Global GCC Industrial Gas Market Size, Share, and COVID-19 Impact Analysis, By Type (Nitrogen, Carbon Dioxide, Oxygen, Helium, Xenon, Krypton, and Argon), Application (Metallurgy, Chemicals, Healthcare, Energy, Manufacturing, and Others), Supply Mode (Packaged, Bulk, and On-Site), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Chemicals & MaterialsGlobal GCC Industrial Gas Market Insights Forecasts to 2030

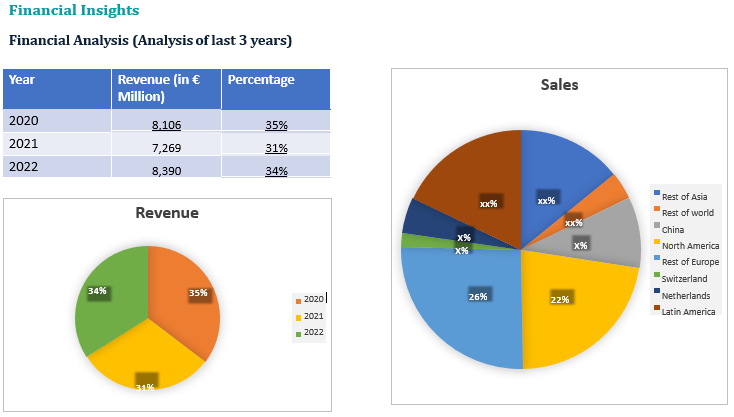

- The global GCC Industrial Gas market was valued at USD 1.9 billion in 2021.

- The market is growing at a CAGR of 6.7% from 2021 to 2030

- The global GCC Industrial Gas market is expected to reach USD 5.68 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

The Global GCC Industrial Gas market is expected to reach USD 1.9 billion by 2030, at a CAGR of 6.7% from 2021 to 2030. The GCC Industrial Gas market has been growing owing to the continuous surge in processed food & beverage consumption.

Get more details on this report -

Report Coverage

This research report categorizes the market for GCC industrial gas based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the GCC industrial gas market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each GCC industrial gas market sub-segments.

Global GCC Industrial Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1.9 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.7% |

| 2030 Value Projection: | USD 5.68 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 145 |

| Segments covered: | By Type, Application, Supply Mode, by Region |

| Companies covered:: | Air Liquide, Dubai Industrial Gases, The Linde Group, Praxair Inc., Abdullah Hashim Industrial & Equipment Co. Ltd, Bristol Gases, Air Products and Chemicals Inc., Buzwair Industrial Gases factory, Gulf Cryo, National Industrial Gas Plants, Yateem Oxygen, Mohsin Haider Darwish LLC, Others |

Get more details on this report -

Market Overview:

To boost production and provide operational flexibility, industrial gases are created. Hydrogen, oxygen, nitrogen, argon, and helium are a few examples of industrial gases. Brazing, food processing, cutting, treating metals, refining, and welding all depend heavily on industrial gases. Light bulb manufacturing, tire inflation, mining, and food packing all employ industrial gases like nitrogen. Additionally, nitro oxide, a byproduct of nitrogen gas, is employed in the pharmaceutical sector to manufacture medications. Growing construction activity in the GCC area and planned high-scale infrastructure projects are anticipated to drive industrial gases' market expansion. It is also anticipated that growing investment in significant industrial and infrastructure projects will fuel the expansion of the GCC industrial gases. Throughout the projected period, the market expansion is anticipated to be driven by the increasing demand for industrial gases for healthcare applications. Industrial gases are frequently employed in other technological applications and in treating various respiratory issues. As a result, during the forecast period, the market expansion is anticipated to be driven by the GCC region's quick growth in the medical sector. As a basic requirement for living, the GCC region's growing demand for packaged food and beverages is anticipated to create new opportunities for market expansion. Throughout the projected period, changes in food consumption habits are also anticipated to boost the expansion of the regional market. A manufacturer may find growth prospects because of the introduction of cutting-edge technology for producing industrial gases and the development of end-use applications, allowing them to better service a sizable market in the area. It is anticipated that this will accelerate the expansion of GCC industrial gases. However, it is anticipated that the high manufacturing cost will impede the expansion of the industrial gas industry. A significant barrier to the market expansion of industrial gases is the high cost of energy in industrial manufacturing. The cost of electricity is anticipated to limit market expansion.

