Global Formic Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Grade 99%, Grade 94%, Grade 85% and Others) By Application (Silage Additives, Dyeing, Animal Feed, Leather Production, Agriculture, Pharmaceuticals, Chemicals and Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) Analysis and Forecast 2021 - 2030

Industry: Chemicals & MaterialsGlobal Formic Acid Market Insights Forecasts to 2030

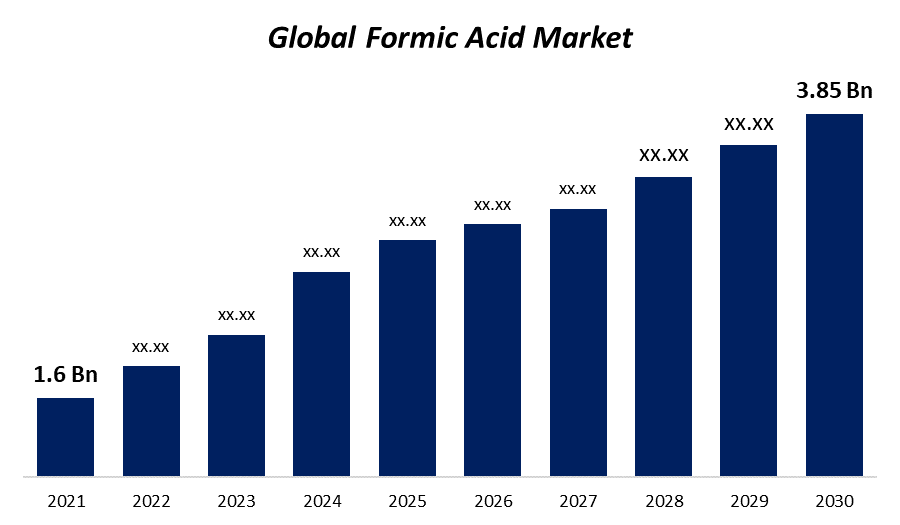

- The Global Formic Acid Market Size was valued at USD 1.6 Billion in 2021.

- The Market Size is Growing at a CAGR of 4.6% from 2022 to 2030

- The Worldwide Formic Acid Market Size is expected to reach USD 3.85 Billion by 2030

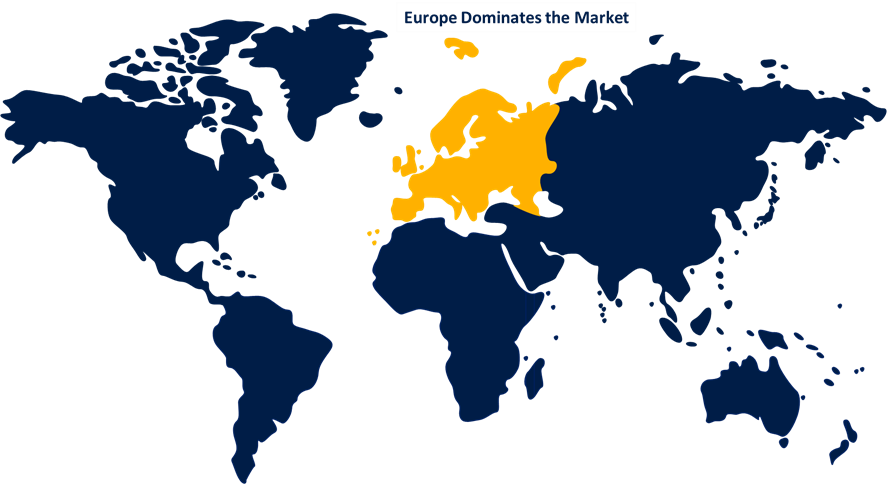

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Formic Acid Market Size is expected to reach USD 3.85 Billion by 2030, at a CAGR of 4.6% during the forecast period 2022 to 2030. The formic acid market has grown due to the increasing demand for preservatives in animal feed. Formic acids possess antibacterial properties, making them a perfect fit for animal feed to be used as a preservative. The increasing demand for formic acid as a preservative propels the growth of the formic acid market in the coming years.

Market Overview

Formic acid is one of the strongest acids that inhibit the growth of bacteria. Formic acid's antibacterial and preservative properties are responsible for the increased demand for formic acid in various sectors. In addition to this, formic acid is biodegradable, a stable liquid under optimum conditions that helps in the removal of mineral depositions like calcium and iron. Market development for formic acid worldwide is expected to be boosted by the rising demand for it in the food processing and pharmaceutical industries. The COVID-19 outbreak affects the chemical industry adversely. Disrupted manufacturing and production processes in the industries during the pandemic hindered the growth of the formic acid market because of reduced demand and fluctuation in raw material availability. Post-COVID-19, the demand for formic acid in various sectors increases, especially in the animal feed sector for the manufacturing of preservatives and the agriculture sector for the manufacturing of fertilizers and pesticides. Moreover, formic acid is used in the hay to reduce the fat content of milch cows. Moreover, the demand for formic acid in the leather production industry. Some factors will affect the growth of the market in future, such as the availability of substitutes in the market, fluctuating availability of raw materials, and use of formic acid in high concentrations may result in harmful effects on the user. In the leather production industry, formic acid is used for sterilization, dyeing and tanning purposes. A combination of formic acid's high quality and global environmental acceptance is one of the main reasons why its demand is increasing.

