Global Frozen Seafood Market Size, Share, Growth, and Industry Analysis, By Product Type (Fish, Crustaceans, Shellfish, Mollusks, and Others), By Distribution Channel (Store-based, and Non-Store-based), By End-User (Food Processing, Food Service, Others) and Regional Insights and Forecast to 2033

Industry: Food & BeveragesGlobal Frozen Seafood Market Insights Forecasts to 2033

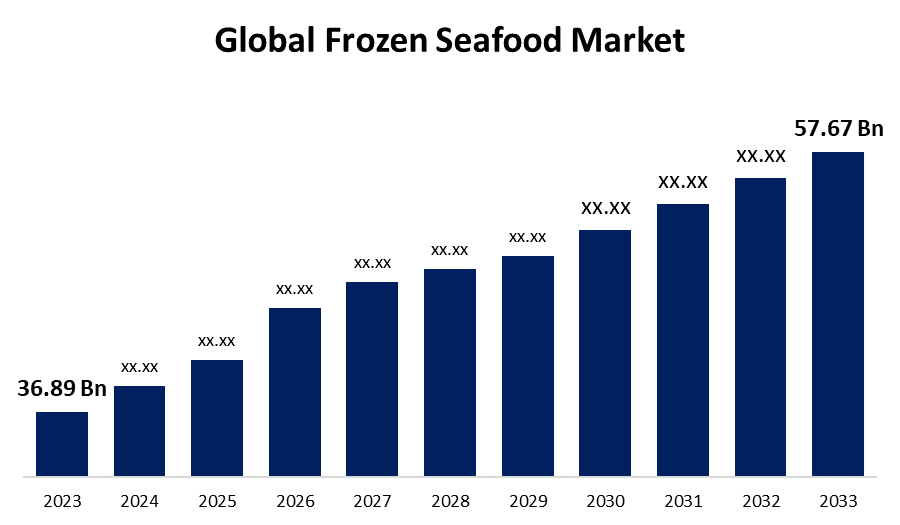

- The Global Frozen Seafood Market Size was Valued at USD 36.89 Billion in 2023

- The Market Size is Growing at a CAGR of 4.57% from 2023 to 2033

- The Worldwide Frozen Seafood Market Size is Expected to Reach USD 57.67 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Frozen Seafood Market Size is Anticipated to Exceed USD 57.67 Billion by 2033, Growing at a CAGR of 4.57% from 2023 to 2033.

A major factor driving the frozen seafood market share expansion has been the changing tastes and lifestyles of consumers. Frozen seafood presents a value proposition to consumers looking to make meal planning and grocery shopping more efficient. Its expansion is further fueled by the benefits of availability and accessibility.

FROZEN SEAFOOD MARKET REPORT OVERVIEW

Seafood products, such as fish, shellfish, and other aquatic delicacies, that are meticulously prepared, preserved, and kept at extremely low temperatures to retain their freshness and quality are referred to as frozen seafood. By lowering the seafood's temperature to much below freezing typically -18°C or lower the freezing technique successfully prevents the growth of microbes and prolongs the shelf life of the meal. This method makes sure the seafood keeps plenty of its flavor, texture, and nutrients. It keeps well in storage for a long time, making it easily accessible for a variety of culinary uses. Seafood can be frozen and transported over great distances without having to be consumed right once, which reduces food waste and offers a useful option for grocery shopping and meal planning.

Seafood that is frozen is ideal for meeting these needs because it provides a simple and quick supper option. With a longer shelf life that ensures freshness and reduces food waste, frozen seafood presents a value proposition in the market that appeals to customers looking for more efficiency in their grocery shopping and meal planning. The benefits of accessibility and availability also support its expansion, since frozen seafood is always available year-round, regardless of location, and is not restricted by time or space. The popularity of frozen fish items has significantly increased due to the rise in health consciousness. Seafood products' high protein content, omega-3 fatty acids, and vital nutrients correspond with the shifting dietary choices of health-conscious consumers. In Qingdao, Shandong Province, from October 30 to November 1, 2024, the China Fisheries and Seafood Expo (CFSE) will take place. CFSE is the world's largest seafood industry show and one of the most prominent events, showcasing a wide range of aquatic and marine items for processing and trading. China received seafood exports from the US worth close to $1.4 billion in 2023.

