France Blister Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Carded and Clamshell), By Technology (Cold-Form and Thermoformed), By Material (Paper & Paperboard, Plastic Films, and Aluminium), By End-Use (Healthcare, Consumer Goods, Industrial Goods, and Food), and France Blister Packaging Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsFrance Blister Packaging Market Insights Forecasts to 2033

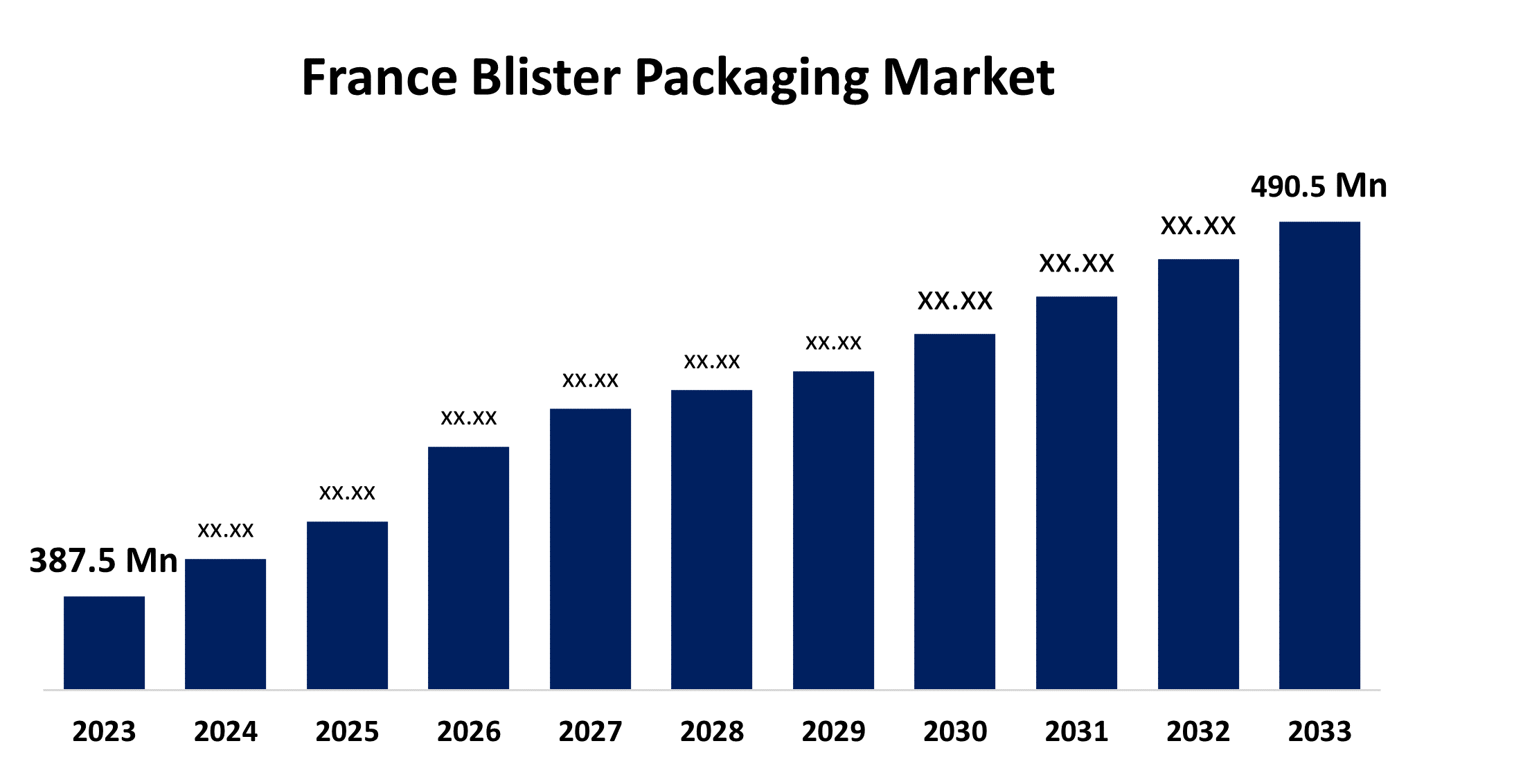

- The France Blister Packaging Market Size was valued at USD 387.5 Million in 2023.

- The Market Size is Growing at a CAGR of 2.39% from 2023 to 2033

- The France Blister Packaging Market Size is Expected to reach USD 490.5 Million by 2033

Get more details on this report -

The France Blister Packaging Market is anticipated to exceed USD 490.5 Million by 2033, growing at a CAGR of 2.39% from 2023 to 2033. The growing focus on product innovation and development, healthcare expenditures, the prevalence of fake medications, increased money spending on healthcare requirements, and the presence of well-established market players are driving the growth of the blister packaging market in the France.

