France Auto Loan Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Vehicle and Commercial Vehicle), By Provider (Banks, OEMs, and Credit Unions), and France Auto Loan Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialFrance Auto Loan Market Insights Forecasts to 2033

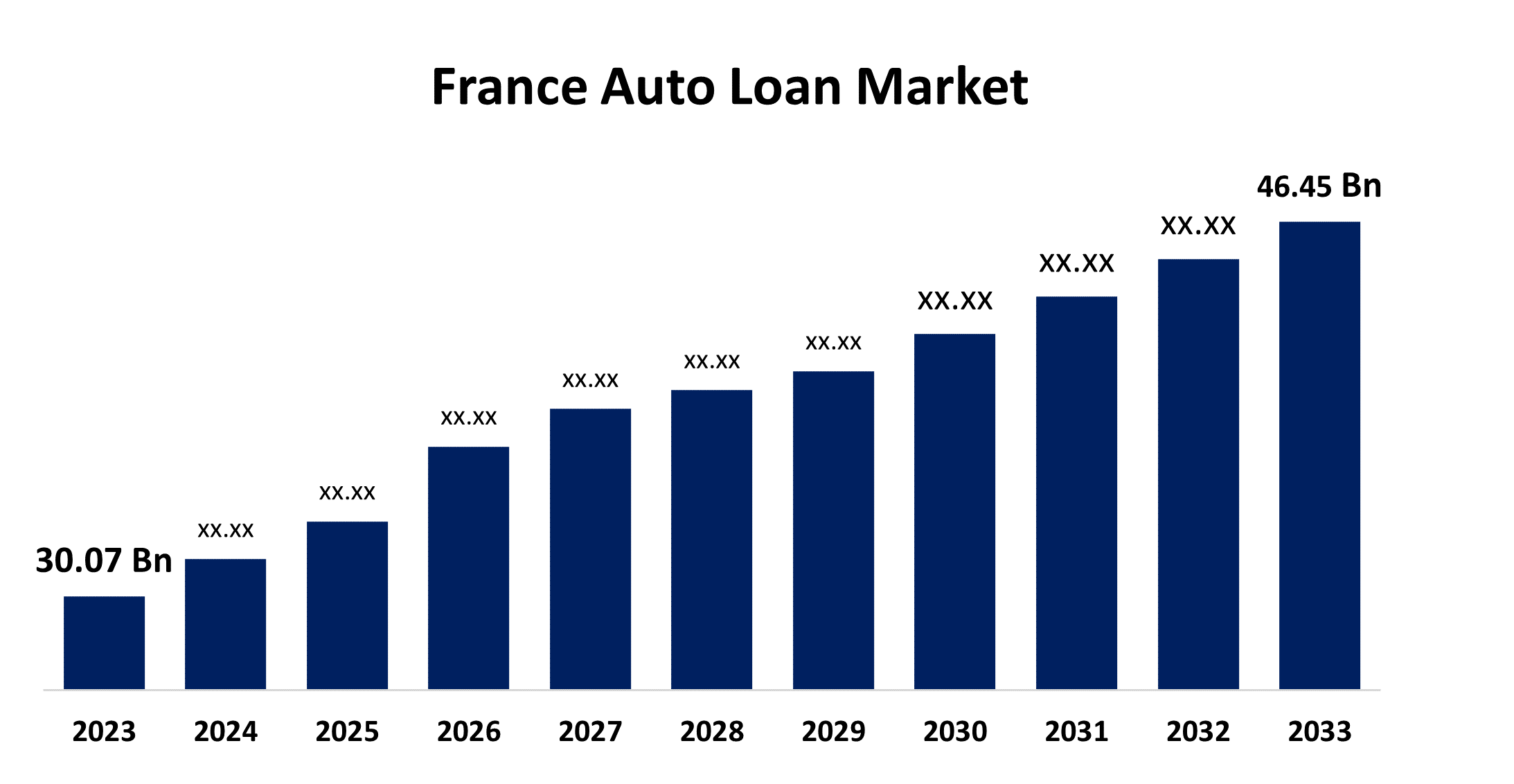

- The France Auto Loan Market Size was valued at USD 30.07 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.44% from 2023 to 2033

- The France Auto Loan Market Size is Expected to reach USD 46.45 Billion by 2033

Get more details on this report -

The France Auto Loan Market Size is anticipated to exceed USD 46.45 Billion by 2033, growing at a CAGR of 4.44% from 2023 to 2033.

