France Plant-based Meat Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Wheat, Blends, and Pea), By Product (Burger Patties, Strips & Nuggets, Sausages, and Meatballs), and France Plant-based Meat Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesFrance Plant-based Meat Market Insights Forecasts to 2033

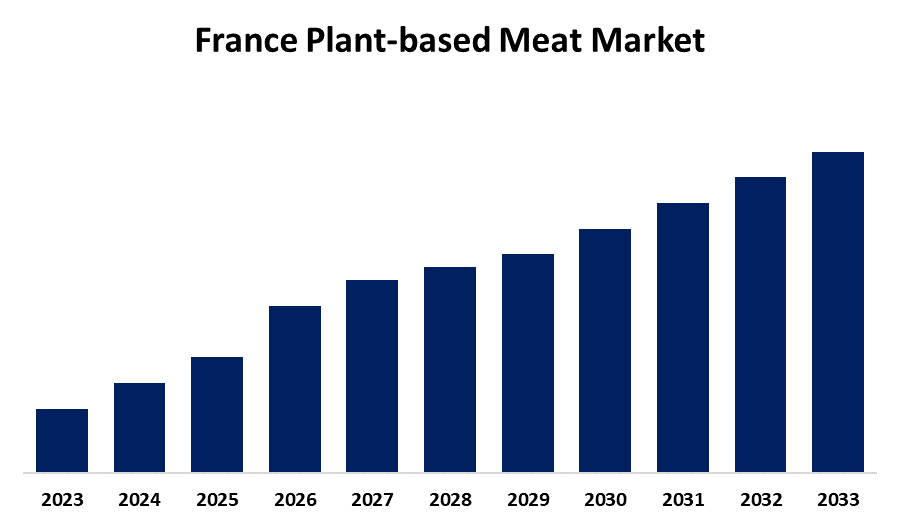

- The Market is Growing at a CAGR of 9.02% from 2023 to 2033

- The France Plant-based Meat Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The France Plant-based Meat Market Size is Expected to Hold a Significant Share by 2033, growing at a CAGR of 9.02% from 2023 to 2033.

Market Overview

Plant-based meat, sometimes known as imitation meat, fake meat, or plant-based meat in a derogatory sense, is a type of food product that is consumed in place of meat and is manufactured from vegetarian or vegan components. Meat substitutes usually mimic the texture, flavor, look, and chemical properties of particular meat varieties. While soy is commonly used to make plant- and fungus-based alternatives (such as tofu, tempeh, and textured vegetable protein), they can also be manufactured with wheat gluten, like seitan, pea protein, like the Beyond Burger, or mycoprotein, like Quorn. The use of plant-based meats has increased due to factors like health consciousness, animal welfare concerns, and environmental awareness. Prominent corporations such as Beyond Meat and Impossible Foods have significantly influenced the development of this sector. In mid-2022, France became the first nation in the European Union to outlaw the use of traditional meat labels for plant proteins. However, an administrative court invalidated the policy because it was too ambiguous and did not give businesses enough time to adjust. The government restricted the amount of plant material in products that use specific other phrases, such as bacon and chorizo, and prohibited the use of 21 meat names to designate protein-based products. The new decree was announced and will go into effect.

Report Coverage

This research report categorizes the market for the France plant-based meat market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France plant-based meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France plant-based meat market.

France Plant-based Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.02% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Source, By Product and COVID-19 Impact Analysis. |

| Companies covered:: | Danone S.A. JCB, Umiami, Archer Daniels Midland Company, DuPont de Nemours Inc., Ingredion Incorporated, Kerry Group PLC, Lantmännen., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nation's production of plant-based proteins will be boosted by the allocation of €100 million by the French government. Rather than environmental concerns, business factors are the main driving force behind this decision. The country's plant-based protein industry is seen as a promising area for innovation and economic progress, and this large investment aims to support it. It appears that just a small portion of French eating behavior involves avoiding meat. Men made up 1.5% of the vegetarian population in 2018, while women made up 2.8%. Approximately 40% of respondents to the poll followed a flexitarian diet, despite the omnivore diet being the most popular. Also, forty percent of French people supported the introduction of vegetarian meals in catering establishments such as restaurants and canteens.

Restraining Factors

One of the main barriers to the market for plant-based meat substitutes is cost. Since plant-based meat is more expensive than animal-based meat, price-sensitive markets like South Africa, China, and India are likely to see slower growth for plant-based meat. The rapidly expanding plant-based business is hampered by the high cost of plant-based meat substitutes, which is why companies supplying them are attempting to lower their pricing.

Market Segmentation

The France plant-based meat market share is classified into source and product.

- The wheat plant-based meat segment is expected to hold a significant market share through the forecast period.

The France plant-based meat market is segmented by source into soy, wheat, blends, and pea. Among these, the wheat plant-based meat segment is expected to hold a significant market share through the forecast period. Wheat is a cereal grain that is widely consumed worldwide and is rich in fiber, vitamins, minerals, and antioxidants. It is an ingredient in many plant-based meat products, including deli slices.

- The strips & nuggets segment is expected to dominate the France plant-based meat market during the projected period.

Based on the product, the France plant-based meat market is divided into burger patties, strips & nuggets, sausages, and meatballs. Among these, the strips & nuggets segment is expected to dominate the France plant-based meat market during the projected period. Due to their increasing consumer appeal and flavor, strips and nuggets are in more demand. As a result of their growing appeal, several businesses are concentrating on diversifying their product lines by adding strips and nuggets manufactured from chickpeas, wheat, soy, corn, rice, and oats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France plant-based meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danone S.A. JCB

- Umiami

- Archer Daniels Midland Company

- DuPont de Nemours Inc.

- Ingredion Incorporated

- Kerry Group PLC

- Lantmännen.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, a premium canola protein isolate called Vertis CanolaPRO was introduced by Royal DSM. As per the company's statement, this novel product enhances the protein composition of plant-based meals and drinks while staying devoid of common allergies. Vertis CanolaPRO works well with cereal and legume proteins in protein blending strategies to fill up the gaps in critical amino acids.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Plant-based Meat Market based on the below-mentioned segments:

France Plant-based Meat Market, By Source

- Soy

- Wheat

- Blends

- Pea

France Plant-based Meat Market, By Product

- Burger Patties

- Strips & Nuggets

- Sausages

- Meatballs

Need help to buy this report?