France Carrier Screening Market Size, Share, and COVID-19 Impact Analysis, By Type (Expanded Carrier Screening and Targeted Disease Carrier Screening), By Technology (DNA Sequencing, Polymerase Chain Reaction, Microarrays, and Others), By End User (Hospitals and Clinics, Reference Laboratories, Physician Offices, and Others), and France Carrier Screening Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareFrance Carrier Screening Market Insights Forecasts to 2033

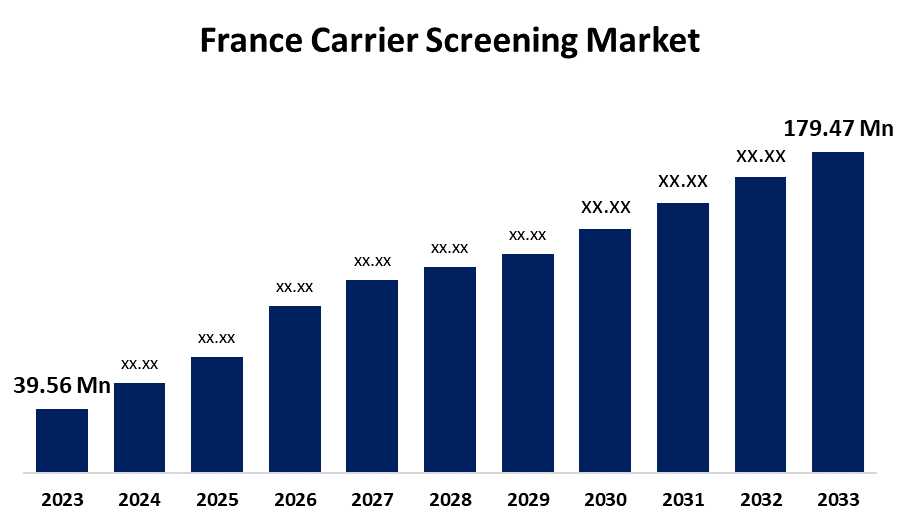

- The France Carrier Screening Market Size Was Valued at USD 39.56 Million in 2023.

- The Market Size is Growing at a CAGR of 16.33% from 2023 to 2033

- The France Carrier Screening Market Size is Expected to Reach USD 179.47 Million By 2033

Get more details on this report -

The France Carrier Screening Market Size is Anticipated to reach USD 179.47 Million By 2033, Growing at a CAGR of 16.33% from 2023 to 2033.

Market Overview

France carrier screening market refers to the healthcare sector focused on genetic testing to identify individuals who may carry a gene for a genetic disorder, even if they do not exhibit symptoms. As awareness of genetic diseases rises, there is growing demand for carrier screening, especially for couples planning pregnancies. The French healthcare system, with its advanced medical infrastructure and high emphasis on preventive healthcare, supports the growth of this market. Additionally, the market is witnessing significant growth due to the increasing adoption of personalized medicine, rising healthcare awareness, and advances in genetic testing technologies such as next-generation sequencing. France's robust healthcare policies, along with increasing government initiatives to promote genetic testing, further fuel this growth. Furthermore, partnerships between healthcare providers, biotechnology companies, and research institutions could accelerate innovation in this space, ensuring more comprehensive and accessible carrier screening options for the French population.

Report Coverage

This research report categorizes the market for the France carrier screening market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France carrier screening market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France carrier screening market.

France Carrier Screening Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 39.56 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.33% |

| 2033 Value Projection: | USD 179.47 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Technology, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Opko Health Inc, Diasorin S.p.A., Eurofins Scientific, InVitae Corporation, Natera Inc., Quest Diagnostics Inc., Illumina Inc., Fulgent Genetics Inc., Myriad Genetics, Inc., Thermo Fisher Scientific Inc. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Advancements in genetic technologies and the growing availability of non-invasive testing methods are improving the accuracy and convenience of screenings, making them more attractive to the public. Government initiatives and healthcare programs aimed at reducing the burden of genetic diseases are further driving market growth. Moreover, the rising prevalence of genetic disorders, such as cystic fibrosis, sickle cell anemia, and thalassemia, is fueling the need for preventive measures like carrier screening.

Restraining Factors

Despite advances in technology, many individuals may still find carrier screening financially prohibitive, especially when not fully covered by insurance.

Market Segmentation

The France carrier screening market share is classified into type, technology, and end user.

- The expanded carrier screening segment accounted for the leading revenue share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The France carrier screening market is segmented by type into expanded carrier screening and targeted disease carrier screening. Among these, the expanded carrier screening segment accounted for the leading revenue share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth can be attributed to the increasing demand for comprehensive testing that identifies a wider range of genetic conditions. Expanded carrier screening allows for the detection of multiple genetic disorders in a single test, making it more appealing to individuals and healthcare providers seeking broader insights into potential hereditary risks.

- The DNA sequencing segment accounted for the major revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The France carrier screening market is segmented by technology into DNA sequencing, polymerase chain reaction, microarrays, and others. Among these, the DNA sequencing segment accounted for the major revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The growth can be attributed to the superior accuracy, high throughput, and ability to detect a broad range of genetic mutations that DNA sequencing offers. The advancements in next-generation sequencing (NGS) technologies have made it possible to analyze multiple genes simultaneously, improving the efficiency and affordability of genetic testing.

- The hospitals and clinics segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The France carrier screening market is segmented by end user into hospitals and clinics, reference laboratories, physician offices, and others. Among these, the hospitals and clinics segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth is largely driven by the fact that hospitals and clinics are key healthcare settings where genetic testing is integrated into routine prenatal care and diagnostic services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France carrier screening market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Opko Health Inc

- Diasorin S.p.A.

- Eurofins Scientific

- InVitae Corporation

- Natera Inc.

- Quest Diagnostics Inc.

- Illumina Inc.

- Fulgent Genetics Inc.

- Myriad Genetics, Inc.

- Thermo Fisher Scientific Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France carrier screening market based on the below-mentioned segments:

France Carrier Screening Market, By Type

- Expanded Carrier Screening

- Targeted Disease Carrier Screening

France Carrier Screening Market, By Technology

- DNA Sequencing

- Polymerase Chain Reaction

- Microarrays

- Others

France Carrier Screening Market, By End User

- Hospitals and clinics

- Reference Laboratories

- Physician Offices

- Others

Need help to buy this report?