France Property and Casualty Insurance Market Size, Share, and COVID-19 Impact Analysis, By Policy Type (Car Insurance - Personal and Commercial, Condo Insurance, Homeowner Insurance, and Renters Insurance), By Distribution Channel (Direct, Banks, Agents, and Brokers), and France Property and Casualty Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialFrance Property and Casualty Insurance Market Insights Forecasts to 2033

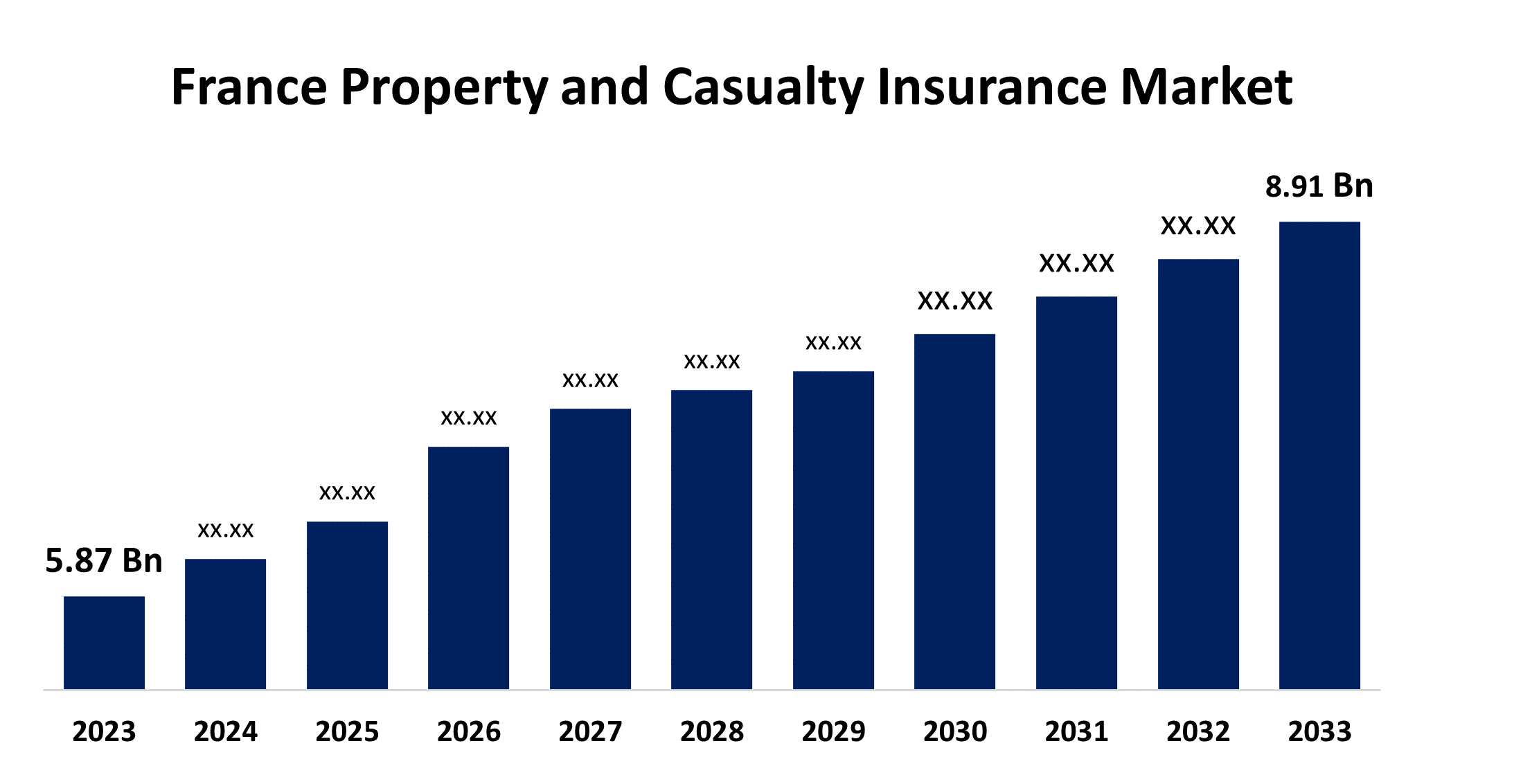

- The France Property and Casualty Insurance Market Size was valued at USD 5.87 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.26% from 2023 to 2033

- The France Property and Casualty Insurance Market Size is Expected to Reach USD 8.91 Billion by 2033

Get more details on this report -

The France Property and Casualty Insurance Market is Anticipated to Exceed USD 8.91 Billion by 2033, growing at a CAGR of 4.26% from 2023 to 2033. Rising per capita insurance premiums in France indicate a growing property and casualty insurance market.

