Global Fungal Keratitis Treatment Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Route of Administration (Oral, Injection, and Topical), By Distribution Channel (Hospitals, Drug Stores and Others), and By Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America) Market Size Statistics & Forecasting To 2030

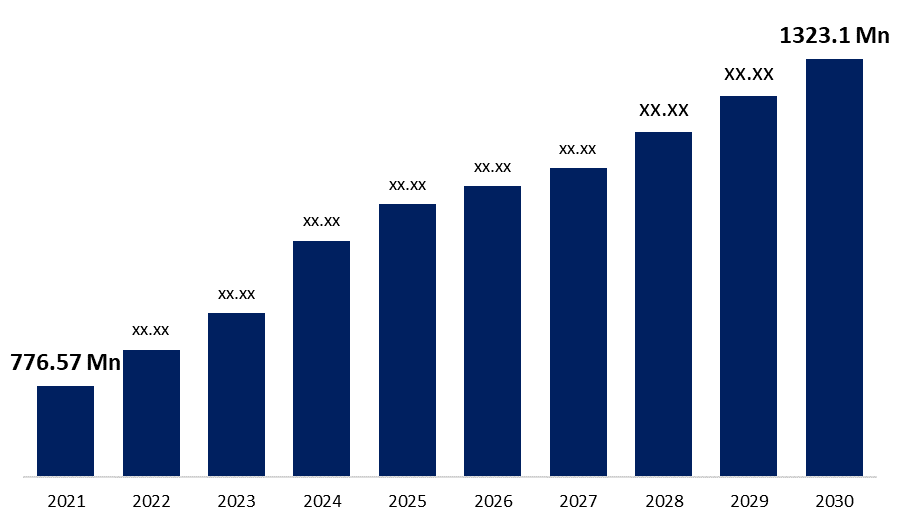

Industry: HealthcareGlobal Fungal Keratitis Treatment Market Size: From early market statistics of USD 776.57 Million in 2021, the global Fungal Keratitis Treatment Market is expected to rise to USD 1323.1 Million in 2030 with a CAGR of 6.1%.

Get more details on this report -

MARKET OVERVIEW

The increasing prevalence of fungal keratitis worldwide, growing public awareness of the potential risks it poses, and technological advances in its therapies are driving the market for fungal keratitis treatments. Fungal keratitis is thought to affect over one million people annually, with 8% to 11% of sufferers losing an eye. Aspergillus are the most frequent cause of fungal keratitis, which is a disease that is becoming more and more widespread. Risk factors for fungal keratitis include trauma, contact lens use, topical corticosteroid use, diabetes mellitus, and low socioeconomic level. Apart from this, the most common risk factor for fungal keratitis is unintentional ocular damage. An infection of the cornea, which is usually brought on by inadequate handling and cleaning of contact lenses or ocular damage, is the basis for the estimated prevalence rate of fungal keratitis. One of the key market drivers during the projection period is anticipated to be an increase in research efforts to create novel treatments and an increase in the sales of ophthalmic medications for fungal keratitis problems.

Global Fungal Keratitis Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 776.57 Million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.1% |

| 2030 Value Projection: | USD 1323.1 Million |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | Data By Administration Method and Channel of Distribution, Regional Analysis, and Projection Through 2030 |

| Companies covered:: | Alvogen, Bausch Health Companies Inc., Gilead Biosciences Inc., Glenmark Pharmaceuticals, Leadiant Biosciences, Merck & Co. Inc., Aurolab, Eyevance Pharmaceuticals LLC, Pfizer Inc., and others. |

| Growth Drivers: | The Increasing Prevalence of Fungal Keratitis Disease And The Expansion of R&D Efforts Are Proving To Be The Major Market Growth Drivers |

| Pitfalls & Challenges: | The loss of Patents and the Fungal Keratitis Treatments Side Effects Are Proving To Be A Significant Obstacle to The Markets Expansion |

Get more details on this report -

MARKET DRIVERS FOR TREATMENT OF FUNGAL KERATITIS WORLDWIDE -

The Increasing Prevalence of Fungal Keratitis Disease And The Expansion of R&D Efforts Are Proving To Be The Major Market Growth Drivers.

