Global Gas Separation Membranes Market Size By Material Type (Cellulose Acetate, Polysulfone), By Application (Carbon Dioxide Removal, Vapor Or Gas Separation), By Region, And Segment Forecasts 2022 - 2032

Industry: Advanced MaterialsGlobal Gas Separation Membranes Market Insights Forecasts to 2032

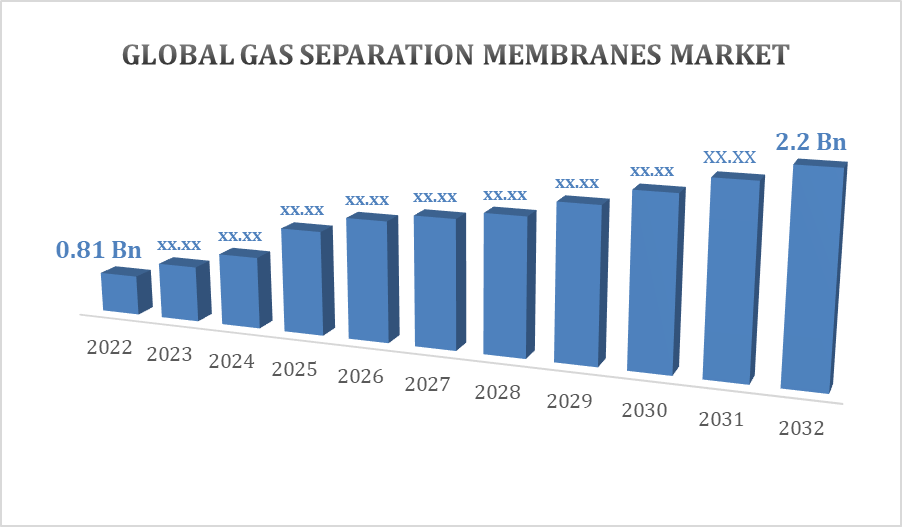

- The Gas Separation Membranes Market Size was valued at USD 0.81 Billion in 2022.

- The Market is Growing at a CAGR of 4.6% from 2022 to 2032

- The Worldwise Gas Separation Membranes Market Size is expected to reach USD 2.2 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Gas Separation Membranes Market Size is expected to reach USD 2.2 Billion by 2032, at a CAGR of 4.6% during the forecast period 2022 to 2032.

The Market is seeing a trend towards eco-friendly and energy-efficient membranes as the globe becomes more sustainable. Hydrogen separation membranes, for example, are becoming more popular as interest in hydrogen as a sustainable energy carrier increases. Membranes for gas separation are used in many different sectors. These membranes are adaptable, with applications ranging from nitrogen generation in the food and beverage industry to carbon capture and storage in the energy sector. Of course, there are difficulties in every market. Among the challenges facing the sector are the high initial cost of membrane systems and the requirement for ongoing membrane performance enhancement. There will always be a need for effective gas separation technology due to the global movement towards cleaner energy. Particularly, carbon capture and hydrogen generation technologies are anticipated to propel the industry ahead.

Gas Separation Membranes Market Value Chain Analysis

The raw ingredients are where it all begins. Depending on the type of membrane, particular polymers or inorganic elements are needed for its manufacture. The entire value chain is built upon these raw ingredients. These basic ingredients are transformed into membranes during the production process. To develop membranes with the required qualities for effective gas separation, this stage frequently calls for precision and sophisticated procedures. After that, membranes are put together to form modules, which can be altered to meet the unique needs of various applications. The functional units that will carry out the gas separation procedure are these modules. The membranes or membrane modules go into the distribution step once they are prepared. Businesses can sell to customers directly or through distributors. Energy, petrochemicals, food and beverage, and other industries use gas separation membranes. These membranes are used by the end users for certain purposes such carbon capture, hydrogen recovery, and nitrogen generation. There is frequently a requirement for continuous service and maintenance following installation. In order to guarantee the durability and best possible performance of the membrane systems, companies could provide extra services.

Gas Separation Membranes Market Opportunity Analysis

A big opportunity exists since hydrogen is becoming more popular as a source of clean energy. The production and purification of hydrogen can be greatly aided by gas separation membranes, which will help the hydrogen economy flourish. The use of gas separation membranes for carbon capture and storage presents a significant possibility as the focus on lowering carbon emissions grows. This can be especially important in sectors like heavy industry and power generation that produce a lot of carbon. As the need for sustainable energy sources grows, upgrading biogas becomes a viable field. Biogas may be effectively upgraded to biomethane using gas separation membranes, which can subsequently be pumped into natural gas pipelines or utilised as a fuel for transportation. Global environmental awareness is rising, which presents chances for market expansion. Businesses that are adept at navigating global marketplaces and meeting the unique requirements of various geographic areas would stand to gain.

Global Gas Separation Membranes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.81 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.6% |

| 2032 Value Projection: | USD 2.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material Type, By Application,and COVID-19 Impact Analysis. |

| Companies covered:: | Air Liquide Advanced Separations, Fujifilm Manufacturing Europe B.V., DIC Corporation, Evonik Industries AG, Parker-Hannifin, UBE Industries, Schlumberger Limited, Honeywell Uop, Sepratek Inc., Air Products and Chemicals, and Others. |

| Growth Drivers: | Increasing the demand for carbon dioxide removal techniques |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Gas Separation Membranes Market Dynamics

Increasing the demand for carbon dioxide removal techniques

The emphasis on cutting carbon emissions and addressing climate change on a worldwide scale has increased interest in CCS projects. Gas separation membranes, especially in the power generating and heavy sectors, are essential for capturing CO2 emissions from industrial processes. Companies and sectors are become more conscious of their carbon footprint. Gas separation membranes improve operations' environmental performance and are in line with company sustainability goals when used for CO2 removal. Gas separation membranes can be used in renewable energy systems to collect CO2 that is created during biomass and bioenergy operations. This integration addresses the requirement for carbon management while promoting the expansion of renewable energy. Gas separation membranes are employed in hydrogen production processes, where the removal of CO2 is vital to assure the quality of the produced hydrogen, in response to the growing demand for clean hydrogen. This is particularly important for sectors like petrochemicals and refineries.

