Germany Automotive Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber (Glass, Carbon, and Natural), By Resin Type (Thermoset and Thermoplastics), By Application (Exterior, Interior, Structure & Power Train, and Other), and Germany Automotive Composites Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationGermany Automotive Composites Market Insights Forecasts to 2033

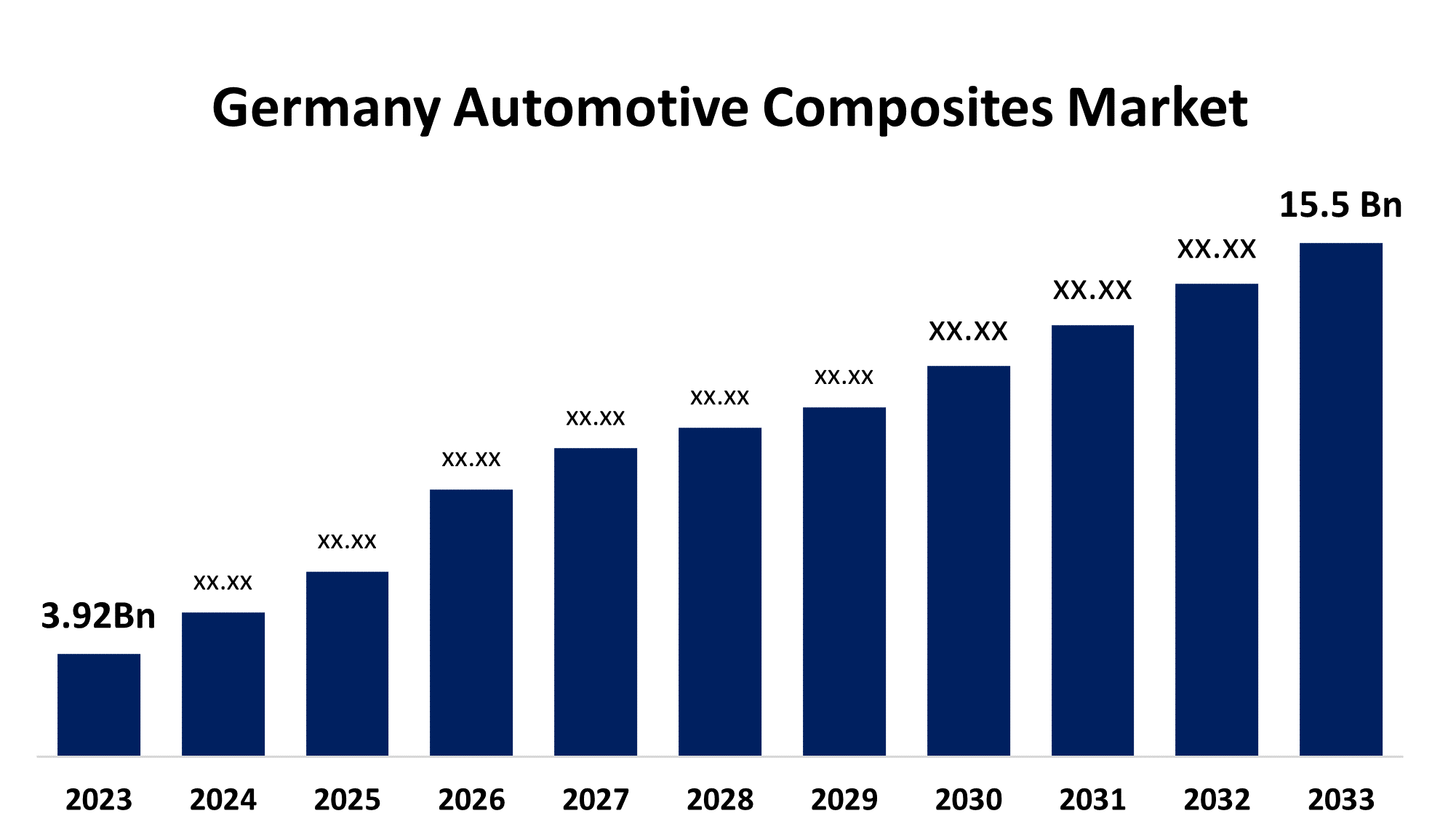

- The Germany Automotive Composites Market Size was valued at USD 3.92 Billion in 2023.

- The Market is growing at a CAGR of 14.74% from 2023 to 2033

- The Germany Automotive Composites Market Size is expected to Reach USD 15.5 Billion by 2033

Get more details on this report -

The Germany Automotive Composites Market is anticipated to exceed USD 15.5 Billion by 2033, growing at a CAGR of 14.74% from 2023 to 2033.