Market Overview

Blister packaging is a pre-formed plastic packaging that functions to preserve the integrity of the products. Blister packaging is made up of thermoplastic such as polyvinyl chloride (PVC) or polyethylene terephthalate (PET) materials. The thermoformed plastic is moldable and are formable web in blister packs creating cavities or packets for blister packs and is backed with paperboard, aluminum foil, or plastic. Blister packaging is popularly used for pharmaceutical products like disintegrated capsules, and tablets, shielding the product from moisture and contamination. Blister packaging exhibits its adaptability and worth in a variety of sectors. It is excellent for maintaining the integrity of medication products and improving the aesthetics of retail products. The incorporation of smart technologies like RFID tags and QR codes on blister packaging is promoting the trend of digitalization and IoT across various industries. Further, the customization and personalization in brands enable tailored designs as per individual preferences for engaging customers and creating a brand’s unique identity which ultimately enhances brand recognition.

Report Coverage

This research report categorizes the market for the France blister packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the blister packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France blister packaging market.

France Blister Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 387.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.39% |

| 2033 Value Projection: | USD 490.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Technology, By End-Use |

| Companies covered:: | Novartis France, Nelipak, Uhlmann Group, Sonoco Products Company, WestRock, Strobel GmbH, Constantia Flexibles, Schreiner Group, Laboratoire Diephez, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing healthcare spending and health consciousness among the people in the country led to an increasing focus on product innovation and development in packaging are driving the market growth for blister packaging. The growing incidences of fake medications in the country surges the need for blister packs. The growing demand for prescription and OTC medications is also responsible for driving the market. The rising disposal income and increased money spending on healthcare requirements as well as the presence of well-established market players in the country are significantly driving the market.

Restraining Factors

Blister packaging of heavy products and fragile products is costly and may lead to break and damage to the product. This limitation of blister packaging is restraining the France blister packaging market.

Market Segmentation

The France Blister Packaging Market share is classified into type, technology, material, and end-use.

- The carded segment accounted for the largest market share during the forecast period.

Based on the type, the France blister packaging market is divided into carded and clamshell. Among these, the carded segment accounted for the largest market share during the forecast period. Carded blister packaging can maintain an ultra-tough enclosure, form different shapes, stack many products, and have easy handling and excellent damage control properties. The increasing demand for carded packaging in food packaging as well as its transparency and versatility, are driving the market growth.

- The thermoformed segment dominates the market with the largest market share during the forecast period.

The France blister packaging market is segmented by technology into cold-form and thermoformed. Among these, the thermoformed segment dominates the market with the largest market share during the forecast period. Thermoformed blister packaging requires cost-effective initial tools and equipment as compared to cold-form. The rising adoption of eco-friendly materials such as bioplastics, and integration of smart packaging technologies as well as preference for customizable packaging solutions are driving the market demand.

- The plastic films segment is anticipated to hold the largest market share during the forecast period.

Based on the material, the France blister packaging market is divided into paper & paperboard, plastic films, and aluminium. Among these, the plastic films segment is anticipated to hold the largest market share during the forecast period. Plastic film blister packaging is used for small consumer goods, foods, and pharmaceutical products. It consists of a cavity or pocket made from a formable web and a backing of paperboard or a lidding seal of aluminium foil or plastic. Plastic film blister packaging offers excellent visibility and security of the product as well as attractive packaging which is responsible for driving the market growth.

- The healthcare segment dominated the France blister packaging market with the largest market share over the forecast period.

Based on the end-use, the France blister packaging market is divided into healthcare, consumer goods, industrial goods, and food. Among these, the healthcare segment dominated the France blister packaging market with the largest market share over the forecast period. The blister packaging of pharmaceutical products reduces contamination and protects from moisture, gas, light, and temperature. These factors are driving the market demand for blister packaging in the healthcare segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France blister packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis France

- Nelipak

- Uhlmann Group

- Sonoco Products Company

- WestRock

- Strobel GmbH

- Constantia Flexibles

- Schreiner Group

- Laboratoire Diephez

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Constantia Flexibles announced its latest pharmaceutical packaging solution, the coldform foil REGULA CIRC, a cutting-edge technology that sets a new standard for sustainability in blister packaging.

- In April 2023, MAX Solutions unveiled a new sustainable alternative to plastic blister packs. The new packaging, named MAX Ecoblister, blends the paper recyclability of a fiber top card and a PaperFoam tray, without compromising the tray’s compostability.

- In November 2021, Novartis Pharmaceuticals Corporation (Novartis) announced new packaging which is available for 30-count blister card packages (blister packs) of SANDIMMUNE (cyclosporine capsules, USP) 100 mg soft gelatin capsules.

- In April 2021, Amcor announced customer trials of the world’s first recyclable polyethylene (PE)-based thermoform blister packaging. The new packaging offers a more environmentally friendly substitute for the most popular kind of healthcare packaging while still meeting the strict specifications of highly specialized and regulated pharmaceutical packaging.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Blister Packaging Market based on the below-mentioned segments:

France Blister Packaging Market, By Type

- Carded

- Clamshell

France Blister Packaging Market, By Technology

- Cold-Form

- Thermoformed

France Blister Packaging Market, By Material

- Paper & Paperboard

- Plastic Films

- Aluminium

France Blister Packaging Market, By End-Use

- Healthcare

- Consumer Goods

- Industrial Goods

- Food

Need help to buy this report?