France E-bikes Market Size, Share, And COVID-19 Impact Analysis, By Propulsion Type (Pedal Assisted, Speed Pedelec, Throttle Assisted), By Battery Type (Lead Acid Battery, Lithium-ion Battery, Others), By Application (Cargo/Utility, City/Urban, Trekking), and France E-bikes Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationFrance E-bikes Market Insights Forecasts to 2033

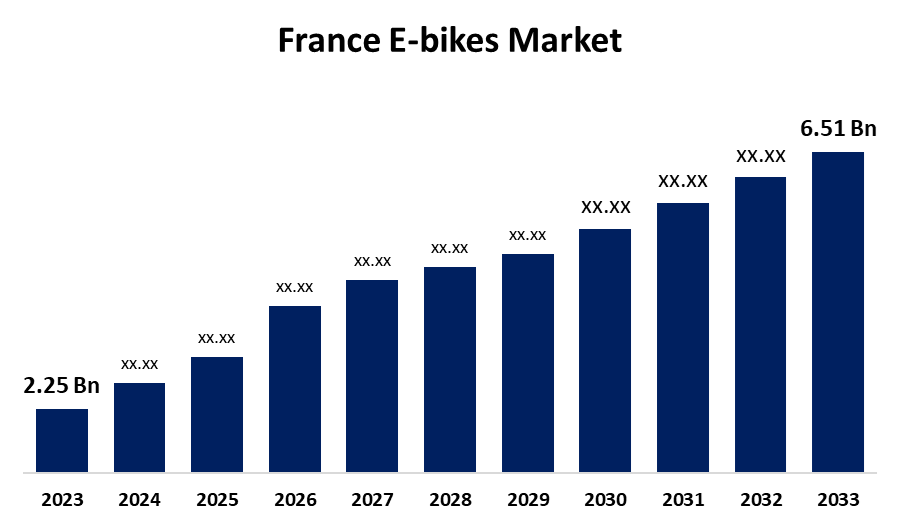

- The France E-bikes Market size was Estimated at USD 2.25 Billion in 2023.

- The France E-bikes Market size is Expected to Grow at a CAGR of around 11.21% from 2023 to 2033.

- The France E-bikes Market size is Expected to Reach USD 6.51 Billion by 2033.

Get more details on this report -

The France E-bikes Market size is predicted to grow from USD 2.25 Billion in 2023 to USD 6.51 Billion by 2033 at a CAGR of 11.21% during the forecast period.

Market Overview

The e-bike market is described as the industry that manufactures and distributes a cycle combined with a motor and rechargeable batteries that allow pedaling effort to be taken off. E-bikes are beneficial for consumers as effective traveling instead of cars in short-range distances. The quickly rechargeable batteries, light motors, and advanced technology allow tiredness to be avoided and become while riding. These bikes are designed to provide a more efficient and eco-friendly mode of transportation compared to traditional bicycles and motor vehicles. According to a Service-Public.fr Le site officiel de l'administration française, the government introduced a subsidy scheme to encourage cycling and reduce car usage. This scheme offered financial assistance to residents for buying new or second-hand bicycles and e-bikes. The scheme promotes a sustainable mode of transport and improves public health by reducing short car journeys.

Report Coverage

This research report categorizes the France e-bike market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France e-bike market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France e-bike market.

France E-bikes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.25 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 11.21% |

| 023 – 2033 Value Projection: | USD 6.51 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Propulsion Type, By Battery Type And COVID-19 Impact Analysis |

| Companies covered:: | Rossignol, T-bird, Ultima, Velobecane, Vepli, Voltaire, Wayscral, Zoov, O2feel, Eovolt, and Others, key players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis, |

Get more details on this report -

Driving Factors

Market growth for e-bike in France is being driven by urbanization, government programs supporting green transport, and increasing demand for alternative transportation solutions. This trend is further supported by growing awareness of the detrimental effects of fossil fuel-powered vehicles. Concurrently, advancements in motor technology, such as mid-drive motors that offer improved torque and weight distribution, are revolutionizing the user experience. Furthermore, connectivity features like GPS navigation and app-based tracking of performance become prevalent following the larger trend of smart transportation. Moreover, the rising disposable income of consumers assists the significant growth of the market with increasing acceptance during recreational and leisure activities.