Market Overview

Automotive composites are materials composed of multiple components with different chemical or physical properties. These materials are created with enhancements in mechanical properties, such as rigidity, ability to withstand impact, and a high ratio of strength to weight. Car composites are widely used in the automotive industry to reduce vehicle weight, enhance fuel efficiency, and boost overall performance. Automotive composites are materials found in cars that are made up of many components mixed to improve performance. Usually, they are made of glass or carbon fibers embedded in a matrix made of thermoplastic resin or epoxy. Lightweight and robust body panels, chassis, and structural reinforcements are produced with this composition. Automotive composites have advantages over conventional materials like steel in terms of weight reduction, fuel efficiency, and safety. In line with industry trends toward sustainability and cutting-edge engineering solutions, they are widely used in the production of contemporary vehicles to satisfy strict regulatory requirements, increase durability, and lessen environmental effects. Manufacturers are attempting to use lightweight composites to lower the weight of their cars to comply with emissions standards and policies. The main tactic has been modified to use composites. Among the many benefits of using composite materials are their strength-to-weight ratio, precision, stability, ease of assembly, and superior finish.

Report Coverage

This research report categorizes the market for the Germany automotive composites market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany automotive composites market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany automotive composites market.

Germany Automotive Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.74% |

| 2033 Value Projection: | USD 15.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fiber, By Resin Type, By Application |

| Companies covered:: | Henkel AG & Co. KGaA, SGL Carbon SE, BASF SE, Owens Corning, Nippon Sheet Glass Co. Ltd., LANXESS AG, Continental AG, ElringKlinger AG, Audi AG, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising need for lightweight materials in the car production industry is one of the key factors driving revenue growth of the Germany automotive composites market. Automotive composites are a great option for parts such as body panels, engine parts, and suspension components due to their good mechanical qualities and high strength-to-weight ratio. The growing emphasis on reducing carbon emissions is also fueling the market's revenue growth for automotive composites. As a result of the strict regulations that governments and regulatory bodies worldwide are implementing to reduce carbon emissions from automobiles, the use of lightweight materials like composites has grown. Furthermore, the growing demand for fuel efficiency is fueling the market's revenue growth for automotive composites. Due to growing concerns about the depletion of fossil resources and rising fuel prices, automakers are focusing on producing more fuel-efficient vehicles.

Restraining Factors

The high costs of carbon fiber and glass fiber composites are impeding the market's expansion because their use in inexpensive cars might significantly raise those cars' prices.

Market Segmentation

The Germany automotive composites market share is classified into fiber, resin type, and application.

- The glass segment is expected to hold the largest market share through the forecast period.

The Germany automotive composites market is segmented by fiber into glass, carbon, and natural. Among them, the glass segment is expected to hold the largest market share through the forecast period. The main consumer of glass fiber composites is the automotive sector due to their outstanding strength, stiffness, flexibility, and ability to withstand chemical damage. The demand for lightweight materials to enhance fuel efficiency and decrease emissions has increased substantially in recent years. Glass fiber composites are commonly used in the automotive industry due to their lower cost compared to carbon and natural fiber.

- The thermoset segment dominates the market with the largest market share over the predicted period.

The Germany automotive composites market is segmented by resin type into thermoset and thermoplastics. Among them, the thermoset segment dominates the market with the largest market share over the predicted period. Numerous automotive applications, including headlight housing, electrical, heat shielding, under-the-hood, and external and interior structural parts, use thermoset materials. Along with these and many other composite qualities, thermoset resins offer a low coefficient of thermal expansion, great impact strength, and excellent dimensional stability.

- The exterior segment dominates the market with the largest market share over the predicted period.

The Germany automotive composites market is segmented by application into exterior, interior, structure & power train, and other. Among them, the exterior segment dominates the market with the largest market share over the predicted period. Automobile composites are extensively utilized in external automobile applications, including heat shielding components and headlamps, among other things. Using indulgent composites in their automobile bodywork is another area of interest for many OEMs. For example, new research indicates that reinforced thermoplastics may be the next big thing. The first mass-produced vehicle with exterior components made of thermoplastic composites is the BMW i3.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany automotive composites market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Henkel AG & Co. KGaA

- SGL Carbon SE

- BASF SE

- Owens Corning

- Nippon Sheet Glass Co. Ltd.

- LANXESS AG

- Continental AG

- ElringKlinger AG

- Audi AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, A new kind of glass fiber composite that is stronger and lighter than conventional glass fiber composites was revealed by BASF. It is anticipated that this novel composite will find usage in numerous automobile applications, such as engine parts and body panels.

- In April 2023, SGL Carbon declared that it would invest EUR 100 million in a new carbon fiber composite manufacturing facility in Germany. The facility will serve the automotive sector. This investment indicates that the Germany market is seeing an increase in demand for automotive composites.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Automotive Composites Market based on the below-mentioned segments:

Germany Automotive Composites Market, By Fiber

- Glass

- Carbon

- Natural

Germany Automotive Composites Market, By Resin Type

- Thermoset

- Thermoplastics

Germany Automotive Composites Market, By Application

- Exterior

- Interior

- Structure & Power train

- Other

Need help to buy this report?