France Fiberglass Market Size, Share, and COVID-19 Impact Analysis, By Type (E-Glass, A-Glass, S-Glass, AR-Glass, C-Glass, R-Glass, Others), By Application (Automotive & Transportation, Building & Construction, Electrical & Electronics, Pipe & Tank, Consumer Goods, Wind Energy, Others), and France Fiberglass Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsFrance Fiberglass Market Insights Forecasts to 2033

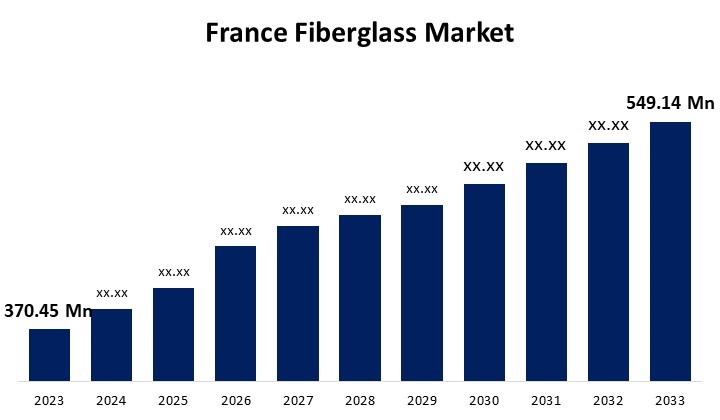

- The France Fiberglass Market Size was valued at USD 370.45 Million in 2023.

- The Market Size is Growing at a CAGR of 4.01% from 2023 to 2033.

- The France Fiberglass Market Size is Expected to Reach USD 549.14 Million by 2033.

Get more details on this report -

The France Fiberglass Market Size is expected to reach USD 549.14 Million by 2033, at a CAGR of 4.01% during the forecast period 2023 to 2033

Market Overview

Fiberglass is a material made up of tiny glass fibers. It can be used for strength or made into a woven layer. The material's main elements include silica sand, soda ash, and limestone. Its great mechanical strength, lightweight nature, and chemical stability make it suitable for a wide range of applications, including aircraft, boats, vehicles, electronic product, storage tanks, and pipes. The growing investments and attention on the development of energy-efficient and sustainable buildings are propelling fiberglass's market growth. The France fiberglass market is growing rapidly as the building industry expands, particularly in emerging markets. Fiberglass is used extensively in construction for a variety of purposes, including insulation, roofing, and reinforcement. The material's high strength-to-weight ratio and insulating qualities make it a good choice for construction projects. Furthermore, fiberglass is durable, resistant to corrosion, and versatile in design, allowing architects and engineers to develop new structures. The fiberglass sector is increasingly embracing sector 4.0 concepts. Sensors, data analytics, and real-time monitoring provide predictive maintenance, which reduces downtime and ensures that equipment functions at top performance. This data-driven strategy also allows firms to optimize production schedules and respond to changing market demands more swiftly.

Report Coverage

This research report categorizes the market for France's fiberglass market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France fiberglass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the France fiberglass market.

France Fiberglass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 370.45 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.01% |

| 2033 Value Projection: | USD 549.14 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application. |

| Companies covered:: | Sicomin, Kordsa France, Owens Corning France, Saint-Gobain Vetrotex, Jushi Group France, Ashland Performance Materials France, Nitto Boseki Europe, Taishan Fiberglass, Chomarat Group, and BGF Industries |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing building industry, particularly in emerging economies, is a primary driver. Fiberglass is commonly utilized in construction because of its outstanding strength-to-weight ratio and insulating characteristics. Furthermore, the automotive industry significantly influences the need for fiberglass. Fiberglass is increasingly being used in the manufacture of automobile components such as body panels, interiors, and structural reinforcements as the industry swings towards lightweight materials to enhance fuel efficiency and reduce emissions. Aside from that, the renewable energy sector is boosting demand for fiberglass. Fiberglass is utilized to make wind turbine blades because of its excellent strength and corrosion resistance. With an increasing focus on renewable energy generation, the demand for fiberglass in wind sectors is expected to witness France market growth in the forecast period.

Restraining Factors

The high cost of restoring damaged fiberglass limits demand for fiberglass over the foreseeable period. The basic version of glass wool is a low-cost and effective insulation material, but it is difficult to recycle, posing a significant challenge for the insulation industry. The glass wool, mask, and protective clothing must all be properly disposed of. Most industrialized countries lack the requisite infrastructure for disposal and recycling, which may have an impact on market revenue growth.

Market Segment

- In 2023, the E-glass segment accounted for the largest revenue share over the forecast period.

Based on the type, the France fiberglass market is segmented into E-glass, A-glass, S-glass, AR-glass, C-glass, R-glass, and others. Among these, the E-glass segment has the largest revenue share over the forecast period. E-glass is the most frequently utilized glass fiber type in the fiberglass industry. It is renowned for its superior electrical insulation, strong tensile strength, and moderate chemical resistance. E-glass fibers are commonly utilized in a variety of industries, including construction, automotive, electrical, and telecommunications. They are utilized in a variety of applications, including composite reinforcement, insulation, thermal and acoustic insulation, and electrical components.

- In 2023, the automotive & transportation segment accounted for the largest revenue share over the forecast period.

On the basis of application, the France fiberglass market is segmented into automotive & transportation, building & construction, electrical & electronics, pipe & tank, consumer goods, wind energy, and others. Among these, the automotive & transportation segment has the largest revenue share over the forecast period. Fiberglass materials are used largely to make lightweight, durable, and high-performance components. Body parts including hoods, fenders, and trunk lids are made from fiberglass. These components benefit from the lightweight and corrosion-resistant qualities of fiberglass composites, which help to enhance fuel efficiency and reduce vehicle weight. Fiberglass is used in the manufacture of many chassis’ components, including suspension parts, subframes, and reinforcements. These components have the advantage of being lightweight while maintaining strength and stiffness.

Competitive Analysis:

List of Key Companies

- Sicomin

- Kordsa France

- Owens Corning France

- Saint-Gobain Vetrotex

- Jushi Group France

- Ashland Performance Materials France

- Nitto Boseki Europe

- Taishan Fiberglass

- Chomarat Group

- BGF Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the France Fiberglass Market based on the below-mentioned segments:

France Fiberglass Market, By Type

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

France Fiberglass Market, By Application

- Automotive & Transportation

- Building & Construction

- Electrical & Electronics

- Pipe & Tank

- Consumer Goods

- Wind Energy

- Others

Need help to buy this report?