Global Furfural Market Size, Share, and COVID-19 Impact Analysis, By Process (Quaker Batch Process, Chinese Batch Process, Rosen Lew Continuous Process, and Others), By Raw Material (Corn Cob, Sugarcane Bagasse, Sunflower Hull, Rice Husk, and Others), By Application (Furfuryl Alcohol, Solvent, Intermediate, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Furfural Market Insights Forecasts to 2033

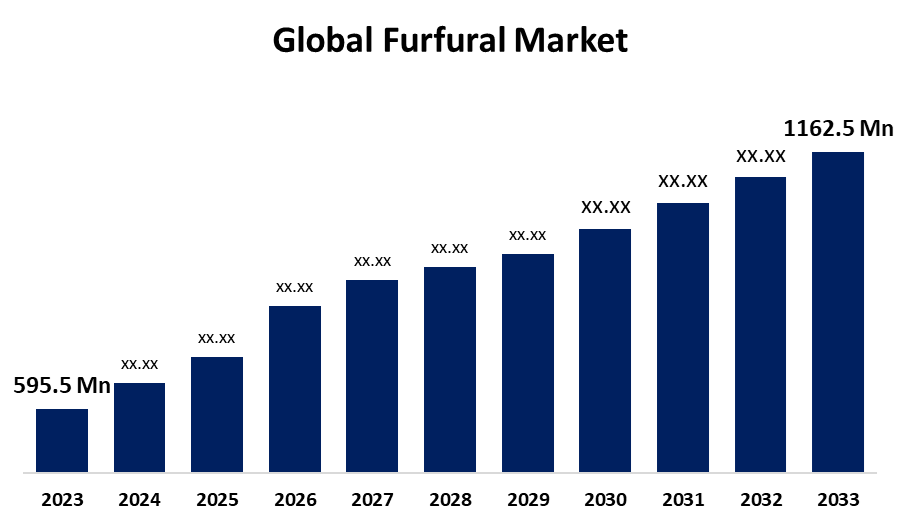

- The Global Furfural Market Size was Estimated at USD 595.5 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.92% from 2023 to 2033

- The Worldwide Furfural Market Size is Expected to Reach USD 1162.5 Million by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Furfural Market Size is anticipated to exceed USD 1162.5 million by 2033, growing at a CAGR of 6.92% from 2023 to 2033. The growing need for furfuryl alcohol owing to the concerns for renewable products is anticipated to drive the market for furfural.

Market Overview

The furfural market refers to the chemical industry that emphasizes using renewable resources and sustainability. Furfural is a green bio-based, colorless, oily chemical compound derived from biomass including corncobs, wheat bran, and sawdust that contain lignocellulose. In the industrial setting, it can be used to recover wax and extract unsaturated chemicals from vegetable oils and aromatics from diesel fuels and lubricating oils. Phenolic resins are also produced using furfural that offers thermosetting and physical resistance properties. Further, it is used as a food flavoring, fragrance in personal care products, and solvent in petrochemical refining to extract dienes from hydrocarbons. Additionally, it is used as wood modification, gasoline additives, jet fuel blend stocks, insecticides, fertilizers, and an all-weather runway and pothole repair method for bomb-damaged runways. In addition, it is used worldwide in the paint and coating, pharmaceutical, food and beverage, and agricultural sectors. The high demand for furfural in the textile industry is providing a lucrative market opportunity for furfural.

Report Coverage

This research report categorizes the furfural market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the furfural market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the furfural market.

Global Furfural Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 595.5 million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.92% |

| 2033 Value Projection: | USD 1162.5 million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Process, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Illovo Sugar Africa (Pty.) Ltd, Linzi Organic Chemical Inc. Ltd., Tran’s Chemicals bvba, Central Romana Corporation, DalindYebo, Hebei Chem, KRBL Ltd., Silva team S.p.a., LENZING AG, Central Romana Corporation, Pennakem, Silvateam, Hongye Holding Group Corporation Ltd., Merck KGaA, and others key Players |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The growing need for furfuryl alcohol in industries such as foundry, resin, and solvents owing to its versatile properties leads to bolster the market growth. Further, the increasing emphasis on eco-friendly and sustainable practices owing to the surging industrial strive to reduce environmental impact is also driving the market. The growing end-user industries like construction, automotive, and electronics are majorly contributing to driving the market demand for furfural.

Restraining Factors

The price volatility which leads to hinders the ability to make strategic decisions about long-term investments, thereby restraining the market. Further, the supply chain disruptions destabilizing the sourcing of raw materials are hindering market growth.

Market Segmentation

The furfural market share is classified into process, raw material, and application.

- The Chinese batch process segment dominated the market with the largest revenue share in 2023.

Based on the process, the furfural market is classified into quaker batch process, Chinese batch process, rosenlew continuous process, and others. Among these, the Chinese batch process segment dominated the market with the largest revenue share in 2023. This is due to the widespread application of the Chinese batch process in numerous small-scale manufacturing establishments, primarily in China. Furfural is produced on a larger scale using Chinese batch technique.

