France Fintech Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-Premises and Cloud), By Technology (Artificial Intelligence, Application Programming Interface (API), Robotic Process Automation, Data Analytics, and Others), and France Fintech Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialFrance Fintech Market Insights Forecasts to 2033

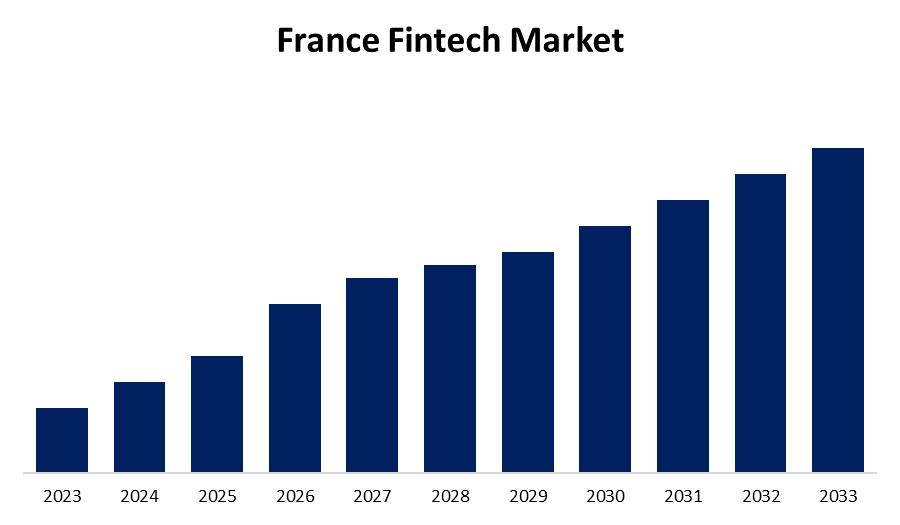

- The Market Size is Growing at a CAGR of 10.6% from 2023 to 2033

- The France Fintech Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The France Fintech Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 10.6% from 2023 to 2033.

Market Overview

Fintech is a software that aims to simplify, speed up, and enhance security in financial services and procedures by combining finance and technology. The fintech sector encompasses a wide range of services, such as payment processing solutions and mobile banking apps, with the goal of enhancing consumer financial well-being and streamlining business financial processes. The fast-paced digitization, automation, and improvement of financial services have resulted in increased convenience for customers. For example, neobanks, which are banks that only function online, allow clients to perform tasks such as requesting credit cards and initiating savings accounts through the Internet without imposing the same fees as conventional banks. Products from other fintech companies, such as digital wallets and peer-to-peer payment apps, have simplified payment procedures for individuals. Reduced fees and convenient online services have turned fintech into a feasible option for communities historically overlooked by the financial sector. More than 90 percent of Hispanic customers utilize some form of fintech services, with 88 percent of Black customers and 79 percent of Asian customers following suit. Businesses have also adopted fintech and played a role in its expansion. Financial institutions offer round-the-clock customer support using chatbots and robo-advisors, insurers utilize AI-based fintech solutions for risk evaluation and precise premium pricing, and businesses access investors and capital via lending platforms.

Report Coverage

This research report categorizes the market for the France fintech market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France fintech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France fintech market.

France Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.6% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment Mode, By Technology |

| Companies covered:: | Olinda SAS, Ledger SAS, Spendesk SAS, Lydia Solutions, PayFit Ltd., October S.A., Shift Technology, Younited S.A, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Massive innovation in the technological field is propelling the growth of the fintech market in France. The combination of algorithmic trading and AI in portfolio management results in improved wealth management and reduces risks significantly. AI algorithms assist fintech key players with analyzing financial data, market news, social media sentiment, and historical datasets to offer real-time insights, enabling better decision-making and decreasing transaction risks. Furthermore, with no specific time restrictions, AI has the capability to analyze both risks and opportunities outside of trading hours, thus driving innovation in the fintech sector in France.

Restraining Factors

Prior to launching the app, application or website, companies must conduct security testing. The problem lies in the potential for unforeseen circumstances that extend the timeline for release. Developers might release unsafe software in order to accelerate the launch of a financial product.

Market segmentation

The France Fintech market share is classified into deployment mode and technology.

- The cloud segment is expected to hold the largest market share through the forecast period.

The France fintech market is segmented by deployment mode into on-premises and cloud. Among them, the cloud segment is expected to hold the largest market share through the forecast period. Cloud solutions provide fintech companies with great scalability and flexibility, enabling them to easily adjust to evolving market needs and grow their operations without requiring a large on-site infrastructure.

- The artificial intelligence segment is expected to hold the largest market share through the forecast period.

The France fintech market is segmented by technology into artificial intelligence, application programming interface (API), robotic process automation, data analytics, and others. Among them, the artificial intelligence segment is expected to hold the largest market share through the forecast period. AI technologies such as chatbots and virtual assistants are being more commonly utilized to improve customer service and support, offering quicker, more effective communication and tailored financial guidance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France fintech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olinda SAS

- Ledger SAS

- Spendesk SAS

- Lydia Solutions

- PayFit Ltd.

- October S.A.

- Shift Technology

- Younited S.A

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, Adevinta Ventures, the investment branch of Adevinta, a prominent classifieds company, put €14 million into France FinTech company Aria to facilitate efficient B2B payments and enhance the B2C checkout process.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Fintech Market based on the below-mentioned segments:

France Fintech Market, By Deployment Mode

- On-Premises

- Cloud

France Fintech Market, By Technology

- Artificial Intelligence

- Application Programming Interface (API)

- Robotic Process Automation

- Data Analytics

- Others

Need help to buy this report?