Infection of the cornea, a transparent dome that covers the coloured part of the eye, results in fungus-caused keratitis. The fungus Fusarium, Aspergillus, and Candida species are some examples of those recognized to frequently cause fungal infections. This condition may result in eye pain, redness, blurred vision, light sensitivity, excessive crying, and discharge from the eyes. A rare illness called fungal keratitis that is left untreated can cause blindness or vision loss. The use of contact lenses, underlying eye disease, compromised immune system, ocular trauma, especially with plants (such as thorns or sticks), and underlying eye disease all increase the chance of getting fungal keratitis. Additionally, the global increase in the incidence of fungal keratitis has a favourable impact on the market's overall expansion. There were 1,051,787 cases of fungal keratitis reported annually in the past, with Asia and Africa having the greatest incidence. The annual incidence would be between 8 and 11% if it were assumed that all cases of fungus were culture-negative. In subtropical and tropical nations, particularly among male agricultural labourers, are seen the highest yearly incidence of fungal keratitis and the largest ratio of fungi to bacteria as causes of microbial keratitis. Along with this, as more individuals use contact lenses, fungal keratitis is becoming more common. Contact lens use, related poor hygiene, and exposure to amoebic water sources are the most common risk factors for an infection that predispose people to infection. As a result, the market's growth is fueled by the rising number of contact lens wearers who are at risk of developing fungal keratitis. As a result, it is clear from the aforementioned facts that the prevalence of fungal keratitis is rising, which is helping the market under study grow.

Increased R&D Activities Are Fuelling The Market's Expansion.

There have been several attempts to create and find fresh antifungal remedies for fungal keratitis. An institute named L.V. Prasad Eye Institute conducted a Phase 2/Phase 3 trial in September 2018 using a Randomized Double-Masked Clinical Trial for a Combination Treatment of 5% Natamycin and 1% Voriconazole for Fungal Keratitis. Additionally, the research centre is probably going to start Phase IV trials soon. Thus, if these studies are successful, a new medication may be developed, which would likely spur market expansion in the ensuing years. The majority of investors now prefer investing in R&D, which has helped the market grow. These research breakthroughs have produced a number of ground-breaking discoveries of extremely effective medications against various fungal keratitis disorders. As a result of the aforementioned variables, the market is most likely to grow more quickly in the upcoming years.

MARKET RESTRAINTS FOR FUNGAL KERATITIS TREATMENT IN THE WORLD

The loss of Patents and the Fungal Keratitis Treatment's Side Effects Are Proving To Be A Significant Obstacle to The Market's Expansion.

It is projected that the market under study will slow significantly because, in 2018, drugs like Vfend (Voriconazole) lost their patent protection. AmBisome was shielded by two patents (US5874104, US5965156) in the United States until 2016 and by one patent (CA1339008) in Canada until 2014. AmBisome generic equivalents are now being created by numerous pharmaceutical companies in India and other countries. Market leaders will see a loss of revenue as a result of these patent expirations since generics and low-cost competitors will be able to enter the market. It is common to experience side effects when using antifungal drugs to treat this problem. Usually minor and transient, these side effects. Treatment for fungal keratitis may cause side effects such as eyelid swelling, severe eye pain and soreness, the appearance of redness in the eye, the feeling that something is stuck in the eye, pus or other discharge, blurred vision, sensitivity to light, and the appearance of redness in the eye. These drugs are also often safe and well-tolerated, with only the potential for local side effects. In addition, it has been found that patients experience a range of negative side effects when they utilize fake drugs to treat fungal keratitis. Therefore, the loss of patent protection for blockbuster drugs and all of these unfavourable impacts brought on by antifungal keratitis medications have constrained market expansion.

MARKET SEGMENTATION FOR TREATMENTS FOR FUNGUS KERATITIS GLOBALLY

The route of administration and distribution channel are the two categories used to segment the worldwide fungal keratitis treatment market. It is further divided into three categories based on how it is administered: orally, intravenously, and topically. The said market segment recorded revenue figures of USD 376 million in 2021 and an anticipated increase to USD 651 million by 2030 with a CAGR of 6.3%; topical segmentation is the most important one. The most popular drugs given for the treatment of fungal keratitis are topical antifungals, which can either be purchased over-the-counter or compounded from a systemic solution into eye drops. For the treatment of fungal keratitis, Natamycin is the only topical antifungal drug that has received approval. The main market restraint, however, is limited ocular penetration. The topical mode of administration, on the other hand, is predicted to undergo significant growth over the forecast period as a result of the approval of new topical formulations for fungal keratitis. The second-most popular method of administration is oral, with a market value of USD 226.20 million in 2021 and an increase to USD 375.7 million by 2030 with a CAGR of 5.8%. The most common and reliable method of administering medication, with both systemic and local effects that work, is an oral treatment. Furthermore, this method of medicine delivery is preferred by both the patient and the doctor. So it is projected that throughout the course of the projection period, all of these factors would increase demand for oral fungal keratitis medications. The injectable route is the third and lowest market value generator in this sector, with a market share of USD 124.3 million in 2021 and an estimated increase to USD 204.8 million by 2030 with a CAGR of 5.7%.

