France Car Loan Market Size, Share, and COVID-19 Impact Analysis, By Distribution Channel (Banks, OEMs, Credit Unions, and Others), By Vehicles Age (New Vehicles and Used Vehicles), By Application (Personal and Commercial), and France Car Loan Market Insights Forecasts 2023 - 2033.

Industry: Banking & FinancialFrance Car Loan Market Insights Forecasts to 2033

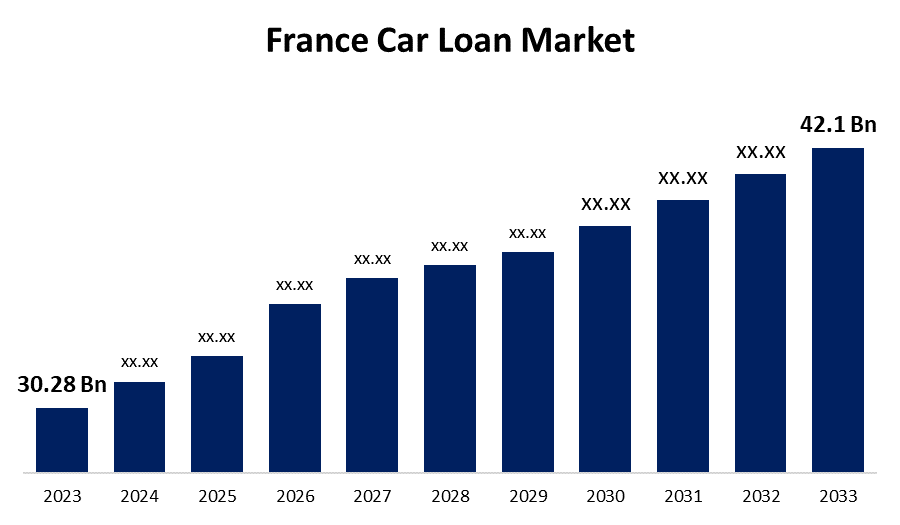

- The France Car Loan Market Size was valued at USD 30.28 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.35% from 2023 to 2033.

- The France Car Loan Market Size is Expected to Reach USD 42.1 Billion by 2033.

Get more details on this report -

The France Car Loan Market size is expected to reach USD 42.1 Billion by 2033, at a CAGR of 3.35% during the forecast period 2023 to 2033.

Market Overview

Manufacturers of specialty cars or financing companies offer auto loans. These include a range of financial solutions that let customers buy cars, like loans and leases. Additionally, banks, credit unions, brokers, original equipment manufacturers (OEMs), and other financial organizations are the main distribution channels for auto finance goods and services. Additionally, auto finance services enable borrowers to buy cars without having to pay for them in full with cash. Increased consumer tastes and trends regarding automobile purchases have led to a vast global demand for certain models and brands of cars, which has become one of the market's main growth factors. Furthermore, a growing number of foreign automakers, including Mercedes, BMW, Toyota, and Volkswagen, are satisfying global consumer expectations, which supports the expansion of the auto finance industry. The primary market factors boosting the market growth include expanding sustainable practices, growing digital transformation, and expanding finance for electric vehicles (EVs). The automotive finance market is being reshaped by digital transformation, which is increasing accessibility, improving consumer experiences, and optimizing operations. Online platform integration makes it possible for loan applications, approvals, and payments to happen quickly and easily. Fintech advances cut down on administrative delays by enabling real-time credit assessments.

Report Coverage

This research report categorizes the market for the France car loan market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France car loan market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France car loan market.

France Car Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 30.28 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.35% |

| 2033 Value Projection: | USD 42.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Distribution Channel, By Vehicles Age, By Application |

| Companies covered:: | Credit Agricole, Societe Generale, BNP Paribas Personal Finance, Banque Populaire, Cofidis, Cetelem, Cofinoga, Flora Bank, Younited Credit, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

In France, the used car market has a significant impact on the auto loan market. Buyers could potentially finance their purchase with less debt since used cars are usually cheaper than new ones. This could lead to an increased demand for car loans to fund these purchases, as purchasing a pre-owned car becomes a more attractive option for a lot of consumers. Rising vehicle costs might enhance competition among lenders as they compete to recruit consumers with more favorable loan arrangements. The France government provides subsidies and tax credits to entice people to purchase cars despite their high cost. These incentives have the potential to increase the appeal of auto loans to people who might not have otherwise thought about purchasing a vehicle.

Restraining Factors

The market for auto loans is challenged by credit risks, interest rate fluctuations, and economic uncertainty. The market might be impacted by modifications to consumer preferences and the conventional ownership model brought about by regulatory changes, environmental concerns, and a shift towards shared mobility.

Market Segment

The France Car Loan Market share is classified into distribution channels, vehicle age, and application.

- The banks segment is expected to hold the largest market share through the forecast period.

Based on distribution channels, the France car loan market is segmented into banks, OEMs, credit unions, and others. Among these, the banks segment is expected to hold the largest market share through the forecast period. This is attributed to their broad reach, solid reputation, and array of financial services, banks control the majority of the market share in the distribution channel for car financing. Since banks are reputable financial companies, they draw in a large clientele by providing a variety of auto finance choices. Their supremacy in the market is a result of their capacity to offer affordable interest rates, a wide range of loan options, and customized services.

- The new vehicles segment is expected to hold the largest market share through the forecast period.

Based on vehicle age, the France car loan market is segmented into new vehicles and used vehicles. Among these, the new vehicles segment is expected to hold the largest market share through the forecast period. Longer loan periods, cheaper interest rates, and appealing finance packages are frequently offered with new cars. These benefits entice customers, making financing for new cars a popular option. Lenders' willingness to provide attractive financing terms might also be influenced by their perception of new cars as lower-risk assets. The market domination of new car finance is cemented by the latest models' appeal and attractive financing choices.

- The personal segment is expected to hold the largest market share through the forecast period.

Based on application, the France car loan market is segmented into personal and commercial. Among these, the personal segment is expected to hold the largest market share through the forecast period. Direct loan applications are far more accessible and convenient for customers. Borrowers can quickly and conveniently input their personal information, check their eligibility, and get approved through online platforms and mobile applications. People can investigate different financing possibilities, evaluate conditions, and select programs that suit their budgets due to this active involvement. Personal applications dominate the market because they are easy to use and provide borrowers with a quick and easy approach to getting auto financing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France car loan market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Credit Agricole

- Societe Generale

- BNP Paribas Personal Finance

- Banque Populaire

- Cofidis

- Cetelem

- Cofinoga

- Flora Bank

- Younited Credit

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, the establishment of a collaboration to offer car finance and services to Mitsubishi Motors clients in France was announced by M Motors Automobiles France, or Mitsubishi Motors in France, and Mobilize Financial Services.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the France Car Loan Market based on the below-mentioned segments:

France Car Loan Market, By Distribution Channel

- Banks

- OEMs

- Credit Unions

- Others

France Car Loan Market, By Vehicle Age

- New Vehicles

- Used Vehicles

France Car Loan Market, By Application

- Personal

- Commercial

Need help to buy this report?