Global Gas Sensor Market Size, Share, and COVID-19 Impact Analysis, By Product (Oxygen (O2)/Lambda Sensors, Carbon Dioxide (CO2) Sensors, Carbon Monoxide (CO) Sensors, Nitrogen Oxide (NOx) Sensors, Methyl Mercaptan Sensor, and Others), By Type (Wireless, Wired), By Technology (Electrochemical, Semiconductor, Solid State/MOS, Photo-ionization Detector (PID), Catalytic, Infrared (IR), and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal Gas Sensor Market Insights Forecasts to 2033

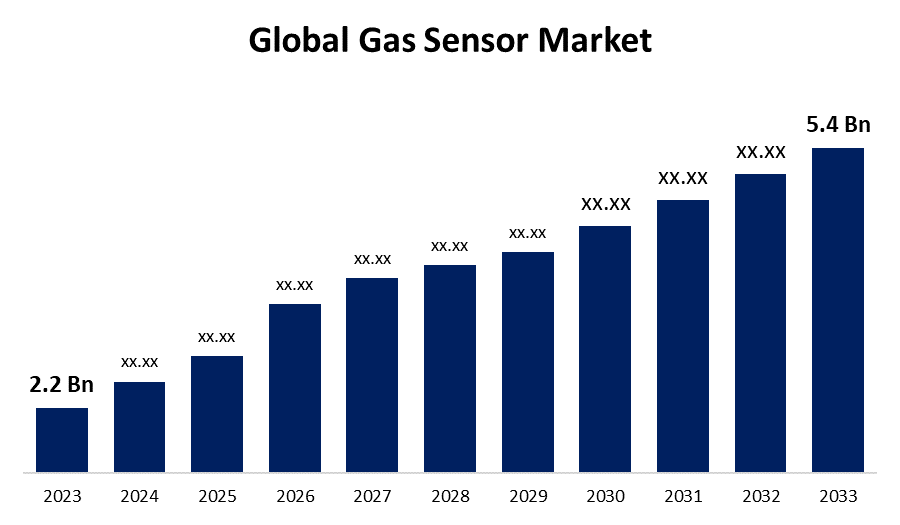

- The Global Gas Sensor Market Size was Valued at USD 2.2 Billion in 2023

- The Market Size is Growing at a CAGR of 9.39% from 2023 to 2033

- The Worldwide Gas Sensor Market Size is Expected to Reach USD 5.4 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Gas Sensor Market Size is Anticipated to Exceed USD 5.4 Billion by 2033, Growing at a CAGR of 9.39% from 2023 to 2033.

Market Overview

A gas sensor is a device designed to detect the presence and concentration of gases in the air. It works by converting the physical or chemical properties of gases into readable signals, which can then be monitored and analyzed. These sensors are used in various applications, including industrial safety, environmental monitoring, and home safety systems, to detect harmful gases like carbon monoxide, methane, and other toxic or combustible gases. Gas sensors help ensure safety and compliance with environmental standards by providing early warnings of gas leaks or hazardous conditions, allowing for timely interventions and preventing potential accidents or health risks. A growing number of gas sensor manufacturers are integrating wireless technologies, like Bluetooth, Wi-Fi, or LoRaWAN, into their products in order to facilitate easy communication with tablets, smartphones, and cloud-based platforms. With improved features like anomaly detection, predictive maintenance, and customizable alerts, these smart gas sensors are a must-have for home, commercial, and environmental applications. The need for gas sensors that can interface with intelligent infrastructure for improved safety measures and efficient resource management is also fueled by the rise in smart homes and smart city initiatives.

Report Coverage

This research report categorizes the market for the global gas sensor market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global gas sensor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global gas sensor market.

Global Gas Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.39% |

| 2033 Value Projection: | USD 5.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Type, By Technology, By Region |

| Companies covered:: | ABB Ltd., AlphaSense Inc., City Technology Ltd., Dynament, Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, Siemens, Sensorix, GfG Gas Detection UK Ltd., FLIR Systems, Inc., CO2 Meter.com, Amphenol Corporation, Gastec Corporation, Honeywell International Inc., Sensirion AG, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing demand for gas sensors in essential industries

The demand for gas sensors is increasing across various industries, including chemical, oil and gas, mining, and power, to detect and monitor harmful gases like sulfur dioxide and chlorine. These gases, if emitted in excess, can have adverse effects on human health. Additionally, explosive gases such as methane, propane, and butane, commonly released by these industries, pose a significant fire risk. To safeguard the environment, several regulatory bodies in countries like the US, UK, Germany, China, and France have established regulations to limit the emission of harmful gases. As a result, the need for gas sensors in refineries and other critical industries is growing to ensure the detection and monitoring of these hazardous substances.

Restraining Factors

Challenges in developing industry-specific gas sensors

One of the biggest challenges facing the gas sensor market is the lengthy and labor-intensive processes involved in developing novel and inventive gas sensors. This leads to higher manufacturing and development expenses.

Market Segmentation

The global gas sensor market share is classified into product, type, and technology.

- The carbon dioxide (CO2) sensors segment is expected to hold the largest share of the global gas sensor market during the forecast period.