Segmentation Analysis

- In 2021, the nitrogen segment dominated the market with the largest market share of 21% and market revenue of 0.39 billion.

Based on the type, the GCC Industrial Gas market is categorized into nitrogen, carbon dioxide, oxygen, helium, xenon, krypton, and argon. In 2021, the nitrogen segment dominated the market with the largest market share of 21% and market revenue of 0.39 billion. Over the projection years, the increasing use of nitrogen gas in the cooling of pharmaceuticals and vaccines is anticipated to have a favorable impact on demand. The GCC industrial gas market will experience increased demand due to potential uses in manufacturing and the expanding need for food processing and packaging. Nitrogen gas is often employed to create processing and storage procedures for food and drinks due to its great cryogenic capabilities. In addition to the elements above, the increased attention of gas providers and manufacturers to establish onsite units for producing frequently used gases close to industrial consumers for convenience of supply will also enhance product consumption in the GCC region. Industrial gases will have significant market expansion in the region due to the region's strong growth in the manufacturing sectors of electronics & telecom, lighting goods, and food & beverage.

- In 2021, the healthcare segment accounted for the largest share of the market, with 24% and a market revenue of 0.45 billion.

Based on application, the GCC Industrial Gas market is categorized into metallurgy, chemicals, healthcare, energy, manufacturing, and others. In 2021, the healthcare segment dominated the market with the largest market share of 24% and market revenue of 0.45 billion. The growing market demand for industrial gases in the GCC region is facilitated by growing awareness of better healthcare practices and cutting-edge technologies. The pandemic scenarios showed the expansion of hospitals and medical facilities in various gulf countries, which has increased the need for functional gases like carbon dioxide, argon, and helium as well as survival gases like oxygen in the region's healthcare industry. The rapid expansion of mining, fabrication, and construction activities contributes to the robust growth of metallurgical uses for industrial gases, including oxygen, nitrogen, and hydrogen. The region, especially in nations like Oman, Saudi Arabia, and Kuwait, is seeing significant demand for various functional gases due to the wide range of advantages of efficient combustion fuel and heat treatment operations over metals.

- In 2021, the on-site segment accounted for the largest share of the market, with 41% and market revenue of 0.77 billion.

The GCC Industrial Gas market is packaged, bulk, and on-site based on supply mode. In 2021, the on-site segment dominated the market with the largest market share of 41% and market revenue of 0.77 billion. Using nitrogen gas in the processing and manufacturing industries has demonstrated tremendous potential, increasing consumer demand. According to market analysis, rising implementations in the production, packaging, and storage of food and beverages have given the nitrogen gas application market a sizable business share. Thus, rising industrial consumer demand for onsite nitrogen gas supply has had an impact on market data in the GCC region.

Regional Segment Analysis of the GCC Industrial Gas Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

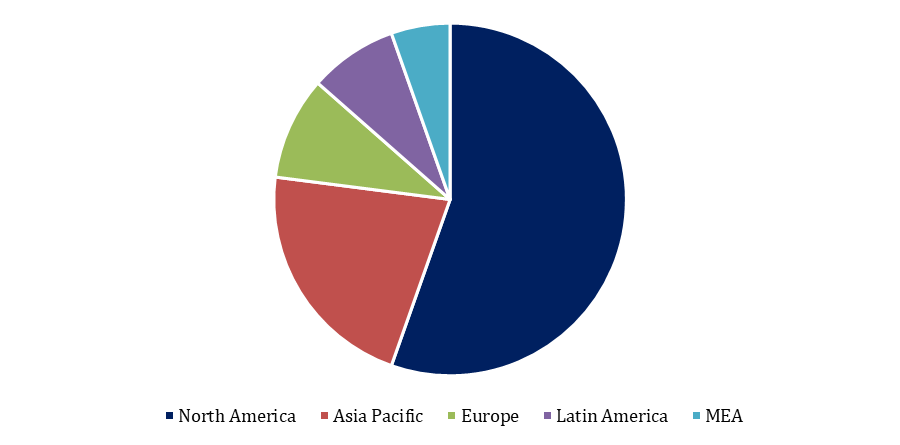

The Middle East and Africa emerged as the largest market for the global GCC Industrial Gas market, with a market share of around 43% and 361.55 billion of the market revenue in 2021.