Restraints & Challenges

Membrane systems can demand a substantial up-front cost. This cost element could be problematic, particularly for smaller companies or sectors of the economy with tighter budgets. Unwanted materials building up on the membrane surface is known as membrane fouling, and it is a recurring problem. Over time, it may become less efficient and require more regular cleaning or replacement, which may increase operating expenses. Certain applications, like those found in the petrochemical sector, call for extreme temperatures and caustic chemicals. It is a continuous struggle to develop membranes that can tolerate such conditions without suffering considerable degradation. Finding materials that can retain performance and structural integrity at high temperatures becomes a limiting factor in applications. This is especially important for procedures like the creation of hydrogen.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Gas Separation Membranes market from 2023 to 2032. The market's size and expansion are attributed to the region's concentration on technical innovation and sophisticated industrial infrastructure. The need for gas separation membranes is largely driven by the energy industry, which includes the oil and gas industries. In North America, applications like carbon capture, hydrogen production, and natural gas processing are especially pertinent. The market for gas separation membranes is further supported by an increase in renewable energy efforts. Gas separation membranes play a critical role in the growing field of renewable energy-based hydrogen manufacturing. Several significant companies in the gas separation membrane market are based in North America. The competitiveness of the market is enhanced by the active involvement of regional companies in manufacturing, distribution, and research and development.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. One of the main factors propelling the market for gas separation membranes is the continuous industrial development in nations like China and India. Applications for these membranes can be found in the steel, chemical, and petrochemical sectors. Gas separation membrane demand is rising as Asia-Pacific nations concentrate on switching to greener energy sources, especially for applications involving the creation of hydrogen and the processing of natural gas. There is a boom in renewable energy projects in the Asia-Pacific area. These initiatives involve the use of gas separation membranes, such as the creation of clean hydrogen from renewable resources.

Segmentation Analysis

Insights by Material Type

The Polymide and Polyaramide segment accounted for the largest market share over the forecast period 2023 to 2032. Membranes made of polyimide and polyaramide are renowned for their remarkable thermal stability. Because of this characteristic, they are appropriate for uses involving high temperatures, like the petrochemical industry's gas separation process. The petrochemical sector gains from the usage of Polyimide and Polyaramide membranes due to its variety of gas streams and demanding operating environment. They are used in gas separation procedures in petrochemical facilities because of their ability to function under high temperatures and pressures. Polyimide and Polyaramide membranes are widely used in many sectors because of their dependability and adaptability. These membranes meet a variety of gas separation requirements, from air separation to natural gas processing.

Insights by Application

Nitrogen Generation and Oxygen Enrichment segment is witnessing the fastest market growth over the forecast period 2023 to 2032. Many businesses, notably the food and beverage, electronics, and pharmaceutical sectors, utilise a lot of nitrogen. This market is expanding because gas separation membranes can produce nitrogen on-site with efficiency. Nitrogen is used in the food and beverage sector for preservation and packaging. Gas separation membranes make it possible to produce nitrogen on-site, which offers food packaging applications a practical and affordable alternative. In the oil and gas sector, the production of nitrogen is essential for processes including increased oil recovery, purging, and blanketing. For on-site nitrogen generation in oil and gas operations, gas separation membranes provide a dependable and portable alternative.

Recent Market Developments

- In March 2019, Air Products and Chemicals had purchased ACP (Europe) SA, one of the market leaders in carbon dioxide production in Europe. The business now has more room to grow in the industrial gases market due to this acquisition. Its network throughout Europe has grown.

Competitive Landscape

Major players in the market

- Air Liquide Advanced Separations

- Fujifilm Manufacturing Europe B.V.

- DIC Corporation

- Evonik Industries AG

- Parker-Hannifin, UBE Industries

- Schlumberger Limited

- Honeywell Uop

- Sepratek Inc.

- Air Products and Chemicals

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Gas Separation Membranes Market, Material Type Analysis

- Cellulose Acetate

- Polysulfone

- Polyimide and Polyaramide

Gas Separation Membranes Market, Application Analysis

- Carbon Dioxide Removal

- Vapor Or Gas Separation

- Nitrogen Generation and Oxygen Enrichment

Gas Separation Membranes Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Gas Separation Membranes Market?The global Gas Separation Membranes Market is expected to grow from USD 0.81 Billion in 2023 to USD 2.2 Billion by 2032, at a CAGR of 4.6% during the forecast period 2023-2032.

-

2. Who are the key market players of the Gas Separation Membranes Market?Some of the key market players of market are Air Liquide Advanced Separations, Fujifilm Manufacturing Europe B.V., DIC Corporation, Evonik Industries AG, Parker-Hannifin, UBE Industries, Schlumberger Limited, Honeywell Uop, Sepratek Inc., Air Products and Chemicals.

-

3. Which segment holds the largest market share?Nitrogen Generation and Oxygen Enrichment segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Gas Separation Membranes Market?North America is dominating the Gas Separation Membranes Market with the highest market share.

Need help to buy this report?