Global Gas Detection Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Portable Gas Detector and Fixed Gas Detector), By Technology (Infrared, Semiconductor, Laser-based Detection, Catalytic, Photoionization Detector, Others), By End-Use (Industrial, Oil & Gas, Automotive, Medical, Aerospace & Defence, Chemical, Building Automation, Domestic Appliances, Environmental, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Gas Detection Equipment Market Insights Forecasts to 2032

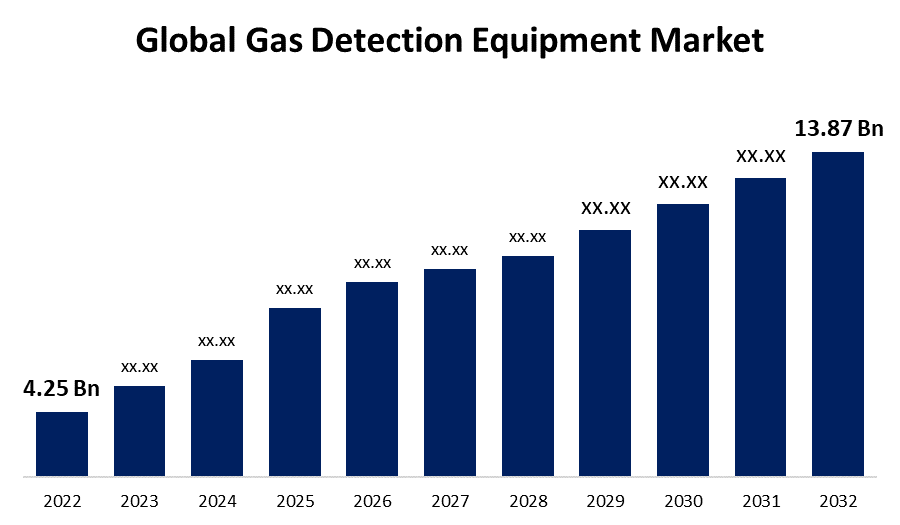

- The Global Gas Detection Equipment Market Size was valued at USD 4.25 Billion in 2022.

- The Market is Growing at a CAGR of 12.56% from 2022 to 2032

- The Worldwide Gas Detection Equipment Market Size is expected to reach USD 13.87 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Gas Detection Equipment Market Size is expected to reach USD 13.87 Billion by 2032, at a CAGR of 12.56% during the forecast period 2022 to 2032.

As a vital component of a safety system, gas detectors assess or measure the depletion of flammable gases, hazardous gases, and oxygen in a given space. Such detectors often trigger a warning signal and are used in restricted places or situations where prolonged exposure to such gas could result in hazardous exposure or a fire hazard. In addition to permanent types, portable gas detectors are also available. This type of equipment is commonly used in the manufacturing sector and can be found in places such as oil drilling platforms for tracking production processes and cutting-edge innovations such as solar. Gas detectors are capable of detecting combustible gases, poisonous gases, oxygen gases, and a variety of other gases. A thermal imaging device can also be used for visual detection; these sensors typically use an audio warning to inform people when a toxic chemical is discovered.

The majority of sensors include metal oxide semiconductor (MOS) sensors, infrared point sensors, photoionization detectors, flammable gas sensors, ultrasonic sensing devices, and photoionization detectors. These kinds of sensors are frequently used in a variety of settings, including industrial plants, refineries, pharmaceutical production facilities, fumigation facilities, paper pulp mills, facilities for building ships and airplanes, hazmat operations, wastewater treatment centers, automobiles, air-quality testing labs, and residential buildings.

Report Coverage

This research report categorizes the market for the global gas detection equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global gas detection equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the gas detection equipment market.

Global Gas Detection Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.25 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.56% |

| 2032 Value Projection: | USD 13.87 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Technology, By End-Use, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Airtest Technologies, Inc., Teledyne Technologies Incorporated, Fortive Corporation, Opgal Optronics Industries Ltd., Siemens, 3M Company, ABB, Lynred, Emerson Electric Co., General Electric Company, Honeywell International Inc., Fluke Corporation, Gas Measurement Instruments Ltd., RKI Instruments, Inc., Trolex Ltd., United Technologies Corporation, Thermo Fisher Scientific Inc. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The growing pressure on protecting worker safety across many end-use sectors throughout the world has fueled the widespread implementation of several protective systems, such as gas detection devices. The increased industrial standards, as well as regulatory norms and laws, have driven the demand for gas detection equipment in manufacturing enterprises to safeguard the safety and health of workers. Furthermore, the growing utilization of smart gas detection equipment that allows for remote monitoring is expected to be a major driver driving the growth of the worldwide gas detection equipment market over the forecast period.

