Global Gabapentin Market Size, Share, and COVID-19 Impact Analysis, By Type (Generic and Branded), By Dosage Form (Tablet, Capsule, and Oral Solution), By Application (Epilepsy, Neuropathic Pain, Restless Legs Syndrome, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Gabapentin Market Insights Forecasts to 2033

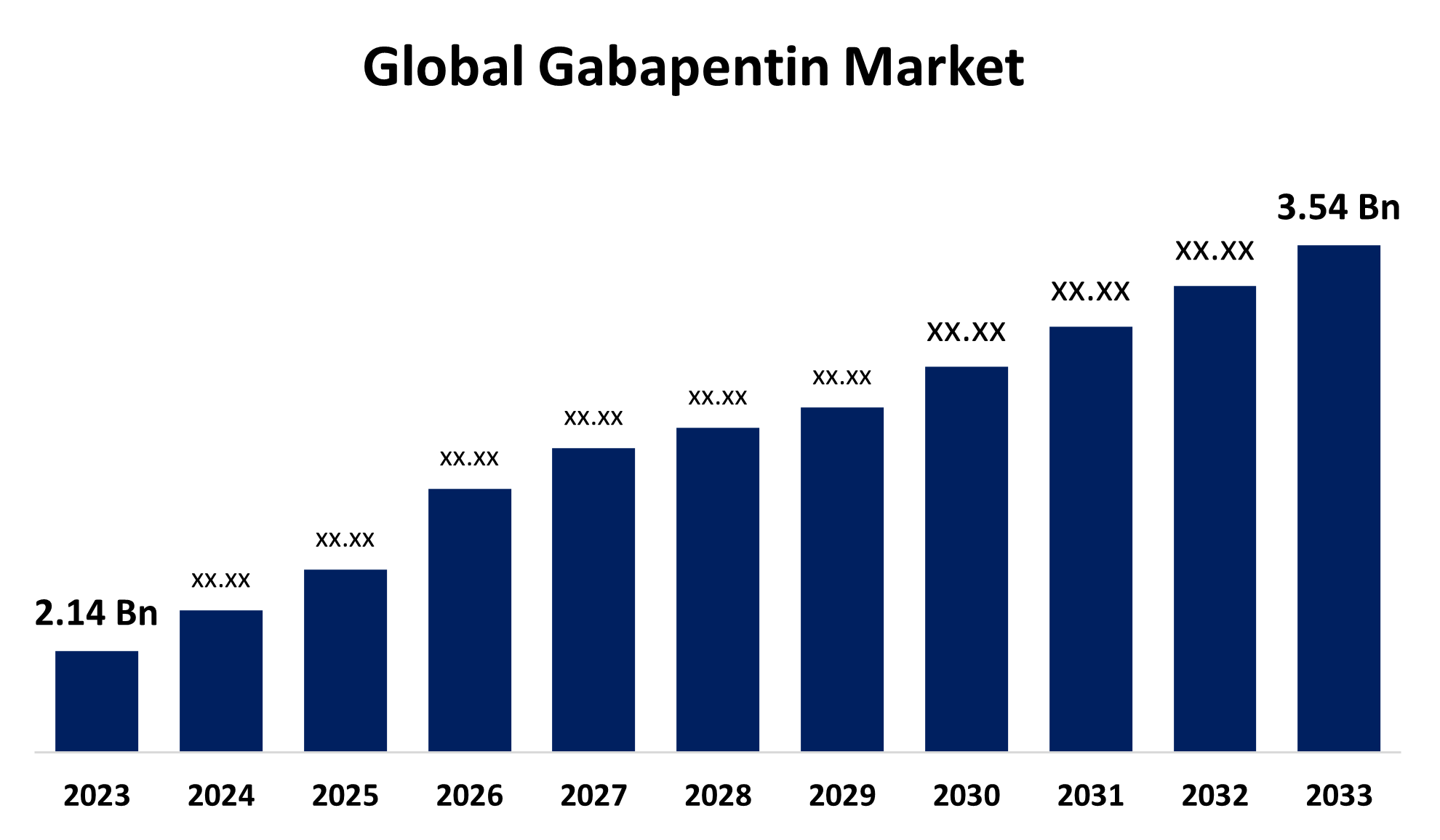

- The Global Gabapentin Market Size was Valued at USD 2.14 Billion in 2023

- The Market Size is Growing at a CAGR of 5.16% from 2023 to 2033

- The Worldwide Gabapentin Market Size is Expected to Reach USD 3.54 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Gabapentin Market Size is Anticipated to Exceed USD 3.54 Billion by 2033, Growing at a CAGR of 5.16% from 2023 to 2033. Increased knowledge of gabapentin's advantages, recommended use, and possible adverse effects, as well as educational programs, present significant opportunities for market expansion.

