France Used Car Market Size, Share, And COVID-19 Impact Analysis, By Vendor Type (Organized and Unorganized), By Fuel Type (Petrol, Diesel, Electric, Hybrid), By Sales Channel (Online and Offline), and France used car market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationFrance used car market Insights Forecasts to 2033

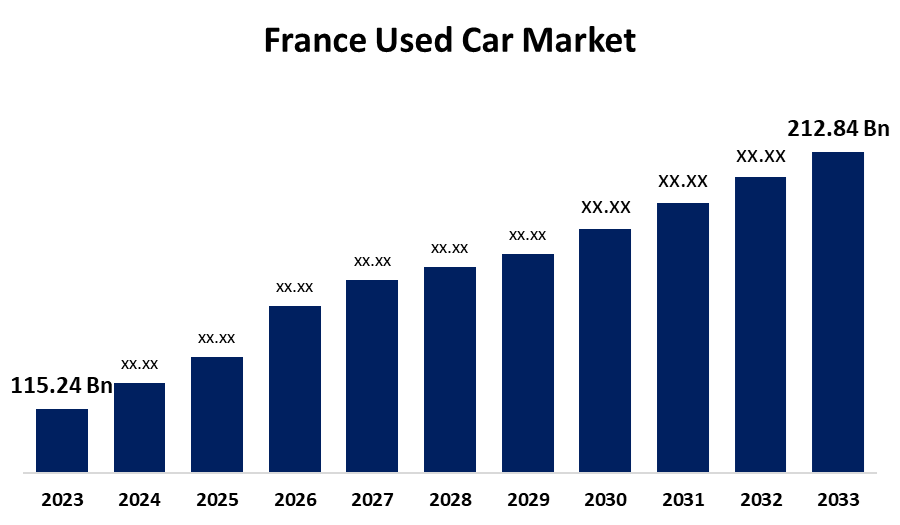

- The France Used Car Market size was Estimated at USD 115.24 Billion in 2023.

- The France Used Car Market size is Expected to Grow at a CAGR of around 6.33% from 2023 to 2033.

- The France Used Car Market size is Expected to Reach USD 212.84 Billion by 2033.

Get more details on this report -

The France Used Car Market size is predicted to grow from USD 115.24 Billion in 2023 to USD 212.84 Billion by 2033 at a CAGR of 6.33% during the forecast period.

Market Overview

The "used car market" refers to the marketplace where pre-owned vehicles are bought and sold. This market gives details about vehicle condition, mileage, brand reputation, and several economic conditions that are the forces influencing the trade. The primary reason consumers typically avoid spending too much expense instead that they prefer used cars according to their daily usage. Concurrently, the sellers are putting up their used vehicles as an upgrade or to dispose of their previous cars. Recently, the government introduced a scheme that can uplift the used car market expansion in the region. Here, according to a Service-Public.fr Le site officiel de l'administration française, a government program designed to encourage the purchase or rental of low-emission vehicles, including used cars. The scheme is coined as Bonus Écologique for the automotive sector with some eligible criteria.

Report Coverage

This research report categorizes the France used car market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France used car market.

France Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 115.24 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.33% |

| 2033 Value Projection: | USD 212.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Vendor Type, By Fuel Type And COVID-19 Impact Analysis |

| Companies covered:: | Hellman and Friedman LLC (AutoScout24), 2 Leboncoin, 3 Aramis Group, 5 La Centrale, BYmyCAR, ParuVendu, HeyCar, NP Paribas Fortis (Arval AutoSelect), Auto Beeb, Reezocar, Autosphere, Access Company Profile, and other Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The used cars market has been expanding significantly due to a variety of variables, such as shifting consumer preferences, technological advancements, and economic shifts. Consumer are also looking for cars that fit their new routines as such of the rise of remote work and lifestyle changes will increase the market expansion. In addition, to making the process more convenient, the growing number of online platforms for used car sales and purchases has given buyers more options. Moreover, the additional government efforts with their schemes and growing awareness regarding the health benefits of resource preservation and reducing waste passes along the spot via this shift in behaviour expand the market.

Restraints & Challenges

The France used car market growth is being restricted because of the high cost of maintenance and servicing. The affordability and accessibility of replacement parts, possible problems from prior ownership, and wear and tear on vehicle components are some of the factors that affect the expansion of the market.

Market Segmentation

The France used car market share is classified into vendor type, fuel type, and sales channel.

- The organized segment accounted for the largest share of the France used car market in 2023 and is expected to grow at a substantial CAGR during the forecast period.

Based on the vendor type, the France used car market is categorizedinto organized and unorganized. Among these, the organized segment accounted for the largest share of the France used car market in 2023 and is expected to grow at a substantial CAGR during the forecast period. This is due to the region development in the automotive infrastructure and to attract cautious buyers, organized players provide a more dependable purchasing experience by upholding higher standards for vehicle quality and customer service. Moreover, features like warranties, thorough vehicle history reports, and easily accessible financing options, boost segmental growth.

- The electric segment accounted for the largest share of the France used car market in 2023 and is projected to grow at a remarkable growth during the forecast period.

Based on the fuel type, the France used car market is segmented into petrol, diesel, electric, and hybrid. Among these, the electric segment accounted for the largest share of the France used car market in 2023 and is projected to grow at a remarkable growth during the forecast period. This segment is attributed to the market expansion because the primary reason for the beneficial impact on consumer demand is the higher expenditure investment for EV charging infrastructure throughout France. Also, the significant segment revenue generated in the market expansion due to the high rate of adopting electric cars by individual transit patterns, such as selecting more sustainable practices and welcoming novel modes of transportation.

- The online segment accounted for the largest share of the France used car market in 2023 and is projected to grow at a remarkable growth during the forecast period.

Based on the sale channel, the France used car market is categorized into online and offline. Among these, the online segment accounted for the largest share of the France used car market in 2023 and is projected to grow at a remarkable growth during the forecast period. This is due to the rise of e-commerce sites, the widespread use of advanced technology, and effective strategies employed by different businesses for their business expansion goal to assist the segment growth. Further, these platforms help customers make well-informed decisions by listing all of the vehicle's details, including make, model, mileage, engine capacity, and condition without digesting their precious time contribute to the segment's dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hellman and Friedman LLC (AutoScout24)

- 2 Leboncoin

- 3 Aramis Group

- 5 La Centrale

- BYmyCAR

- ParuVendu

- HeyCar

- NP Paribas Fortis (Arval AutoSelect)

- Auto Beeb

- Reezocar

- Autosphere

- Access Company Profile

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In December 2021, Cazoo officially launched in France. This online car retailer, known for making car buying as simple as ordering any other product online, aims to bring the same convenience and transparency to the French market. They offer a wide selection of high-quality, reconditioned cars that can be purchased entirely online and delivered directly to customers' doors.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France used car market based on the below-mentioned segments:

France Used Car Market, By Vendor Type

- Organized

- Unorganized

France Used Car Market, By Fuel Type

- Petrol

- Diesel

- Electric

- Hybrid

France Used Car Market, By Sale Channel

- Online

- Offline

Need help to buy this report?