France Motor Insurance Market Size, Share, and COVID-19 Impact Analysis, By Policy Type (Third-party Liability Insurance, Comprehensive Coverage, and Collision Coverage), By Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Distribution Channel (Insurance Agents/Brokers, Direct Response, and Banks), and France Motor Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialFrance Motor Insurance Market Insights Forecasts to 2033

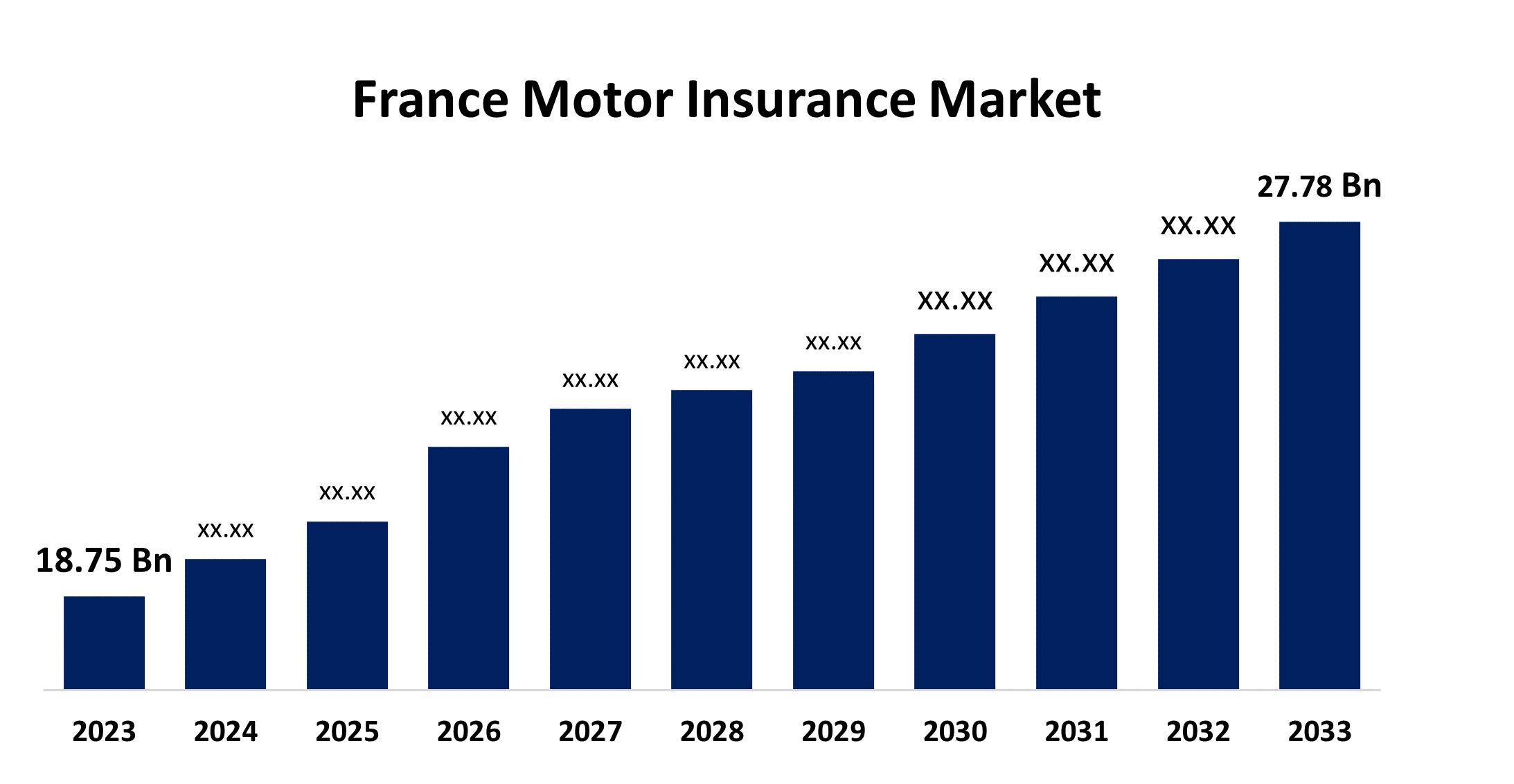

- The France Motor Insurance Market Size was valued at USD 18.75 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.01% from 2023 to 2033

- The France Motor Insurance Market Size is Expected to Reach USD 27.78 Billion by 2033

Get more details on this report -

The France Motor Insurance Market Size is Anticipated to Exceed USD 27.78 Billion by 2033, growing at a CAGR of 4.01% from 2023 to 2033. The French motor insurance market is one of the most popular, as individuals want to be safe and have a protective shield in the event of a collision or other mishap.

