Global Friction Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Metallic Materials, Sintered Materials, Organic Materials, Ceramic Materials, Others), By Application (Brake Pads, Brake Linings, Clutches, Others), End-user Industry (Automotive, Railway, Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Friction Materials Market Insights Forecasts to 2033

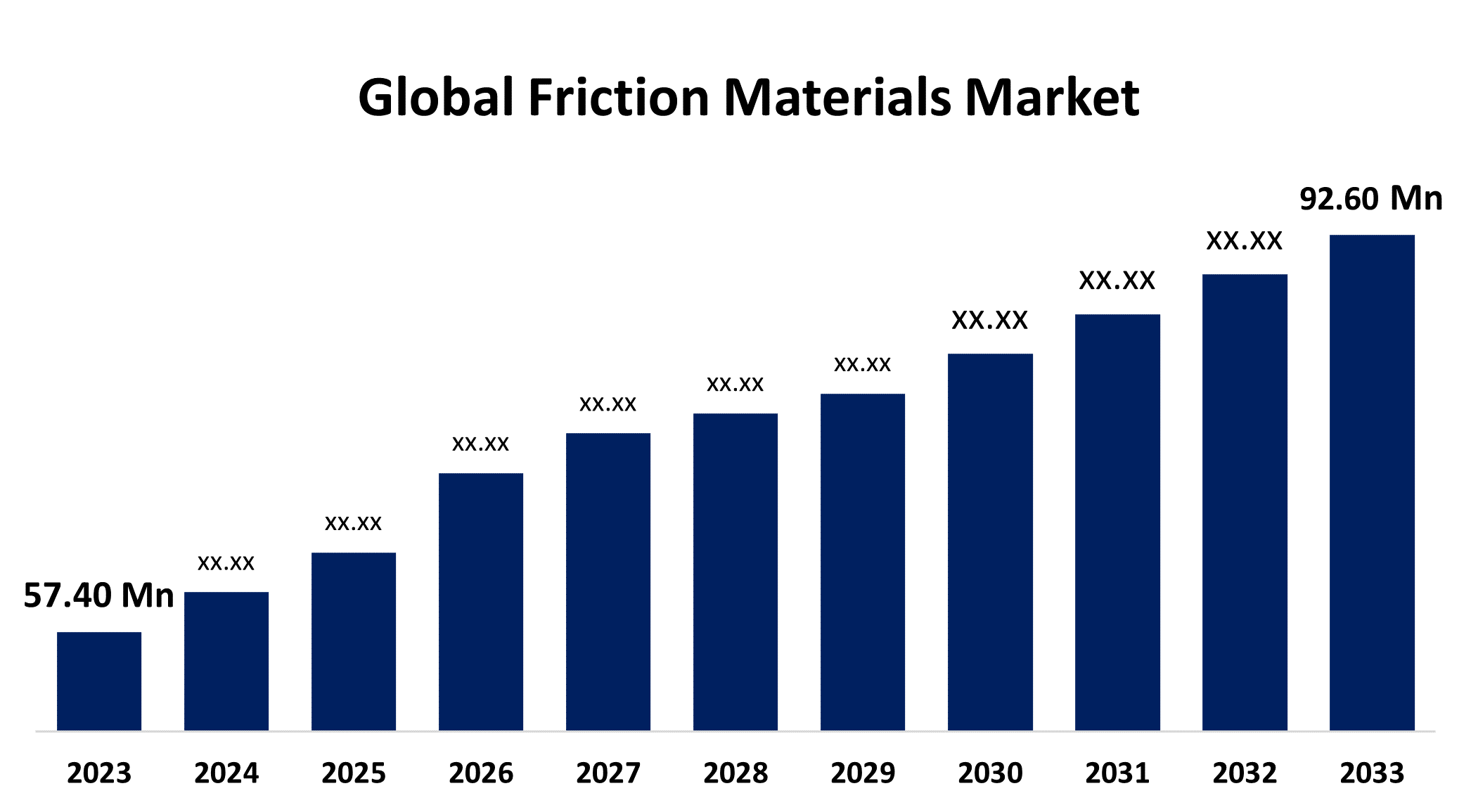

- The Global Friction Materials Market Size was Valued at USD 57.40 Million in 2023

- The Market Size is Growing at a CAGR of 4.90% from 2023 to 2033

- The Worldwide Friction Materials Market Size is Expected to Reach USD 92.60 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Friction Materials Market Size is Anticipated to Exceed USD 92.60 Million by 2033, Growing at a CAGR of 4.90% from 2023 to 2033.