Additionally, as governments throughout the world are striving to reduce the emission of methane from oil and gas, there is a growing demand for gas detection technologies. Gas detection systems may drastically reduce methane leaks during transportation, natural gas extraction, and power generation. As a result, the rising implementation of gas detectors from oil & gas and power generation industries is increasing the demand for gas detection equipment market growth.

Furthermore, IR camera-based gas detectors have witnessed an enormous surge in utilization in the past few decades due to their ability to detect the occurrence of combustible gases that are not apparent to the human eye. From several meters away, these cameras can identify a range of undetectable gases, including hydrocarbon-based gases such as ethane, methane propane, and butane. The capacity to remotely monitor gas leaks is a fundamental advantage of using IR camera-based detection technologies.

Furthermore, manufacturers all over the world are producing smart gas detection equipment by focusing on the application of revolutionary wireless technologies as well as the seamless incorporation of artificial intelligence (AI) and big data. Because smart gas detection equipment uses wireless technologies such as ZigBee, Wi-Max, wireless internet, and Bluetooth connectivity, end customers can track the product's function from remote locations in real-time. As a result of all of these reasons, the global gas detection equipment market is expected to rise at an exponential rate throughout the forecast period.

Market Segmentation

By End-Use Insights

The oil & gas segment accounted the largest market share of more than 38.7% over the forecast period.

On the basis of end-use, the global gas detection equipment market is segmented into industrial, oil & gas, automotive, medical, aerospace & defence, chemical, building automation, domestic appliances, environmental, and others. Among these, oil & gas are dominating the market with the largest market share of 38.7% over the forecast period. The expanding market for natural gas and petroleum has led to potential hazards during production, such as exposure to noxious and combustible gases while extraction and gas leakage. In addition, there has been a substantial rise in shale gas drilling activities, which is expected to be a major driver of the segment's expansion throughout the forecast period. In restricted locations, gas detectors are also essential to ensure adequate levels of oxygen in the presence of dangerous gases and volatile organic compounds.

By Technology Insights

The semiconductor segment is witnessing significant CAGR growth over the forecast period.

On the basis of technology, the global gas detection equipment market is segmented into infrared, semiconductor, laser-based detection, catalytic, photoionization detector, and others. Among these, the semiconductor is witnessing significant CAGR growth over the forecast period. The majority of gas detectors based on semiconductors are inexpensive and detect flammable gases. Because of characteristics such as resistance to corrosion and extended life, they are frequently employed for applications in industries such as petrochemical, automotive, and medical. Cooperative arrangements between different semiconductor technology manufacturers and gas detection equipment suppliers are expanding the market for gas detection equipment market globally. Furthermore, the infrared category is predicted to develop the most rapidly during the forecast period. Infrared-based gas detectors are used to detect gases such as methane and carbon dioxide as well as organic compounds with volatile properties such as benzene, butane, and acetylene because they are resistant to contamination and toxicity.

By Product Type Insights

The fixed gas detector segment is dominating the market with the largest market share over the forecast period.

On the basis of product type, the global gas detection equipment market is segmented into the portable gas detector and fixed gas detectors. Among these, the fixed gas detector segment is dominating the market with the largest market share of 58.73% over the forecast period. As companies become more cognizant of potential hazards connected with toxic gases in the workplace, the requirement for healthy and secure working conditions is a primary driving force behind the increasing adoption of fixed gas detectors. Wireless technology use is also propelling the trajectory of the fixed gas detector market, as it enables greater effectiveness in surveillance and data processing. The increased use of fixed gas detectors in the worldwide market can also be attributed to the advantages provided by such devices, such as the minimum sampling amount needed for gas detection and real-time monitoring capability.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 35.7% market share over the forecast period, because of their portability and versatility, portable gas detectors are becoming increasingly popular in the Asia Pacific. These detectors are lightweight and portable, thus rendering them perfect for use in big industrial operations. Sensor technology advancements and development additionally contribute to the design of more precise and reliable gas detection devices. Furthermore, the increase in exploration and production by numerous oil companies, like the National Offshore Oil Corporation of China and the Oil & Natural Gas Corporation of India, is boosting the requirement for the gas detection equipment market in the region. China is predicted to lead the Asia Pacific gas detection equipment market. The rising number of new-build buildings in China is expected to stimulate demand for the gas detection equipment market in a variety of industrial applications. Furthermore, the expansion of activities by local oil corporations such as the National Offshore Oil Corporation of China is supporting the market demand in the region.

