Global Forklift Market Size, Share, and COVID-19 Impact Analysis, By Class (Class 1, Class 2, Class 3, and Class 4/5), By Power Source (Internal Combustion Engine and Electric), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: Automotive & TransportationGlobal Forklift Market Insights Forecasts to 2032

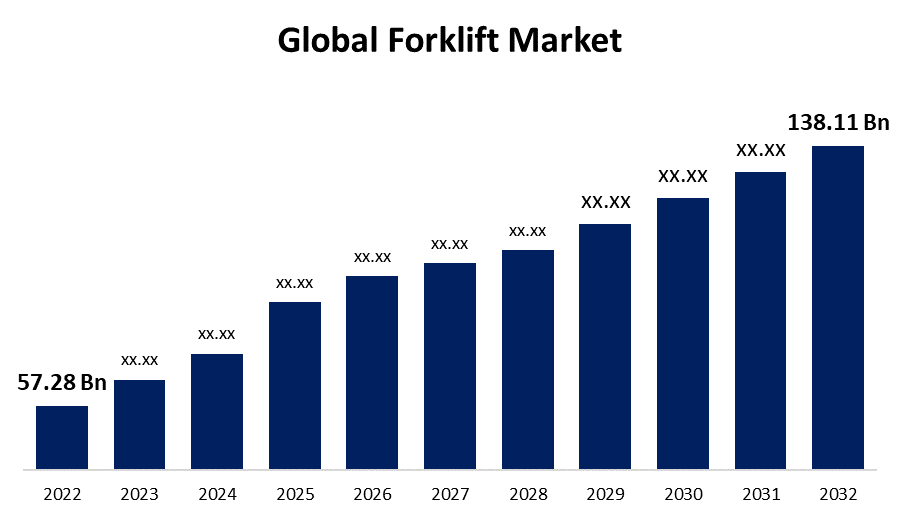

- The Global Forklift Market Size was valued at USD 57.28 Billion in 2022.

- The Market is growing at a CAGR of 9.2% from 2023 to 2032.

- The Worldwide Forklift Market Size is expected to reach USD 138.11 Billion by 2032.

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Forklift Market Size is expected to reach USD 138.11 Billion by 2032, at a CAGR of 9.2% during the forecast period 2023 to 2032.

Market Overview

A forklift, also known as a lift truck or powered industrial truck, is a versatile material-handling vehicle widely used in warehouses, construction sites, and various industries. It is equipped with hydraulic lifting mechanisms and forks attached to the front, enabling it to lift and transport heavy loads with ease. Forklifts come in different types, including counterbalance, reach trucks, pallet jacks, and order pickers, each designed for specific tasks and operating conditions. They can be powered by internal combustion engines or electric motors. Forklifts play a crucial role in enhancing productivity and efficiency by facilitating the movement and stacking of goods. However, operating forklifts requires proper training and adherence to safety protocols to prevent accidents and ensure the well-being of operators and those working in proximity. Forklifts are an essential tool for modern material handling, contributing significantly to the smooth functioning of industries worldwide.

Report Coverage

This research report categorizes the market for forklift market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the forklift market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the forklift market.

Global Forklift Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 57.28 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.2% |

| 2032 Value Projection: | USD 138.11 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Class, By Power Source, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Anhui Heli Co., Ltd., Clark Material Handling Company Inc., Crown Equipment Corporation, Doosan Industrial Vehicles Co. Ltd, Hangcha Group Co., Hyster-Yale Materials Handling, Inc., Jungheinrich AG, KION Group AG, Komatsu Ltd., Mitsubishi Logisnext Co., Ltd., Toyota Material Handling, Caterpillar Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The forklift market is driven by several factors that contribute to its growth and demand. The expansion of the e-commerce sector has resulted in increased warehousing and logistics activities, creating a higher demand for forklifts to handle material handling tasks efficiently. Additionally, the growth of the manufacturing and construction industries worldwide has boosted the need for forklifts for loading, unloading, and transporting heavy goods. Moreover, the focus on improving operational efficiency and reducing labor costs has led to the adoption of forklifts in various industries. Technological advancements, such as the development of electric forklifts that offer environmental benefits and lower operating costs, have further propelled market growth. Furthermore, stringent safety regulations and the emphasis on worker safety have increased the demand for advanced forklifts equipped with safety features. Overall, the drivers of the forklift market encompass industry expansion, operational efficiency, technological advancements, and safety requirements.

Restraining Factors

The forklift market faces certain restraints that can hinder its growth and adoption. Firstly, the high initial investment cost associated with purchasing forklifts can pose a challenge, particularly for small and medium-sized enterprises with limited budgets. Additionally, the maintenance and operational costs of forklifts, including fuel or electricity expenses and periodic servicing, can add to the overall expenses. Another restraint is the lack of skilled operators, as operating a forklift requires specialized training and expertise. Moreover, the stringent regulations and compliance standards related to forklift operations and safety can create additional hurdles for businesses. Lastly, the availability of alternative material handling equipment and technologies, such as automated guided vehicles (AGVs) and robotic systems, presents competition to the forklift market.

