France In-Vitro Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Reagents, and Services), By End-use (Hospitals, Laboratory, Home-care, and Others), and France In-Vitro Diagnostics Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareFrance In-Vitro Diagnostics Market Insights Forecasts to 2033

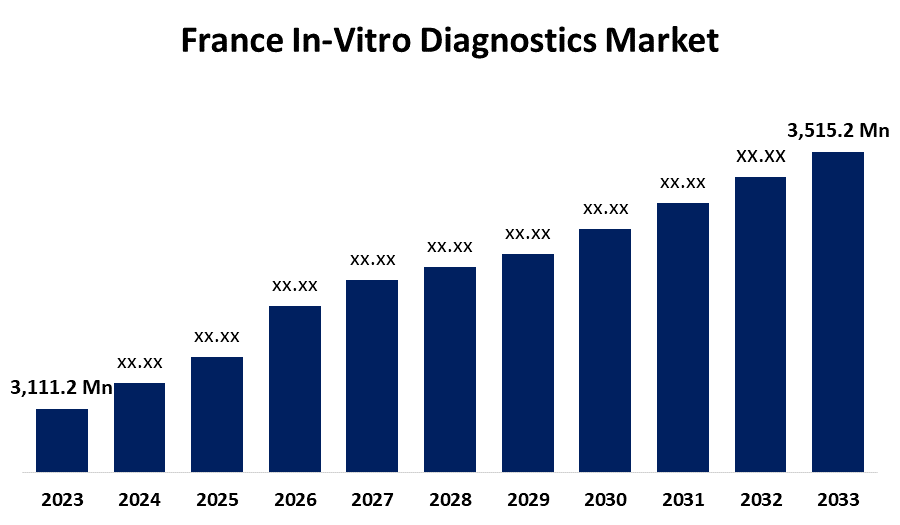

- The France In-Vitro Diagnostics Market Size was valued at USD 3,111.2 Million in 2023.

- The Market Size is Growing at a CAGR of 1.2% from 2023 to 2033

- The France In-Vitro Diagnostics Market Size is Expected to Reach USD 3,515.2 Million by 2033

Get more details on this report -

The France In-Vitro Diagnostics Market Size is Anticipated to Reach USD 3,515.2 Million by 2033, growing at a CAGR of 1.2% from 2023 to 2033.

Market Overview

In-vitro diagnostics (IVD) are medical devices that run diagnostic tests on biological samples like blood, urine, and tissues. These tests aid in the detection and monitoring of infectious diseases, autoimmune diseases, and a variety of medical conditions, as well as the periodic analysis of drug therapy modifications. In vitro diagnostic tests are used to diagnose and manage a variety of diseases. Biological samples such as blood, urine, stool, tissues, and other bodily fluids are collected and analyzed to diagnose various diseases and conditions. Furthermore, IVD tests are typically performed in both standalone and hospital-based laboratories. IVD tests use a variety of technologies, including polymerase chain reaction, which selectively replicates specific DNA and RNA sequences in the test tube. The France in-vitro diagnostics market is expanding due to the rapid increase in chronic and infectious diseases, technological advancements, and the introduction of point-of-care diagnostics. The In-Vitro Diagnostics market is a thriving sector of the France medical industry. Currently, the sector is undergoing significant transformations. However, as the country faces escalating financial pressures from an aging population and a comprehensive national healthcare system, the need to capitalize on efficient diagnostics' cost/benefit advantages is becoming more apparent within the industry.

Report Coverage

This research report categorizes for the France in-vitro diagnostics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France in-vitro diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France in-vitro diagnostics market.

France In-Vitro Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3,111.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.2% |

| 2033 Value Projection: | USD 3,515.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By End-use |

| Companies covered:: | Abbott Laboratories, Becton, Dickinson and Company, BioMerieux, Bio-Rad Laboratories, Inc., Danaher Corporation, F. Hoffmann-La Roche AG, QIAGEN N.V., Siemens Healthineers, Sysmex Corporation, Thermo Fischer Scientific Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth can be attributed to increased IVD adoption as the incidence of infectious and chronic diseases rises. The development of automated IVD systems for laboratories and hospitals that provide efficient, accurate, and error-free diagnoses is expected to drive market growth. The increasing number of IVD products launched by major players is also driving market growth. Technological advancements in terms of accuracy, portability, and cost-effectiveness are expected to be significant rendering drivers in this market. The introduction of novel and highly accurate clinical laboratory tests is driving the adoption of novel IVD tests.

Restraining Factors

Stringent regulatory policies and unclear reimbursement policies limit growth. Also, In-vitro diagnostics instruments can only be used by skilled professionals, which raises the devices' maintenance costs and, as a result, slows overall market growth.

Market Segmentation

The France in-vitro diagnostics market share is classified into product and end-use

- The reagents segment is expected to hold the largest market share through the forecast period.

The France in-vitro diagnostics market is segmented by product into instruments, reagents, and services. Among these, the reagents segment is expected to hold the largest market share through the forecast period. Major players have launched extensive R&D initiatives to develop novel reagents and test kits. The increased R&D activities to enable faster cancer detection and precision medicine are allowing companies to concentrate on niche profitable areas of the IVD industry.

- The hospitals segment is expected to dominate the France in-vitro diagnostics market during the forecast period.

Based on the end-use, the France in-vitro diagnostics market is divided into hospitals, laboratory, home care, and others. Among these, the hospitals segment is expected to dominate the France in-vitro diagnostics market during the forecast period. The ongoing development of healthcare infrastructure, combined with favorable government initiatives, is expected to improve existing hospital facilities. As a result, the demand for hospital-based IVD tests is growing. Hospitals purchase the majority of IVD devices and use them extensively.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France in-vitro diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Becton, Dickinson and Company

- BioMerieux

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- QIAGEN N.V.

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fischer Scientific Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Roche Diagnostics France launched the BenchMark ULTRA PLUS system in France, its most advanced platform for staining histological or cytological samples on microscope slides. It was first shown as part of Carrefour Pathologie 2022 at the Palais des Congrès de la Porte Maillot in Paris.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France in-vitro diagnostics market based on the below-mentioned segments:

France In-Vitro Diagnostics Market, By Product

- Instruments

- Reagents

- Services

France In-Vitro Diagnostics Market, By End-use

- Hospitals

- Laboratory

- Home-care

- Others

Need help to buy this report?