Market Overview

The property insurance market includes insurance services that protect consumers and companies from financial losses caused by damage or loss of assets, such as homes, business structures, or personal items. Policyholders pay regular premiums to insurance companies, which in turn offer coverage for occurrences such as fire, theft, natural disasters, and other property-related hazards. Property insurance is critical for protecting assets and giving financial assistance to repair or replace property that has been damaged or lost as a result of insured situations. The France Property & Casualty Insurance Market is highly competitive and expanding nationwide, accounting for the majority of the Non-Life Insurance Segment. All property and casualty insurance businesses are required to modify their systems and procedures to generate and appropriately price new products and insurance packages. Property and casualty insurance businesses are creating innovative, appealing, customized coverage and performance or usage-based insurance solutions to address this. Additionally, vendors have to analyze enormous quantities of user data in order to provide competitive pricing to their end users. For improved competitiveness, French insurance companies are adopting new technologies for property and liability insurance, which have the potential to generate novel services for consumers.

Report Coverage

This research report categorizes the market for the France property and casualty insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France property and casualty insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France property and casualty insurance market.

France Property and Casualty Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 5.87 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.26% |

| 2033 Value Projection: | USD 8.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Policy Type, By Distribution Channel |

| Companies covered:: | Aviva PLC, Generali Group, MACIF, Axa, Allianz, Groupama, Covea Insurance, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The value of per-capita insurance premium expenditure in France has grown in recent years, reflecting the growth of France's Property and Casualty Insurance Market. Furthermore, some new technological breakthroughs and insurers' interest in obtaining secure protection against their professional and personal property or mishaps are increasing per capita insurance spending, hence strengthening the property and casualty protection market in France. Property & casualty insurance claims in France are mostly dispersed across three sectors: car insurance, multi-risk house insurance, and professional property insurance. Companies in France appear to be focusing on these three major industries independently to strengthen the property and casualty insurance industry. They are predicted to increase significantly over the projection timeframe. Insurance density and average premium prices are major factors influencing market penetration and competitiveness. Trends including Digital Issuance and Digital Channels are transforming relationships with clients and policy management.

Restraining Factors

The property and casualty insurance industry in France is extremely competitive, with many insurers competing for market share. This intense rivalry puts pressure on pricing and profitability, making it difficult for businesses to distinguish themselves. The property and casualty insurance market is prone to fraudulent claims, which can result in monetary losses for insurers. To limit this risk, insurance companies must invest in effective fraud detection systems and risk management procedures.

Market Segmentation

The France property and casualty insurance market share is classified into policy type and distribution channel.

- The homeowner insurance segment is expected to hold a significant market share through the forecast period.

The France property and casualty insurance market is segmented by policy type into car insurance - personal and commercial, condo insurance, homeowner insurance, and renters insurance. Among these, the homeowner insurance segment is expected to hold a significant market share through the forecast period. The capacity of homeowners insurance to safeguard homeowners from unforeseen dangers and potential financial losses is a crucial element driving the segment's growth. This kind of insurance usually pays for losses brought on by natural catastrophes, theft, vandalism, and fire to the covered property.

- The brokers segment is expected to hold a significant market share in the France property and casualty insurance market during the forecast period.

Based on the distribution channel, the France property and casualty insurance market is divided into direct, banks, agents, and brokers. Among these, the brokers segment is expected to hold a significant market share in the France property and casualty insurance market during the forecast period. The ability of brokers to function as a critical intermediary, facilitating the relationship between insurers and policyholders, is a significant element driving category growth. Brokers play an important role in offering customized counsel and experience, guiding individuals through the complicated landscape of insurance options to obtain coverage that meets their specific needs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France property and casualty insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aviva PLC

- Generali Group

- MACIF

- Axa

- Allianz

- Groupama

- Covea Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, In the French auto insurance market, Pacifica, the P&C division of Crédit Agricole Assurances, partnered with Mobilize Financial Services. By the end of 2023, Pacifica will have joined Mobilize Financial Services as an auto insurance partner for policies purchased by clients who bought new or used vehicles.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Property and Casualty Insurance Market based on the below-mentioned segments:

France Property and Casualty Insurance Market, By Policy Type

- Car Insurance - Personal and Commercial

- Condo Insurance

- Homeowner Insurance

- Renters Insurance

France Property and Casualty Insurance Market, By Distribution Channel

- Direct

- Banks

- Agents

- Brokers

Need help to buy this report?