Global Frozen Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cocktails, Smoothies, Slushies, Others), By Packaging (Single-Serve Packs and Multi-Serve Packs), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Frozen Drinks Market Insights Forecasts to 2033

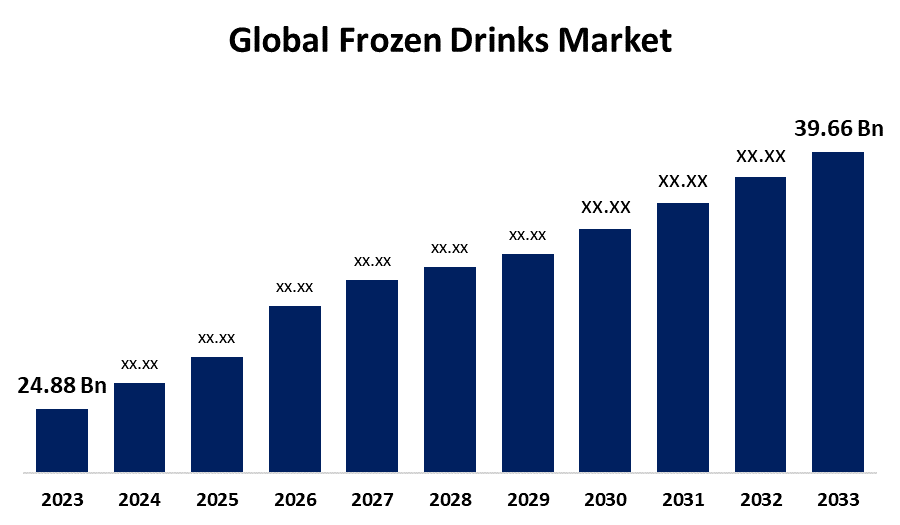

- The Global Frozen Drinks Market Size was estimated at USD 24.88 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.77% from 2023 to 2033

- The Worldwide Frozen Drinks Market Size is Expected to Reach USD 39.66 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Frozen Drinks Market size was worth around USD 24.88 Billion in 2023 and is predicted to grow to around USD 39.66 Billion by 2033 with a compound annual growth rate (CAGR) of 4.77% between 2023 and 2033. The frozen drinks market is fueled by increased consumer needs for convenient, refreshing cold drinks, particularly in warm climates. Market trends such as health-oriented decisions, low-calorie drinks, and new flavor innovations also play a part. Market demand also increases due to increased cafe popularity, fast food establishments, and food service locations.

Market Overview

The frozen drinks industry is part of the beverage sector that deals with the manufacturing and selling of beverages in a frozen or semi-frozen form. Frozen drinks are usually made by mixing or blending ingredients with ice to create a slushy texture. They may vary from non-alcoholic ones like fruit smoothies and slushies to alcoholic ones like margaritas and daiquiris. These beverages are generally consumed for their refreshing flavor and cooling sensation, which makes them favorite options during hot weather or in hot climatic regions. Moreover, constant innovation in taste, ingredients, and packaging technology keeps manufacturers at the forefront of consumer needs and market trends. By offering new and innovative flavors of frozen beverages, like new combination flavors or lower-calorie variations, firms can reach consumers who crave novelty and goodness. With increases in efficiency and functionality in frozen drink machines, businesses can meet growing demand and still deliver quality and consistency. The capacity to realign with altering consumer preferences and tastes through the development of the product, involving innovations in the frozen drink machines, is important for maintaining competitiveness and growth within the frozen drink market.

Report Coverage

This research report categorizes the frozen drinks market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the frozen drinks market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the frozen drinks market.

Global Frozen Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2033 |

| Market Size in 2033: | USD 24.88 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.77% |

| 023 – 2033 Value Projection: | USD 39.66 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product Type, By Packaging, By Distribution Channel |

| Companies covered:: | The Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Unilever PLC, Keurig Dr Pepper Inc., Red Bull GmbH, Monster Beverage Corporation, Jamba, Inc., Smoothie King Franchises, Inc., Tropicana Products, Inc., Arizona Beverages USA, F’real Foods, LLC, Barfresh Food Group, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Hot weather and seasonal fluctuations, especially during summer, boost the need for cold and refreshing frozen beverages, including slushies, iced coffees, and smoothies. Consumers are increasingly turning to healthier, low-calorie, and nutrient-dense frozen beverages, such as fruit smoothies and detox drinks, in sync with the surging health-oriented culture fueling the demand for the frozen drinks market. Further, ongoing innovation in tastes, ingredients (such as superfoods), and personalized alternatives appeals to a broad customer base and fuels market growth. Frozen beverages' presence in restaurants, fast food outlets, convenience stores, and ready-to-consume packaged foods makes them highly accessible and convenient for customers, spurring market growth.

Restraining Factors

Most frozen beverages, particularly slushies, milkshakes, and certain frozen cocktails, have very high levels of sugar and calories. With increased awareness among health-conscious consumers about the dangers of consuming too much sugar, they might shun these drinks, and market growth would be restricted. In addition, Frozen beverages, particularly those prepared with fresh fruit and perishable ingredients, will not have a long shelf life. This can create problems for retailers and manufacturers in storage, inventory, and product spoilage, lowering profit margins and impacting availability.

