France Feed Additives Market Size, Share, and COVID-19 Impact Analysis, By Source (Synthetic and Natural), By Form (Dry and Liquid), By Livestock (Poultry, Ruminants, Swine, Aquatic Animals, and Others), and France Feed Additives Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesFrance Feed Additives Market Insights Forecasts to 2033

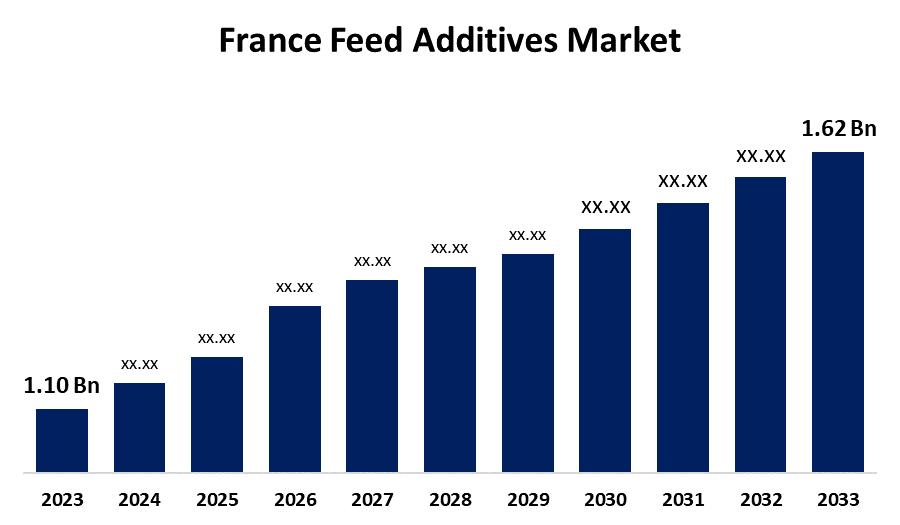

- The France Feed Additives Market Size Was valued at USD 1.10 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.95% from 2023 to 2033

- The France Feed Additives Market Size is expected to reach USD 1.62 Billion by 2033

Get more details on this report -

The France Feed Additives Market Size is anticipated to exceed USD 1.62 Billion by 2033, Growing at a CAGR of 3.95% from 2023 to 2033. The increasing animal export market and livestock production are driving the growth of the feed additives market in the France.

Market Overview

Feed additives are used to improve the feed itself, enhancing the health and performance of the animals, and the nutritional content of animal products in animal nutrition. Supplements like these include a variety of compounds that aid in the breakdown and assimilation of nutrients, such as probiotics, enzymes, amino acids, and vitamins. Because of its significant effects on the environment and animal producers alike, feed efficiency has become a major concern in animal husbandry. As less feed is needed to produce the same amount of meat, improved feed efficiency lowers feed costs for agriculture's environmental impact while also conserving resources and reducing greenhouse gas emissions. Probiotics, prebiotics, and botanical extracts are examples of natural growth boosters that have become quite popular as substitutes for synthetic chemicals and conventional antibiotics. As a result, the market for feed additives has experienced tremendous growth due to the growing demand for clean-label and organic animal products.

Report Coverage

This research report categorizes the market for the France feed additives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France feed additives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France feed additives market.

France Feed Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.10 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.95% |

| 2033 Value Projection: | USD 1.62 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Form, By Livestock |

| Companies covered:: | Cargill Inc., BASF SE, Alltech Inc., Danisco Animal Nutrition, Elanco Animal Health, Chr. Hansen Holding A / S, Archer Daniels Midland, Adisseo, Nutreco NV, Lallemand Inc, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Concerns about the safety of food, particularly about meat and dairy products, have boosted the use of feed additives in the country which is anticipated to drive market growth. Internationally, French animal breeds are widely favored and well-liked for meat and related goods. ITC Trade reports that live animals were exported for USD 2.4 billion in 2019 as opposed to USD 2.1 billion in 2016. Thus, an increasing animal export market contributes to driving the demand for feed additives in France. The growing costs for feed raw materials, a greater focus on lowering feed production costs, and rising demand for meat and dairy products are driving the market demand.

Restraining Factors

In the European Union, antibiotics are not allowed to be used as growth promoters in animal feed. The restricted use of antibiotics-based feed additives and the transition towards more sustainable and responsible alternatives are challenging the market.

Market Segmentation

The France Feed Additives Market share is classified into source, form, and livestock.

- The synthetic segment is expected to witness the fastest CAGR growth during the forecast period.

The France feed additives market is segmented by source into synthetic and natural. Among these, the synthetic segment is expected to witness the fastest CAGR growth during the forecast period. The agricultural industry is highly concerned about spoilage and waste, and synthetic additives are excellent at increasing the shelf life of feed products. Reduced unit costs are another advantage of optimized production procedures for synthetic additives. Farmers and producers benefit from these cost savings, which boosts their operational effectiveness without sacrificing the quality of their output.

- The dry segment is predicted to grow at the fastest CAGR over the forecast period.

Based on the form, the France feed additives market is divided into dry and liquid. Among these, the dry segment is predicted to grow at the fastest CAGR over the forecast period. For feed manufacturers, dry forms are the favored option since they are simpler to measure, store, and mix into animal feed. Thus, the reduced transportation costs, logistical ease, and adaptability in various feeding systems are responsible for driving the market growth in the dry segment.

- The poultry segment dominates the market with the largest market share during the forecast period.

The France feed additives market is segmented by livestock into poultry, ruminants, swine, aquatic animals, and others. Among these, the poultry segment dominates the market with the largest market share during the forecast period. The alteration in dietary preferences among the rising population is driving the market demand. Because of its efficiency and high rate of turnover, chicken farming is especially well-suited to gain from feed additives. Additionally, the poultry industry has been at the forefront of implementing cutting-edge technology and breakthroughs in animal nutrition, such as nutrigenomics and precision feeding.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France feed additives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- BASF SE

- Alltech Inc.

- Danisco Animal Nutrition

- Elanco Animal Health

- Chr. Hansen Holding A / S

- Archer Daniels Midland

- Adisseo

- Nutreco NV

- Lallemand Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2019, Lallemand Animal Nutrition entered a research and development partnership with the French biotech firm Dendris. The partnership would focus on developing a monitoring tool to characterize microbial fibrolytic activity in the ruminant digestive tract.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Feed Additives Market based on the below-mentioned segments:

France Feed Additives Market, By Source

- Synthetic

- Natural

France Feed Additives Market, By Form

- Dry

- Liquid

France Feed Additives Market, By Livestock

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

Need help to buy this report?