Germany Automotive Aftermarket Size, Share, and COVID-19 Impact Analysis, By Replacement Parts (Turbochargers, Body parts, Lighting & electronic components, Filters, Brake parts, Exhaust components, Wheels, Battery, Others), By Certification (Genuine Parts, Uncertified, Certified Parts), By Distribution Channel (Distributors, Wholesalers, Retailers), and Germany Automotive Aftermarket Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationGermany Automotive Aftermarket Insights Forecasts to 2033

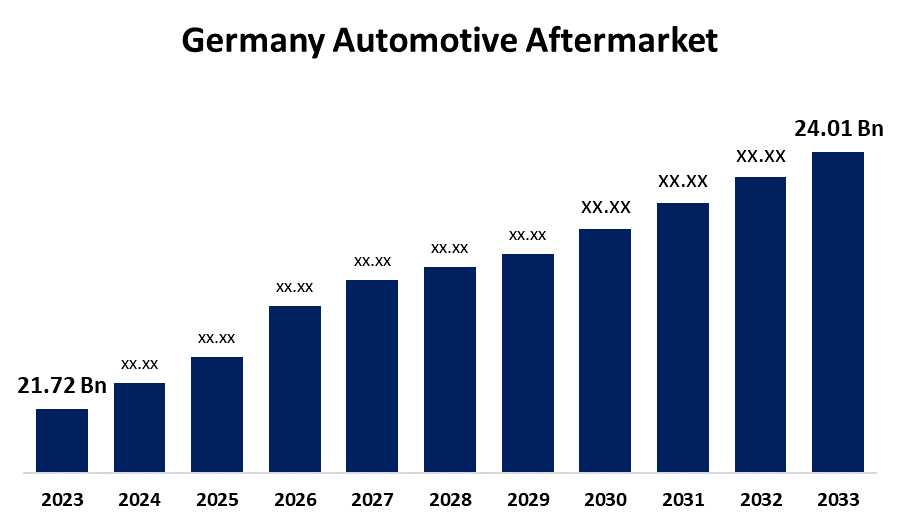

- The Germany Automotive Aftermarket Size was valued at USD 21.72 Billion in 2023

- The Market Size is growing at a CAGR of 1.01% from 2023 to 2033

- The Germany Automotive Aftermarket Size is expected to reach USD 24.01 Billion by 2033

Get more details on this report -

The Germany Automotive Aftermarket Size is anticipated to exceed USD 24.01 billion by 2033, growing at a CAGR of 1.01% from 2023 to 2033.

Market Overview

The automotive aftermarket refers to the secondary market for vehicle parts, accessories, tools, equipment, and services that are used in the repair, maintenance, customization, or enhancement of vehicles after they have been sold by the original equipment manufacturer (OEM). In other words, it encompasses all products and services related to automobiles that are not directly supplied by the vehicle's manufacturer. Several factors contribute to disruption in Germany's automobile business, including readily shifting consumer needs, severe competitive dynamics, and digitalization. The rapid adoption of smartphones has expanded the availability of transportation services such as hailing, as well as important information that influences buyer purchase decisions. In addition, technological advances by market players in industries such as lighting and electrical components, turbochargers, and high-capacity engines are likely to drive automotive aftermarket expansion within Germany. Additionally, to enhance environmental sustainability and safety, vendors and manufacturers offer complex and innovative approaches. Furthermore, digitization of services and sales for product delivery, as well as digital distribution portals for aftermarket products in collaboration with global automotive suppliers, are projected to attract significant investment from industry players.

Report Coverage

This research report categorizes the market for the Germany automotive aftermarket based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive aftermarket. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive aftermarket.