- The corn cobs segment accounted for the largest revenue share of the global furfural market in 2023.

Based on the raw material, the furfural market is classified into corn cob, sugarcane bagasse, sunflower hull, rice husk, and others. Among these, the corn cobs segment accounted for the largest revenue share of the global furfural market in 2023. Corn cobs contain high pentosane concentration and are used to manufacture furfural. The procedures of hydrolysis, pre-treatment, purification, and separation are used in the synthesis of furfural from corncob.

- The furfuryl alcohol segment dominated the market with the largest revenue share of 86.0% in 2023.

Based on the application, the furfural market is classified into furfuryl alcohol, solvent, intermediate, and others. Among these, the furfuryl alcohol segment dominated the market with the largest revenue share of 86.0% in 2023. Furfuryl alcohol is extensively utilized in the synthesis of furan resin, a crucial chemical feedstock used in the manufacturing of paints, cement, adhesives, thermoset polymer matrix composites, and casting resins. Further, the use of furfuryl alcohol in the petroleum and refining industries is driving the market.

Regional Segment Analysis of the furfural market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

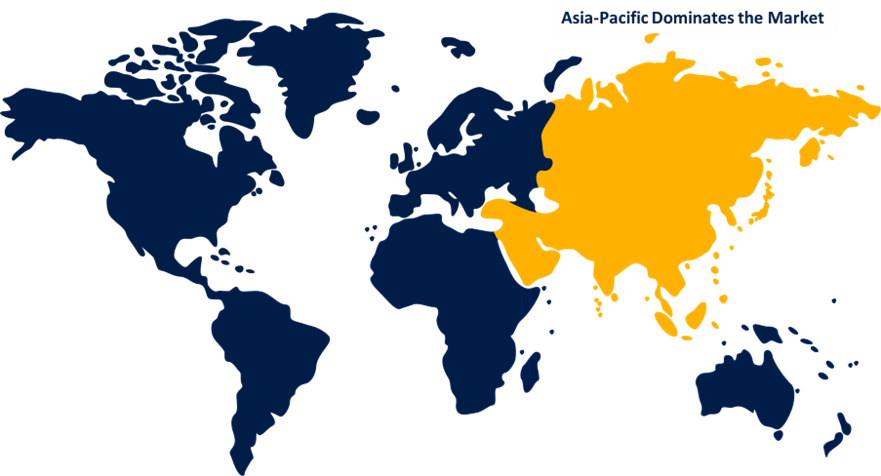

Asia Pacific is anticipated to hold the largest share of the furfural market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the furfural market over the predicted timeframe. The adoption of furfural offers a competitive substitute for petroleum-based chemicals, lowering dependency on limited fossil fuel supplies and minimizing environmental effects as businesses and consumers place a greater emphasis on sustainability and environmental impact. The ongoing R&D efforts in furfural production technologies and product development significantly contributed to driving the market demand.

North America is expected to grow at the fastest CAGR growth of the furfural market during the forecast period. Furfural is used to produce furfuryl alcohol, which has applications in manufacturing foundry resins, lubricants, plastics, and adhesives, thereby driving the market demand. The presence of well-established chemical and fertilizer manufacturers in the region is contributing to propel the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the furfural market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Illovo Sugar Africa (Pty.) Ltd

- Linzi Organic Chemical Inc. Ltd.

- Trans Furans Chemicals bvba

- Central Romana Corporation

- DalinYebo

- Hebeichem

- KRBL Ltd.

- Silva team S.p.a.

- LENZING AG

- Central Romana Corporation

- Pennakem

- Silvateam

- Hongye Holding Group Corporation Ltd.

- Merck KGaA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Carbon negative materials company Origin Materials announced that it had commenced the startup of Origin 1, the world’s first commercial CMF plant, located in Sarnia, Ontario.

- In May 2021, the Kilombero Sugar Company in Tanzania, in which Illovo Sugar South Africa is a majority shareholder, approved an expansion project to the value of $238.5 million. To align with the country’s policy to achieve self-sufficiency by 2025, this new development would increase Kilombero’s sugar production by 144 000 tonnes from current levels of around 127 000 tonnes of sugar per annum to 271 000 tonnes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the furfural market based on the below-mentioned segments:

Global Furfural Market, By Process

- Quaker Batch Process

- Chinese Batch Process

- Rosenlew Continuous Process

- Others

Global Furfural Market, By Raw Material

- Corn Cob

- Sugarcane Bagasse

- Sunflower Hull

- Rice Husk

- Others

Global Furfural Market, By Application

- Furfuryl Alcohol

- Solvent

- Intermediate

- Others

Global Furfural Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the furfural market over the forecast period?The furfural market is projected to expand at a CAGR of 6.92% during the forecast period.

-

2. What is the market size of the furfural market?The Furfural Market Size is Expected to Grow from USD 595.5 Million in 2023 to USD 1162.5 Million by 2033, at a CAGR of 6.92% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the furfural market?Asia Pacific is anticipated to hold the largest share of the furfural market over the predicted timeframe.

Need help to buy this report?