France Manufactured Homes Market Size, Share, and COVID-19 Impact Analysis, By Type (Single Section Homes and Multi- Section Homes), By End Use (Residential End Use and Commercial End Use), and France Manufactured Homes Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingFrance Manufactured Homes Market Insights Forecasts to 2033

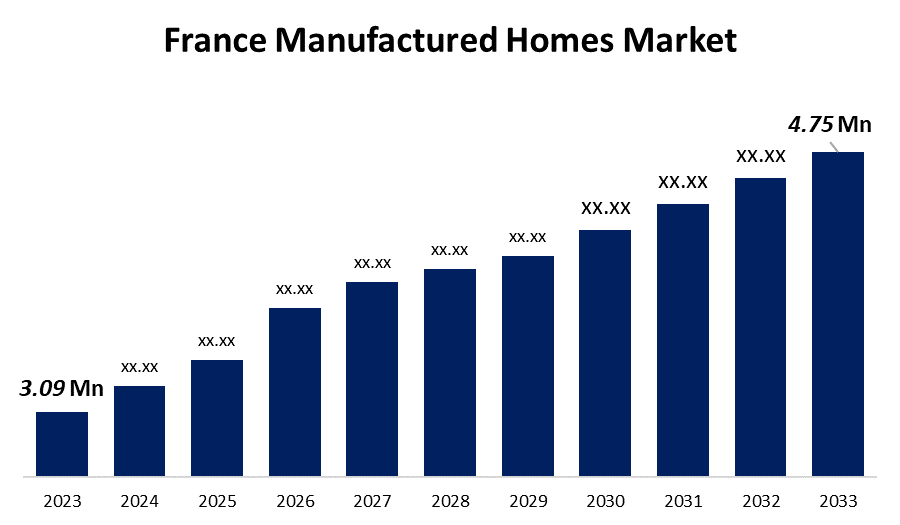

- The France Manufactured Homes Market Size was valued at USD 3.09 Million in 2023.

- The Market is growing at a CAGR of 4.39% from 2023 to 2033

- The France Manufactured Homes Market Size is expected to reach USD 4.75 Million by 2033

Get more details on this report -

The France Manufactured Homes Market is anticipated to exceed USD 4.75 Million by 2033, growing at a CAGR of 4.39% from 2023 to 2033.

Market Overview

Manufactured homes, sometimes referred to as assembled homes, are assembled entirely in a factory and delivered by truck to the construction site. Manufactured homes are constructed utilizing pre-assembled building modules on a steel framework, which facilitates its transportation, lifting, and placement at the appropriate location. These dwellings come in a variety of sizes, from compact single-section units with only one room to spacious, opulent multi-section residences with living rooms, kitchens, bedrooms, and patios. The demand for the manufactured housing market is expected to rise over the forecast period due to rising preferences for prefabricated homes over traditional homes due to their lower construction costs per square foot and the growing need for affordable housing. A large percentage of the population cannot afford the time and money required to build a house. A ground-breaking global answer to the issue of affordable, high-quality housing is manufactured housing. When comparing prefabricated housing units to traditional site-built homes, the cost of building per square foot is significantly lower. These homes also deploy quickly and can be moved to a different location if necessary. Because of its benefits, including lower overall construction costs and significant time savings, prefabricated housing is becoming more and more common in non-residential development projects including hotels, malls, retail centers, schools, and office buildings.

Report Coverage

This research report categorizes the market for the France manufactured homes market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the manufactured homes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the manufactured homes market.

France Manufactured Homes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.09 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.39% |

| 2033 Value Projection: | USD 4.75 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By End Use, and COVID-19 Impact Analysis |

| Companies covered:: | Baluchon, Clayton, Siblu, Bimify, IRM, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of manufactured homes is growing in France, mostly due to the country's growing population, fast urbanization, and rising housing demand. In addition, the nation's rising building costs as a result of the country's growing shortage of building supplies contributed to the trend of consumers moving toward mobile homes. Additionally, a 2022 social outreach organization was providing mobile small dwellings. AMISEP educated homeless individuals to build tiny homes as part of the development process, and these homes are becoming more and more popular in locations where there is a strong need for small-scale housing. Consequently, the French manufactured home industry will be driven by the increasing demand for tiny dwellings.

Restraining Factors

The primary raw material for construction, steel, fluctuates in price, which has an impact on suppliers' profitability and is predicted to impede the expansion of the manufactured homes market over the projection period. Increasing mortgage interest rates makes purchasing a home an expensive endeavor. It is anticipated that this can also limit market expansion.

Market Segmentation

The France manufactured homes market share is classified into type and end-use.

- The multi-section homes segment is expected to hold the largest market share through the forecast period.

The France manufactured homes market is segmented by type into single-section homes and multi-section homes. Among them, the multi-section homes segment is expected to hold the largest market share through the forecast period. The size of the economy has an impact on manufactured homes, and larger multi-section homes are more affordable for manufacturers to build than single-section homes. During the projected period, this market segment will be driven mostly by the younger generation's growing preference for larger homes in the suburbs.

- The residential end use segment dominates the market with the largest market share over the predicted period.

The France manufactured homes market is segmented by end use into residential end use and commercial end use. Among them, the residential end use segment dominates the market with the largest market share over the predicted period. As a result of growing public awareness of the need to reduce waste and growing demand for faster, more efficient housing development. The need for affordable and high-quality housing has increased due to population growth and rapid urbanization, which is driving the manufactured housing market's predicted strong growth shortly. Residential construction activities have increased as a result of increased investments made in the housing industry by governments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France manufactured homes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baluchon

- Clayton

- Siblu

- Bimify

- IRM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, At the RV/MH Hall of Fame, Clayton, a maker of modular homes, unveiled its CrossMod home. Amid the expanding affordable housing problem, the house offers a contemporary form of accommodation for single people and families. These buildings are also a component of the recently constructed 21,000-square-foot Manufactured Home Museum extension.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Manufactured Homes Market based on the below-mentioned segments:

France Manufactured Homes Market, By Type

- Single Section Homes

- Multi- Section Homes

France Manufactured Homes Market, By End-Use

- Residential End Use

- Commercial End Use

Need help to buy this report?