France Crane Market Size, Share, and COVID-19 Impact Analysis, By Crane Type (Mobile Cranes, Fixed Cranes, Overhead Cranes, Tower Cranes), By Load Capacity (Less than 20 Tons, 20-100 Tons, 101-200 Tons, Greater than 200 Tons), By Application (Construction, Mining, Transport/Port, Manufacturing, Others), and France Crane Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationFrance Crane Market Insights Forecasts to 2033

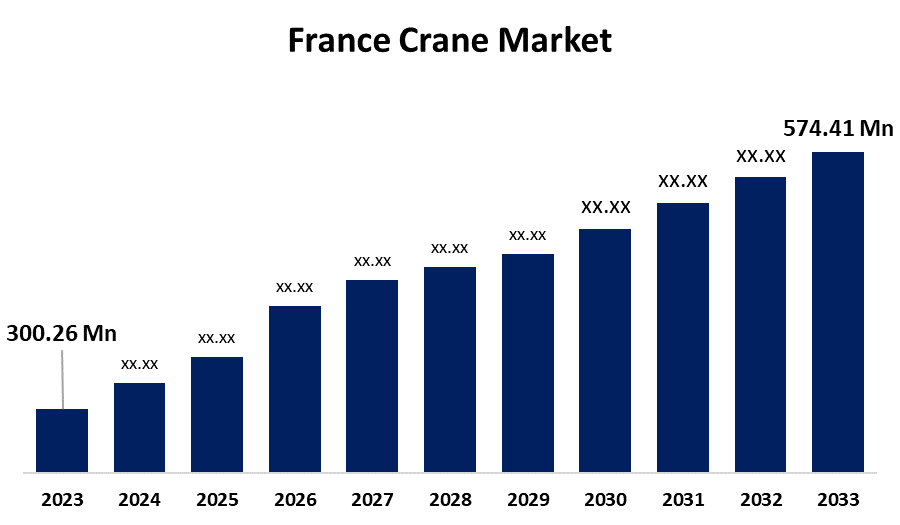

- The France Crane Market Size was Valued at USD 300.26 Million in 2023

- The Market Size is Growing at a CAGR of 6.70% from 2023 to 2033

- The France Crane Market Size is Expected to Reach USD 574.41 Million by 2033

Get more details on this report -

The France Crane Market Size is anticipated to exceed USD 574.41 Million by 2033, growing at a CAGR of 6.70% from 2023 to 2033. The regional market for the crane is propelling due to major cities-oriented infrastructure development, a phenomenal change in the technology sector, the presence of key industrial players along with their collaborative projects, and the government devoted to bringing novel solutions in automotive.

Market Overview

The crane market encompasses the global industry involved in the design, manufacturing, distribution, rental, and maintenance of cranes. Cranes are heavy machinery used for lifting and moving heavy materials, typically in construction, manufacturing, transportation, and various industrial applications. The crane market is a vital part of the global construction and industrial landscape, driven by infrastructure development, urbanization, and technological advancements. Some key types of cranes in the market are mobile cranes which are versatile cranes mounted on wheels or tracks, fixed cranes showcased stationary cranes like the tower and overhead cranes, and specialized cranes described as tailored for specific tasks, and crawler cranes. According to French diplomacy, France Relance recovery plan is indeed related to the France crane market. The plan, worth €100 billion, aims to boost the French economy and make it more resilient and future-ready. It includes investments in infrastructure, construction, and other sectors that are likely to drive demand for cranes.

Report Coverage

This research report categorizes the france crane market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the france crane market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the france crane market.

Driving Factors

The regional market for cranes is in high demand for construction projects because these are necessary for moving heavy equipment and materials. In addition, the development of residential and commercial buildings has increased due to the growing trend of urbanization, which has increased the demand for cranes in major cities in France. Moreover, advances in technology have produced crane models that are more effective and adaptable, increasing their attractiveness to a greater variety of industries which propels the native market. Further driving market expansion is the adoption of cutting-edge technologies like automation and the Internet of Things, which improve crane operations' efficiency and safety.

Restraints & Challenges

The France crane market is being hampered by the high cost of treatments, economic downturns supply chain disruptions, regulatory challenges, high maintenance costs, labor shortages, and ecoissue.

Market Segmentation

The France Crane Market share is classified into crane type, load capacity, and application.

- The mobile cranes segment accounted for the largest revenue share of the France crane market in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the crane type, the France crane market is categorized into mobile cranes, fixed cranes, overhead cranes, and tower cranes. Among these, the mobile crane segment accounted for the largest revenue share of the France crane market in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment growth contributed to the market expansion due to the capacity to work on different terrains and in various weather circumstances. It makes them essential for construction projects, infrastructure development, and industrial applications sectors booming in France. Moreover, mobile cranes are very flexible and can be transported quickly from one to another sites which propels their popularity in the construction and industrial sectors and assists the regional market revenue generated.

- The 100-200 ton segment accounted for the largest revenue share of the France crane market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the load capacity, the France crane market is classified into less than 20 tons, 20-100 tons, 101-200 tons, and greater than 200 tons. Among these, the 100-200 ton segment accounted for the largest revenue share of the France crane market in 2023 and is projected to grow at a substantial CAGR during the forecast period. This is due to the region expanding infrastructure and construction projects, which indicate the cranes have substantial lifting capacities for maneuvering heavy machinery and supplies. Moreover, cranes with this capacity range's versatility and ability render them flawless for an array of utilizes, including industrial ventures and residential construction propels the segment expansion.

- The construction segment held an enormous revenue share of the France crane market in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the France crane market is segmented into construction, mining, transport/port, manufacturing, and others. Among these, the construction segment held an enormous revenue share of the France crane market in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the construction industry's need for strong and adaptable lifting equipment. Hence, cranes are vital for collecting building materials, moving big stuff, and ensuring that projects wrap up quickly at construction sites, infrastructures business premises, and residential projects which fuels the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France crane market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Konecranes and Demag - Siège social

- Manitowoc Crane Group

- HIAB

- Mediaco Ile de

- Wolffkran

- SANY

- Liebherr

- Tadano

- FOSELEV

- A.A.Y.M.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In July 2024, FOSELEV, a leading French crane rental company, added seven new Grove cranes to its fleet. This latest delivery includes a mix of three, four, and five-axle Grove all-terrain cranes. These cranes are designed for their compact footprints, easy transportation, long booms, and versatility across multiple industries.

- In April 2024, The Liebherr LTR 1150 telescopic crawler crane made its debut at the Intermat exhibition in Paris. This new crane is quite impressive, boasting a maximum lifting capacity of 150 tonnes and a 52-meter telescopic boom. It's designed to be highly transportable, with a transport-friendly profile that allows for easy and economical transportation to and from construction sites.

- In February 2024, A.A.Y.M., the family-run heavy lifting and handling company based in Lamballe, France, added a second Grove crane to its fleet. This new crane is a Grove GMK5150XL, which boasts a 150-ton capacity and a 68.7-meter main boom.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France crane market based on the below-mentioned segments:

France Crane Market, By Crane Type

- Mobile Crane

- Fixed Cranes

- Overhead Cranes

- Tower Cranes

France Crane Market, By Load Capacity

- Less than 20 Tons

- 20-100 Tons

- 101-200 Tons

- Greater than 200 Tons

France Crane Market, By Application

- Construction

- Mining

- Transport/Port

- Manufacturing

- Others

Need help to buy this report?