Market Overview

Friction materials are substances that provide friction between two solid surfaces to control or prevent forward or backward motion. Friction materials are made from organic fibers such as rubber, resin, and aramid, sintered metals such as brass, steel, and copper, and ceramic. These materials are designed to generate resistance to motion, typically to control or limit movement, transmit forces, or convert kinetic energy into heat. Friction materials are commonly used in various applications such as brakes in vehicles, clutches, industrial machinery, and other mechanical systems where controlled frictional interaction is necessary for safe and efficient operation. The friction materials market is primarily driven by the expansion of the automotive and railway industries, as well as an increase in automobile sales around the world. The growth in migration to cities in emerging countries, as well as the ability of individuals to buy automobiles, are also promoting market progress. Furthermore, the increased adoption of electric vehicles with superior braking systems has propelled the friction materials market. Friction materials are also utilized to construct high-speed railway networks and metro train systems driving the market growth worldwide.

Report Coverage

This research report categorizes the market for friction materials market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the friction materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the friction materials market.

Global Friction Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 57.40 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.90% |

| 2033 Value Projection: | USD 92.60 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Akebono Brake Industry Co., Ltd., Nisshinbo Brake Inc., ASIMCO Technologies, EBC Brakes, Federal-Mogul Holdings, Valeo Friction Materials India, Yantai Hi-Pad Brake Technology, Robert Bosch GmbH5, Carlisle Brake & Friction, Aisin Corporation, Brake Parts Inc LLC, ZF Friedrichshafen AG, ACDelco, Brembo S.p.A., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The friction materials market is driven by several key factors that collectively influence its growth and dynamics. Primarily, the demand is significantly propelled by the automotive industry, where friction materials are crucial for brake systems and other components. Industrial machinery also plays a pivotal role, requiring durable friction materials for heavy-duty applications. Technological advancements such as new material formulations and eco-friendly solutions, drive market growth, alongside stringent regulatory standards and increasing emphasis on safety and efficiency. The aftermarket segment, driven by the need for replacement and maintenance, provides long-term demand. Emerging economies contribute to growth through industrialization and infrastructure development, while environmental concerns and globalization of automotive production shape product innovation and market strategies.Top of FormBottom of Form

Restraining Factors

The friction materials market faces several challenges that restrain its growth and development including environmental regulations, particularly concerning emissions and hazardous materials, which pose significant hurdles for traditional friction materials. Cost pressures and the threat of alternative technologies, such as regenerative braking systems and lightweight composites, also limit market expansion. Global economic uncertainty and slow adoption in emerging markets further complicate growth prospects. Additionally, maintaining high-performance standards and addressing health and safety concerns associated with friction materials are ongoing challenges.

Market Segmentation

The friction materials market share is classified into type, application, and end-user industry.

- The sintered materials segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the friction materials market is classified into metallic materials, sintered materials, organic materials, ceramic materials, and others. Among these, the sintered materials segment is estimated to hold the highest market revenue share through the projected period. Sintered materials are preferred for their ability to withstand high temperatures, provide consistent friction performance, and exhibit excellent durability under extreme conditions. These materials are extensively used in applications requiring high-performance braking systems, such as sports cars, racing vehicles, heavy-duty trucks, and industrial machinery. The growing demand for reliable and high-performance friction solutions across automotive and industrial sectors is expected to drive the sintered materials segment's growth worldwide.

- The brake pads segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the friction materials market is divided into brake pads, brake linings, clutches, and others. Among these, the brake pads segment is anticipated to hold the largest market share through the forecast period. Brake pads are crucial components in automotive braking systems, responsible for converting kinetic energy into heat through friction to slow or stop vehicles effectively. The steady demand for brake pads stems from ongoing vehicle production, replacement needs in the aftermarket, and increasing vehicle fleet sizes worldwide. Factors such as stringent safety regulations, technological advancements in braking systems, and consumer preferences for enhanced performance and durability further bolster the demand for brake pads.

- The automotive segment dominates the market with the largest market share through the forecast period.

Based on the end-user industry, the friction materials market is categorized into automotive, railway, and construction. Among these, the automotive segment dominates the market with the largest market share through the forecast period. This segment encompasses various applications within the automotive sector, including brake pads, brake linings, and clutch systems. The robust demand from the automotive industry is driven by factors such as increasing global vehicle production, rising consumer demand for passenger and commercial vehicles, and stringent regulatory standards for vehicle safety and emissions. Additionally, advancements in automotive technology, such as electric vehicles (EVs) and hybrid vehicles, continue to influence the adoption of specialized friction materials capable of meeting the performance requirements of EV vehicles driving the market growth worldwide.