Report Coverage

This research report categorizes the market for the frozen seafood market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the frozen seafood market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the frozen seafood market.

Global Frozen Seafood Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 36.89 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.57% |

| 2033 Value Projection: | USD 57.67 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By End-User |

| Companies covered:: | Premium Seafood Company Inc., The Sirena Group, M&J Seafood Ltd, Beaver Street Fisheries, Mazetta Company LLC, High Liner Foods Inc, Mowi ASA, Forster Frozen Foods Pvt Ltd., IFC Frozen Seafoods, Castlerock Inc., Sterling Seafood Corp., Clifton Seafood Company, Marine Harvest ASA, Austevoll Seafood ASA, Charoen Pokphand Foods, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

“Increasing use of frozen seafood is lowering its impact on the environment”

Frozen seafood is preferred by consumers and it has a lessened carbon footprint than other seafood since it must travel quickly using less energy. Another advantage of frozen seafood is a reduction in processing waste. The market for frozen seafood is being enhanced by the growth of the sustainable food movement and rising consumer awareness of the food's environmental impact. Frozen seafood has several benefits, including a longer shelf life, lower cost compared to fresh fish, and higher nutritional value. One of the most effective ways to lock in and protect the quality and freshness of seafood is to flash-freeze it at sea. This method of freezing seafood is often referred to as flash-frozen seafood.

“The desire for quick-to-eat food items is rising, which is increasing sales of frozen seafood”

The focus of manufacturers on producing healthier food products is one of the reasons driving the worldwide frozen seafood market. The use of cryogenic technology during the freezing process helps to prevent the formation of bacteria in the frozen seafood items. Globally, a large number of producers of frozen fish use cryogenic freezing technology, which aids in sustaining low temperatures and applies liquid nitrogen or solid carbon dioxide directly to frozen seafood products. Seafood products can be kept frozen for a long time by using contemporary freezing techniques. As a result, strong expansion is anticipated in the worldwide frozen seafood market over the forecast period.

RESTRAINING FACTORS

“Excessive energy costs could impede market expansion”

Seafood storage and freezing involve a lot of energy use, which raises operating expenses. Especially for small and medium-sized businesses, this can be a significant hindrance.

Market Segmentation

The global frozen seafood market share is classified into product type, distribution channel, and end-user.

Which segment is expected to hold the largest share of the global frozen seafood market during the forecast period?

“The fish segment holds the largest share of the global frozen seafood market during the forecast period”

Based on product type, the global frozen seafood market is classified into fish, crustaceans, shellfish, mollusks, and others. The driving causes of the fish segment are the widespread consumption and the rising demand for chemical-free fish with longer shelf lives. The increasing popularity of fish aquaculture and large-scale fishing also contribute to the need. The fish segment's adoption is largely driven by the economic prosperity of emerging economies. These nations have seen tremendous economic growth, which has increased people's disposable income and encouraged them to choose ready-to-eat foods like frozen fish for quick and easy meals. The affordability and accessibility of frozen fish are major factors in its rising popularity in these developing nations.

Which channel is most dominant in the global frozen seafood market?

“The store-based category is expected to dominate the market over the forecast period”

Based on the distribution channel, the global frozen seafood market is classified into store-based, and non-store-based. Supermarkets, hypermarkets, and convenience stores are included in this category since they make frozen fish products easily accessible, which adds to their appeal. Emerging economies are crucial to store-based sales of frozen seafood items, just like fish markets are. The retail sector grows dramatically along with these economies' ongoing economic development. In these developing nations, supermarkets and hypermarkets provide consumers with easy access to frozen seafood, and the convenience of one-stop shopping increases demand for frozen seafood items.

Why food processing user is most popular among the customers?

“The food processing segment is projected to dominate the market throughout the forecast period”

Based on end-users, the global frozen seafood market is classified into food processing, food service, and others. Several factors influence the food processing industry's demand for frozen fish products. As is the case with fish and store-based segments, the food processing industry's adoption of frozen seafood products is significantly influenced by growing economies. Due to its convenience, longer shelf life, and ease of storage compared to fresh products, frozen seafood is in high demand due to its economic development, which has led to a significant increase in the activity of the food processing sector. These factors further increase the appeal of frozen seafood to food processing businesses. Preferences for frozen fish products in the food processing business are significantly influenced by consumer trends and behavior.