Germany Automotive AfterMarket Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 21.72 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.01% |

| 2033 Value Projection: | USD 24.01 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Replacement Parts, By Certification, By Distribution Channel |

| Companies covered:: | Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, NOVORIZON GmbH, VEECOO UG, Socialwave, autoaid, 3YOURMIND GmbH, Kopernikus, Virtue Intelligence, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The age of cars is the key reason driving the growth of the automotive aftermarket industry. Older vehicles typically require regular servicing and repairs due to overtime wear and stress on their components. The aftermarket industry advantages from steady demand for substituting parts and services. Combustion systems, tires, and brakes are a few automotive components that get worse with time and use. The need for various parts to be changed in older vehicles serves as a driving factor for the market. In response to the need for ecologically friendly vehicles, aftermarket accessories that include catalytic converters and electronic chips that enhance fuel economy on older vehicles have increased in popularity. Owners are particularly keen on adding new amenities to their older vehicles, which is a major driver of the automotive aftermarket industry's growth.

Restraining Factors

One of the most significant issues is the increasing variety of modern automobiles. Cars require specific skills and equipment for servicing and repairing due to the complexity of their electronic systems and parts, which are becoming more technologically advanced. Due to the complexities of constantly changing technologies, independent services, and aftermarket vendors may find it difficult to remain updated and make investment decisions in gear and skills.

Market Segmentation

The Germany automotive aftermarket share is classified into replacement parts, certification, and distribution channel.

- The turbocharger segment is expected to grow at the fastest CAGR during the forecast period.

The Germany automotive aftermarket is segmented by replacement parts into turbochargers, body parts, lighting & electronic components, filters, brake parts, exhaust components, wheels, battery, and others. Among these, the turbocharger segment is expected to grow at the fastest CAGR during the forecast period. These turbochargers serve to meet government guidelines for reduced emissions of hazardous gasses such as nitrous oxide and CO2 in automobiles. Recent improvements in brake components, body parts, and automobile tires, together with the introduction of variable nozzle technology turbocharger, are gaining favor in the market. As a consequence, of the growing demand for high-power automobiles and severe pollution rules in Europe, turbochargers have increased in popularity in LCV, HCV, and passenger cars.

- The genuine parts segment is expected to hold the largest share of the Germany automotive aftermarket during the forecast period.

Based on the certification, the Germany automotive aftermarket is divided into genuine parts, uncertified, and certified parts. Among these, the genuine parts segment is expected to hold the largest share of the Germany automotive aftermarket during the forecast period. Genuine automotive parts can be produced by both automobile manufacturers and OEMs. These components have been verified to be of excellent quality, varied, readily available, and come with a warranty. These parts can be pricey, so only buy from licensed sellers.

- The retailer segment is expected to hold the largest share of the Germany automotive aftermarket during the forecast period.

Based on the distribution channel, the Germany automotive aftermarket is divided into distributors, wholesalers, and retailers. Among these, the retailer segment is expected to hold the largest share of the Germany automotive aftermarket during the forecast period. Dealers sell automobile parts at retail through dealership contracts with OEM suppliers, and they also assist with repair and maintenance. Some distributors in underdeveloped countries want to trade with suppliers. Transportation and fleet management service providers have contracts with original manufacturers to provide spare parts and services. The growing popularity of renewable energy products focuses on the manufacturing and sale of aftermarket goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany automotive aftermarket along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental AG

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- NOVORIZON GmbH

- VEECOO UG

- Socialwave

- autoaid

- 3YOURMIND GmbH

- Kopernikus

- Virtue Intelligence

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Continental has chosen additional steps to enhance the competitiveness of its Automotive division. These initiatives are focused on enhancing the effectiveness of Automotive's worldwide research and development system. By 2025, the group sector plans to streamline several of its 82 current development locations, optimize existing infrastructures by consolidating development units, and maximize synergies in work processes. Efficiency measures will impact approximately 1,750 jobs globally, with 380 of those being at Elektrobit, a software subsidiary.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany automotive aftermarket based on the below-mentioned segments:

Germany Automotive Aftermarket, By Replacement Parts

- Turbochargers

- Body parts

- Lighting & electronic components

- Filters

- Brake parts

- Exhaust components

- Wheels

- Battery

- Others

Germany Automotive Aftermarket, By Certification

- Genuine Parts

- Uncertified

- Certified Parts

Germany Automotive Aftermarket, By Distribution Channel

- Distributors

- Wholesalers

- Retailers

Need help to buy this report?