Market Segmentation

- In 2022, the class 3 segment accounted for around 37.2% market share

On the basis of class, the global forklift market is segmented into class 1, class 2, class 3, and class 4/5. The Class 3 segment holds the largest market share in the forklift industry. Class 3 forklifts are electric motor-powered pallet jacks and walkie stackers. There are several reasons behind their dominant market position. Electric forklifts have gained popularity due to their environmental benefits and lower operating costs compared to internal combustion engine forklifts. The increasing focus on sustainability and reducing carbon emissions has propelled the demand for electric forklifts. Additionally, Class 3 forklifts are well-suited for indoor applications, such as warehouses and distribution centers, where maneuverability and compact size are crucial. They offer efficient pallet handling and stacking capabilities, improving productivity in confined spaces. Furthermore, advancements in electric forklift technology, such as improved battery life and charging infrastructure, have boosted the adoption of Class 3 forklifts. Overall, the Class 3 segment's market leadership is a result of its environmental friendliness, cost-effectiveness, and suitability for indoor material handling tasks.

- In 2022, the electric segment dominated with more than 65.7% market share

Based on the power source, the global forklift market is segmented into internal combustion engine and electric. The electric segment holds the largest market share in the forklift industry. Electric forklifts have witnessed significant growth and adoption due to several factors. The increasing emphasis on sustainability and reducing carbon emissions has driven the demand for electric-powered material handling equipment. Electric forklifts offer environmental benefits by eliminating exhaust emissions and reducing noise pollution. Advancements in battery technology have improved the performance and efficiency of electric forklifts, enabling longer operating hours and quicker charging times. Additionally, the lower operating costs of electric forklifts, such as reduced fuel and maintenance expenses, make them an attractive choice for businesses. Moreover, the versatility and adaptability of electric forklifts make them suitable for a wide range of applications, from indoor warehousing to outdoor operations. Overall, the electric segment's market leadership is a result of its environmental advantages, cost-effectiveness, and technological advancements in battery-powered forklifts.

Regional Segment Analysis of the Forklift Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

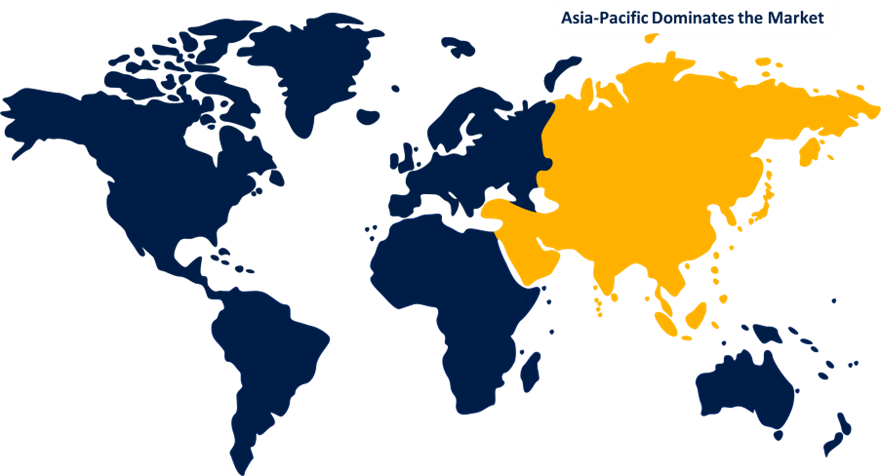

Asia-Pacific dominated the market with more than 46.2% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific holds the largest market share in the forklift industry. Several factors contribute to the region's dominance. The Asia-Pacific is experiencing rapid industrialization and urbanization, leading to increased manufacturing activities and infrastructure development. The growing demand for forklifts in industries such as automotive, electronics, and logistics drives market growth. Additionally, the e-commerce boom in the region has fueled the need for efficient material-handling equipment, including forklifts, to support warehousing and logistics operations. Moreover, the presence of key manufacturing hubs, such as China, Japan, and South Korea, further strengthens the market in Asia-Pacific. These countries have a strong industrial base and are major exporters, driving the demand for forklifts. Furthermore, government initiatives promoting industrial growth, favorable investment policies, and rising consumer spending contribute to the market's expansion. Overall, Asia-Pacific's market leadership is driven by its industrial growth, e-commerce expansion, and supportive government policies.

Recent Developments

- In July 2022, TMH (Toyota Material Handling) recently revealed its acquisition of PennWest Toyota Lift, a forklift dealership headquartered in Pennsylvania. This acquisition encompasses multiple locations, including Mount Pleasant, Pittsburgh, and Erie. In the United States, TMH is the proud owner of the Hoist Liftruck series, which includes container handlers, marina trucks, and FLTs. Additionally, TMH offers a wide range of medium and heavy forklifts in their product portfolio.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global forklift market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Anhui Heli Co., Ltd.

- Clark Material Handling Company Inc.

- Crown Equipment Corporation

- Doosan Industrial Vehicles Co. Ltd

- Hangcha Group Co.

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Material Handling

- Caterpillar Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global forklift market based on the below-mentioned segments:

Forklift Market, By Class

- Class 1

- Class 2

- Class 3

- Class 4/5

Forklift Market, By Power Source

- Internal Combustion Engine

- Electric

Forklift Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?