France Life & Non-Life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life and Non-Life), By Distribution Channel (Direct, Agency, Banks, and Others), and France Life & Non-Life Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialFrance Life & Non-Life Insurance Market Insights Forecasts to 2033

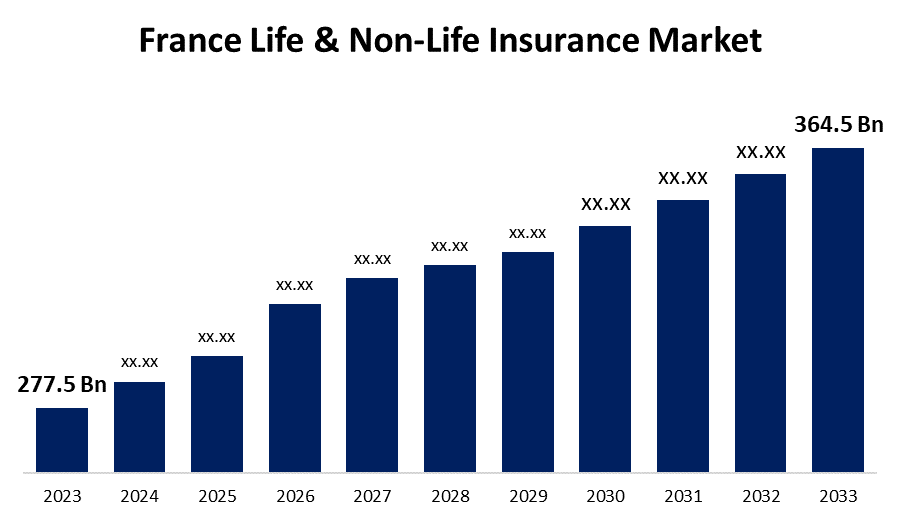

- The France Life & Non-Life Insurance Market Size was valued at USD 277.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.76% from 2023 to 2033

- The France Life & Non-Life Insurance Market Size is expected to reach USD 364.5 Billion by 2033

Get more details on this report -

The France Life & Non-Life Insurance Market is anticipated to exceed USD 364.5 Billion by 2033, growing at a CAGR of 2.76% from 2023 to 2033. The growing integration of innovative insurance products, increasing awareness about financial security, and the proliferation of insurtech industry are driving the growth of the life & non-life insurance market in the France.

Market Overview

Life & non-life insurance is a contract or agreement between a company and someone who buys the insurance. Non-life insurance, also known as general insurance, is all about protecting the things individuals own, and covers property, businesses, and people. In France, life insurance is a risk-free and appealing savings option. It provides a wide range of adaptable possibilities. It also offers its holders certain financial benefits. In 2021, about half of French individuals who had life insurance continued to view it as a highly desirable financial choice. The rising awareness about the importance of financial security and the role of insurance as well as about the risks associated with life events, health issues, property damage, and other unforeseen circumstances among the people tend to invest in insurance policies. The demand for life & non-life insurance is being driven by the insurtech industry’s rapid growth. Insurtech companies leverage technology to expedite processes, improve customer experiences, and provide cutting-edge insurance solutions. Further, strategic partnerships on the emphasize tackling long-standing industry obstacles and heralding an era of revolutionary innovation, fostering market competitiveness, stimulating product diversification and ultimately increasing the overall insurance market by improving accessibility and customizing services to evolving client needs.

Report Coverage

This research report categorizes the market for the France life & non-life insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Life & Non-Life Insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the life & non-life insurance market.

France Life & Non-Life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 277.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.76% |

| 2033 Value Projection: | USD 364.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Credit Agricole, Societe Generale, Covea, La banque postale, Allianz, Axa, MAIF, MACIF, ACM, Credit mutuel, Groupama, Caisse D’Epargne, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing integration of innovative insurance products helps in providing personalized offerings to customers driving the market growth. Further, the increasing awareness about financial security and the role of insurance among the people is contributing to market demand. The growing inclination towards investment in insurance policies owing to the awareness about the risks associated with health issues, life events, and property damage leads to propel the market. In addition, the proliferation of insurtech industry is significantly contributing to driving the France life & non-life insurance market.

Restraining Factors

Stringent regulations and compliance requirements pose a market challenge. Further, fraudulent activities are contributing to restraining market growth.

Market Segmentation

The France Life & Non-Life Insurance Market share is classified into type and distribution channel.

- The non-life segment dominates the market with the largest market share in 2023.

The France life & non-life insurance market is segmented by insurance type into life and non-life. Among these, the non-life segment dominates the market with the largest market share in 2023. Non-life insurance protects property, businesses and individuals and, provides coverage for damages on indemnity basis. French insurance companies are adopting new technologies and the incorporation of innovations like real-time tracking, accident prevention technologies and personalized coverage options are likely to drive the market in the non-life insurance segment.

- The agency segment accounted for the largest share of the France life & non-life insurance market in 2023.

Based on the distribution channel, the France life & non-life insurance market is divided into direct, agency, banks, and others. Among these, the agency segment accounted for the largest share of the France life & non-life insurance market in 2023. Agents build awareness and confidence among the clients about the consumer options and benefits, leading to higher customer satisfaction and retention rates. Thus benefits including tailored guidance with the assurance of a trustworthy relationship are driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France life & non-life insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Credit Agricole

- Societe Generale

- Covea

- La banque postale

- Allianz

- Axa

- MAIF

- MACIF

- ACM

- Credit mutuel

- Groupama

- Caisse D'Epargne

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Berkshire Hathaway Specialty Insurance (BHSI) today announced that it has introduced a proprietary Directors & Ocers Insurance policy in France. The new D&O coverage enhances BHSI's ability to provide multinational programs and services to companies with exposure in France and throughout the company's global network, which spans 170 countries.

- In December 2021, Allianz Partners and Uber are partnered to provide benefits and protection to insurance for independent drivers and couriers in Europe. Allianz Partners would provide Uber’s Partner Protection program, covering independent drivers and couriers that use the Uber and Uber Eats apps across 23 European countries. The coverage includes on-trip benefits in cases of accidents, injury or hospitalisations, as well as off-trip benefits such as sick pay and maternity/paternity payments.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Life & Non-Life Insurance Market based on the below-mentioned segments:

France Life & Non-Life Insurance Market, By Type

- Life

- Non-Life

France Life & Non-Life Insurance Market, By Distribution Channel

- Direct

- Agency

- Banks

- Others

Need help to buy this report?