North America, on the contrary, is expected to grow the fastest during the forecast period. The abundance of a substantial oil and gas pipeline network, along with oil and gas refinery operations, in countries such as the United States and Canada anticipate substantial growth for market expansion. In addition, an increasing demand for the well-being and security of the workforce who are constantly exposed to hazardous gases is driving regional gas detection equipment market growth. One of the key factors driving the growth of the gas detection equipment market is the rising need to reduce accidents caused by gas leaks.

List of Key Market Players

- Airtest Technologies, Inc.

- Teledyne Technologies Incorporated

- Fortive Corporation

- Opgal Optronics Industries Ltd.

- Siemens

- 3M Company

- ABB

- Lynred

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Fluke Corporation

- Gas Measurement Instruments Ltd.

- RKI Instruments, Inc.

- Trolex Ltd.

- United Technologies Corporation

- Thermo Fisher Scientific Inc.

Key Market Developments

- On January 2022, Guardhat, a pioneer in end-to-end connected worker solutions, has announced a connection with RKI Instruments' GX-3R Pro gas detector. Integrating RKI Instruments' GX-3R Pro gas detector into the Guardhat Platform enables users to respond to exposure threats to individual workers in real-time before incidents occur, as well as aggregate and analyze exposure trends for actionable intelligence to improve worker safety and operations.

- On April 2022, MSA Safety, Inc., a global leader in the development of safety solutions that help to protect people and facility infrastructures, has announced the ALTAIR ioTM 4 Gas Detection Wearable device, which is a game changer in the industry. MSA+ allows safety managers to bundle hardware and software requirements for long-term safety breakthroughs and a straightforward approach to stay ahead of safety innovation while spending the least amount of money.

- On May 2022, Opgal Optronics Industries Ltd. released the EYECGAS App for remote management of the EYECGAS 2.0. The ability to link your OGI camera to the dedicated app is the newest feature of the EyeCGas 2.0 Optical Gas Imaging (OGI) toolbox. This OGI app guarantees faster and more efficient inspections while also saving time when reporting a potentially hazardous gas leak.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Gas Detection Equipment Market based on the below-mentioned segments:

Gas Detection Equipment Market, Product Type Analysis

- Portable Gas Detector

- Fixed Gas Detector

Gas Detection Equipment Market, Technology Analysis

- Infrared

- Semiconductor

- Laser-based Detection

- Catalytic

- Photoionization Detector

- Others

Gas Detection Equipment Market, End-Use Analysis

- Industrial

- Oil & Gas

- Automotive

- Medical

- Aerospace & Defence

- Chemical

- Building Automation

- Domestic Appliances

- Environmental

- Others

Gas Detection Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Gas Detection Equipment market?The Global Gas Detection Equipment Market is expected to grow from USD 4.25 billion in 2022 to USD 13.87 billion by 2032, at a CAGR of 12.56% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Fortive Corporation, Opgal Optronics Industries Ltd., Siemens, 3M Company, ABB, Lynred, Emerson Electric Co., Honeywell International Inc., Fluke Corporation, Gas Measurement Instruments Ltd., RKI Instruments, Inc., Trolex Ltd., Thermo Fisher Scientific Inc.

-

3. Which segment dominated the Gas Detection Equipment market share?The oil & gas segment in end-use type dominated the Gas Detection Equipment market in 2022 and accounted for a revenue share of over 38.7%.

-

4. What are the elements driving the growth of the Gas Detection Equipment market?Stringent workplace safety laws, rising demand for infrared (IR) camera-based gas detectors, and expanding oil and gas pipeline infrastructure are key elements driving the growth of the gas detection equipment market.

-

5. Which region is dominating the Gas Detection Equipment market?Asia Pacific is dominating the Gas Detection Equipment market with more than 35.7% market share.

-

6. Which segment holds the largest market share of the Gas Detection Equipment market?The fixed gas detector segment based on product type holds the maximum market share of the Gas Detection Equipment market.

Need help to buy this report?