Global Forklift Truck Market Size, Share, and COVID-19 Impact Analysis, By Class Type (Class 1, Class 2, Class 3, Class 4, Class 5), By Power Source Type (Internal Combustion Engine, Electric), By End-Use Industry (Mining, Industrial, Food & Beverages, Construction, Chemical, Logistic, Manufacturing, Natural Resources, Retail & E-Commerce, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis a006Ed Forecast 2021 - 2030

Industry: Automotive & TransportationGlobal Forklift Truck Market Insights Forecasts to 2030

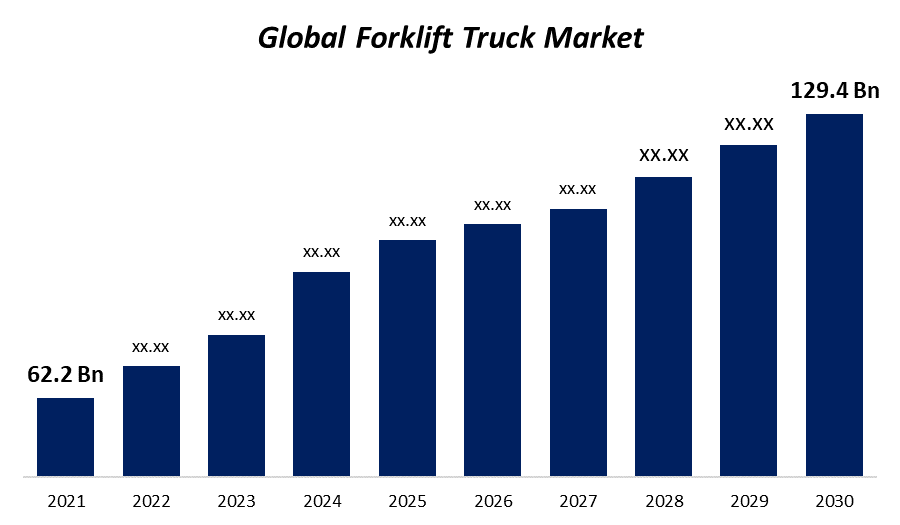

- The Forklift Truck Market size was valued at USD 62.2 billion in 2021

- The market is growing at a CAGR of 7.45% from 2022 to 2030

- The Global Forklift Truck Market is expected to reach USD 129.4 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Forklift Truck Market is expected to reach USD 129.4 billion by 2030, at a CAGR of 7.45% during the forecast period 2022 to 2030.

Market Overview

A forklift truck is a piece of industrial machinery that is powered by electricity or gas and has a metal fork platform attached to the front. The fork platform can be used to carry or store freight, pallets, or machinery while lifting heavy loads. A forklift truck's truck frame serves as the foundation for its lifting and includes wheels, counterweights, a carriage, and a mast. Electrical and internal combustion engines are the two types of engines used in forklift trucks. Forklift trucks are used in a variety of applications, including shipping docks, industrial settings, warehouses, and truck loading and unloading. Because they come in a variety of sizes and power sources, they can be found in both small businesses and large, intricate industrial manufacturing operations.

The use of forklifts is essential in distribution centers and warehouses. These buildings are regarded as necessary in order to allow for efficient and secure mobility. There are several models and load capacities of forklift trucks. The majority of forklifts in a typical warehouse have load capacities ranging from one to five tonnes. Heavier loads, such as loaded shipping containers, are raised by larger equipment capable of lifting up to 50 tonnes.

Report Coverage

This research report categorizes the market for Global Forklift Truck Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Forklift Truck Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Forklift Truck Market.

Driving Factors

Over the last few years, the booming global e-commerce sector and developments in warehouse management have raised the demand for forklift trucks that can handle big loads and operate through small spaces. In addition, warehouse owners prioritise improving efficiency inside the warehouse and operational plants while reducing operational costs. Electric forklift trucks growing popularity among recycling centre operators and chemical producers is expected to boost the forklift truck market growth. The benefits of an electric forklift, which is powered by batteries and offers benefits such as less maintenance, reduced vibration, low noise, and low weight, make it convenient for employees to operate in the field. These are the primary driving elements influencing the global expansion of the forklift truck sector.

Global Forklift Truck Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 62.2 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 7.45% |

| 2030 Value Projection: | USD 129.4 billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Class Type, By Power Source Type, By End-Use, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Toyota Industries Corporation, Anhui Heli Co., Ltd., Mitsubishi Logisnext Co., Ltd., Hyster-Yale Materials Handling, Inc., Doosan Corporation, Crown Equipment Corporation, KION Group AG, Konecranes, Paletrans Equipment, Lonking Holdings Limited, Crown Equipment Corporation, Jungheinrich AG, Mitsubishi Heavy Industries Group, Komatsu Ltd., EP Equipment, Cargotec Oyj, Manitou Group |

| Growth Drivers: | In addition, warehouse owners prioritise improving efficiency inside the warehouse and operational plants while reducing operational costs. |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Restraining Factors

The high cost of maintenance and the constantly changing cost of raw materials may make it difficult for the market to expand. Furthermore, strict emission rules may partially hamper forklift truck market expansion. In 2020, the COVID-19 pandemic also had a negative influence on manufacturing, construction, and warehouse activity.

Market Segmentation

- In 2021, the class 3 segment is witnessing a higher growth rate over the forecast period.

Based on class type, the Global Forklift Truck Market is segmented into class 1, class 2, class 3, class 4, and class 5. Among these, the class 3 segment is witnessing a higher growth rate over the forecast period. Since they have lower base and maintenance costs than other forklifts, their utilisation in warehouses and distribution hubs has grown. Electric warehouse pedestrian trucks and pallet jacks are examples of class 3 forklifts.