When broken down by distribution channel, the aforementioned market is divided into hospitals and pharmacies, with pharmacies accounting for the majority of the market, which is expected to rise to USD 658.8 million by 2030 with a CAGR of 5.9%. In 2021, the market was valued at USD 393.3 million. Drug stores are independent pharmacies that can sell prescription drugs to the general public at retail prices, thanks to state authorization. Along with hospitals and government pharmacies, charitable organizations also receive the drugs. For the purchasing of antifungal drugs and other pharmaceuticals, people rely on retail pharmacies as one-stop shops. The next section in this group is hospitals, which had a market value of USD 212.3 million in 2021 and were projected to reach USD 351.1 million by 2030 with a CAGR of 5.75%.

REGIONAL ANALYSIS OF THE MARKET FOR TREATING FUNGUS KERATITIS WORLDWIDE

Get more details on this report -

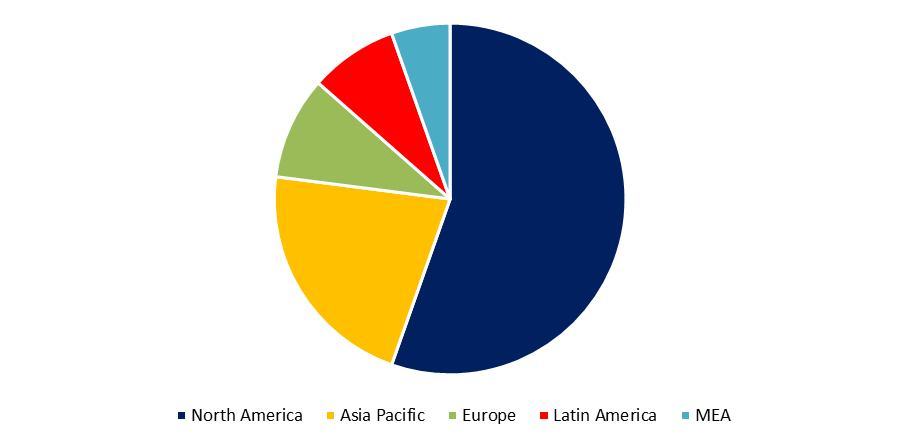

North America, Europe, and Asia make up the three main geographic segments of the global market for fungal keratitis treatments. The market in North America, which had a value of USD 274.08 million in 2021 and was projected to reach USD 439.9 million in 2030 with a CAGR of 5.4%, currently has a dominant position. With a market value of USD 198.04 million in 2021 and USD 367.1 million by 2030 and a CAGR of 7.1%, the Asia-Pacific is the second most important region. The least contributing of these three regions is Europe, which contributed USD 187.1 million in 2021 and is projected to increase to USD 300.3 million in 2030 with a CAGR of 5.4%.

COMPETITORS IN THE GLOBAL FUNGAL KERATITIS TREATMENT MARKET

Global fungal keratitis treatment market competitors include Alvogen, Bausch Health Companies Inc., Gilead Biosciences Inc., Glenmark Pharmaceuticals, Leadiant Biosciences, Merck & Co. Inc., Aurolab, Eyevance Pharmaceuticals LLC, Pfizer Inc., and others.

RECENT EVENTS INVOLVING IMPORTANT PLAYERS -

- Alvogen and Yas Holding announced their licence and distribution agreement to market their generics portfolio in April 2020.

- In March 2019, Bausch Health Companies Inc. finished the purchase of some Synergy Pharmaceuticals assets for around USD 195 million.

- Peloton Therapeutics was purchased by Merck & Co. Inc in July 2019 for $1.01 billion.

- For their upcoming global expansion, Eyevance Pharmaceuticals LLC purchased Tobradex ST in October 2019.

MARKET SEGMENTATION FOR FUNGAL KERATITIS MARKET-

Based on Route of Administration –

- Oral

- Injection

- Topical

Based on Distribution Channel –

- Hospitals

- Drug stores

Based on Region –

- North America

- Europe

- Asia-Pacific

- Middle-East & Africa

Need help to buy this report?