France Hearing Aids Market Size, Share, and COVID-19 Impact Analysis, By Technology (Analog, Digital), By Product (Hearing Implants, Hearing Aid Devices), By Distribution Channel (Manufacturer Owned Retail Chains, Large Retail Chains, Public, Others), and France Hearing Aids Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareFrance Hearing Aids Market Insights Forecasts to 2033

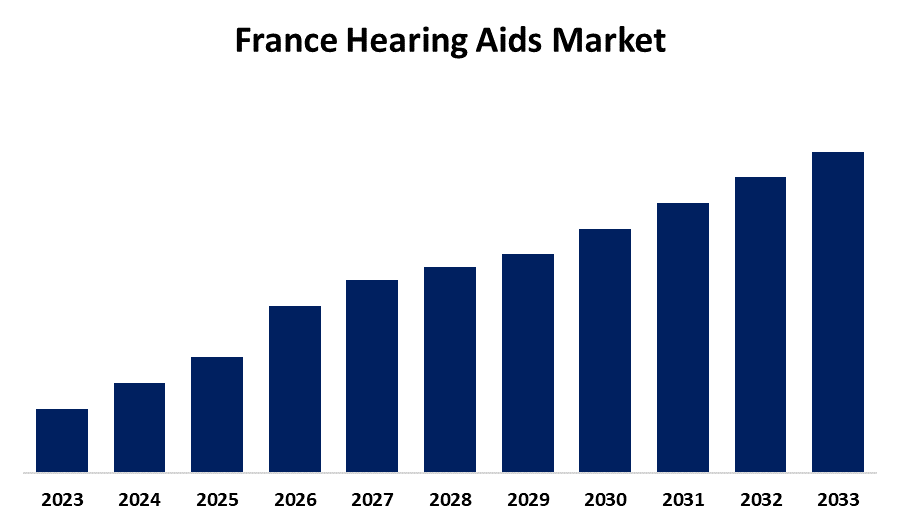

- The Market Size is growing at a CAGR of 6.9% from 2023 to 2033.

- The France Hearing Aids Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The France Hearing Aids Market Size is expected to reach a significant share by 2033, growing at a CAGR of 6.9% from 2023 to 2033.

The France hearing aids market continues to expand as a result of growing incidences of hearing diseases, greater awareness and activities regarding hearing aid devices, and expanding technological breakthroughs in hearing aid devices.

Market Overview

Hearing aids are small electronic devices designed to amplify sound for individuals with hearing loss. They are worn either behind the ear, in the ear, or in the ear canal, and they work by capturing sound through a microphone, processing it electronically to adjust for the individual's hearing loss, and then delivering the amplified sound through a speaker into the ear. The market is rising as more people utilize cochlear implants as well as advanced hearing devices. Hearing implants are surgically placed hearing aids that allow people who are entirely or mostly deaf to hear sounds surrounding them. Additionally, the rising prevalence of hearing diseases, as well as greater knowledge and activity around hearing aid devices, are significant drivers moving the hearing aid business forward. The high growth of the industry is mostly attributable to the fact that persons with either short-term or long-term hearing loss can improve or recover their hearing senses with the use of hearing aids.

Report Coverage

This research report categorizes the market for the France hearing aids market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France hearing aids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France hearing aids market.

France Hearing Aids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Product, By Distribution Channel |

| Companies covered:: | Sonova Holding, Sivantos Pte Ltd, GN Store Nord AS, William Demant Holding A/S, Widex A/S, Starkey Hearing Technologies Inc., Audition Opera, Audika, Amplifon, Vivason chatelet, Audition Benoit, Acuitis, Benjamin Opticien, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Private banks and financial institutions have increased their funding efforts to cover operations and other medical-related charges, which helped the industry. Various developed countries run health insurance programs, which provide significant growth potential for players in the field. As a result of greater program understanding and enhanced presentation of terms and conditions, the consumer base has grown to serve in the expected period. Behind-the-ear (BTE) hearing aids are more prominent due to their improved efficiency, enhanced connectivity, and ease of use. The fact that these devices function best for people of every generation and with any type of hearing impairment improves their patient base, making them ideal for the vast majority of people with hearing loss. Behind-the-ear hearing aids are the most common type of hearing aid. They have more amplification power than other hearing aids and a directional microphone to improve efficiency.

Restraining Factors

There is now a shortage of skilled professionals in many countries who can successfully perform ENT therapies such as cochlear implantation. This problem is substantially more common in poor communities. Despite having a large target patient population, these places are expected to have a limited supply of qualified ENT surgeons, limiting the number of ENT procedures performed each year, including cochlear implantation. As a result, the hearing aid market will face considerable challenges.

Market Segmentation

The France hearing aids market share is classified into technology, product, and distribution channels.

- The digital segment is expected to hold a significant share of the France hearing aids market during the forecast period.

The France hearing aids market is segmented by technology into analog and digital. Among these, the digital segment is expected to hold a significant share of the France hearing aids market during the forecast period. Adaptive functions in digital hearing aids include noise reduction, feedback cancellation, directional microphones, and a variety of program settings. These capabilities adapt dynamically to different listening environments, improving pronunciation and increasing user satisfaction in a range of scenarios. When compared to analog hearing aids, digital hearing aids provide superior sound quality, processing capabilities, and more functions. These technological advancements make digital gadgets appealing to people seeking precise and effective remedies for their hearing problems.

- The hearing aid devices segment is expected to hold the largest share of the France hearing aids market during the forecast period.

Based on the product, the France hearing aids market is divided into hearing implants and hearing aid devices. Among these, the hearing aid devices segment is expected to hold the largest share of the France hearing aids market during the forecast period. This is due to the launch of innovative products by various manufacturers and an increasing older population. Hearing aids are used to treat a variety of illnesses, including sensorineural and conductive hearing loss, as well as single-sided deafness. Hearing aids can improve the perception of sounds. All of these factors will drive the growth of the France hearing aids market throughout the forecast period.

- The large retail chain segment is expected to hold the largest share of the France hearing aids market during the forecast period.

Based on the distribution channel, the France hearing aids market is divided into manufacturer owned retail chains, large retail chains, public, and others. Among these, the large retail chain segment is expected to hold the largest share of the France hearing aids market during the forecast period. Because of the rising market for over-the-counter (OTC) hearing aid networks in retail chains, the major retail chain segment is likely to dominate.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France hearing aids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sonova Holding

- Sivantos Pte Ltd

- GN Store Nord AS

- William Demant Holding A/S

- Widex A/S

- Starkey Hearing Technologies Inc.

- Audition Opera

- Audika

- Amplifon

- Vivason chatelet

- Audition Benoit

- Acuitis

- Benjamin Opticien

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Signia, a pioneer in hearing aids and a division of WS Audiology, introduced a groundbreaking technology called Integrated Xperience, which allows individuals wearing hearing aids to hear every speaker in loud group conversations. The hearing aids guarantee better speech comprehension even when the speakers change positions or the wearer shifts their head.

Market Segment

This study forecasts country revenue from 2020 to 2033. Spherical Insights has segmented the Germany washing machine market based on the below-mentioned segments:

France Hearing Aids Market, By Technology

- Analog

- Digital

France Hearing Aids Market, By Product

- Hearing Implants

- Hearing Aid Devices

France Hearing Aids Market, By Distribution Channel

- Manufacturer Owned Retail Chains

- Large Retail Chains

- Public

- Others

Need help to buy this report?