France Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Services (Storage, Transportation, and Value-added Services), By Temperature Type (Chilled and Frozen), By Application (Dairy Products (Ice-cream, Butter, Milk, others), Horticulture (Fresh Fruits and Vegetables), Life Sciences, Chemicals, Meat and Fish, Processed Food Products, Pharma, and Others) and France Cold Chain Logistics Market Insights Forecasts 2023 - 2033.

Industry: Automotive & TransportationFrance Cold Chain Logistics Market Insights Forecasts to 2033

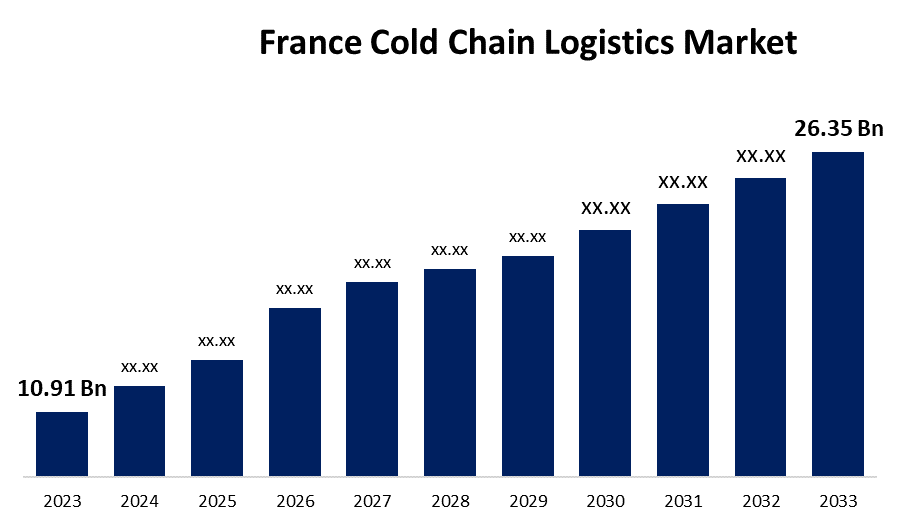

- The France Cold Chain Logistics Market Size was valued at USD 10.91 Billion in 2023

- The Market Size is Growing at a CAGR of 9.22% from 2023 to 2033.

- The France Cold Chain Logistics Market Size is Expected to Reach USD 26.35 Billion by 2033.

Get more details on this report -

The France Cold Chain Logistics Market size is Expected to Reach USD 26.35 Billion by 2033, at a CAGR of 9.22% during the forecast period 2023 to 2033.

Market Overview

Cold chain logistics is the process of transporting items such as food and medicine that must be kept at a specific temperature. The basic goal of cold chain logistics is to store things in a certain temperature range while maintaining their quality. The cold chain's logistics are divided into three components: distribution, storage, and refrigerated transportation. France is a key logistics hub in Europe, with a substantial impact on worldwide trade. Its strategic location and well-developed transportation infrastructure position it as a major player in the cold chain logistics network. The French cold chain logistics market serves a variety of industries, including food and beverage, medicines, chemicals, and flower products. This diversity illustrates the cold chain's agility and adaptability to fulfill the specific needs of many sectors. France is well-known for its wine business, and cold chain logistics play an important part in wine distribution.

Report Coverage

This research report categorizes the market for the France cold chain logistics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cold chain logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cold chain logistics market.

France Cold Chain Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Services, By Temperature Type, By Application |

| Companies covered:: | Kuehne + Nagel, Sofrilog, XPO Logistics, IRIS Logistics, Mutual Logistics, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The French cold chain logistics market is rapidly expanding as a result of rising demand for fresh and frozen food products such as fruits, vegetables, dairy, and meat. Furthermore, the e-commerce sector is expanding, with an increase in online grocery purchases. Furthermore, consumer expectations are rising in terms of product quality, safety, and sustainability. The pharmaceutical business is increasingly adopting temperature-sensitive medications and vaccinations. Furthermore, prioritize reducing food waste and avoiding product deterioration. Environmental sustainability is a major concern, and the French cold chain logistics market is embracing more environmentally friendly procedures. This includes energy-efficient transportation, eco-friendly packaging, and efforts to lessen overall environmental effect. The growth of e-commerce and online purchasing has had an impact on France's cold chain logistics business.

Restraining Factors

The maintenance and management of cold chain infrastructure incurs high operational expenditures. A shortage of competent labor and experienced professionals in cold chain logistics. Due to these factors, the growth of the French cold chain logistics market is hampering.

Market Segment

- In 2023, the transportation segment accounted for the largest revenue share over the forecast period.

Based on services, the France cold chain logistics market is segmented into storage, transportation, and value-added services. Among these, the transportation segment has the largest revenue share over the forecast period. Transportation services make up a considerable portion of the cold chain logistics sector in France. The transportation segment comprises refrigerated trucks, reefer containers, and temperature-controlled vehicles designed to convey products efficiently and safely.

- In 2023, the frozen segment is witnessing significant growth over the forecast period.

Based on temperature type, the France cold chain logistics market is segmented into chilled and frozen. Among these, the frozen segment is witnessing significant growth over the forecast period. This can be attributed to the fact that freezing food decreases biological activities that cause food degradation. Furthermore, frozen foods are available year-round, which contributes to the increase in demand.

- In 2023, the dairy products segment is witnessing significant growth over the forecast period.

Based on application, the France cold chain logistics market is segmented into dairy products (ice cream, butter, milk, others), horticulture (fresh fruits and vegetables), life sciences, chemicals, meat and fish, processed food products, pharma, and others. Among these, the dairy products segment is witnessing significant growth over the forecast period. As the dairy sector grows, the necessity for strong cold chain infrastructure, such as refrigerated storage facilities, temperature-controlled transportation, and efficient distribution networks, becomes more apparent. Investments in updating and expanding cold chain logistics capacities to fulfill rising demand for dairy products might be driving the strong increase seen in this section of the French cold chain logistics market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France cold chain logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kuehne + Nagela

- Sofrilog

- XPO Logistics

- IRIS Logistics

- Mutual Logistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, CMA CGM (CMACG.UL), a French shipping operator, has agreed to buy the logistics assets of family-run business Bollore for 5 billion euros ($5.5 billion). CMA CGM gave the Bollore company the option to sell its logistics operation, which produced more than 7 billion euros in sales last year and employs 13,500 people.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the France Cold Chain Logistics Market based on the below-mentioned segments:

France Cold Chain Logistics Market, By Service

- Storage

- Transportation

- Value-added Services

France Cold Chain Logistics Market, By Temperature Type

- Chilled

- Frozen

France Cold Chain Logistics Market, By Application

- Dairy Products

- Ice-cream

- Butter

- Milk

- Others

- Horticulture

- Fresh Fruits

- Vegetables

- Life Sciences

- Chemicals

- Meat and Fish

- Processed Food Products

- Pharma

- Others

Need help to buy this report?