Global Foreign Exchange Market Size, Share, and COVID-19 Impact Analysis, By Counterparty (Reporting Dealers, Other Financial Institutions, and Non-financial Customers), By Type (Currency Swaps, Outright Forward, and FX Swaps), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Foreign Exchange Market Insights Forecasts to 2033

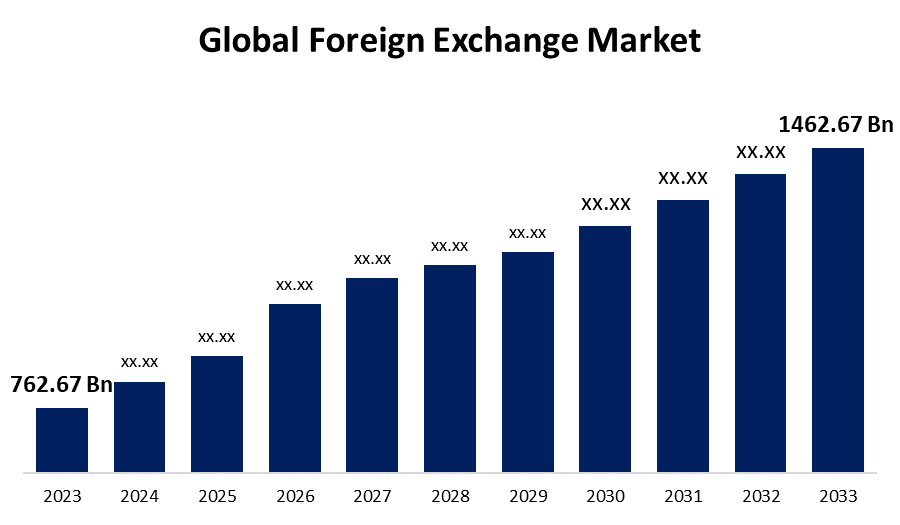

- Global Foreign Exchange Market Size was Valued at USD 762.67 Billion in 2023

- The Market Size is Growing at a CAGR of 6.73% from 2023 to 2033

- The Worldwide Foreign Exchange Market Size is Expected to Reach USD 1462.67 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Foreign Exchange Market Size is Anticipated to Exceed USD 1462.67 Billion by 2033, Growing at a CAGR of 6.73% from 2023 to 2033.

Market Overview

The foreign exchange market is a worldwide decentralized marketplace where currencies are bought and sold. The foreign exchange market is an over-the-counter (OTC) marketplace that regulates the trading rate for worldwide currencies. The foreign exchange market is the largest and most liquid financial market in the global, with exchange volumes surpassing $6 trillion per day. Moreover, the forex market enables international trade and investment by allowing industries to change one currency into another. The forex market works 24 hours a day, 5 days a week, with exchange taking place in main financial centers around the globe. The market is obsessed with numerous factors, including economic data, geopolitical events, and central bank policies. The exchange rate, which is the value of one currency compared to another, is resolute by supply and demand forces in the market. Furthermore, Banks, forex dealers, commercial companies, central banks, investment management firms, hedge funds, retail forex dealers, and investors created foreign exchange markets. Traders can select from a varied range of currency pairs and trading strategies, offering plenty of profit opportunities. The rate of trading in the forex market is comparatively low compared to other financial markets. Forex trading enables traders to use leverage to raise their trading position, potentially intensifying profits. The forex market is global, making it a valuable tool for international industries to manage their currency risk. The forex market is highly translucent, with real-time price data accessible to all market applicants. The main types of foreign exchange markets are spot markets, forward markets, future markets, options markets, and swaps markets.

Report Coverage

This research report categorizes the market for the global foreign exchange market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global foreign exchange market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global foreign exchange market.

Global Foreign Exchange Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 762.67 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.73% |

| 2033 Value Projection: | USD 1462.67 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Counterparty, By Type, By Region |

| Companies covered:: | Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC Holdings plc, JPMorgan Chase & Co., The Royal Bank of Scotland, UBS AG, Standard Chartered PLC, State Street Corporation, XTX Markets Limited, London Stock Exchange Group plc, NatWest Group plc, Other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges ,Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing market liquidity is notably driving the market growth. The global market is the most simply liquidated financial market, as it encompasses the trading of several currencies all around the globe. Traders in this market have whole liberty to buy or sell currencies anytime, as per their individual choice. Liquidity states the capability of the currency pair to be bought and sold without creating a major alteration in its exchange rate in the global market. Furthermore, the swift accessibility of news and pricing delivers foreign exchange traders with the most informed statistics for trading. Such factors will fuel market development during the forecast period. The increase in international businesses is suggestively contributive to the development of the foreign exchange market going onward. International transactions state to transactions concerning two or more related industries in which at least one party is a non-resident. Improved global trade and international transactions surge the size and activity of the foreign exchange market. The growing terrorism threats are anticipated to drive the growth of the foreign exchange market going forward. Terrorism threats are defined as the probable risks and dangers posed by individuals, groups, or organizations that are involved in acts of terrorism. Terrorism events can lead to an increase in safe-haven demand for currencies, improved geopolitical and economic risks, monetary policy responses, international collaboration and information sharing, counter-terrorism financing creativities, and flight to safe havens.