Market Overview

A specific type of insurance designed to provide financial security for vehicles such as cars, trucks, motors, and other road-going vehicles is called motor insurance, sometimes referred to as car insurance or auto insurance. Its primary goal is to offer protection against physical harm or injury sustained in an accident. It also covers responsibility in cases where an automobile is involved. Theft and damage from non-collision occurrences including weather, vandalism, natural disasters, or collisions with stationary objects may be covered by auto insurance. Legal requirements that differ by location dictate the precise terms and circumstances of motor insurance. Owners of cars, motorcycles, commercial trucks, and other road vehicles can be protected by motor insurance against monetary losses resulting from collisions or physical damage. It also offers defense against legal obligations originating from an incident that kills, seriously injures or damages another person's property. In order to give better coverage and support throughout the claims process, insurance firms now provide a variety of plans and add-ons, such as cashless claims, depreciation cover, 24/7 road assistance, and towing facilities.

Report Coverage

This research report categorizes the market for the France motor insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France motor insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France motor insurance market.

France Motor Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 18.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.01% |

| 2033 Value Projection: | USD 27.78 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Policy Type, By Vehicle Type, By Distribution Channel |

| Companies covered:: | Predica-Prevoyance Dialogue Du Credit Agricole, Generali Group, Maaf Vie, Macif, Gmf Assurances, Inter Mutuelles Assistance Gie, Adrea Mutuelle, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France motor insurance market is driven by a growing emphasis on vehicle safety, legal mandates, and an increase in the number of vehicles on the road. Telematics and usage-based insurance are examples of technological breakthroughs that have an impact on market dynamics. Furthermore, increased knowledge of the financial protection provided by car insurance, along with the necessity for comprehensive coverage, helps to drive market growth. Competitive pricing strategies, insurance digitization, and creative product offerings are all accelerating the industry. The changing environment of mobility and customer tastes are affecting the demand for vehicle insurance products in France, resulting in a dynamic and competitive market. Additionally, the growing usage of heavy-duty vehicles for bulk cargo transportation and commercial vehicles for intercity passenger tours and travel is improving the market's outlook. In addition, insurance companies provide hassle-free, totally digital platforms for insurance comparison, purchase, and renewal online.

Restraining Factors

France's motor insurance market faces a severe task as consumer tastes shift swiftly. Traditional insurance arrangements must evolve to meet the desire for personalized, technology-driven solutions.Escalating geopolitical tensions, particularly the Russia-Ukraine war, have had a substantial impact on the French motor insurance market. Increased uncertainties and geopolitical dangers have resulted in higher insurance premiums and a rise in claims, influencing market dynamics. The war has affected supply lines, damaged automobile production, and resulted in higher insurance premiums. Geopolitical instability has exacerbated economic uncertainty, altering consumer behavior and insurance purchase patterns.

Market Segmentation

The France motor insurance market share is classified into policy type, vehicle type, and distribution channel.

- The comprehensive coverage segment is expected to hold the largest market share through the forecast period.

The France motor insurance market is segmented by policy type into third-party liability insurance, comprehensive coverage, and collision coverage. Among these, the comprehensive coverage segment is expected to hold the largest market share through the forecast period. In addition to providing coverage for third-party liability, comprehensive insurance also shields policyholders from a wider range of risks, including theft, vandalism, and natural disasters.

- The passenger vehicles segment is expected to hold a significant market share through the forecast period.

The France motor insurance market is segmented by vehicle type into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment is expected to hold a significant market share through the forecast period. The dominance highlights the significance of meeting the various demands of individual vehicle owners in the French motor insurance market and is a sign of the significant presence and demand for insurance services within the passenger car category.

- The insurance agents/brokers segment is expected to dominate the France motor insurance market during the forecast period.

Based on the distribution channel, the France motor insurance market is divided into insurance agents/brokers, direct response, and banks. Among these, the insurance agents/brokers segment is expected to dominate the France motor insurance market during the forecast period. The segment drives demand for insurance by streamlining automobile insurance transactions and acting as brokers between insurers and clients. The insurance agents/brokers category contributes considerably to market dynamics by giving individualized advice, assessing individual needs, and offering a wide choice of insurance products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France motor insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Predica-Prevoyance Dialogue Du Credit Agricole

- Generali Group

- Maaf Vie

- Macif

- Gmf Assurances

- Inter Mutuelles Assistance Gie

- Adrea Mutuelle

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, the French MACIF Group declared its intention to purchase the windshield repair business Mondial Pare-Brise. With a network of 806 sites, Mondial Pare-Brise is the third-biggest participant in the French market. The first insurance company in France to purchase a network for auto glass replacement and repair is Macif.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Motor Insurance Market based on the below-mentioned segments:

France Motor Insurance Market, By Policy Type

- Third-party Liability Insurance

- Comprehensive Coverage

- Collision Coverage

France Motor Insurance Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

France Motor Insurance Market, By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

Need help to buy this report?