Germany Amines Market Size, Share, and COVID-19 Impact Analysis, By Product (Ethanolamine, Fatty Amines, Alkyl Amines, and Others), By Application (Crop Protection, Surfactants, Water Treatment, Personal Care, Gas Treatment, and Others), and Germany Amines Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsGermany Amines Market Insights Forecasts to 2033

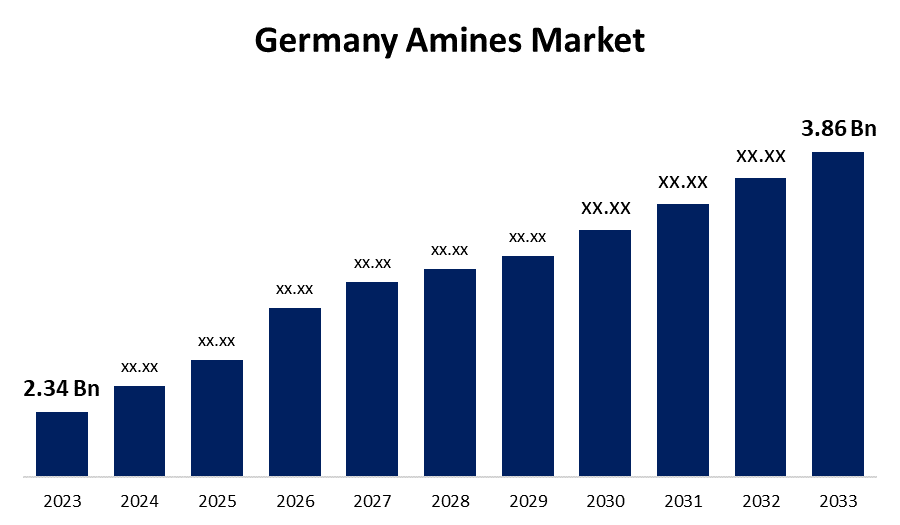

- The Germany Amines Market Size was valued at USD 2.34 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.13% from 2023 to 2033

- The Germany Amines Market Size is Expected to Reach USD 3.86 Billion by 2033

Get more details on this report -

The Germany Amines Market Size is Anticipated to Reach USD 3.86 Billion by 2033, Growing at a CAGR of 5.13% from 2023 to 2033.

Market Overview

Amines are organic compounds derived from ammonia (NH3). They are formed by replacing one or more hydrogen atoms with an alkyl or aryl group, making an amine a functional group. Amines have diverse uses in Germany, including in the construction, automotive, crop protection, and pharmaceutical industries. They are utilized in the production of agrochemicals, biocides, rubber processing chemicals, lubricant additives, corrosion inhibitors, and more. In 2022, Germany was a leading importer and exporter of amine compounds, exporting $1.12 billion worth of amine compounds, ranking as the 4th largest exporter in the world. Additionally, amine compounds were the 261st most exported product in Germany that year. The primary destinations for Germany's amine compound exports were Switzerland ($179 million), South Korea ($136 million), the United States ($107 million), Belgium ($97.1 million), and Italy ($72.4 million). BASF operates production plants for specialty amines in Ludwigshafen and Schwarzheide, Germany. Additionally, they are used in the production of pharmaceuticals such as analgesics, antihistamines, and antimalarials. Furthermore, companies are investing in research and development to develop new drugs and therapies which is driving the growth of Germany amines market.

Report Coverage

This research report categorizes the market for the Germany amines based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany amines market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany amines market.

Germany Amines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.34 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.13% |

| 2033 Value Projection: | USD 3.86 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application. |

| Companies covered:: | Mitsubishi Gas Chemical Co Inc, Akzo Nobel NV, Solvay SA, Celanese Corp Class A, Eastman Chemical Co, LyondellBasell Industries NV Class A, Huntsman Corp, Arkema SA, Dow Inc, Basf SE, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the amines market in Germany is driven by several factors. Germany has around 10,000 water treatment plants, and 96% of wastewater from homes and public institutions is purified. There is an increasing pollution of groundwater and surface water, leading to a growing demand for chemicals from these sectors. Amines are used in fertilizers and pesticides, and the demand for these chemicals is increasing due to population growth and the need for higher crop yields. Amines are also used as emulsifiers and pH adjusters in many personal care products.

Restraining Factors

The government has implemented strict regulations regarding the use of products in various industries. These guidelines are in place to ensure the safety of workers and consumers alike, as amines can pose significant health risks if not handled properly. Companies that use these products must adhere to strict guidelines and safety protocols, including proper handling, storage, and disposal procedures.

Market Segmentation

The Germany amines market share is classified into product and application.

- The ethanolamine segment is expected to hold the largest market share through the forecast period.

The Germany amines market is segmented by product into ethanolamine, fatty amines, alkyl amines, and others. Among these, the ethanolamine segment is expected to hold the largest market share through the forecast period. This compound has a wide range of applications, including use as surfactants, corrosion inhibitors, textile processing agents, gas treatment chemicals, and personal care products. It is an organic compound that contains both amine (-NH2) and alcohol (-OH) functional groups. In textile applications, these products are used as an intermediate in the production of softeners, emulsifiers, and textile processing chemicals.

- The surfactants segment is expected to dominate the Germany amines market during the forecast period.

Based on the application, the Germany amines market is divided into crop protection, surfactants, water treatment, personal care, gas treatment, and others. Among these, the surfactants segment is expected to dominate the Germany amines market during the forecast period. This is due to the widespread use of surfactants in industries such as personal care, household cleaning, agrochemicals, and oil and gas, this segment has significantly dominated the market. Surfactants are crucial components in shampoos, soaps, detergents, and other cleaning products, as they effectively remove dirt and oil from surfaces. The increasing consumer focus on hygiene, cleanliness, and personal grooming has driven the demand for surfactant-based products, leading to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany amines market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Gas Chemical Co Inc

- Akzo Nobel NV

- Solvay SA

- Celanese Corp Class A

- Eastman Chemical Co

- LyondellBasell Industries NV Class A

- Huntsman Corp

- Arkema SA

- Dow Inc

- Basf SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, The German Company BASF has recently opened a new large-scale production plant for alkyl ethanolamines at its Verbund site in Antwerp, Belgium. This significant investment will boost the company's global annual production capacity for alkyl ethanolamines, such as dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA), by almost 30 percent to over 140,000 tons per year. The new plant plays a crucial role in BASF's production network for this portfolio at its sites in Ludwigshafen, Germany; Antwerp, Belgium; Geismar, Louisiana; and Nanjing, China.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Amines Market based on the below-mentioned segments:

Germany Amines Market, By Product

- Ethanolamine

- Fatty Amines

- Alkyl Amines

- Others

Germany Amines Market, By Application

- Crop Protection

- Surfactants

- Water Treatment

- Personal Care

- Gas Treatment

- Others

Need help to buy this report?