to USD 553.24 Billion by 2033, at a CAGR of 4.50% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global footwear market over the predicted timeframe.

Need help to buy this report?