Report Coverage

This research report categorizes the market for global formic acid based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global formic acid market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global formic acid market sub-segments.

Formic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1.6 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 4.6% |

| 2030 Value Projection: | USD 3.85 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Gujarat Narmada Valley Fertilizers and Chemicals Limited, Feicheng Acid Chemicals Co. Ltd, BASF SE, Eastman Chemical Company, Perstorp, Wuhan Ruisunny Chemical Co. Ltd., Rashtriya Chemicals and Fertilizers Limited, Chongqing Chuandong Chemical Co., Anhui Asahi Kasei Chemical, GNFC Ltd., Polioli SpA, Beijing Chemical Industry Group Co. Ltd., Shandong Baoyuan Chemical Co. Ltd., and LUXI Group Co. Ltd. |

| Growth Drivers: | The implementation of this technology is anticipated in the future. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics:

- Driver- Rise in Demand

Formic acid is used to coagulate latex in the manufacture of natural rubber, as a crucial chemical building block, to control the pH level of chemical reactions, and in the manufacturing of pharmaceuticals, pigments, and fragrances. Catalysts made from formic acid are frequently employed in the production of various compounds. It is common practise to employ formic acid, an eco-friendly de-icing agent, to keep airport runways continuously ice-free. These exceptional features will provide the market further growing momentum.

- Restraint- Strict Regulation

It is anticipated that formic acid usage regulations will impede market expansion. These are designed to protect natural resources from the potential harm formic acid will cause to the environment. To use fewer non-renewable resources, the manufacturing of formic acid uses steam, which may come from a renewable source. While the suppliers are gradually overcoming these technical obstacles, there are no imperceptible roadblocks that reduce the market's size.

- Opportunity- Rise in Use

It is also a by-product of the manufacturing of acetic acid. Water, alcohols, and other hydrocarbons like acetone and ether all help formic acid dissolve. The demand for the acid in a variety of applications, including preservatives, animal feed, agriculture, and leather, is predicted to increase significantly during the forecast period, which will drive growth in the market.

- Challenges- Availability of Alternatives

Even though many of its many alternatives have been replaced by formic acid, the main problem facing formic acid producers is producing the chemical in a more environmentally friendly manner. The implementation of this technology is anticipated in the future. Long-term exposure to formic acid carries several potential health hazards. It can result in some skin allergies that become apparent with repeated exposure as well as chronic kidney damage. The market expansion is anticipated to be hampered by this.

Segmentation Analysis

- In 2021, the grade 85% segment accounted for the largest share of the market, with 30% and a market revenue of 0.48 billion.

Based on the grade, the formic acid market is categorized into grade 99%, grade 94%, grade 85% and others. In 2021, the grade 30% segment accounted for the largest share of the market, with 18.6% and a market revenue of 0.48 billion. The increased demand for the grade 85% of formic acid is because it is less toxic and has less harmful effects on the environment. Moreover, grade 85% formic acid is used as a standard concentration in various applications.

- In 2021, the animal feed segment dominated the market with the largest market share of 18.6% and market revenue of 0.29 billion.

Based on the application, the formic acid market is categorized into silage additives, dyeing, animal feed, leather production, agriculture, pharmaceuticals, chemicals and others. In 2021, the animal feed segment dominated the market with the largest market share of 18.6% and market revenue of 0.29 billion. The maximum share of the animal feed segment in the growth of the formic acid market is the result of increasing demand for preservatives in livestock because formic acid prevents the growth of bacteria in the feed.

Regional Segment Analysis of the Formic Acid Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, the U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific emerged as the largest market for the global formic acid market, with a market share of around 39.5% and 1.6 billion of the market revenue in 2021.

- In 2021, Asia Pacific emerged as the largest market for the global formic acid market, with a market share of around 39.5% and 1.6 billion of the market revenue. Asia Pacific is expected to be the largest market. The increase in the demand for animal feed in the region will propel the growth of the formic acid market. Moreover, the demand for formic acid in the pharmaceutical sector will also contribute a large share in the market's growth.

- Europe market is expected to grow at the fastest CAGR between 2021 and 2030. The increased demand for livestock feed storage preservatives boosts the market's growth in the forecast period.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global formic acid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Gujarat Narmada Valley Fertilizers and Chemicals Limited

- Feicheng Acid Chemicals Co. Ltd

- BASF SE

- Eastman Chemical Company

- Perstorp

- Wuhan Ruisunny Chemical Co. Ltd.

- Rashtriya Chemicals and Fertilizers Limited

- Chongqing Chuandong Chemical Co.

- Anhui Asahi Kasei Chemical

- GNFC Ltd.

- Polioli SpA

- Beijing Chemical Industry Group Co. Ltd.

- Shandong Baoyuan Chemical Co. Ltd.

- LUXI Group Co. Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In November 2020, BASF, as part of its expansion strategy, decided to raise the prices of acetic and propionic acid in all the regions.

- In March 2021, BASF decided to increase the prices of all grades of formic acid in the North American region by USD 0.05/pound.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global formic acid market based on the below-mentioned segments:

Global Formic Acid Market, By Type

- Grade 99%

- Grade 94%

- Grade 85%

- Others

Global Formic Acid Market, By Application

- Silage Additives

- Dyeing

- Animal Feed

- Leather Production

- Agriculture

- Pharmaceuticals

- Chemicals

- Others

Global Formic Acid Market, Regional Analysis

- North America

- THE US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?