Market Overview

Gabapentin is often used to treat and prevent seizures in individuals with epilepsy or to treat postherpetic neuralgia, which is a type of nerve pain that can follow a shingles virus infection. As decided by healthcare professionals, gabapentin can also be used for other problems. Gabapentin works by influencing the chemicals and neurons in the body that cause seizures and different kinds of pain. Gabapentin can disrupt the brain's aberrant electrical activity. When compared to other drugs that are used to treat related disorders, gabapentin is a reasonably priced drug. It has become a desirable choice for both patients and medical professionals. Government programs and awareness-raising efforts play a significant role in driving the growth of gabapentin market. The newly created gabapentin formulations provide improved effectiveness and user-friendliness. Additionally, it has helped the gabapentin market expand. The demand for gabapentin is driven by its shown effectiveness in treating neuropathic pain.

Report Coverage

This research report categorizes the gabapentin market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the gabapentin market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the gabapentin market.

Global Gabapentin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.14 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.16% |

| 023 – 2033 Value Projection: | USD 3.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Dosage Form, By Application, By Regional Analysis |

| Companies covered:: | GLENMARK PHARMACEUTICALS LTD., Arbor Pharmaceuticals, LLC, Sun Pharmaceutical Industries Ltd., Ascend Laboratories LLC, B.P. Pharma, Zydus Lifesciences, Teva Pharmaceutical Industries Ltd, Amneal Pharmaceuticals LLC., Cipla, Apotex Inc., Assertio Holdings, Inc., Aurobindo Pharma, Pfizer Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need to reduce the dangers of opiate addiction and reliance is a major factor in the change, which presents gabapentin as a safer substitute. Effective pain management is essential for neuropathic pain, which is driven by diseases including diabetic neuropathy, post-herpetic neuralgia, and trigeminal neuralgia. The market is expanding as a result of gabapentin's adaptability in treating a range of illnesses outside of its original prescription, including anxiety disorders, migraines, and restless legs syndrome. Gabapentin is being prescribed off-label for these illnesses by doctors and other healthcare professionals more frequently, which is expanding its market reach and driving demand.

Restraining Factors

The side effects associated with gabapentin, the availability of alternative treatments, and the growing misuse of gabapentin are restraining the market.

Market Segmentation

The gabapentin market share is classified into type, dosage form, and application.

- The generic segment is estimated to hold the largest market revenue share through the projected period.

Based on the type, the gabapentin market is classified into generic and branded. Among these, the generic segment is estimated to hold the largest market revenue share through the projected period. The expiration of brand-name gabapentin patents has increased competition, driven down prices, and encouraged doctors to prescribe generics, especially in cost-sensitive markets where neuropathic pain and epilepsy are on the rise.

- The capsule segment is anticipated to hold the largest market share through the forecast period.

Based on dosage form, the gabapentin market is divided into tablet, capsule, and oral solution. Among these, the capsule segment is anticipated to hold the largest market share through the forecast period. In response to their ease of use and quick absorption, capsules guarantee accurate dosage and are preferred by medical professionals, to improve patient compliance.

- The epilepsy segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the gabapentin market is divided into epilepsy, neuropathic pain, restless legs syndrome, and others. Among these, the epilepsy segment is anticipated to hold the largest market share through the forecast period. The growing demand for gabapentin in this epilepsy category is mostly due to the rising diagnosis rates and the growing need for reliable treatment choices.

Regional Segment Analysis of the Gabapentin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the gabapentin market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the gabapentin market over the predicted timeframe. A strong healthcare system, extensive insurance coverage, and significant investments in research and development all contribute to the high frequency of neurological illnesses and neuropathic pain problems in North America. Furthermore, gabapentin's rising use in a variety of applications is being facilitated by healthcare providers' growing understanding of its effectiveness.

Asia Pacific is expected to grow at the fastest CAGR growth of the gabapentin market during the forecast period. Healthcare spending in the region is on the rise and people are becoming more conscious of neurological conditions. The growing population, particularly in nations like China and India, adds to the rise in the frequency of disorders that gabapentin treats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the gabapentin market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GLENMARK PHARMACEUTICALS LTD.

- Arbor Pharmaceuticals, LLC

- Sun Pharmaceutical Industries Ltd.

- Ascend Laboratories LLC

- B.P. Pharma

- Zydus Lifesciences

- Teva Pharmaceutical Industries Ltd

- Amneal Pharmaceuticals LLC.

- Cipla

- Apotex Inc.

- Assertio Holdings, Inc.

- Aurobindo Pharma

- Pfizer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, The USFDA gave Zydus Lifesciences approval to produce and sell 300 mg and 600 mg once-daily gabapentin tablets for the treatment of postherpetic neuralgia. The company plans to introduce these tablets right away.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the gabapentin market based on the below-mentioned segments:

Global Gabapentin Market, By Type

- Generic

- Branded

Global Gabapentin Market, By Dosage Form

- Tablet

- Capsule

- Oral Solution

Global Gabapentin Market, By Application

- Epilepsy

- Neuropathic Pain

- Restless Legs Syndrome

- Others

Global Gabapentin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the small molecule API market over the forecast period?The small molecule API market is projected to expand at a CAGR of 5.57% during the forecast period

-

2. What is the market size of the small molecule API market?The Global Small Molecule API Market Size is Expected to Grow from USD 202.84 Billion in 2023 to USD 348.70 Billion by 2033, at a CAGR of 5.57% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the small molecule API market?North America is anticipated to hold the largest share of the small molecule API market over the predicted timeframe.

Need help to buy this report?