Regional Segment Analysis of the Global Frozen Seafood Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Which region is expected to hold the largest share of the frozen seafood market over the forecast period?

“Europe region is holding the highest share of the global frozen seafood market during the forecast period”

Get more details on this report -

Frozen seafood has become a more practical option due to the increase in demand for quick and simple meals. The growing health consciousness among consumers has raised awareness of the nutritional advantages of seafood. Furthermore, the growing consumer focus on sustainability and ethical sourcing in the fish business has created a need for certified frozen seafood products that follow eco-friendly standards. The quality, texture, and flavor of frozen seafood have all improved because of developments in freezing and packaging technologies, which have made it very appealing to consumers. Because frozen seafood has a longer shelf life than fresh seafood, it helps restaurants and other food outlets buy in quantity and minimizes food waste. Additionally, the proliferation of frozen seafood in physical stores and online marketplaces, along with the growth of online sales channels, has significantly increased consumer access to these products. As a result, sustained expansion is anticipated in the frozen seafood sector in Europe. Spain was the world's fourth-largest importer of fish and seafood in 2023. Its fish and seafood products are highly consumed and expensive per capita, and it boasts the largest fish processing sector in Europe.

Why North-America is growing at the fastest CAGR in the global frozen seafood market?

The US and Canada are the main drivers of the substantial frozen seafood sector in North America. Growing health consciousness and the need for quick meal options contribute to high consumption rates. North American consumers are demonstrating a clear preference for premium, organic, and sustainably derived products, which is in line with a larger movement towards better lives. The convenience of seafood, its purported health benefits, and the hectic nature of modern life are major motivators.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global frozen seafood market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Premium Seafood Company Inc.

- The Sirena Group

- M&J Seafood Ltd

- Beaver Street Fisheries

- Mazetta Company LLC

- High Liner Foods Inc

- Mowi ASA

- Forster Frozen Foods Pvt Ltd.

- IFC Frozen Seafoods

- Castlerock Inc.

- Sterling Seafood Corp.

- Clifton Seafood Company

- Marine Harvest ASA

- Austevoll Seafood ASA

- Charoen Pokphand Foods

- Others

Key Market Developments

- In March 2022, the largest fish processing firm in Spain, Grupo Profand, stated that it had acquired a controlling ownership in Kefalonia Fisheries SA, an aquaculture farm located in Lixouri, Greece. Kefalonia Fisheries SA is well-known for producing seabass and seabream. The change has increased the Profand's global reach.

- In February 2022, "Oscealliance," a seafood distribution company established in Saint-Herblain, France, announced the successful acquisition of two seafood trading and processing companies in the nation. The company's portfolio has been strengthened by the acquisition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global frozen seafood market based on the below-mentioned segments:

Global Frozen Seafood Market, By Product Type

- Fish

- Crustaceans

- Shellfish

- Mollusks

- Others

Global Frozen Seafood Market, By Distribution Channels

- Store-based

- Non-Store-based

Global Frozen Seafood Market, By End-User

- Food Processing

- Food Service

- Others

Global Frozen Seafood Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global frozen seafood market over the forecast period?The global frozen seafood market size is expected to grow from USD 36.89 billion in 2023 to USD 57.67 billion by 2033, at a CAGR of 4.57% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global frozen seafood market?Europe is projected to hold the largest share of the global frozen seafood market over the forecast period.

-

3.Who are the top key players in the frozen seafood market?Premium Seafood Company Inc, The Sirena Group, M&J Seafood Ltd, Beaver Street Fisheries, Mazetta Company LLC, High Liner Foods Inc, Mowi ASA, Forster Frozen Foods Pvt Ltd., IFC Frozen Seafoods, Castlerock Inc, Sterling Seafood Corp., Clifton Seafood Company, Marine Harvest ASA, Austevoll Seafood ASA, Charoen Pokphand Foods, and Others.

Need help to buy this report?