Regional Segment Analysis of the Friction Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

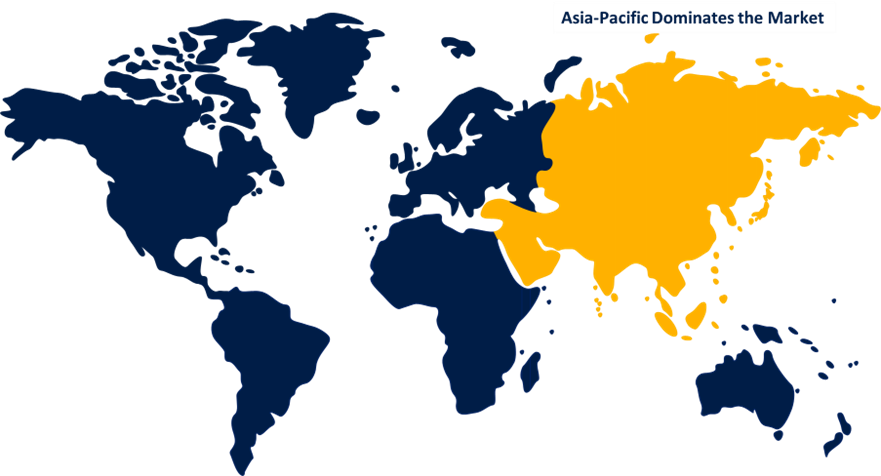

Asia Pacific is anticipated to hold the largest share of the friction materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the friction materials market over the predicted timeframe. The region benefits from having the world's largest automotive market, which is driven by fast urbanization, rising consumer spending power, and expanding vehicle production. This demand extends to friction materials used in brake systems, clutches, and other automotive applications. Additionally, Asia Pacific's industrial sector is experiencing significant growth, supported by infrastructure development projects across countries like China, India, and Southeast Asian nations. These projects require friction materials for construction machinery, railways, and other industrial applications. Technological advancements in friction material formulations and increasing regulatory standards further enhance market expansion in the region.

North America is expected to grow at the fastest CAGR growth of the friction materials market during the forecast period. The North American segment is attributed to several factors that emphasize the region's leadership in technological innovation, stringent regulatory standards, and robust industrial and infrastructure development. The automotive industry, in particular, benefits from advances in friction material technologies that aim to improve performance, safety, and environmental sustainability. Furthermore, a well-established aftermarket for automotive and industrial components provides the continual need for replacement friction materials, hence supporting market expansion. With a focus on innovation, regulatory compliance, and consumer-driven preferences for high-quality products, North America is expected to maintain its rapid growth expansion in the friction materials market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the friction materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akebono Brake Industry Co., Ltd.

- Nisshinbo Brake Inc.

- ASIMCO Technologies

- EBC Brakes

- Federal-Mogul Holdings

- Valeo Friction Materials India

- Yantai Hi-Pad Brake Technology

- Robert Bosch GmbH5

- Carlisle Brake & Friction

- Aisin Corporation

- Brake Parts Inc LLC

- ZF Friedrichshafen AG

- ACDelco

- Brembo S.p.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, American company Wabtec announced the introduction of new brake technology in Paris's rail system, according to the railway transport news page Railway Supply.

- In January 2024, HELLA PAGID, a global supplier of automotive braking systems, announced the launch of its latest product line HELLA PAGID Semi-Metallic Silver brake pads.

- In August 2023, Nisshinbo Holdings announced the sale of TMD Friction Group, a manufacturer of brake friction solutions, to AEQUITA SE & Co. KGaA., an industrial group subsidiary.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the friction materials market based on the below-mentioned segments:

Global Friction Materials Market, By Type

- Metallic Materials

- Sintered Materials

- Organic Materials

- Ceramic Materials

- Others

Global Friction Materials Market, By Application

- Brake Pads

- Brake Linings

- Clutches

- Others

Global Friction Materials Market, By End-user Industry

- Automotive

- Railway

- Construction

Global Friction Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the friction materials market over the forecast period?The friction materials market is projected to expand at a CAGR of 4.90% during the forecast period.

-

2.What is the market size of the friction materials market?The Global Friction Materials Market Size is Expected to Grow from USD 57.40 Million in 2023 to USD 92.60 Million by 2033, at a CAGR of 4.90% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the friction materials market?Asia Pacific is anticipated to hold the largest share of the friction materials market over the predicted timeframe.

Need help to buy this report?