France Soft Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product (Carbonated and Non-Carbonated), By Sales Channel (Hypermarkets/Supermarkets, Specialty Stores, and Convenience Stores), and France Soft Drinks Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesFrance Soft Drinks Market Insights Forecasts to 2033

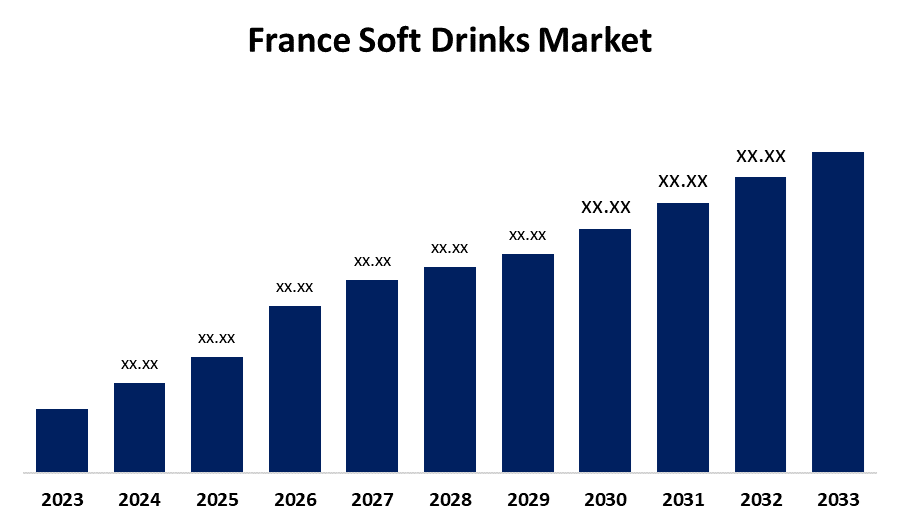

- The Market is Growing at a CAGR of 3.1% from 2023 to 2033

- The France Soft Drinks Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The France Soft Drinks Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 3.1% from 2023 to 2033.

Market Overview

Any flavored water beverage with added sweetness and usually some carbonation qualifies as a soft drink. Artificial or natural flavors can be utilized. Soft drinks are free of alcohol and are sweet, bubbly, and pleasant. They are formed of carbonated beverages and syrup (sugar and extracts from plants or fruits). Fruit juice, high-fructose corn syrup, sugar, sugar substitutes, or whatever combination of the above could be used as the sweeteners. In addition to other components, soft drinks can additionally contain artificial colors, preservatives, and caffeine. French customers are choosing non-alcoholic drinks due to their growing health consciousness. Soft drink consumption has increased generally as a result of this health-conscious mindset, but there is also a developing market for goods that are low in sugar or have extra vitamins and minerals.

Report Coverage

This research report categorizes the market for the France soft drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France soft drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France soft drinks market.

France Soft Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 3.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Coca-Cola European Partners (CCEP), PepsiCo France, Danone, Nestlé Waters France, Orangina Suntory France, Refresco France, Groupe Alma, and Otherrs Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Among the markets experiencing the highest growth in the global boom of alcohol-free drinks is France. There has been a shift in the country's large alcohol business with the influx of companies producing alcohol-free wines, beers, cocktails, and spirits. Additionally, France consumed 1.5 billion liters of fruit juice last year, or 23 liters per person annually, or one glass two to three times a week. Unlike in other nations, the French prefer "pure juice," which is fruit that has been pasteurized and squeezed. With 56% of sales, it is currently the most popular drink in France, increasing 10% in just five years. Juice that has been preserved in its home country and then rehydrated in France is called concentrated juice; bottles of pure juice cost roughly €2.40, or €1. The French soft drink market is driven by the trend of French consumers turning more and more towards soft drinks, as seen by the facts and statements presented.

Restraining Factors

Customers who are concerned about their health are looking for alternatives that have less sugar, like naturally sweetened, low-sugar, and sugar-free beverages. Soft drink producers face a problem as a result of this shift in customer behavior since they must adjust to changing tastes and provide healthier substitutes to keep market share.

Market Segmentation

The France soft drinks market share is classified into product and sales channel.

- The carbonated segment is expected to hold the largest market share through the forecast period.

The France soft drinks market is segmented by product into carbonated and non-carbonated. Among these, the carbonated segment is expected to hold the largest market share through the forecast period. Carbonated beverages' popularity in the marketplace has been further cemented by their association with a variety of events and eating habits. They are eaten during parties, as well as drinks and meals in social settings.

- The hypermarkets/supermarkets segment is expected to dominate the France soft drinks market during the forecast period.

Based on the sales channel, the France soft drinks market is divided into hypermarkets/supermarkets, specialty stores, and convenience stores. Among these, the hypermarkets/supermarkets segment is expected to dominate the France soft drinks market during the forecast period. Customers can choose from a variety of refreshments at these sizable retail establishments, such as fruit juices, carbonated sodas, filtered water, and other non-alcoholic drinks. A primary benefit of purchasing soft drinks at hypermarkets and supermarkets is the wide assortment of products available.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France soft drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coca-Cola European Partners (CCEP)

- PepsiCo France

- Danone

- Nestlé Waters France

- Orangina Suntory France

- Refresco France

- Groupe Alma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Refresco was a well-known European bottler of fruit juices and soft drinks. It operated four manufacturing facilities in France and planned to expand its packaging facility in Le Quesnoy, close to Valenciennes, by adding a new carton line. The overall investment varied based on the alternatives selected by the company, ranging from €2 million to €5 million.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the France Soft Drinks Market based on the below-mentioned segments:

France Soft Drinks Market, By Product

- Carbonated

- Non-Carbonated

France Soft Drinks Market, By Sales Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

Need help to buy this report?