Market Segmentation

The frozen drinks market share is classified into product type, packaging, and distribution channel.

- The slushies segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the frozen drinks market is divided into cocktails, smoothies, slushies, and others. Among these, the slushies segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to slushies being one of the most affordable frozen drinks available, making them accessible to a wide range of consumers. Whether it's kids looking for a sweet treat or adults grabbing a quick refreshing drink, slushies cater to nearly every age group. Slushies are generally less expensive than other frozen beverages such as smoothies or frozen cocktails, thus making them an appealing option for price-conscious consumers.

- The single-serve packs segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the packaging, the frozen drinks market is divided into single-serve packs and multi-serve packs. Among these, the single-serve packs segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by single-serve packs that are convenient for on-the-go consumption, and suit the busy lives of most consumers. Whether it's an iced coffee, frozen smoothie, or slushie, single-serve versions enable individuals to easily grab a drink without having to prepare or share it.

- The supermarket/hypermarket segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the frozen drinks market is divided into online stores, supermarkets/hypermarkets, convenience stores, specialty stores, and others. Among these, the supermarket/hypermarket segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets providing a lot of frozen beverage choices, covering various consumer preferences. These choices range from flavor varieties, sizes of packaging (single-serve and multi-serve), and even healthier ones such as fruit-based smoothies or low-calorie frozen drinks.

Regional Segment Analysis of the Frozen Drinks Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

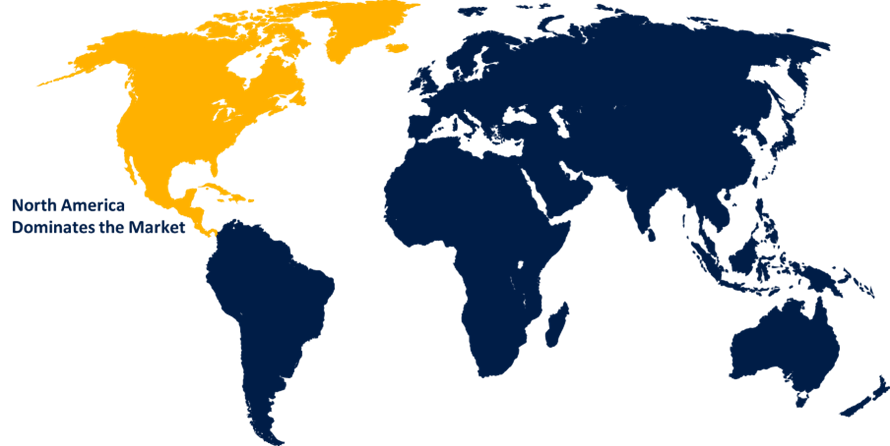

North America is anticipated to hold the largest share of the frozen drinks market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the frozen drinks market over the predicted timeframe. North America, especially the United States, has a rich history of frozen beverages being an integral part of mainstream beverage culture. Popular frozen beverages such as Slurpees, frozen cokes, and Starbucks frappuccinos are household names. These brands have existed for decades, fostering a deeply embedded demand for frozen drinks. Ongoing innovation in flavors, ingredients, and convenience keeps the market fresh and exciting, further increasing demand.

Asia Pacific is expected to grow at a rapid CAGR in the frozen drinks market during the forecast period. APAC possesses a huge youth population, particularly in India and China. The young generation is significantly influenced by global trends, social media, and Western culture, and thus demand for fashion-oriented frozen drinks such as bubble tea, smoothies, and frozen coffees has increased tremendously.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the frozen drinks market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Coca-Cola Company

- PepsiCo, Inc.

- Nestlé S.A.

- Unilever PLC

- Keurig Dr Pepper Inc.

- Red Bull GmbH

- Monster Beverage Corporation

- Jamba, Inc.

- Smoothie King Franchises, Inc.

- Tropicana Products, Inc.

- Arizona Beverages USA

- F'real Foods, LLC

- Barfresh Food Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Taco Bell launched Baja Dream Freezes. These frozen drinks are available in two flavors: Baja Blast and Strawberry Baja Blast, both blended with vanilla crème. They are a new menu item at Taco Bell, providing a cool, slushy drink with a creamy twist.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the frozen drinks market based on the below-mentioned segments:

Global Frozen Drinks Market, By Product Type

- Cocktails

- Smoothies

- Slushies

- Others

Global Frozen Drinks Market, By Packaging

- Single-Serve Packs

- Multi-Serve Packs

Global Frozen Drinks Market, By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

Global Frozen Drinks Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the frozen drinks market over the forecast period?The global frozen drinks market is projected to expand at a CAGR of 4.77% during the forecast period.

-

2. What is the market size of the frozen drinks market?The global frozen drinks market size is expected to grow from USD 24.88 Billion in 2023 to USD 39.66 Billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the frozen drinks market?North America is anticipated to hold the largest share of the frozen drinks market over the predicted timeframe.

Need help to buy this report?