Restraining Factors

Instead of taking a fixed trading rate, the foreign exchange customs a changing exchange rate. For this reason, several factors disturb exchange rates. Moreover, politics, the economy, and market psychology all affect foreign exchange prices and frequently ensure. Furthermore, government funds and financial policy, as well as increased rates and trends, trade balance rates and trends, and other financial variables can all affect the foreign exchange rate. Politics can damagingly affect a nation's economy and subsequently have a bearing on foreign exchange. Instances of such political circumstances include the instability of a government and political conflict.

Market Segmentation

The global foreign exchange market share is classified into counterparty and type.

- The reporting dealers segment is expected to hold the largest share of the global foreign exchange market during the forecast period.

Based on the counterparty, the global foreign exchange market is divided into reporting dealers, other financial institutions, and non-financial customers. Among these, the reporting dealers segment is expected to hold the largest share of the global foreign exchange market during the forecast period. This is due to their stimulus and contribution to trading activities. Reporting dealers mostly include large financial institutions. Reporting dealers act as mediators among several market participants. Reporting dealers are marketable investment banks that provision activity in the foreign exchange market. They enable smooth transactions. Reporting dealer's trading activities create profits and deliver valuable market information. Reporting dealers also contribute to market proficiency and transparency. Reporting dealers endorse fair competition and maintain loyalty to best practices in the market. Reporting dealers also contribute to price sighting by monitoring market circumstances and analyzing fundamental factors.

- The currency swaps segment is expected to hold the largest share of the global foreign exchange market during the forecast period.

Based on the type, the global foreign exchange market is divided into currency swaps, outright forward, and FX swaps. Among these, the currency swaps segment is expected to hold the largest share of the global foreign exchange market during the forecast period. Currency swaps dominate the global foreign exchange market owing to currency swaps having developed as the most common type of transaction in the global foreign exchange market. The modification from spot transactions to currency swaps is credible as currency swaps are frequently utilized for liquidity management and currency risk evading. According to the Bank for International Settlements (BIS) triennial survey, currency swaps are now the most extensively used foreign currency instrument.

Regional Segment Analysis of the Global Foreign Exchange Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global foreign exchange market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global foreign exchange market over the predicted timeframe. This is attributed to the North America is supported by many elements, including the predominance of the US dollar as a global reserve currency. Moreover, the region's robust financial infrastructure and vigorous regulatory framework deliver a sense of confidence and stability. Technological advancements in trading platforms and the easy accessibility of a diversity of financial products are attractive to institutional and individual investors alike. The economic policies in North America, its openness to foreign trade, and its adherence to financial trends global all contribute to the development of foreign exchange activities.

Asia Pacific is expected to grow at the fastest pace in the global foreign exchange market during the forecast period. This is attributed to the foreign exchange market in the Asian region is a swiftly increasing and dynamic market. It is obsessed with several unique factors, including the region's large population, growing economic development, and the existence of several major global financial institutions. The region's large population offers a large pool of potential customers for foreign exchange services, while its economic development has led to amplified demand for foreign currency. This has resulted in a large and liquid market for foreign exchange transactions. The existence of major global financial institutions in the region has also contributed to the progress of the foreign exchange market. These institutions deliver access to a wide range of financial products and services, including foreign exchange services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global foreign exchange market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barclays

- BNP Paribas

- Citibank

- Deutsche Bank

- Goldman Sachs

- HSBC Holdings plc

- JPMorgan Chase & Co.

- The Royal Bank of Scotland

- UBS AG

- Standard Chartered PLC

- State Street Corporation

- XTX Markets Limited

- London Stock Exchange Group plc

- NatWest Group plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, JP Morgan discovered the summary of novel FX Warrants designated in Hong Kong dollars in the Hong Kong market, marking its position as the inaugural issuer in Asia to present FX Warrants featuring CNH/HKD (Chinese Renminbi traded outside Mainland China/Hong Kong dollar) and JPY/HKD (Japanese Yen/Hong Kong dollar) as fundamental currency pairs. These fresh FX Warrants are usually to commence trading on the Hong Kong Stock Exchange.

- In October 2023, Deutsche Bank AG confirmed its purchase of Numis Corporation Plc. The incorporation of both brands under the name 'Deutsche Numis' highlights their collective influence and standing in the UK and global markets. 'Deutsche Numis' develops as a prominent entity in UK investment banking and the ideal advisor for UK-listed companies. This acquisition is in line with Deutsche Bank's Global Hausbank strategy, targeting to become the primary partner for clients in financial services and nurturing stronger relationships with companies throughout the United Kingdom.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global foreign exchange market based on the below-mentioned segments:

Global Foreign Exchange Market, By Counterparty

- Reporting Dealers

- Other financial Institutions

- Non-financial Customers

Global Foreign Exchange Market, By Type

- Currency Swaps

- Outright Forward

- FX Swaps

Global Foreign Exchange Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC Holdings plc, JPMorgan Chase & Co., The Royal Bank of Scotland, UBS AG, Standard Chartered PLC, State Street Corporation, XTX Markets Limited, London Stock Exchange Group plc, NatWest Group plc, and others.

-

2. What is the size of the global foreign exchange market?The Global Foreign Exchange Market is expected to grow from USD 762.67 Billion in 2023 to USD 1462.67 Billion by 2033, at a CAGR of 6.73% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global foreign exchange market over the predicted timeframe.

Need help to buy this report?