- In 2021, the electric segment is witnessing significant CAGR growth over the forecast period.

On the basis of materials, the Global Forklift Truck Market is segmented into the internal combustion engine, and electric. Among these, the electric segment is witnessing significant CAGR growth over the forecast period. The fact that electrically driven forklift trucks do not require fuel storage at their location is a significant advantage. Corporations are compelled to use electric material-handling vehicles because they are simple to operate and maintain within warehouses due to the significant pollution emissions from these forklift trucks. These electric forklift trucks can load and unload heavy items from the ground or docks, making them perfect for use indoors.

- In 2021, the residential Forklift Truck segment is dominating the market with the largest market share of 55% over the forecast period.

Based on the end-use industry, the Global Forklift Truck Market is segmented into mining, industrial, food & beverages, construction, chemical, logistics, manufacturing, natural resources, retail & e-commerce, and others. Among these, the residential Forklift Truck segment dominates the market with the largest market share of 55% over the forecast period. These trucks are typically used in the food and beverage industries. Because of the expansion of the commercial food and beverage business, the use of these vehicles is expanding at a faster rate. Due to their frequent fast turnaround, washdowns, caustic chemicals, and cold storage, several food processing facilities and warehouses demand sophisticated material handling equipment. Machines that are subpar or unreliable might result in ruined products, lost productivity, and costly maintenance. Such vehicles play a significant role in the food and beverage business in such settings.

Regional Segment Analysis of the Forklift Truck Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

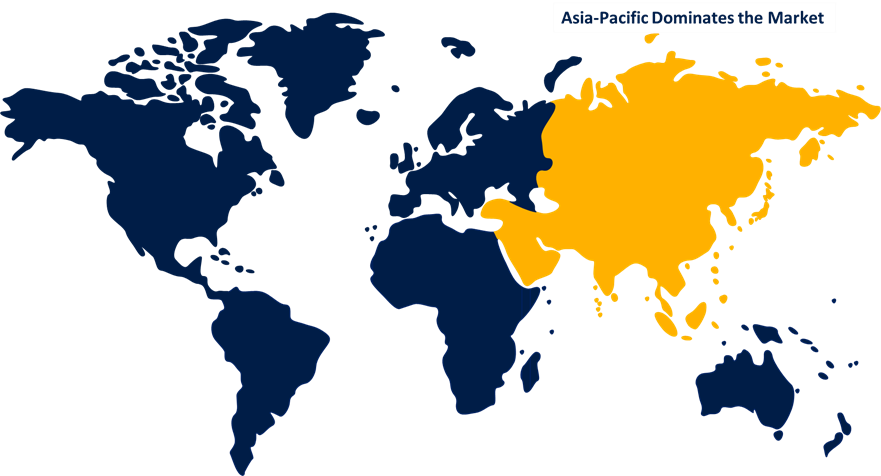

Asia Pacific is dominating the market with the largest market share of 35%.

Asia Pacific is expected to emerge as the market's leading region throughout the projected period, with a market share of 35% and 560,000 units in 2021. The region's expansion is attributable to an increase in demand for sophisticated equipment for material handling in industries such as construction, manufacturing, food and beverage, and many others. Furthermore, Asia Pacific's dominance in lift truck sales and volumes is largely due to the companies' widespread presence in China. China has the most both registered and unregistered local players with a solid foothold all around the nation.

North America is predicted to experience the fastest development in total revenues in the region. Europe, on the other hand, is expected to rise significantly in the worldwide market. The Africa and Middle East regions would experience moderate growth as a result of recent technology advancements and growth in the materials handling companies and industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Forklift Truck Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players

- Toyota Industries Corporation

- Anhui Heli Co., Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Hyster-Yale Materials Handling, Inc.

- Doosan Corporation

- Crown Equipment Corporation

- KION Group AG

- Konecranes

- Paletrans Equipment

- Lonking Holdings Limited

- Crown Equipment Corporation

- Jungheinrich AG

- Mitsubishi Heavy Industries Group

- Komatsu Ltd.

- EP Equipment

- Cargotec Oyj

- Manitou Group

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, KION Group has established a new forklift truck plant in China, laying the groundwork for future supply chain solutions plants. A total of roughly US$ 150 million is being invested in Jinan for the future production of industrial trucks and supply chain solutions. The location is expected to generate over 1,000 new job opportunities.

- In May 2021, Jungheinrich has revealed the ERD 220i electric pallet truck. The latest ERD 220i is the compact truck in its class, with an L2 dimension of just 1,065 mm. The 220i is more than 300mm shorter than its forerunner, because of its revolutionary lithium-ion battery architecture, which results in a 25% space reduction.

- In April 2021, Godrej Material Handling has unveiled the latest Uno Electric Forklift truck. The latest Uno Electric Forklift is a workhorse in the 1.5 to 3-tonne forklift market, with upgraded ergonomics, increased safety, improved visibility, and a longer runtime on every charge.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Forklift Truck Market based on the below-mentioned segments:

Global Forklift Truck Market, By Class Type

- Class 1

- Class 2

- Class 3

- Class 4

- Class 5

Global Forklift Truck Market, By Power Source Type

- Internal Combustion Engine

- Electric

Global Forklift Truck Market, By End-Use Industry

- Mining

- Industrial

- Food & Beverages

- Construction

- Chemical

- Logistic

- Manufacturing

- Natural Resources

- Retail & E-Commerce

- Others

Global Forklift Truck Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?