France Car Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Third-Party Liability Coverage, Collision, Comprehensive, and Others), By Distribution Channel (Direct Sales, Individual Agents, Brokers, Banks, Online, and Others), and France Car Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsFrance Car Insurance Market Insights Forecasts to 2033

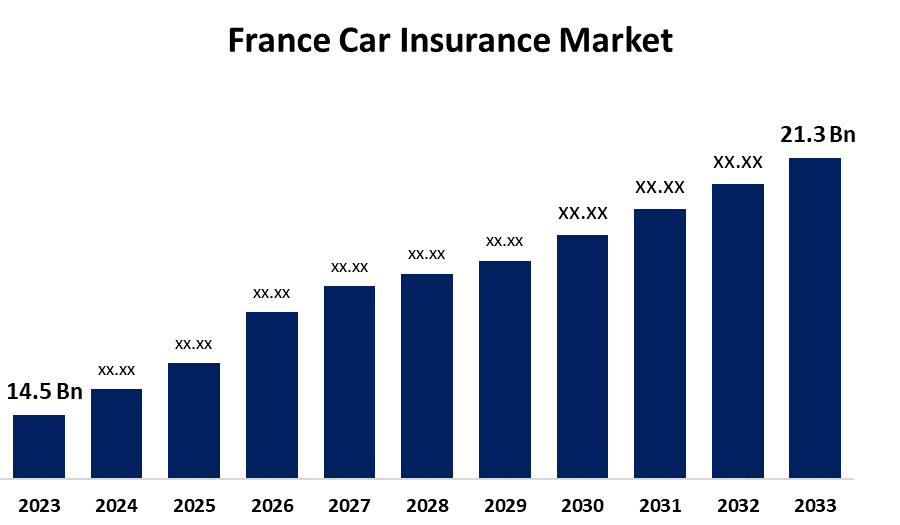

- The France Car Insurance Market Size was valued at USD 14.5 billion in 2023.

- The Market is growing at a CAGR of 3.92% from 2023 to 2033

- The France Car Insurance Market Size is expected to reach USD 21.3 billion by 2033

Get more details on this report -

The France Car Insurance Market is anticipated to exceed USD 21.3 billion by 2033, growing at a CAGR

of 3.92% from 2023 to 2033. The growing number of traffic accidents and the increase in online car insurance is driving the growth of the car insurance market in France.

Market Overview

Car insurance is a type of insurance that provides cover for loss or damage to the car, mitigating financail loss due to accidents causing damage to the car. It is legal agreement in which owner of the vehicle agrees to pay a set premium amount over time to the insurance provider in order to get financial protection in a scenario where the vehicle is damaged or lost. The online purchases of insurance policies cover the premium prices as well as several benefits. French car insurance companies are increasing the innovation of their products. Insurers are investing in this new market and introducing associated insurance products in the auto insurance industry in an effort to combat the proliferation of connected devices. With the help of telemetry technology, insurers gather data on driver profiles. France insurers are increasingly investing in digital technologies to improve customer experience, expedite workflows, and provide more individualized services.

Report Coverage

This research report categorizes the market for the France car insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the car insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the car insurance market.

France Car Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.5 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 3.92% |

| 2033 Value Projection: | USD 21.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Coverage, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Predic-Prevoyance Dialogue Du Credit Agricole, Generali Iard, Allianz, Axa France Iard, Macif and others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

With the increasing population in France, there are growing incidences of car accidents that are responsible for driving the market demand for car insurance because dependency of on car insurance to prevent financial loss. The stringent government regulation surges the need for car insurance with the growing sales of cars, significantly propelling the market growth. The changing customer inclination towards the online purchasing of insurance policies due to premium prices and several benefits is driving the market growth.

The concerns related toRestraining Factors issues of fraud, efficient and quick claim handling, and adjusting to new risks are challenging the market growth of France car insurance market.

Market Segmentation

The France Car Insurance Market share is classified into coverage and distribution channel.

The third-party liability coverage segment accounted for the largest market share during the forecast period.

The France Car Insurance market is segmented by coverage into third-party liability coverage, collision, comprehensive, and others. Among these, the third-party liability coverage segment accounted for the largest market share during the forecast period. The understanding of legal requirements and the need to adhere to mandated auto insurance are associated with the demand for third-party liability coverage. Consumer awareness about the legal requirements and reasonable prices of third-party liability are contributing to market growth.

The direct sales segment dominated the market with the largest share of the France car insurance market during the forecast period.

Based on the distribution channel, the France car insurance market is divided into direct sales, individual agents, brokers, banks, online, and others. Among these, the direct sales segment dominated the market with the largest share of the France car insurance market during the forecast period. In direct sales, insurance companies sell policies to customers directly through their channels providing direct communication with insurance companies, which enables personalized assistance and productive workflows. Several benefits associated with direct sales and the cost-effectiveness surge the market growth in the direct sales segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France car insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Predic-Prevoyance Dialogue Du Credit Agricole

Generali Iard

Allianz

Axa France Iard

Macif

Others

Key Target Audience

Market Players

Investors

End-users

Government Authorities

Consulting And Research Firm

Venture capitalists

Value-Added Resellers (VARs)

Recent Developments

In June 2023. JLR and Allianz Partners announced the launch of an embedded insurance programme, to enhance the purchasing experience for Range Rover, Defender, Discovery, and Jaguar clients across Europe. The Simply Drive service offering clients the convenience of immediate and complimentary insurance cover for the first month of ownership, making their purchase quicker and easier.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Car Insurance Market based on the below-mentioned segments:

France Car Insurance Market, By Coverage

Third-Party Liability Coverage

Collision

Comprehensive

Others

France Car Insurance Market, By Distribution Channel

Direct Sales

Individual Agents

Brokers

Banks

Online

Others

Need help to buy this report?