France Insurance Brokerage Market Size, Share, and COVID-19 Impact Analysis, By Mode (Online and Offline), By Commission (Policy Basis, Premium Basis, and Fixed), and France Insurance Brokerage Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialFrance Insurance Brokerage Market Insights Forecasts to 2033

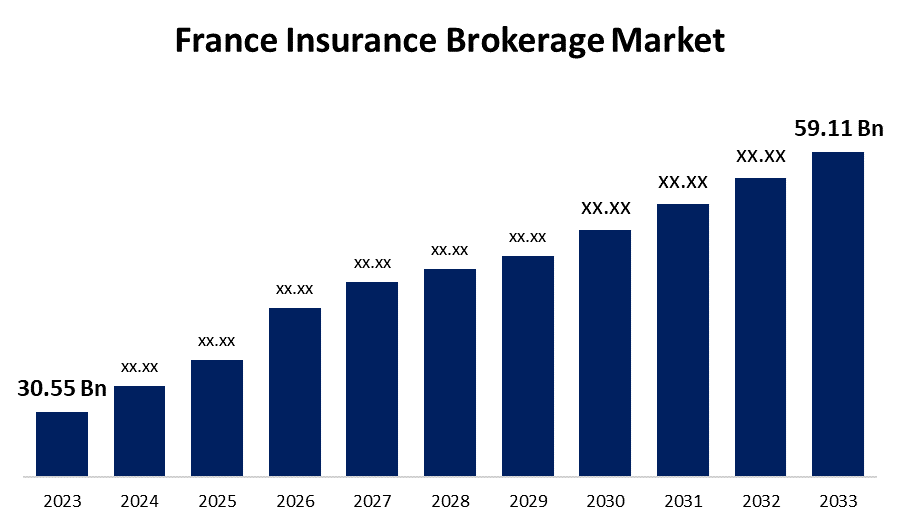

- The France Insurance Brokerage Market Size was valued at USD 30.55 Billion in 2023.

- The Market is Growing at a CAGR of 6.82% from 2023 to 2033

- The France Insurance Brokerage Market Size is Expected to Reach USD 59.11 Billion by 2033

Get more details on this report -

The France Insurance Brokerage Market is Anticipated to Reach USD 59.11 Billion by 2033, growing at a CAGR of 6.82% from 2023 to 2033

Market Overview

The medium through which individuals, companies, or organizations looking for insurance coverage are connected to insurance providers is known as insurance brokerage. As an independent agent who works for clients' interests rather than those of a particular insurance company, an insurance broker is a qualified individual. Finding clients affordable insurance plans that fit their needs is their main objective. In the upcoming years, the French insurance brokerage market is growing moderately due to the rising demand for insurance products across a range of industries, including real estate, healthcare, and automobiles.

Report Coverage

This research report categorizes the market for the France insurance brokerage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France insurance brokerage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France insurance brokerage market.

France Insurance Brokerage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 30.55 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.82% |

| 2033 Value Projection: | USD 59.11 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mode, By Commission |

| Companies covered:: | Marsh & McLennan Companies, Aon plc, Willis Towers Watson, Howden Group Holdings, BMS Group Limited, Arthur J. Gallagher & Co., Lockton Companies, Inc., JLT Group, and Others |

| Growth Drivers: | 6.82% |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Market participants' growing adoption of innovations and digitalization is predicted to fuel the expansion of the French insurance brokerage business. Insurance brokers are adopting cutting-edge technologies like blockchain, artificial intelligence (AI), and data analytics in response to the growth of Insurtech, to offer their customers individualized and effective services. In turn, improving customer satisfaction and cutting expenses is expected to accelerate the expansion of the insurance brokerage business in France. It is also anticipated that the French insurance brokerage market will expand due to the rising demand for insurance products and services brought on by people's growing awareness of risks and need for financial security.

Restraining Factors

Insurance brokers now have more administrative and compliance costs due to strict laws about cybersecurity, and data protection hampers the market growth.

Market Segmentation

The France insurance brokerage market share is classified into mode and commission

- The online segment is expected to hold the largest market share through the forecast period.

The France insurance brokerage market is segmented by mode into online and offline. Among these, the online segment is expected to hold the largest market share through the forecast period. A change in consumer behavior has resulted from the increasing digitization of many industries, including the insurance sector. Customers can easily research, compare, and buy insurance policies at their own pace and from the comfort of their homes with the help of online insurance brokerages.

- The policy basis segment is expected to dominate the France insurance brokerage market during the forecast period.

Based on the commission, the France insurance brokerage market is divided into policy basis, premium basis, and fixed. Among these, the policy basis segment is expected to dominate the France insurance brokerage market during the forecast period. The most prevalent kind of commission structure in France is the policy basis. A portion of the customer's premium is given to brokers for each policy they sell.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France insurance brokerage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Marsh & McLennan Companies

- Aon plc

- Willis Towers Watson

- Howden Group Holdings

- BMS Group Limited

- Arthur J. Gallagher & Co.

- Lockton Companies, Inc.

- JLT Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2021, to increase openness and safeguard consumers, the French government recently enacted new regulations for insurance brokers. Insurance brokers must now better inform customers about their insurance options and be more open about their fees and commissions under the new regulations.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France insurance brokerage market based on the below-mentioned segments:

France Insurance Brokerage Market, By Product Mode

- Online

- Offline

France Insurance Brokerage Market, By Commission

- Policy basis

- Premium basis

- Fixed

Need help to buy this report?