- The Middle East and Africa emerged as the largest market for the global GCC Industrial Gas market, with a market share of around 43% and 361.55 billion of the market revenue in 2021. The region's oil and gas output is declining, and the need to develop a medical infrastructure is growing, which has fueled the region's demand for industrial gas applications. The positive prognosis will also support the demand for industrial gases in the GCC for applicable medical gas applications and the individual advantages of different industrial gases like argon and specialty gases like krypton and xenon across the processing industry. Through 2030, Saudi Arabia's nitrogen gas production is expected to increase by more than 7%. Due to applications in the chemical, pharmaceutical, food, and metallurgy sectors, this will further fuel market growth throughout this area.

- The Asia Pacific market is expected to grow at the fastest CAGR between 2021 and 2030. Manufacturers in the industrial gas industry have substantial growth possibilities in the Asia Pacific. The demand for industrial gases in the area is influenced by the region's growing population, the existence of established market participants, and expanding economies like India, China, South Korea, and Singapore. Rapid urbanization and regional industrial expansion are further factors driving the Asia Pacific industrial gas market. The growing food and beverage, manufacturing, electronics, and mining sectors in the Asia Pacific present lucrative prospects for firms working in the industrial gases industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global GCC Industrial Gas market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Air Liquide

- Dubai Industrial Gases

- The Linde Group

- Praxair Inc.

- Abdullah Hashim Industrial & Equipment Co. Ltd

- Bristol Gases

- Air Products and Chemicals Inc.

- Buzwair Industrial Gases factory

- Gulf Cryo

- National Industrial Gas Plants

- Yateem Oxygen

- Mohsin Haider Darwish LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In January 2021, A CO2 emissions capture system will be purchased, installed, and run by the Gulf Cryo business in Saudi Arabia. In order to manufacture high-purity, food-grade green CO2, the firm aims to treble its current CO2 production capacity in Saudi Arabia and capture more than 250,000 tonnes of CO2 emissions annually.

- In April 2021, In order to increase efficiency and improve customer value, Aramco and SABIC announced their plans to reorganize marketing and sales, as well as commercial and supply chain activities. Aligning the strategies of SABIC and Aramco was the goal of this endeavor.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global GCC Industrial Gas market based on the below-mentioned segments:

GCC Industrial Gas Market, By Type

- Nitrogen

- Carbon Dioxide

- Oxygen

- Helium

- Xenon

- Krypton

- Argon

GCC Industrial Gas Market, By Application

- Metallurgy

- Chemicals

- Healthcare

- Energy

- Manufacturing

- Others

GCC Industrial Gas Market, By Supply Mode

- Packaged

- Bulk

- On-Site

GCC Industrial Gas Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the global GCC Industrial Gas market?As per Spherical Insights, the size of the GCC Industrial Gas market was valued at USD 1.9 billion in 2021 to USD 5.68 billion by 2030.

-

What is the market growth rate of the global GCC Industrial Gas market?The global GCC Industrial Gas market is growing at a CAGR of 6.7% during the forecast period 2022-2030.

-

Which region dominates the global GCC Industrial Gas market?The MEA emerged as the largest market for GCC Industrial Gas.

-

What is the significant driving factor for the GCC Industrial Gas market?High Demand for industrial gas from Various Industries will influence the market's growth.

-

Which factor is limiting the growth of the GCC Industrial Gas market?Strict government policies could hamper the market growth.

-

Who are the key players in the global GCC Industrial Gas market?Key players in the GCC Industrial Gas market are Air Liquide, Dubai Industrial Gases, The Linde Group, Praxair Inc., Abdullah Hashim Industrial & Equipment Co. Ltd, Bristol Gases, Air Products and Chemicals Inc., Buzwair Industrial Gases factory, Gulf Cryo, National Industrial Gas Plants, Yateem Oxygen, Mohsin Haider Darwish LLC, and others.

Need help to buy this report?