Market Overview

The spectrum of financing alternatives known as "auto loans" allow consumers to buy a vehicle under any agreement other than making a single, complete cash payment. Customers can easily purchase vehicles and save time using auto loans instead of depleting their savings upfront. The procedure by which consumers can get financing or borrow money through a formal contract from a bank, credit union, or an automobile manufacturer or dealer where the purchase is being made is known as the auto loan market. In addition, by adding interest to the amount borrowed, the lender makes money. Furthermore, a cash sale in which the customer pays for the complete transaction with cash—is an additional choice for vehicle finance. The likelihood is that interest rates will be avoided by a buyer who chooses this option for auto finance. The worldwide auto loan market is expanding as a result of the rise in vehicle prices and the development of online applications for auto financing. Additionally, the expansion of the auto loan market is positively impacted by the adoption of digital technology for financing automobiles. Throughout the auto loan market forecast, it is anticipated that the adoption of technology in current product lines and the unrealized potential of emerging economies would present lucrative opportunities for market expansion.

Report Coverage

This research report categorizes the market for the France auto loan market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the auto loan market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the auto loan market.

France Auto Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 30.07 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.44% |

| 2033 Value Projection: | USD 46.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Vehicle Type, By Provider |

| Companies covered:: | Credit Agricole Group, Societe Generale Group, BNP Paribas Personal Finance, Vehiclerefour Banque, SA, Orange Bank SA, Carrefour Banque, SA, Toyota France Management, Capitole Finance Tofinso, Cofidis SA, AXA Banque, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in vehicle prices in France is driving the growth of the auto loan market. As vehicle prices continue to rise, more individuals are resorting to auto loans for financial assistance. This makes auto loans an attractive option for those without immediate funds. Responding to the rise in vehicle prices. Government incentives, such as tax credits and subsidies, are designed to encourage vehicle purchases despite rising prices, making auto loans more attractive to consumers. Expected future demand for automotive loans in France is expected to increase as production and sales of heavy-duty and light-commercial vehicles, mainly for commercial vehicles, increase. Online loan servicing has emerged as the most disruptive technology in the industry. Additionally, mobile and web-based platforms allow easy viewing, comparison, and application for loan services. This leads to the growth of the auto loan market.

Restraining Factors

The rise of rideshare services, intense competition, market saturation, and increased lending from various lenders are hampering the expansion of the auto loan market. Regulations governing interest rates, lending practices, and consumer protection can present difficulties for those involved in the auto loan business. In addition, loan terms and conditions can be affected by the gradual depreciation of automobiles and their unpredictable resale value.

Market Segmentation

The France auto loan Market share is classified into vehicle type and provider.

- The passenger vehicle segment is expected to hold the largest market share through the forecast period.

The France auto loan market is segmented by vehicle type into passenger vehicle and commercial vehicle. Among them, the passenger vehicle segment is expected to hold the largest market share through the forecast period. Increasing distance between places of residence, service, sports, education, and shopping has increased the need for mobility. The automotive sector is expanding due to the ever-changing needs of consumers. There is a growing need for improvements in telematics, safety, advanced driver assistance systems, security systems, and autonomous vehicles, especially in terms of residential vehicles.

- The banks segment dominates the market with the largest market share over the predicted period.

The France auto loan market is segmented by provider into banks, OEMs, and credit unions. Among them, the banks segment dominates the market with the largest market share over the predicted period. When vehicles are bought through financing, banks have agreements with several automakers and dealers, and they split commissions with these businesses. Generally speaking, banks provide consumers and businesses with personal and individual auto loans that encompass auto financing. Because banks offer vehicle financing at a low rate, customers regularly purchase auto loans and financing from them, which fuels the growth of the vehicle finance business. For the duration of the projected year, the banking segment will be driven primarily by quicker services, easier loan approval procedures, and loan loyalty.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France auto loan market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Credit Agricole Group

- Societe Generale Group

- BNP Paribas Personal Finance

- Vehiclerefour Banque, SA

- Orange Bank SA

- Carrefour Banque, SA

- Toyota France Management

- Capitole Finance Tofinso

- Cofidis SA

- AXA Banque

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Orange SA was forced to exit the market after BNP Paribas Personal Finance initiated exclusive negotiations with the company to take on its Orange Bank customers. Orange's strategy to gradually remove Orange Bank from the retail banking sector in France and Spain includes collaboration.

- In September 2022, Cofidis France introduced "Missions Booster," a new solidarity program, to assist 40 associations within its jurisdiction. The company provided volunteer work to associations in their local region for three days per employee, for a total of 4,500 days given to the non-profit sector. The company employs 1,500 individuals.

Market Segment

This study forecasts revenue at French, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Auto Loan Market based on the below-mentioned segments:

France Auto Loan Market, By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

France Auto Loan Market, By Provider

- Banks

- OEMs

- Credit Unions

Need help to buy this report?