Based on the product, the global gas sensor market is categorized into oxygen (O2)/lambda sensors, carbon dioxide (CO2) sensors, carbon monoxide (CO) sensors, nitrogen oxide (NOx) sensors, methyl mercaptan sensors, and others. Among these, the carbon dioxide (CO2) sensors segment is expected to hold the largest share of the global gas sensor market during the forecast period. Carbon dioxide sensors are primarily utilized to monitor indoor air quality in various settings, including homes, office buildings, automotive environments, healthcare facilities, and other applications. These sensors play a crucial role in ensuring that air quality remains within safe and comfortable levels, directly impacting health and productivity. Recognizing the growing demand for more efficient and accurate monitoring, numerous companies are investing in the development of MEMS-based (Micro-Electro-Mechanical Systems) carbon dioxide sensors. These advanced sensors offer enhanced sensitivity, miniaturization, and energy efficiency, making them suitable for a wide range of applications. As a result, the market is seeing an influx of innovative CO2 sensor technologies designed to meet the specific needs of different industries, thereby improving overall indoor air quality management.

- The wired segment is expected to grow at the fastest CAGR during the forecast period.

Based on the type, the global gas sensor market is categorized into wireless and wired. Among these, the wired segment is expected to grow at the fastest CAGR during the forecast period. Wired gas sensors are valued for their low maintenance, compact size, cost-effectiveness, and high accuracy. These sensors are highly reliable as they provide a direct connection between the sensor and the receiving device, making them ideal for critical environments like mines, oil rigs, and nuclear power plants. Additionally, there is a growing trend of incorporating wired gas sensors in residential applications, driven by their reliability and effectiveness in ensuring safety. This increasing adoption in homes, alongside their established use in industrial settings, is significantly contributing to the growth of the wired gas sensor market. The dependable nature and efficiency of these sensors make them a preferred choice for monitoring and detecting gas levels in various environments, ensuring both safety and compliance with regulations.

- The electrochemical segment is expected to grow at the fastest CAGR during the forecast period.

Based on the technology, the global gas sensor market is categorized into electrochemical, semiconductor, solid-state/MOS, photo-ionization detector (PID), catalytic, infrared (IR), and others. Among these, the electrochemical segment is expected to grow at the fastest CAGR during the forecast period. The demand for electrochemical sensors is increasing because they use less power, operate more safely, and provide better specificity for detecting target gases. These sensors work by oxidizing the target gas at the electrode, which allows them to accurately measure the resulting current. This efficient detection method makes electrochemical sensors particularly valuable in identifying toxic gas concentrations. As a result, the mining sector is expected to see a growing demand for this technology, given its effectiveness in ensuring safety and accurate gas monitoring. The combination of low power consumption, safety, and precise gas detection makes electrochemical sensors an attractive choice for industries where gas monitoring is critical.

Regional Segment Analysis of the Global Gas Sensor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global gas sensor market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global gas sensor market over the forecast period. The growing awareness of the impact of air pollutants on human health in Asia Pacific countries, such as India and China, is driving demand for gas sensors for air quality monitoring. Continued urbanization in the region is also driving up demand for gas sensors. Furthermore, governments in the Asia Pacific region are heavily investing in smart city projects, creating a significant market for smart sensor devices. Such factors are positive for regional market growth.

Europe is expected to grow at the fastest CAGR growth of the global gas sensor market during the forecast period. Stringent regulations governing gas emissions, as well as the subsequent need for emissions monitoring, are expected to drive regional market growth. In Europe, safety regulations require all vehicle manufacturers to include gas sensor technologies in their offerings. As pollution regulations tighten, the use of gas sensors in the automotive industry to reduce pollution is expected to grow in the coming years. Furthermore, several regional market players are developing advanced gas sensors, which will ultimately drive the market's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global gas sensor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- Sensorix

- GfG Gas Detection UK Ltd.

- FLIR Systems, Inc.

- CO2 Meter.com

- Amphenol Corporation

- Gastec Corporation

- Honeywell International Inc.

- Sensirion AG

- Others

Key Market Developments

- In December 2023, CO2 Meter.com, a Florida-based company, launched the CM-900, an industrial gas detector that can measure carbon dioxide (CO2) or oxygen and protect personnel working near hazardous gases. The newly released CM-900 detector features an industrially adaptive enclosure that can withstand harsh and wash-down environments. It also includes audible and visual alarms that alert people to potentially dangerous situations.

- In September 2022, Sensorix announced the launch of its 'Satellix' gas sensor format, which includes electrochemical sensors and pellistors for LEL monitoring. The product was designed to detect gases used in semiconductor processes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global gas sensor market based on the below-mentioned segments:

Global Gas Sensor Market, By Product

- Oxygen (O2)/Lambda Sensors

- Carbon Dioxide (CO2) Sensors

- Carbon Monoxide (CO) Sensors

- Nitrogen Oxide (NOx) Sensors

- Methyl Mercaptan Sensor

- Others

Global Gas Sensor Market, By Type

- Wireless

- Wired

Global Gas Sensor Market, By Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

Global Gas Sensor Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global gas sensor market over the forecast period?The Global Gas Sensor Market Size is Expected to Grow from USD 2.2 Billion in 2023 to USD 5.4 Billion by 2033, at a CAGR of 9.39% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global gas sensor market?Asia Pacific is projected to hold the largest share of the global gas sensor market over the forecast period.

-

3. Who are the top key players in the kosher food market?The top key players in the global gas sensor market are ABB Ltd., AlphaSense Inc., City Technology Ltd., Dynament, Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, Siemens, Sensorix, GfG Gas Detection UK Ltd., FLIR Systems, Inc., CO2 Meter.com, Amphenol Corporation, Gastec Corporation, Honeywell International Inc., Sensirion AG, Others.

Need help to buy this report?