Restraints & Challenges

The France e-bike market growth is being restricted because of high initial costs, the use of advanced components, innovative technologies, and complications during integration raises high keeping costs, which raises retail prices, and low recognition.

Market Segmentation

The France e-bike market share is classified into propulsion type, battery type, and application.

- The pedal assisted segment accounted for the largest share of the France e-bike market in 2023 and is expected to grow at a substantial CAGR during the forecast period.

Based on the propulsion type, the France e-bikes market is categorizedinto pedal assisted, speed pedelec, and throttle assisted. Among these, the pedal assisted segment accounted for the largest share of the France e-bike market in 2023 and is expected to grow at a substantial CAGR during the forecast period. This is due to the region development in the infrastructure and government programs supporting green transport. Moreover, with the ability to select from three to five assist modes, pedal-assisted e-bikes, give riders a personalized riding experience while preserving the classic cycling feel. Concurrently, longer battery life and lower maintenance needs than other propulsion types contribute to the segment's excels by making them an ideal choice for daily usage.

- The lithium-ion battery segment accounted for the largest share of the France e-bikes market in 2023 and is projected to grow at a remarkable growth during the forecast period.

Based on the battery type, the France e-bikes market is categorized into lead acid battery, lithium-ion battery, and others. Among these, the lithium-ion battery segment accounted for the largest share of the France e-bike market in 2023 and is projected to grow at a remarkable growth during the forecast period. This segment is attributed to the market expansion because the greater energy density, longer lifespan, and superior power-to-weight ratio of lithium-ion batteries over traditional battery technologies are their prominence and are more reasonably priced and appealing to buyers. Moreover, lithium-ion batteries are becoming an ideal choice among retail chains and independent retailers for their profitable revenue. Concurrently, increased R&D expenditures, rising need for all-terrain e-bikes, and the growing acceptance of e-bikes for both commuting and leisure in remote locations all contribute to the segment's growth.

- The city/urban segment accounted for the largest share of the France e-bikes market in 2023 and is projected to grow at a remarkable growth during the forecast period.

Based on the application, the France e-bike market is categorized into cargo/utility, city/urban, and trekking. Among these, the city/urban segment accounted for the largest share of the France e-bikes market in 2023 and is projected to grow at a remarkable growth during the forecast period. This is due to government initiatives such as the creation of bicycle-specific infrastructure and subsidy programs that further support the growth of this segment. Moreover, the growing environmental consciousness of citizens and their choice of sustainable transportation options that lessen traffic jams and carbon emissions in urban areas further contribute to the segment's dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France e-bike market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rossignol

- T-bird

- Ultima

- Velobecane

- Vepli

- Voltaire

- Wayscral

- Zoov

- O2feel

- Eovolt

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In February 2025, Karbike is a new French startup that has developed an innovative electric bike designed to address urban traffic challenges. Their bikes combine pedal power with an electric motor and offer additional space for passengers, groceries, or luggage. This makes them a practical and eco-friendly solution for city commuting.

- In September 2023, Volkswagen Financial Services (VWFS) and Pon Holdings formed a strategic alliance to expand bike leasing in Europe. This partnership aims to accelerate the growth of the bicycle and e-bike leasing market, making e-bikes more accessible to employees and commercial customers.

- In September 2022, France introduced substantial incentives to encourage people to switch from cars to bicycles or e-bikes. The government is offering subsidies of up to €4,000 to residents who trade in their gas-powered cars for electric bikes or traditional bicycles.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France e-bike market based on the below-mentioned segments:

France E-bikes Market, By Propulsion Type

- Pedal Assisted

- Speed Pedelec

- Throttle Assisted

France E-bikes Market, By Battery Type

- Lead Acid Battery

- Lithium-ion Battery

- Others

France E-bikes Market, By Application

- Cargo/Utility

- City/Urban

- Trekking

Need help to buy this report?